B2B Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

ALL IN ONE MEGA PACK - CONSIST OF:

B2B Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

B2B FINANCIAL MODEL FOR STARTUP INFO

Highlights

This advanced five-year corporate financial model for B2B companies features a comprehensive financial forecasting structure including a consolidated income statement, balance sheet, and cash flow forecasting model, all designed to support robust B2B budgeting and financial analysis. With built-in key financial charts, summaries, and funding forecasts, this b2b financial statement model facilitates detailed revenue projection modeling and financial scenario planning for B2B startups and established businesses alike. The template is fully unlocked for customization, enabling precise estimation of startup costs, expense forecast modeling, and strategic b2b investment financial model development to optimize operational performance and profitability.

The advanced b2b financial planning model in this Excel template addresses key pain points by streamlining business to business financial forecasting, enabling users to efficiently build comprehensive corporate financial models for b2b, including b2b revenue projection models and b2b sales financial models. It simplifies b2b budgeting and financial analysis through automated b2b profit and loss models and b2b cash flow forecasting models, reducing manual errors and saving time. Additionally, financial scenario planning b2b allows for quick adjustments to assumptions, supporting better decision-making under uncertainty. For startups and established firms alike, the model offers detailed b2b expense forecast models, b2b subscription financial models, and b2b pricing strategy financial models, catering to diverse operational needs while facilitating accurate b2b financial ratio analysis. This ready-made solution helps buyers organize data seamlessly, optimize b2b investment financial models, and present credible financial statements that impress investors and lenders, transforming complex financial management into an accessible and actionable process.

Description

Our advanced b2b financial planning model Excel template is designed to provide comprehensive business to business financial forecasting, enabling entrepreneurs and established companies to create detailed b2b revenue projection models, sales financial plans, and expense forecast models with ease. This dynamic corporate financial model for b2b integrates key components such as b2b profit and loss models, cash flow forecasting, and financial scenario planning to visualize monthly and yearly financial statements, including P&L, balance sheets, and cash flow forecasts over a five-year horizon. Utilizing a bottom-up approach, the model incorporates pricing strategy financial assumptions alongside OPEX and capital expenditure inputs to generate accurate b2b budgeting and financial analysis outputs, performance KPIs, and break-even calculations. Tailored for b2b startups and mature companies alike, the model aids in efficient financial modeling for b2b companies by streamlining complex calculations, enhancing operational financial management, and supporting robust b2b investment financial modeling and subscription financial models to help optimize profitability and strategic growth.

B2B FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Effective management is vital in B2B success, and our advanced financial modeling for B2B companies offers a comprehensive 5-year revenue projection model to guide your business strategy. For startups, our B2B startup financial model streamlines cash flow forecasting and expense forecast analysis, providing critical insights into liquidity and cash burn rate. This corporate financial model for B2B empowers you to navigate financial scenario planning confidently, ensuring sustainable growth and optimized financial performance from day one.

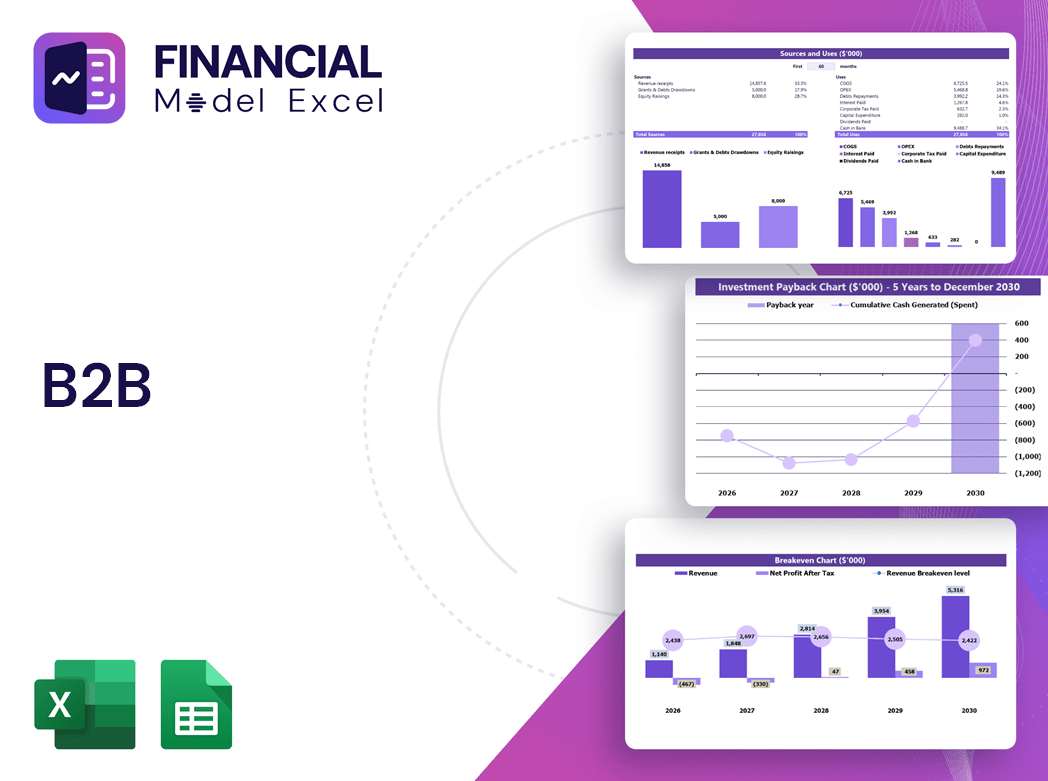

Dashboard

Our advanced B2B financial planning model features an intuitive dashboard presenting critical metrics through dynamic graphs and charts. Key insights include detailed revenue projections, profit and loss statements, cash flow forecasting, and comprehensive financial ratio analysis. This corporate financial model for B2B simplifies budgeting, forecasting, and scenario planning by organizing data with precision and accuracy, empowering businesses to make informed, strategic decisions with confidence.

Business Financial Statements

Our advanced b2b profit and loss model Excel template delivers precise income statement projections, highlighting your company’s revenue, expenses, gains, and losses over a specified period. Essential for financial modeling for B2B companies, this P&L forecast integrates seamlessly with your startup’s pro forma balance sheet and b2b cash flow forecasting model. Designed to support comprehensive business to business financial forecasting and scenario planning, it offers clarity on profitability without conflating cash and non-cash transactions—perfect for informed budgeting, financial analysis, and strategic decision-making in B2B environments.

Sources And Uses Statement

The Sources and Uses template in Excel is essential for B2B financial planning models, enabling businesses to accurately track income sources and fund allocation. This tool supports advanced financial modeling for B2B companies by providing clarity in cash flow forecasting, expense forecasting models, and overall financial performance analysis. Utilizing this template ensures precise corporate financial management, enhances budgeting, and improves financial scenario planning, empowering informed decision-making across B2B revenue projection and investment strategies.

Break Even Point In Sales Dollars

A break-even point in unit sales is a crucial B2B financial planning model that identifies when your company or product reaches profitability. This corporate financial model for B2B offers precise insights into sales volume needed to cover fixed and variable costs. By integrating this into your B2B budgeting and financial analysis, you empower smarter business-to-business financial forecasting and enhance your overall financial performance model. Streamline your path to profit with this advanced financial model tailored for B2B companies.

Top Revenue

The Top Revenue tab in our pro forma financial statements template provides a clear, detailed breakdown of each B2B offering’s financial performance. Leveraging this advanced financial model for B2B companies, you gain precise annual revenue projections, including comprehensive revenue depth and bridges. Ideal for business-to-business financial forecasting, this tool enhances your financial scenario planning by delivering actionable insights into your revenue streams, supporting effective budgeting, forecasting, and strategic decision-making. Elevate your B2B financial planning model with a professional, data-driven approach designed for accuracy and growth.

Business Top Expenses Spreadsheet

For fast-growing B2B startups, precise expense planning and control are critical to sustained success. Our advanced corporate financial model for B2B companies categorizes expenses into four key segments, ensuring clarity and focused analysis. Large expenses are closely monitored and justified within the model to prevent losses. The flexible 'other' category allows for additional cost tracking tailored to your business needs. Leveraging this B2B budgeting and financial analysis tool empowers you to optimize cash flow forecasting, enhance profit and loss management, and drive confident financial decision-making. Effective cost management is the foundation of robust B2B financial performance.

B2B FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The advanced B2B financial planning model empowers businesses to accurately forecast expenses and evaluate financial performance, ensuring strategic growth. Utilizing a comprehensive corporate financial model for B2B enables precise budgeting and financial analysis, helping identify operational weaknesses early. This insight guides informed decision-making and optimizes revenue projection models. A robust B2B profit and loss model is essential for securing loans or attracting investors, demonstrating financial stability and potential. Leverage financial modeling for B2B companies to drive effective financial scenario planning and unlock your company’s full financial capabilities.

CAPEX Spending

Effective growth in B2B companies relies on strategic investment showcased through advanced financial modeling for B2B firms. Capital expenditures (CAPEX) play a crucial role in acquiring assets to enhance operational capacity and drive expansion. These investments are meticulously captured within a corporate financial model for B2B, reflected as depreciated expenditures over a multi-year horizon on the projected balance sheet. Leveraging a robust b2b cash flow forecasting model and b2b budgeting and financial analysis ensures that CAPEX aligns with sustainable revenue projection models, empowering informed decision-making for long-term financial performance and competitive advantage.

Loan Financing Calculator

Our advanced B2B financial planning model features a built-in loan amortization schedule with pre-structured formulas that precisely detail repayment timelines. Each installment is clearly segmented to show principal and interest amounts over monthly, quarterly, or annual periods. This corporate financial model for B2B companies ensures transparent, accurate debt tracking, enhancing your financial forecasting, budgeting, and cash flow forecasting capabilities for informed decision-making.

B2B FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The advanced b2b financial planning model features a detailed proforma chart showcasing monthly revenue projections across five core products. Designed for flexibility, it allows seamless addition of products and customizable periods for comprehensive business to business financial forecasting. This corporate financial model for b2b empowers precise budgeting, cash flow forecasting, and revenue projection—perfect for optimizing your financial scenario planning and strategic decision-making.

Cash Flow Forecast Excel

The statement of cash flows is a crucial component of any corporate financial model for B2B companies. It provides clear insights into cash generation and liquidity, essential for accurate b2b cash flow forecasting models. Understanding cash inflows and outflows enables businesses to identify funding gaps, optimize b2b budgeting and financial analysis, and attract additional financing. Integrating this statement into your b2b financial planning model enhances financial scenario planning and strengthens investment decisions, ultimately driving sustainable growth and profitability in the competitive B2B landscape.

KPI Benchmarks

A benchmarking study is a vital financial modeling tool for B2B companies, assessing key performance indicators such as profit margins, cost per unit, and productivity. By comparing these metrics against industry peers through a corporate financial model for B2b or a b2b financial performance model, businesses gain strategic insights to optimize operations. Leveraging benchmarking within b2b budgeting and financial analysis enables startups and established firms alike to identify best practices, refine their b2b revenue projection model, and drive superior financial outcomes through informed decision-making.

P&L Statement Excel

Our Monthly Profit & Loss Statement Template Excel is an essential tool for B2B financial planning models, offering clear insights into revenue streams, gross and net earnings. Designed for business-to-business financial forecasting, it enables precise analysis of profit margins and cost structures. With easy-to-understand visuals, including graphs and key financial ratios, this corporate financial model for B2B firms supports informed decision-making. Ideal for B2B budgeting and financial analysis, it helps business owners monitor profitability, streamline expense forecasts, and optimize cash flow forecasting models to drive sustained growth and operational efficiency.

Pro Forma Balance Sheet Template Excel

Our b2b financial statement model includes a projected balance sheet template in Excel, a crucial tool for any business. It details current and long-term assets, liabilities, and equity, providing a comprehensive snapshot of financial health. This essential report supports accurate b2b financial ratio analysis and enhances your corporate financial model for b2b by enabling informed decision-making and strategic planning. Incorporating this into your financial modeling for b2b companies ensures precise business to business financial forecasting and strengthens your overall b2b budgeting and financial analysis.

B2B FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our advanced B2B financial planning model integrates key metrics like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) to deliver precise business valuations. WACC evaluates capital costs by balancing equity and debt, serving as a crucial risk metric for lenders. Meanwhile, DCF enables investors to accurately assess the present value of future cash flows, guiding informed investment decisions. This corporate financial model for B2B companies empowers business owners, creditors, and investors with reliable financial forecasting and scenario planning for sustainable growth.

Cap Table

A comprehensive b2b financial statement model offers a reliable method to evaluate stock impact on your company’s financial health. By systematically inputting and analyzing data, this advanced financial model for B2B firms delivers deep insights into equity distribution and financial performance. Leveraging such a model enhances accuracy in b2b financial planning, enabling precise forecasting, scenario planning, and informed decision-making to strengthen your corporate financial strategy.

B2B FINANCIAL MODEL STARTUP ADVANTAGES

The B2B cash flow forecasting model ensures startups maintain sufficient cash to cover suppliers and employee payments confidently.

The 5-year B2B financial model empowers precise forecasting to maximize future growth and mitigate business risks effectively.

The b2b cash flow forecasting model proactively identifies cash gaps and surpluses, ensuring smarter financial decisions.

Take control of cash flow and drive growth with an advanced financial model tailored for B2B businesses.

B2B startup financial models deliver actionable insights, enhancing customer understanding and driving strategic business growth.

B2B BUDGET FINANCIAL MODEL ADVANTAGES

The b2b cash flow forecasting model enables early identification of potential cash shortfalls, ensuring proactive financial management.

The advanced financial model B2B acts as an early warning system, optimizing cash flow and enhancing strategic forecasting.

The advanced financial model B2B delivers precise forecasting to drive smarter, profit-focused business decisions effortlessly.

Unlock precise B2B financial forecasting and strategic insights with our user-friendly, advanced financial modeling tool.

The advanced financial model B2B enhances trust by delivering precise, transparent business-to-business financial forecasting and analysis.

A B2B cash flow forecasting model builds stakeholder trust by clearly projecting your company’s future financial performance.

Our advanced financial model B2B delivers precise revenue projections, empowering smarter business-to-business financial planning decisions.

Streamline B2B financial planning and forecasting effortlessly with our Excel template—no formulas, formatting, or consultants needed.

Unlock strategic growth with our advanced financial model B2B, delivering great value for money and precise forecasting.

Leverage our robust B2B financial model for accurate forecasting, maximizing profits with no hidden or recurring fees.