Mortgage Financing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Mortgage Financing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Mortgage Financing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

MORTGAGE FINANCING FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year mortgage portfolio financial model is an essential business plan template designed for startups and entrepreneurs in the real estate financing sector to impress investors and secure funding. Featuring robust home loan financial projection models, mortgage underwriting financial analysis, and detailed mortgage amortization schedule tools, it provides key financial charts, summaries, and funding forecasts. Crafted with a deep understanding of mortgage loan origination and servicing dynamics, this real estate mortgage financial modeling tool enables precise housing finance cash flow modeling and mortgage refinance financial analysis, fully unlocked for easy customization and strategic planning.

This comprehensive mortgage loan analysis financial model template in Excel effectively addresses common pain points faced by buyers, such as the complexity of mortgage amortization schedule modeling, challenges in mortgage underwriting financial models, and the difficulty of accurate mortgage interest rate modeling tools. Its user-friendly design streamlines the process of creating home loan financial projection models and housing finance cash flow models, while integrated features support real estate mortgage financial modeling and mortgage refinance financial analysis with ease. By providing built-in capabilities for mortgage portfolio financial models and home mortgage risk assessment models, this ready-made tool eliminates the need for building complex spreadsheets from scratch, ensuring accurate, efficient, and customizable property financing financial forecasts to support confident decision-making in the dynamic housing market.

Description

This comprehensive mortgage loan analysis financial model is an adaptable Excel template designed to deliver a robust home loan financial projection model, enabling startups and established mortgage financing businesses to forecast revenues, expenses, and cash flows for up to 60 months. Integrating a mortgage portfolio financial model with a detailed mortgage amortization schedule model and housing finance cash flow model, it provides a three-statement framework—including profit loss, projected balance sheet, and cash flow forecasts—on both monthly and annual levels. Equipped with advanced mortgage underwriting financial model features, sales and feasibility analysis, diagnostic tools, and financing options evaluation such as equity funding, this residential mortgage financial template is tailored for diverse real estate mortgage financial modeling needs. It also supports mortgage interest rate modeling tools and mortgage refinance financial analysis, making it an indispensable asset for mortgage brokers and lenders seeking an intuitive mortgage servicing financial model and a reliable mortgage loan origination model without requiring prior financial expertise.

MORTGAGE FINANCING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive mortgage loan analysis financial model integrates key components like the income statement, cash flow, and balance sheet to deliver a holistic view. Whether it’s a home loan financial projection model or a mortgage portfolio financial model, monthly updates ensure accuracy, while a full pro forma income statement is finalized annually. This disciplined approach, essential for all businesses regardless of size, enables precise property financing financial forecasts and supports informed decision-making in mortgage underwriting, risk assessment, and refinancing strategies. Consistent use of such residential mortgage financial templates drives strategic growth and financial stability.

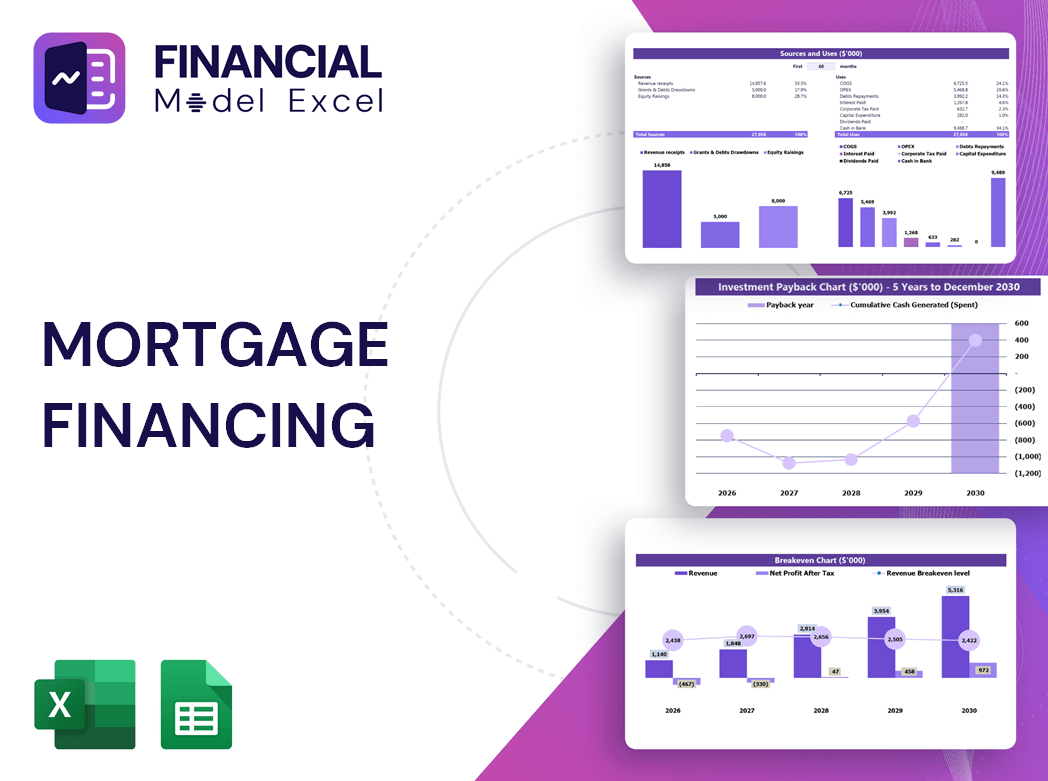

Dashboard

The Dashboard tab in this comprehensive mortgage financial model offers an insightful snapshot through dynamic graphs, charts, key ratios, and concise financial summaries. Designed for seamless integration, these visualizations can be effortlessly copied into your pitch deck, enhancing presentations for mortgage loan analysis, home loan financial projections, or real estate mortgage financial modeling. Whether you’re assessing mortgage portfolio performance or conducting housing finance cash flow reviews, this tool provides clear, professional insights to support informed decision-making and strategic planning.

Business Financial Statements

Our comprehensive financial model integrates mortgage loan analysis with consolidated financial statements, including P&L, balance sheet forecasts, and cash flow projections. Designed for both monthly and annual reporting, this home loan financial projection model allows seamless incorporation of existing financial data from QuickBooks, Xero, FreshBooks, and more. Ideal for mortgage portfolio financial modeling and property financing financial forecasts, it empowers users to create dynamic rolling forecasts that enhance real estate mortgage financial modeling and strategic decision-making. Elevate your mortgage underwriting and servicing processes with this versatile, professional template.

Sources And Uses Statement

A comprehensive mortgage loan analysis financial model provides critical insights into the source and allocation of funds, highlighting income streams and expense distributions. Utilizing tools like a home loan financial projection model or a mortgage portfolio financial model enables precise tracking of cash flows and risk assessment. This strategic approach is vital for effective real estate mortgage financial modeling, ensuring informed decision-making, optimized mortgage underwriting, and enhanced profitability. Mastering these models empowers businesses to manage housing finance efficiently, drive sustainable growth, and achieve long-term financial success in the competitive mortgage market.

Break Even Point In Sales Dollars

Breakeven analysis is essential in financial modeling, such as mortgage loan analysis or housing finance cash flow models. It identifies the point where total revenues cover fixed and variable costs, enabling profitability. Fixed costs—like administrative salaries or rent—remain constant regardless of sales volume, while variable costs fluctuate directly with sales, including expenses such as inventory or shipping. Integrating breakeven analysis within real estate mortgage financial modeling or mortgage loan repayment financial models ensures precise forecasting and strategic decision-making for sustainable growth and risk management.

Top Revenue

When creating a home loan financial projection model, revenue stands as the cornerstone of any real estate mortgage financial modeling effort. Accurate revenue forecasts, grounded in historical data and growth rate assumptions, are pivotal for a reliable mortgage portfolio financial model. Financial analysts must leverage comprehensive mortgage loan analysis tools to craft strategies that enhance the enterprise’s value within the housing finance cash flow model. Our residential mortgage financial template integrates all essential components, empowering users to develop precise, insightful revenue streams and optimize their property financing financial forecast for robust financial planning.

Business Top Expenses Spreadsheet

Our comprehensive mortgage loan analysis financial model features a detailed top expense report, spotlighting the four largest cost categories and consolidating others for streamlined review. This tool empowers users to efficiently monitor and track expense trends annually, ensuring proactive cost optimization. Whether for start-ups or established firms, leveraging our home loan financial projection model is essential to effectively manage expenses, sustain profitability, and support robust mortgage portfolio financial planning. Accurate expense oversight drives informed decision-making and long-term financial success in real estate mortgage financial modeling.

MORTGAGE FINANCING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive mortgage loan analysis financial model empowers businesses to meticulously organize expenses and project financial needs accurately. Utilizing a home loan financial projection model helps identify vulnerabilities, enabling strategic improvements. Clear, structured expense forecasts within a mortgage portfolio financial model are vital for effective communication with investors and securing financing. This real estate mortgage financial modeling approach ensures robust housing finance cash flow management, supporting confident decision-making and sustainable growth.

CAPEX Spending

A company’s capital expenditure budget reflects strategic financial investments aimed at enhancing business performance and growth. This includes acquiring new equipment, adopting advanced mortgage loan analysis financial models, or implementing cutting-edge real estate mortgage financial modeling techniques. Such investments drive expansion in products and services while supporting accurate mortgage underwriting financial models and housing finance cash flow models. On the projected balance sheet template, these expenditures are recorded as depreciated assets over time, ensuring precise property financing financial forecasts and robust mortgage portfolio financial models that bolster long-term business value.

Loan Financing Calculator

Start-ups and early-stage companies must expertly manage their mortgage loan repayment financial model to ensure accurate cash flow projections. A detailed mortgage amortization schedule model breaks down loan amounts and maturity terms, crucial for real estate mortgage financial modeling. Principal repayments and interest expenses significantly impact the housing finance cash flow model and overall mortgage portfolio financial model. Integrating these schedules into a residential mortgage financial template enhances debt forecasting and supports strategic financial planning, ensuring robust mortgage underwriting financial model accuracy and effective debt management.

MORTGAGE FINANCING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our comprehensive mortgage loan analysis financial model integrates EBIT (Earnings Before Interest and Tax) as a key financial metric. This essential figure is derived by deducting the cost of sales and operating expenses from total revenue, providing clear insight into operational profitability. Incorporating EBIT within our home loan financial projection model enables accurate real estate mortgage financial modeling, empowering informed decisions across mortgage underwriting, portfolio management, and servicing financial forecasts.

Cash Flow Forecast Excel

Our comprehensive housing finance cash flow model offers a dynamic platform for detailed mortgage loan analysis and real estate mortgage financial modeling. Featuring a robust, integrated three-way financial projection template, it enables precise monitoring of operating, investing, and financing cash flows. Designed for flexibility, users can input data monthly or annually, supporting accurate mortgage portfolio financial forecasts and home loan financial projection models. This tool is essential for professionals seeking reliable cash flow insights to optimize mortgage underwriting financial models and enhance property financing financial forecasts.

KPI Benchmarks

The mortgage loan analysis financial model is an essential tool for startups in real estate and housing finance. By leveraging benchmarking against industry averages, this home loan financial projection model empowers companies to evaluate their strengths and identify growth opportunities. Whether using a mortgage portfolio financial model or a housing finance cash flow model, comprehensive analysis offers clarity in navigating complex markets. Startups can confidently shape their strategies, optimize mortgage underwriting financial models, and enhance property financing financial forecasts. Embracing benchmarking is crucial for driving informed decisions and achieving sustainable success in residential mortgage financial modeling.

P&L Statement Excel

The Profit and Loss Statement within our mortgage financing financial model offers a clear view of your primary revenue streams and key expenses. This essential tool enables stakeholders to evaluate profitability, income structure, and debt repayment capacity. Leveraging advanced home loan financial projection models, users can confidently analyze forecasted profitability and assess future performance. Whether for mortgage portfolio financial modeling or real estate financing projection, this statement ensures comprehensive insights to drive informed decisions and optimize mortgage loan analysis.

Pro Forma Balance Sheet Template Excel

We included a 5-year projected balance sheet in Excel, essential for comprehensive mortgage portfolio financial modeling. This pro forma template presents current and long-term assets, liabilities, and equity, offering critical insights for accurate home loan financial projection models. It supports detailed financial analysis, enabling precise ratio calculations vital for mortgage underwriting financial models and housing finance cash flow models. This template empowers informed decision-making in real estate mortgage financial modeling and property financing financial forecasts.

MORTGAGE FINANCING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive mortgage financing financial model features a startup valuation template designed to meet investor expectations with clear, data-driven insights. The weighted average cost of capital (WACC) demonstrates the minimum return stakeholders can anticipate, assuring sound investment decisions. Our free cash flow valuation emphasizes the cash flow available to both shareholders and creditors, while the discounted cash flow analysis accurately captures the present value of all future projected cash flows. This real estate mortgage financial modeling tool is essential for confident financial planning and strategic mortgage investment decisions.

Cap Table

Our comprehensive mortgage loan analysis financial model integrates multiple financing rounds, illustrating how new investor shares affect investment returns. Utilizing this real estate mortgage financial modeling tool, users can track ownership structures and percentage changes after each round, effectively capturing dilution impacts. This home loan financial projection model ensures clarity in property financing financial forecasts, empowering stakeholders with accurate insights into mortgage portfolio dynamics and investment performance throughout funding stages.

MORTGAGE FINANCING FINANCIAL PLAN EXCEL ADVANTAGES

Optimize decision-making with our mortgage financing financial model’s precise 5-year projection template for business growth.

Our mortgage loan analysis financial model simplifies assumptions entry, enhancing accuracy and streamlining your financial planning process.

Accurately forecast cash flow and optimize decisions with our comprehensive mortgage financing financial model template.

The mortgage loan analysis financial model empowers precise forecasting, improving strategic decisions and maximizing investment returns.

Accurately calculate startup expenses with our mortgage loan financial model for precise financing and strategic planning advantages.

MORTGAGE FINANCING FINANCIAL FORECAST TEMPLATE EXCEL ADVANTAGES

Unlock accurate home loan financial projections with our customizable mortgage loan analysis model, updated anytime for precision.

Easily refine your mortgage financing financial model by adjusting inputs anytime for accurate, dynamic business projections.

Our integrated mortgage portfolio financial model empowers investors with precise forecasts and optimized risk management strategies.

Our mortgage portfolio financial model delivers comprehensive, investor-friendly insights by seamlessly integrating all assumptions and projections.

The housing finance cash flow model helps identify potential cash shortfalls early for proactive financial management.

The mortgage loan analysis financial model acts as an early warning system, ensuring accurate cash flow projections.

Optimize decisions efficiently with our mortgage loan analysis financial model—get it right the first time.

Maximize funding success with our mortgage loan analysis financial model for precise, investor-ready real estate financing projections.

Our mortgage loan analysis financial model enhances accuracy, ensuring stakeholder trust through reliable and transparent forecasting.

A mortgage portfolio financial model ensures clear future insights, building stakeholder trust and boosting investment confidence.