Bistro Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Bistro Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Bistro Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BISTRO FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly bistro financial planning model designed for comprehensive financial modeling for bistro startups, including a restaurant financial forecast model, bistro revenue and expense model, and cash flow analysis for bistro. This dynamic financial model for bistro offers an integrated bistro profit and loss forecast, financial statement model for bistro, and bistro break-even analysis template with monthly and annual timelines. Ideal for both startup and existing bistros, it supports evaluation of financial viability, capital budgeting for bistro, and restaurant funding financial model purposes, featuring an unlocked format for full customization and detailed expense tracking model.

This ready-made bistro financial planning model alleviates the common pain points faced by startup owners and managers by providing a comprehensive, dynamic financial model for bistro operations that streamlines restaurant financial forecast modeling, cash flow analysis, and profit and loss forecasting all in one Excel template. Designed with detailed bistro revenue and expense models, expense tracking, and cost estimation features, this template assists in precise budgeting projections and break-even analysis, helping users avoid the frustration of inconsistent or incomplete data. By integrating capital budgeting, financial risk assessment, and sales forecasting tools, it empowers owners to make informed decisions to enhance financial viability and optimize operational performance, minimizing errors and saving time previously spent on manual calculations or complex formulas. This model enhances clarity and transparency, making it easier to attract funding through reliable restaurant financial performance models and clear financial statement presentations, ultimately boosting confidence in business growth strategies and investor communications.

Description

This dynamic bistro financial planning model offers a comprehensive solution for restaurant financial forecast modeling by providing detailed monthly and yearly bistro income statement projections, cash flow analysis for bistro operations, and a bistro revenue and expense model to monitor financial health. Equipped with a user-friendly bistro break-even analysis template and cost estimation model for bistro business expenses, it enables precise capital budgeting for bistro startups and supports financial viability modeling through robust profit and loss forecasts and expense tracking. Additionally, this operational financial model incorporates restaurant funding financial model components and a bistro financial risk assessment model to help you effectively evaluate investment returns, optimize budget projections, and enhance overall restaurant financial performance.

BISTRO FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Looking to validate your bistro startup’s financial viability or secure funding? Our dynamic bistro financial planning model simplifies complex forecasting with an easy-to-use Excel template. Customize your bistro revenue and expense model, conduct cash flow analysis, and generate profit and loss forecasts effortlessly. Whether it’s a restaurant financial forecast model or a bistro break-even analysis template, our comprehensive tool covers sales projections, cost estimation, and capital budgeting. Build a robust financial statement model for your bistro startup and make confident decisions with a single click—no advanced Excel skills needed!

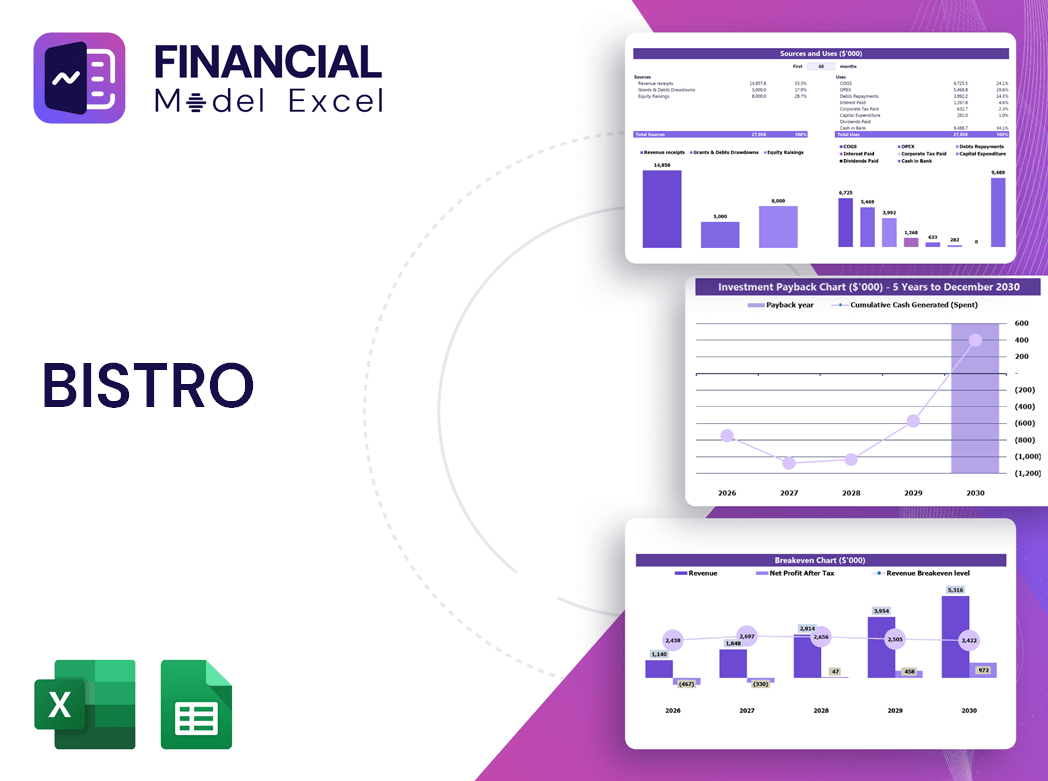

Dashboard

Build a robust 3-way financial model using our dynamic financial model for bistro startups, making your business plan numbers compelling and investor-ready. The dashboard features comprehensive charts, graphs, and a detailed financial statement model for bistro, providing clear insights into your restaurant’s financial performance. Easily copy and integrate these visuals into presentations to showcase your bistro’s revenue and expense model, cash flow analysis, and break-even projections. Elevate your financial planning with our bistro budget projection template and secure your capital budgeting goals with confidence.

Business Financial Statements

A comprehensive bistro financial planning model integrates the profit and loss forecast, balance sheet projection, and cash flow analysis. The profit and loss forecast highlights income and expenses, revealing operational profitability. The balance sheet offers a snapshot of the bistro’s financial position and capital structure at a specific moment. Meanwhile, cash flow projections detail the inflows and outflows from core operations, investments, and financing activities. Together, these elements create a dynamic financial model for bistro startups, providing an essential foundation for informed decision-making, financial viability assessment, and strategic growth.

Sources And Uses Statement

The sources and uses chart is a vital element of any dynamic financial model for bistro startups. It provides a comprehensive overview of funding sources alongside detailed cash distribution, essential for effective capital budgeting and cash flow analysis for bistro operations. This chart enhances accuracy in bistro financial planning models and supports precise restaurant financial forecasts, enabling informed decision-making and improved financial viability. Integrating this chart within a bistro revenue and expense model or a financial statement model for bistros ensures clear tracking of investments and expenditures, strengthening your restaurant’s financial performance and profitability outlook.

Break Even Point In Sales Dollars

The bistro break-even analysis template is a crucial component of your financial modeling for bistro startup. This key financial indicator determines the sales revenue needed to cover all operating expenses, including taxes. Reaching this break-even point signals that the bistro revenue and expense model balances, and the business begins generating profits. Understanding this threshold ensures the financial viability model for your bistro, empowering informed decisions and boosting investor confidence by highlighting when start-up investments start to pay off.

Top Revenue

The Top Revenue tab in your bistro financial planning model enables a detailed demand report for products and services, spotlighting profitability across scenarios to inform strategic decisions. Using the pro forma financial statements template, develop a revenue bridge illustrating key revenue drivers like sales volume and unit price over time. This dynamic financial model for bistro startups supports accurate sales forecasting—even distinguishing weekdays versus weekends—enhancing resource allocation and optimizing operational performance. Harness these insights to strengthen your restaurant financial forecast model and drive sustainable growth.

Business Top Expenses Spreadsheet

Easily manage and analyze your costs with our Bistro Expense Tracking Model, featured in the Top Expenses section of our dynamic financial modeling template. Organized into four detailed categories plus an adaptable ‘Other’ field, this restaurant financial forecast model ensures comprehensive expense tracking tailored to your bistro’s unique needs. Perfect for accurate cost estimation, informed cash flow analysis, and precise profit and loss forecasting, it empowers your bistro startup with actionable financial insights to drive smart decisions and sustainable growth.

BISTRO FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our bistro financial planning model offers seamless integration of individual and group budgets, allowing precise tracking of full-time and part-time salary costs. With dynamic financial modeling for your bistro startup, all data effortlessly updates across the entire restaurant financial forecast model. This ensures your bistro revenue and expense model remains accurate, providing a comprehensive bistro profit and loss forecast and streamlined cash flow analysis for effective decision-making.

CAPEX Spending

A bistro’s capital budgeting for expansion or new equipment investment is crucial in its financial modeling. This restaurant financial forecast model treats capital expenditures as assets on the balance sheet rather than expenses on the profit and loss forecast. Over time, depreciation allocates the cost, ensuring accurate expense tracking. Utilizing a dynamic financial model for bistro startups enables precise cash flow analysis and cost estimation, supporting informed decisions for sustainable growth. Integrating capital budgeting with a bistro revenue and expense model optimizes financial viability and enhances overall operational performance.

Loan Financing Calculator

A comprehensive financial modeling for bistro startups includes a dynamic loan amortization schedule, detailing periodic payments toward principal and interest. Integrated into restaurant financial forecast models, this tool streamlines capital budgeting and cash flow analysis for bistros. By using a pre-built amortization calculator within the bistro financial planning model, owners can accurately track outstanding loan balances and repayment timelines. This enhances financial viability assessments and supports precise expense tracking, ultimately optimizing the bistro’s profit and loss forecast and overall operational financial model.

BISTRO FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The Bistro Financial Planning Model offers comprehensive insights into earnings growth and net income expansion. By leveraging the Bistro Profit and Loss Forecast alongside the Restaurant Financial Forecast Model, startups can effectively track sales and revenue trends. This dynamic financial model enables precise monitoring of business growth, ensuring strategic development aligns with financial goals. Utilizing the Bistro Revenue and Expense Model and Cash Flow Analysis for Bistro, entrepreneurs gain confidence in their operational success and long-term profitability.

Cash Flow Forecast Excel

The cash flow analysis for bistro is a crucial component of the dynamic financial model for bistro startups. This cash flow forecast template enables seamless input of operating, investing, and financing activities, ensuring accurate projections. Integrated within the three-statement bistro financial planning model, it directly impacts the restaurant financial forecast model and projected balance sheet. Without a precise pro forma cash flow statement, the bistro income statement projection and overall financial statement model for bistro cannot balance, making this tool essential for reliable bistro financial viability and capital budgeting decisions.

KPI Benchmarks

Benchmarking is a crucial financial metric within a dynamic financial model for bistro startups. It enables management to evaluate performance indicators—such as profit margins, cost per unit, and productivity—by comparing them against industry peers. Utilizing tools like a bistro financial planning model or restaurant financial forecast model, benchmarking offers valuable insights into operational efficiency and financial viability. Whether for established bistros or startups, this process guides strategic decisions, enhances the bistro revenue and expense model, and supports sustainable growth in a competitive market.

P&L Statement Excel

The bistro profit and loss forecast provides a comprehensive financial statement model for bistro startups, evaluating profitability and business viability. By integrating a restaurant financial forecast model with dynamic charts and detailed tables, it offers clear insights into revenue, expenses, and demand trends. This operational financial model enables precise cash flow analysis and cost estimation, empowering owners to track income and expenses effectively. Leveraging this bistro income statement projection enhances decision-making and ensures a robust financial planning model tailored for sustainable growth and performance optimization.

Pro Forma Balance Sheet Template Excel

Our dynamic financial model for bistro startups features a comprehensive 5-year bistro income statement projection, including a pre-built balance sheet proforma. This restaurant financial forecast model enables stakeholders to clearly assess the bistro’s financial position by illustrating how operations influence assets, liabilities, and equity. By integrating the bistro revenue and expense model with cash flow analysis and expense tracking, users gain insight into the interconnection between sales growth, profit and loss forecasts, and the overall financial viability model for the bistro business, ensuring informed decision-making and strategic planning.

BISTRO FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our dynamic financial model for bistro startups seamlessly integrates two powerful valuation methods: discounted cash flow (DCF) and weighted average cost of capital (WACC). This comprehensive restaurant financial forecast model ensures precise cash flow analysis and robust financial viability insights. Designed to enhance your bistro’s financial planning, it supports accurate profit and loss forecasts and capital budgeting decisions, empowering confident growth strategies and optimized operational performance.

Cap Table

A comprehensive bistro financial planning model is essential for startups to accurately assess ownership structure and investor equity. Similar to a cap table startup tool, it helps analyze share distribution based on investor contributions, ensuring transparent capital budgeting for bistro ventures. Integrating this with a dynamic financial model for bistro operations enhances decision-making by aligning funding insights with precise bistro revenue and expense models. This approach streamlines financial viability assessments and supports effective cash flow analysis, driving sustainable growth in the competitive restaurant industry.

BISTRO THREE STATEMENT FINANCIAL MODEL ADVANTAGES

Secure funding confidently with a bistro financial planning model that ensures accurate startup loan projections and success.

Create multiple scenarios effortlessly with our dynamic bistro financial model for precise planning and risk management.

Dynamic financial model for bistro ensures precise forecasting, empowering startups to navigate challenges confidently and profitably.

Gain full control and accuracy in forecasting with the dynamic bistro financial model 5-year projection template.

Unlock precise startup expense insights with our dynamic financial model for bistro success and sustainable growth.

BISTRO BOTTOM UP FINANCIAL MODEL ADVANTAGES

Use the bistro financial planning model to build a compelling plan and secure essential funding confidently.

Impress investors with a strategic bistro financial planning model that ensures accuracy, clarity, and confident funding decisions.

The dynamic bistro financial planning model empowers investors with precise forecasts and profitability insights for confident decisions.

The bistro financial planning model streamlines startup costs, ensuring investor-ready clarity and confident funding decisions.

The bistro financial planning model saves you time by streamlining accurate budget projections and cash flow analysis effortlessly.

The bistro financial planning model saves time on cash flow projections, letting you focus on growth and customer satisfaction.

Our dynamic financial model for bistro startups ensures precise forecasting to maximize profits and minimize risks effortlessly.

The Bistro Financial Planning Model streamlines budgets effortlessly—no formulas, formatting, or costly consultants needed.

The bistro financial planning model delivers great value by accurately forecasting profits and optimizing cash flow management.

Leverage our proven bistro financial planning model for accurate, affordable projections with no hidden or recurring fees.