Blockchain Based Identity Verification Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Blockchain Based Identity Verification Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Blockchain Based Identity Verification Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BLOCKCHAIN BASED IDENTITY VERIFICATION FINANCIAL MODEL FOR STARTUP INFO

Highlights

A sophisticated 5-year blockchain-based KYC financial framework and identity verification financial model is essential for businesses at any stage, providing reliable blockchain digital identity verification economics and investment model insights with minimal financial planning experience required. This decentralized identity verification finance model template enables users to conduct blockchain identity verification cost analysis, evaluate startup ideas, plan pre-launch expenses, and secure funding from banks, angels, grants, and VC funds. Fully unlocked and editable, it offers robust financial projections and forecasting tools to assess the financial viability of blockchain identity solutions and develop a comprehensive blockchain-powered identity verification financial strategy.

The blockchain identity verification financial model Excel template effectively addresses pain points by providing a highly customizable and user-friendly platform tailored for blockchain-based KYC financial frameworks, enabling startups to streamline decentralized identity verification finance models with ease. This model integrates comprehensive financial forecasting blockchain identity verification tools, including automated updates of all key performance indicators and financial statements upon input adjustments, thus eliminating manual errors and saving vital analytical time. By incorporating blockchain identity verification cost analysis and ROI analysis, the template enhances financial feasibility assessments and investment model blockchain identity verification decision-making, while its built-in DCF valuation framework supports precise monitoring of the blockchain identity authentication financial plan’s real-time economic impact. This ready-made solution not only simplifies the complex financial modeling blockchain identity technology process but also serves as an invaluable strategic asset in demonstrating the financial viability of blockchain identity models to stakeholders and potential investors.

Description

This blockchain-based KYC financial framework offers a comprehensive financial modeling solution tailored for entrepreneurs aiming to launch decentralized identity verification finance models, enabling precise financial forecasting and economic impact analysis. The dynamic Excel template facilitates detailed blockchain identity verification financial projections, including profit and loss statements, pro forma balance sheets, cash flow forecasts, and break-even calculations, all built on a bottom-up revenue approach incorporating pricing assumptions, OPEX, and capital expenditures. Designed to optimize blockchain identity management financial systems, this model also provides key performance indicators and diagnostic charts to evaluate financial viability and ROI, ensuring efficient management of operational activities and customer demand while simplifying complex blockchain identity verification cost analysis and enhancing strategic investment planning in blockchain identity solution financial feasibility.

BLOCKCHAIN BASED IDENTITY VERIFICATION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A well-crafted blockchain identity verification financial model is essential to secure investor confidence. Utilizing a comprehensive, investor-friendly pro forma income statement and a detailed blockchain-based KYC financial framework enables precise financial forecasting and ROI analysis. This financial strategy not only validates the investment required but also highlights the economic impact and financial feasibility of your blockchain identity management system. Leveraging such financial modeling tools ensures your startup’s blockchain identity solution is positioned for attractive investment and sustainable growth.

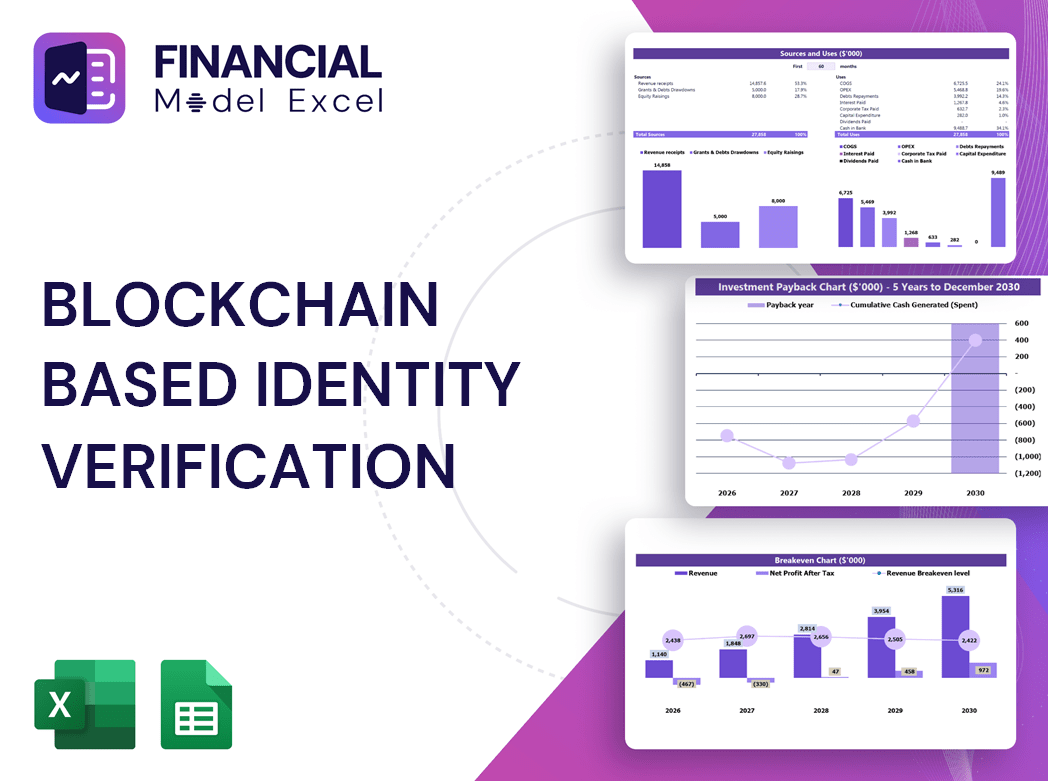

Dashboard

Discover the comprehensive Blockchain Identity Verification Financial Model dashboard — your all-in-one solution for real-time insights. Effortlessly monitor decentralized identity verification metrics, revenue breakdowns, cash flow analysis, and profitability forecasts. Visualized through intuitive charts and graphs, this powerful tool supports financial forecasting, ROI analysis, and economic impact assessments within blockchain-based KYC and identity management frameworks. Empower your strategic decisions with clear, concise financial projections tailored for blockchain digital identity finance models, ensuring optimal financial viability and investment evaluation at a glance. Elevate your blockchain identity verification financial planning with this dynamic, data-driven dashboard.

Business Financial Statements

A comprehensive financial model for blockchain identity verification seamlessly integrates historical and projected company reports, enhancing blockchain identity verification financial projections. Incorporating key financial statements into dynamic charts offers clear visualization, crucial for investor presentations within blockchain-based KYC financial frameworks. Our Excel template automates these financial charts, streamlining analysis for blockchain identity management financial systems. This blockchain digital identity finance blockchain model empowers strategic decision-making by delivering insightful financial forecasting and ROI analysis, ensuring the financial viability and economic impact of blockchain-powered identity verification are thoroughly evaluated.

Sources And Uses Statement

The three-statement model for cash sources and uses offers a robust framework to manage financial activities effectively. Integral to blockchain identity verification financial models, it supports both startups and established enterprises by providing clear insights into cash flow and resource allocation. This model not only signals financial health to investors but also drives strategic growth within blockchain-based KYC financial frameworks. Leveraging such structured financial planning enhances the economic impact and ROI analysis of blockchain digital identity verification systems, empowering businesses to innovate confidently in decentralized identity verification finance models.

Break Even Point In Sales Dollars

Our blockchain identity verification financial model seamlessly integrates with your core financial statements, automating break-even analysis to enhance strategic planning. This dynamic worksheet calculates break-even sales, units, and ROI, offering clear insights into the financial viability of blockchain-based identity solutions. By leveraging this blockchain-powered identity verification financial strategy, management can precisely forecast profitability timelines and make informed decisions to optimize investment returns within the digital identity finance blockchain model framework.

Top Revenue

In financial forecasting, the top line (gross revenue) and bottom line (net profit) are critical metrics that investors and analysts monitor closely. Top-line growth signals increased revenues, reflecting strong operational decisions and boosting overall financial health. Within blockchain identity verification, integrating these metrics into a robust financial model—such as a blockchain-based KYC financial framework or decentralized identity finance model—enables accurate financial projections and ROI analysis. Understanding the economic impact and cost analysis of blockchain identity solutions is essential for assessing financial viability and guiding strategic investment decisions in this evolving technology space.

Business Top Expenses Spreadsheet

Optimizing major expenses is crucial for the financial viability of blockchain identity verification models. Our blockchain-based KYC financial framework features a comprehensive top-spending report within the three-way financial model template. It highlights the four largest cost categories while grouping remaining costs as "other," enabling clear tracking of expense trends over time. For startups and established firms leveraging blockchain identity solutions, rigorous financial forecasting and expense management are essential to sustain profitability and maximize ROI in this evolving digital identity finance blockchain model.

BLOCKCHAIN BASED IDENTITY VERIFICATION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are critical in any blockchain-based identity verification financial model. Managing these early expenses is essential to safeguard against cash shortfalls and funding gaps. A well-structured financial model for blockchain identity solutions integrates a bottom-up pro forma, capturing detailed company expenses and financing data. This approach ensures a comprehensive expense plan, enhancing financial viability and supporting strategic growth. Effective financial forecasting and cost analysis within the blockchain identity finance model empower startups to optimize resources and drive sustainable success in decentralized identity verification markets.

CAPEX Spending

The initial startup costs represent the total capital invested in developing and securing assets within the blockchain-based KYC financial framework. This strategic CAPEX investment enhances operational efficiency and strengthens the company’s competitive edge in blockchain identity verification. Our report details how these expenditures drive asset performance, excluding salaries and general operating expenses. Given industry variability, capital investment levels differ widely, underscoring the importance of contextual financial modeling in evaluating blockchain digital identity verification economics and the financial viability of blockchain identity solutions.

Loan Financing Calculator

Our blockchain identity verification financial model Excel template integrates a comprehensive loan amortization schedule tailored for diverse loan types. It systematically tracks key metrics including principal amount, interest type and rate, loan duration, and repayment schedules. Designed to support blockchain-based KYC financial frameworks, this tool enhances the financial modeling of blockchain identity solutions by providing precise, transparent data vital for cost analysis, ROI projections, and strategic investment planning in decentralized identity verification finance models. Elevate your financial forecasting and economic impact assessments with this robust blockchain identity management financial system template.

BLOCKCHAIN BASED IDENTITY VERIFICATION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The blockchain-based KYC financial framework features a detailed proforma chart outlining monthly revenue across five core products. Designed for flexibility, this financial model for blockchain identity solutions allows seamless customization—add products or adjust analysis periods to suit your needs. This comprehensive financial projection supports strategic decision-making, enhancing the economic viability and investment planning of decentralized identity verification finance models.

Cash Flow Forecast Excel

A robust financial modeling blockchain identity technology relies on precise cash flow projections. The cash flow budget template in Excel integrates operating, investing, and financing flows, forming the backbone of the blockchain-based KYC financial framework. Accurate cash flow forecasting ensures alignment across all financial statements, enabling reliable blockchain identity verification financial projections and ROI analysis. This essential tool supports the financial viability and economic impact assessments of decentralized identity verification finance models, providing a solid investment model for blockchain identity verification solutions within a five-year horizon.

KPI Benchmarks

A benchmarking study is essential for accurate financial modeling in blockchain identity verification projects. By comparing key metrics—such as unit costs, profit margins, and productivity—with industry leaders or related businesses, startups can objectively assess their financial viability and forecast ROI. This approach strengthens blockchain-based KYC financial frameworks and decentralized identity verification finance models, offering a comprehensive analysis of economic impact and cost efficiency. Ultimately, benchmarking empowers companies to refine their blockchain identity management financial systems and develop robust investment and financial strategies for sustainable growth.

P&L Statement Excel

Projecting income and expenses using a financial forecasting model is essential for evaluating the financial viability of blockchain-based identity verification solutions. By analyzing past performance, businesses can develop a blockchain identity verification financial strategy that anticipates revenue streams and potential costs. This approach enables informed decision-making, optimizing profitability and mitigating risks within decentralized identity verification finance models. Integrating blockchain digital identity verification economics into your financial plan ensures a robust investment model, driving sustainable growth and demonstrating the economic impact and ROI of blockchain identity management systems.

Pro Forma Balance Sheet Template Excel

A robust financial model for blockchain identity verification integrates projected balance sheets, income statements, and cash flow templates to deliver a balanced, comprehensive outlook. Five-year blockchain-based KYC financial frameworks offer critical insights into a company’s development and liquidity, essential for accurate cash flow forecasting. Investors rely heavily on these projections to assess financial viability, calculating key ratios like leverage, productivity, return on equity, and ROI. This blockchain identity verification financial strategy not only supports informed decision-making but also highlights the economic impact and ROI of decentralized identity solutions, driving confidence in investment and long-term sustainability.

BLOCKCHAIN BASED IDENTITY VERIFICATION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our financial projections employ two integrated valuation methodologies—Discounted Cash Flow (DCF) and Weighted Average Cost of Capital (WACC)—to accurately model the blockchain identity verification financial framework. This approach offers a comprehensive analysis of the economic impact and financial viability of blockchain-based identity solutions, supporting robust financial forecasting and ROI analysis. It ensures precise insights into the decentralized identity verification finance model, aligning investment strategies with sustainable growth in blockchain-powered identity verification systems.

Cap Table

The cap table captures your company’s share capital, crucial for informed financial decisions involving market capitalization and valuation. With our startup financial model, you can accurately analyze the blockchain-based identity verification financial framework’s market value for strategic investment. Our comprehensive financial model includes detailed proformas and essential calculations for thorough financial forecasting and feasibility assessment of blockchain identity verification solutions. Access the full version now to leverage advanced financial modeling tools and drive sound investment strategies in this innovative decentralized identity verification finance model.

BLOCKCHAIN BASED IDENTITY VERIFICATION FINANCIAL PROJECTION MODEL ADVANTAGES

Leverage blockchain identity verification’s financial model to unlock cost-efficiency and drive scalable, future-ready growth.

The blockchain-based identity verification financial model optimizes capital demand forecasting for scalable, cost-efficient startup planning.

Avoid cash flow shortfalls with a robust blockchain-based identity verification financial model for accurate forecasting and growth.

Blockchain-powered identity verification financial strategy enables secure, cost-effective settlements across 161 global currencies seamlessly.

Boost stakeholder confidence with a robust blockchain identity verification financial model ensuring transparency and profitability.

BLOCKCHAIN BASED IDENTITY VERIFICATION FINANCIAL MODEL FOR STARTUP ADVANTAGES

Unlock superior ROI with our blockchain identity verification financial model, driving cost-efficient, scalable, and secure investment growth.

The blockchain-based identity verification financial model boosts investor confidence, accelerating funding and securing crucial investment meetings.

The blockchain identity verification financial model ensures secure, cost-effective, and scalable solutions for modern finance systems.

Sophisticated yet user-friendly blockchain identity financial model delivers reliable results with minimal planning and basic Excel skills.

The blockchain identity verification financial model ensures secure, cost-effective, and scalable solutions for modern finance systems.

This blockchain-based identity verification financial model ensures accurate ROI analysis with minimal planning and user-friendly Excel tools.

Our blockchain-based KYC financial framework optimizes costs, enhancing ROI and ensuring sustainable, scalable identity verification solutions.

The blockchain identity verification financial model enables seamless planning without programming, formulas, or costly consulting services.

The blockchain-based KYC financial framework builds stakeholder trust through transparent, secure, and cost-effective identity verification.

A blockchain identity verification financial model enhances investor confidence through clear, reliable cash flow forecasting and strategic insights.