Blockchain For Renewable Energy Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Blockchain For Renewable Energy Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Blockchain For Renewable Energy Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BLOCKCHAIN FOR RENEWABLE ENERGY FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year blockchain renewable energy financing model Excel template offers comprehensive blockchain energy financial modeling tailored for startups and entrepreneurs seeking funding and business planning solutions. Featuring key financial charts, summaries, metrics, and funding forecasts, it integrates blockchain-based energy finance solutions to optimize renewable energy blockchain cost analysis and project finance. Designed to estimate required startup costs, this decentralized energy finance model supports blockchain green energy investment strategies and smart contracts renewable energy finance for effective fundraising and strategic decision-making.

The blockchain renewable energy financing model template addresses key pain points by providing an all-encompassing, integrated financial framework designed for ease and precision in projecting blockchain energy project finance outcomes. It eliminates the need for costly external consultants by allowing users to customize critical inputs such as expenditure, growth rates, and net earnings, with automatic updates across all components, ensuring accuracy in blockchain energy market financial model forecasts. By incorporating smart contracts renewable energy finance features and distributed ledger renewable energy finance principles, this ready-made Excel solution facilitates seamless blockchain energy project cost forecasting and renewable energy blockchain integration. It also supports advanced scenarios like blockchain carbon credit financial model assessments and blockchain green energy investment model strategies, enabling startups and investors to optimize funding decisions and streamline blockchain-based energy finance solutions within a decentralized energy finance model framework.

Description

The blockchain renewable energy financing model offers a comprehensive blockchain energy project finance solution designed to optimize revenue streams and accurately forecast cash flow through smart contracts renewable energy finance mechanisms. This decentralized energy finance model integrates distributed ledger renewable energy finance technology to enhance transparency and efficiency in funding, allowing stakeholders to analyze blockchain energy trading financial models alongside blockchain carbon credit financial models for comprehensive investment strategies. The financial plan Excel template includes a detailed 5-year projection, covering blockchain energy asset financing, blockchain power purchase agreement modeling, and renewable energy blockchain integration, facilitating precise blockchain energy project cost forecasting and blockchain energy finance optimization. It supports various financing options such as equity funding and business loans, while incorporating key financial statements, ratios, and diagnostic tools essential for sustainable blockchain clean energy investment strategies and blockchain green energy investment model success.

BLOCKCHAIN FOR RENEWABLE ENERGY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This blockchain renewable energy financing model offers entrepreneurs a comprehensive proforma business plan, integrating financial assumptions on costs and revenues. Utilizing advanced blockchain energy financial modeling and smart contracts for renewable energy finance, it delivers a clear, data-driven overview of project viability. By leveraging decentralized energy finance models and blockchain-based energy finance solutions, this template streamlines renewable energy blockchain integration, optimizing cost forecasting and investment strategies to empower sustainable energy ventures.

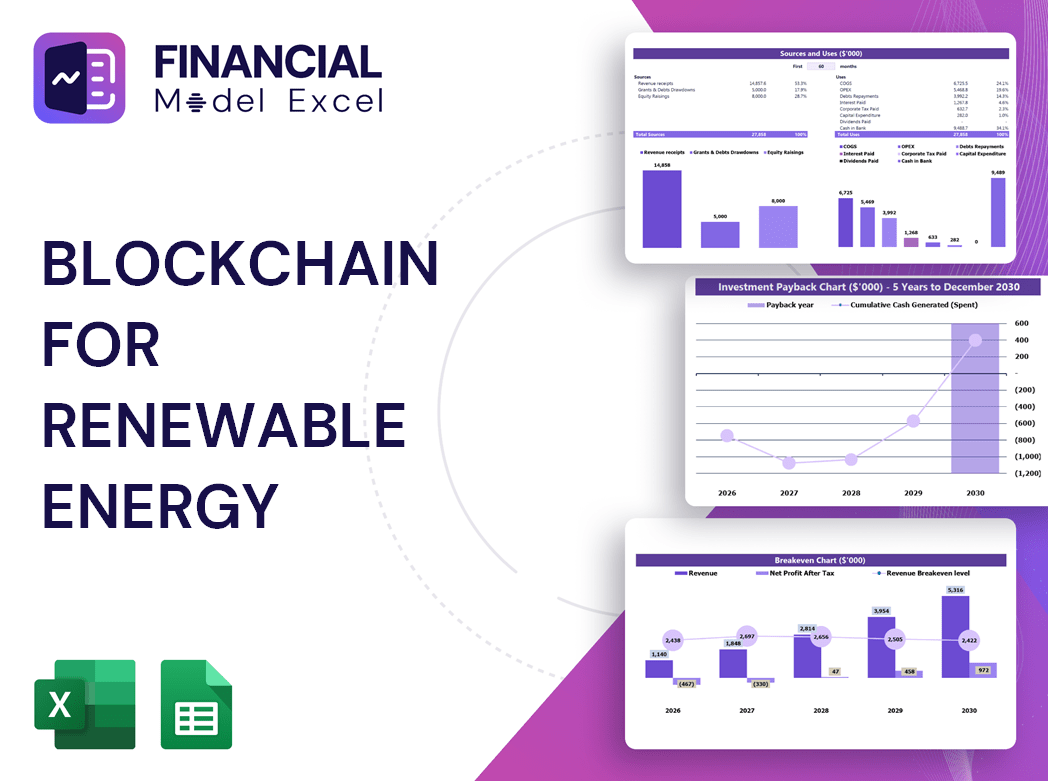

Dashboard

Our profit and loss projection features a comprehensive financial dashboard tailored for blockchain renewable energy financing models. This panel highlights key indicators including cash flow statements, annual revenue segmentation, profit forecasts, and overall fund movement. Designed to support blockchain energy financial modeling and blockchain-based energy finance solutions, it enables precise blockchain energy project cost forecasting and finance optimization. This tool is essential for stakeholders leveraging distributed ledger renewable energy finance and blockchain clean energy investment strategies, ensuring transparent, data-driven decisions in decentralized energy finance models.

Business Financial Statements

Our advanced blockchain energy financial modeling tool empowers entrepreneurs to develop comprehensive startup financial statements, forecasts, and cost analyses. By integrating blockchain renewable energy financing models and smart contracts renewable energy finance elements, users can generate dynamic presentations featuring detailed financial charts. These visualizations effectively communicate insights on blockchain-based energy finance solutions and distributed ledger renewable energy finance to stakeholders and potential investors. Streamline your renewable energy blockchain integration with data-driven, transparent, and engaging financial reports that highlight the viability of blockchain green energy investment models and decentralized energy finance strategies.

Sources And Uses Statement

The sources and uses chart within a blockchain energy financial modeling framework offers vital insights into fund management. It clearly delineates capital inflows and expenditure across blockchain-based energy finance solutions, enabling startups to optimize renewable energy blockchain integration and financing strategies. This transparency is crucial for executing smart contracts in renewable energy finance, supporting blockchain renewable energy funding, and ensuring effective blockchain energy project cost forecasting. By leveraging a decentralized energy finance model, startups can enhance blockchain clean energy investment strategies and maximize blockchain energy finance optimization for sustainable growth.

Break Even Point In Sales Dollars

The break-even point is crucial in business, pinpointing when total revenue equals total costs, including fixed and variable expenses. Utilizing financial modeling tools, such as excel templates, companies can accurately forecast unit sales needed to cover costs and set optimal sales prices. The contribution margin—sales price minus variable cost per unit—directly influences profitability. Integrating this analysis with blockchain energy financial modeling enhances renewable energy project finance by providing transparent, decentralized insights for blockchain renewable energy financing models and blockchain-based energy finance solutions, optimizing funding strategies and cost forecasting in green energy investments.

Top Revenue

This blockchain energy financial modeling template offers a dedicated tab for in-depth analysis of revenue streams across each product or service category. Designed to optimize blockchain renewable energy financing models, it enables precise evaluation of distributed ledger renewable energy finance and blockchain green energy investment models. Users can leverage this tool for comprehensive blockchain energy project finance insights, enhancing blockchain-based energy finance solutions and smart contracts renewable energy finance strategies, driving informed decisions in blockchain clean energy investment strategies and decentralized energy finance models.

Business Top Expenses Spreadsheet

The Top Expenses tab in this blockchain energy project finance model offers a comprehensive annual expense overview, categorized into key areas such as customer acquisition, wages & salaries, fixed and variable costs, and other operational expenses. Designed for blockchain renewable energy financing models, it enables precise cost forecasting and optimization, supporting robust renewable energy blockchain integration and financing strategies. This financial model empowers companies to streamline blockchain-based energy finance solutions, enhancing transparency and efficiency in distributed ledger renewable energy finance and blockchain clean energy investment strategies.

BLOCKCHAIN FOR RENEWABLE ENERGY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are critical in any blockchain renewable energy financing model, accruing before operations commence. Early monitoring prevents overspending and funding gaps. Our blockchain energy project finance template includes a detailed proforma for start-up costs, showcasing both expenses and funding. This allows you to track expenditures accurately and develop precise cost budgets, optimizing your blockchain clean energy investment strategies from the outset.

CAPEX Spending

CapEx startup expenses represent significant investments in blockchain energy asset financing, crucial for developing a decentralized energy finance model. These large, time-bound costs are integral to renewable energy blockchain integration, reflected in five-year projected balance sheets and cash flow pro formas. They fund enhancements in technology and equipment, optimizing blockchain-based energy finance solutions. Properly capturing these expenses in financial models—such as blockchain energy project cost forecasting or blockchain green energy investment models—ensures accurate renewable energy blockchain cost analysis and supports robust blockchain clean energy investment strategies.

Loan Financing Calculator

Our blockchain energy project finance model features an integrated loan amortization schedule with dynamic formulas. This cutting-edge tool provides precise forecasting of principal and interest payments across monthly, quarterly, or annual intervals. Designed for decentralized energy finance models and blockchain renewable energy financing, it streamlines renewable energy blockchain integration and optimizes cost analysis. Enhance your blockchain green energy investment strategies with our smart contracts renewable energy finance solution, ensuring transparent, accurate tracking of loan repayments within your blockchain energy market financial model.

BLOCKCHAIN FOR RENEWABLE ENERGY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our blockchain renewable energy financing model offers comprehensive financial planning tailored for startups, featuring pre-built proformas for profit and loss, balance sheets, and cash flow statements. Integrated with blockchain energy financial modeling, it enables precise cost forecasting, profitability, margin, and liquidity analysis. Designed for seamless renewable energy blockchain integration, this model supports investor presentations and optimizes blockchain-based energy finance solutions, including smart contracts and decentralized energy finance. Monitor key performance metrics effortlessly to drive informed decisions and accelerate your green energy investment strategies with confidence.

Cash Flow Forecast Excel

Utilizing a cash flow format within Excel is essential for accurate transaction tracking, ensuring no losses for you or your clients. In blockchain energy project finance, integrating cash flow projections supports robust financial modeling and renewable energy blockchain integration. This approach underpins sound decision-making in blockchain-based energy finance solutions, enabling optimal cost forecasting and cash management. Effective cash flow analysis forms the foundation of successful blockchain renewable energy financing models and promotes transparency in distributed ledger renewable energy finance.

KPI Benchmarks

The blockchain renewable energy financing model leverages distributed ledger technology to optimize financial planning through benchmarking key performance indicators against industry averages. By integrating blockchain energy financial modeling and smart contracts for renewable energy finance, companies—especially start-ups—can compare their results with best practices in blockchain-based energy finance solutions. This approach enhances project cost forecasting and investment strategies, offering a robust tool for strategic management and blockchain clean energy investment optimization.

P&L Statement Excel

This comprehensive blockchain energy financial modeling tool is designed for both professionals and newcomers. It provides clear, detailed projections of profit and loss, offering vital insights into income and expenses. By integrating blockchain renewable energy financing models and smart contracts, it enhances transparency and efficiency in renewable energy blockchain integration. Ideal for crafting robust blockchain green energy investment models, this solution empowers informed decision-making and strategic planning in decentralized energy finance, ensuring optimal outcomes for clean energy projects.

Pro Forma Balance Sheet Template Excel

The projected balance sheet forecast is crucial in renewable energy blockchain integration, complementing profit and loss statements and cash flow projections. Utilizing blockchain energy financial modeling enhances accuracy in forecasting cash flows and investment returns. This robust forecasting—integrated with blockchain-based energy finance solutions—enables investors to evaluate profitability ratios like return on equity and invested capital. By leveraging decentralized energy finance models, startups can optimize renewable energy blockchain funding and boost confidence in financial viability, ensuring transparent, reliable insights for sustainable blockchain green energy investment models.

BLOCKCHAIN FOR RENEWABLE ENERGY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

In blockchain energy project finance, tools like Weighted Average Cost of Capital (WACC) and Discounted Cash Flows (DCF) are vital. WACC assesses the capital cost, balancing equity and debt, serving as a key risk indicator for lenders in blockchain renewable energy financing models. Meanwhile, DCF evaluates the present value of future cash flows, enabling precise renewable energy blockchain integration and investment decisions. Together, these financial models optimize blockchain-based energy finance solutions, enhancing the accuracy of distributed ledger renewable energy finance and supporting smart contracts renewable energy finance strategies for sustainable growth.

Cap Table

A blockchain renewable energy financing model enhances transparency by securely tracking ownership of energy assets—such as shares, warrants, and options—within a decentralized ledger. This distributed ledger renewable energy finance approach ensures real-time updates, empowering companies to optimize blockchain energy project finance and make informed decisions. Integrating blockchain energy financial modeling with smart contracts streamlines renewable energy blockchain cost analysis and funding, driving efficient, profitable growth while supporting clean energy investment strategies.

BLOCKCHAIN FOR RENEWABLE ENERGY STARTUP FINANCIAL PROJECTIONS ADVANTAGES

Blockchain energy financial modeling enhances transparency and optimizes renewable energy project financing for better investment decisions.

Optimize surplus cash flow efficiently with blockchain renewable energy financing model for transparent, secure financial planning.

Blockchain renewable energy financing model enhances transparency and accelerates team alignment for optimized project success.

Easily optimize renewable energy financing with blockchain models for accurate income statements and balance sheet integration.

Blockchain renewable energy financing model streamlines expert collaboration, ensuring efficient, transparent, and secure project finance management.

BLOCKCHAIN FOR RENEWABLE ENERGY FINANCIAL PROJECTION EXCEL ADVANTAGES

Our blockchain renewable energy financing model optimizes investment efficiency, reducing costs and accelerating project funding.

Our blockchain renewable energy financing model streamlines funding with zero programming, no consultants, and effortless integration.

Blockchain energy financial modeling proactively identifies cash gaps and surpluses, optimizing renewable energy project funding efficiency.

Blockchain energy project finance enables precise cash flow forecasts, preventing deficits and optimizing investment opportunities efficiently.

Blockchain renewable energy financing models optimize investment security, minimizing risks and avoiding cash flow shortfalls effectively.

Blockchain renewable energy financing models optimize cash flow forecasting, reducing risks and enhancing investment predictability.

The blockchain renewable energy financing model ensures transparent, cost-efficient funding with great value for money and optimized returns.

Unlock cost-effective, transparent renewable energy financing with our proven, no-fee blockchain energy financial model template.

Blockchain renewable energy financing model ensures transparent, secure, and efficient funding for sustainable energy projects.

Our blockchain renewable energy financing model streamlines reports, meeting lender requirements for faster, accurate funding decisions.