Borehole Drilling Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Borehole Drilling Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Borehole Drilling Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BOREHOLE DRILLING FINANCIAL MODEL FOR STARTUP INFO

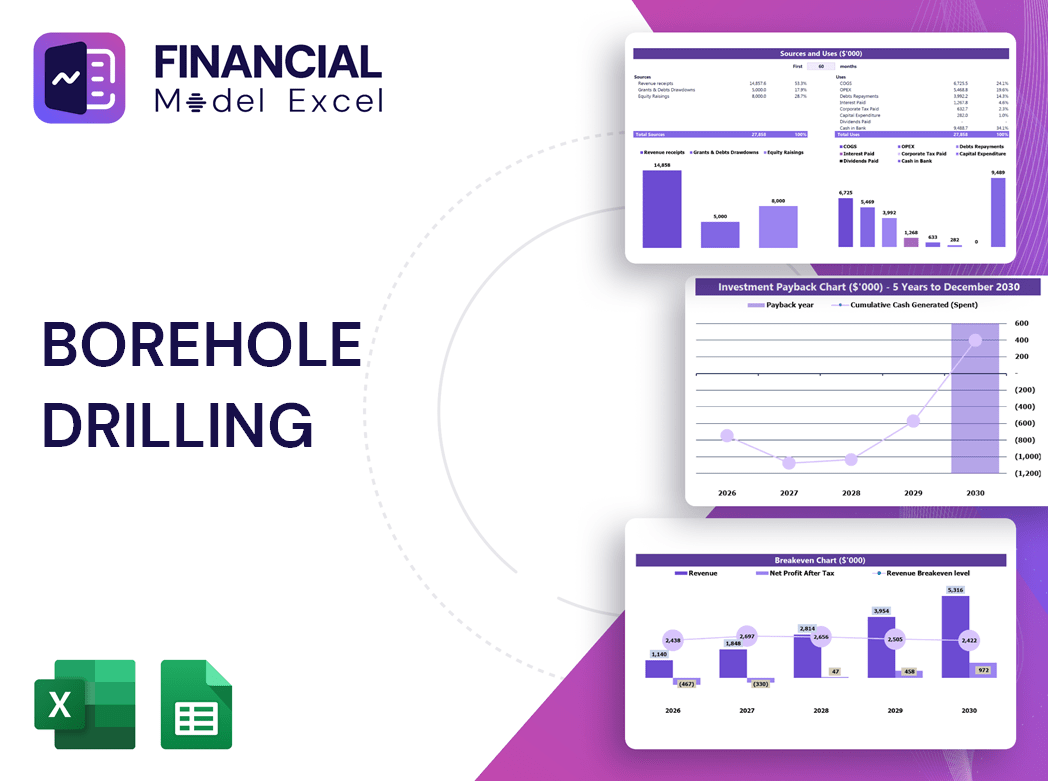

Highlights

Generate a comprehensive 5-year borehole drilling financial projection model featuring a detailed cash flow statement template in Excel, an interactive financial dashboard, and core metrics aligned with GAAP/IFRS standards. This borehole drilling investment model facilitates thorough financial viability analysis, incorporating borehole drilling operational cost modeling, expenses budgeting, and profitability analysis to support robust borehole project financial planning. Utilize this borehole drilling financial feasibility study and funding model to perform break-even analysis and capital expenditure evaluation, ensuring a solid financial forecast for borehole drilling ventures. Perfectly designed for securing funding from banks or investors, this unlocked and fully editable borehole drilling cost analysis model empowers stakeholders to make informed decisions based on a reliable borehole drilling cash flow model and revenue projections.

The borehole drilling financial projection model addresses critical pain points by streamlining borehole drilling cost analysis and operational cost modeling, enabling users to conduct thorough borehole project financial planning with confidence. This ready-made Excel template simplifies budgeting and expense tracking through an integrated borehole drilling expenses budgeting framework, while its robust borehole drilling cash flow model and income statement model provide real-time insights into profitability and financial viability. With built-in features for break-even analysis, capital expenditure modeling, and financial risk assessment, users can easily evaluate borehole drilling investment potential, forecast revenues accurately via a borehole project revenue model, and optimize funding strategies using the borehole drilling funding model. Overall, this comprehensive solution mitigates the complexity of financial forecasting for borehole drilling projects, ensuring actionable and reliable decision-making support.

Description

Our borehole drilling financial projection model is expertly crafted to provide comprehensive borehole drilling cost analysis, ensuring precise borehole project financial planning supported by a robust 5-year financial forecast for borehole drilling operations. This borehole drilling cash flow model incorporates detailed borehole drilling expenses budgeting, capital expenditure tracking, and financial risk assessment borehole drilling components, enabling accurate evaluation of the borehole drilling financial viability and profitability analysis. Designed for ease of use without requiring advanced financial expertise, the borehole drilling investment model features dynamic dashboards and automatic recalculations, facilitating seamless borehole drilling budget planning, break-even analysis, and borehole drilling funding model scenarios to optimize your borehole project revenue model and overall financial return model.

BOREHOLE DRILLING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

The borehole drilling financial projection model offers a comprehensive 5-year forecast, essential for investors to evaluate a start-up’s financial viability and profitability. Utilizing this borehole drilling investment model enables precise budgeting, cost analysis, and revenue planning, ensuring clarity on funding requirements and expected returns. A robust borehole drilling cash flow and capital expenditure model strengthens investor confidence by highlighting financial risk assessment and operational cost management. Without a well-developed borehole drilling financial feasibility study and business plan, securing investor support becomes challenging. Equip your start-up with a professional borehole drilling financial forecast for confident, data-driven decision-making.

Dashboard

This borehole drilling financial projection model features a dynamic panel displaying key financial indicators over specific periods. It provides a detailed breakdown of revenues, a comprehensive borehole drilling cash flow model, and precise financial forecasts. Ideal for borehole project financial planning, the panel aids in analyzing operational costs, budgeting expenses, and assessing financial viability. By offering clear insights into cash flows and profitability, this model is essential for optimizing borehole drilling investment strategies and ensuring sound financial management throughout the project lifecycle.

Business Financial Statements

A comprehensive borehole drilling financial projection model is vital for effective project financial planning. Integrating key elements from historical and projected financial statements into dynamic charts enhances clarity and supports informed decision-making. Our Excel-based borehole drilling cost analysis and cash flow models automate these visuals, simplifying financial viability assessments and profitability analysis. This approach is ideal for presenting compelling financial forecasts, break-even analyses, and funding models to investors, ensuring transparent budgeting and robust financial risk assessment for successful borehole drilling ventures.

Sources And Uses Statement

In borehole drilling financial planning, utilizing a comprehensive financial projection model is essential. It provides precise calculations and detailed insights into funding sources and allocation, ensuring accurate borehole drilling cost analysis and budgeting. This financial forecast for borehole drilling empowers investors with a clear assessment of capital expenditure, operational costs, and revenue streams. Integrating a borehole drilling cash flow model and profitability analysis enhances the financial viability and risk assessment of your project, making it impossible to succeed without these critical financial tools for effective borehole project management.

Break Even Point In Sales Dollars

The borehole drilling financial projection model includes a comprehensive break-even analysis, enabling precise identification of when revenue surpasses total costs. This essential financial tool guides borehole project financial planning by illustrating the critical sales volume and pricing needed to cover both fixed and variable expenses. Leveraging this analysis within the borehole drilling profitability and cash flow models ensures informed decision-making, helping to assess financial viability and optimize budgeting. Ultimately, it empowers management to forecast the exact point at which the borehole drilling investment begins generating sustainable profits, supporting robust financial risk assessment and strategic growth.

Top Revenue

This Borehole Drilling Financial Projection Model features a comprehensive revenue tab, enabling in-depth analysis of income generated by each product or service category. Designed for borehole project financial planning, it streamlines borehole drilling profitability analysis by providing clear insights into revenue streams. This tool supports accurate borehole drilling cost analysis and cash flow modeling, empowering stakeholders to make informed decisions based on detailed financial forecasts and budgeting. Optimize your borehole drilling investment strategy and enhance financial viability with precise revenue modeling tailored to your project’s unique operational dynamics.

Business Top Expenses Spreadsheet

Our borehole drilling financial projection model offers a highly efficient approach to tracking operational expenses. Divided into four primary sections plus an ‘Other’ category for customized entries, it ensures comprehensive budgeting and cost analysis. This borehole drilling cost analysis model enables precise tracking of your project’s financial viability, while the integrated financial forecast for borehole drilling helps anticipate changes over the next five years. Use this tailored financial planning tool to optimize borehole drilling cash flow, streamline capital expenditure, and enhance profitability analysis for informed decision-making and sustained growth.

BOREHOLE DRILLING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Effective borehole drilling financial planning begins with precise cost management from day one. Our comprehensive borehole drilling financial projection model empowers your business to control start-up expenses, preventing cash flow disruptions and funding gaps. Designed for accurate borehole drilling cost analysis and budgeting, this tool supports detailed financial forecasts, cash flow modeling, and profitability analysis. With our professional borehole drilling investment and operational cost models, you gain clarity on financial viability, break-even points, and risk assessment. Optimize your borehole project’s financial return and secure sustainable growth through strategic expense monitoring using our expert financial feasibility frameworks.

CAPEX Spending

This borehole drilling financial feasibility study template features a dedicated tab for comprehensive analysis of revenue streams. It systematically breaks down revenues by product and service, streamlining borehole project revenue modeling and enhancing financial planning accuracy. Ideal for borehole drilling profitability analysis and cash flow modeling, this tool supports precise borehole drilling budget planning and financial forecasting, empowering stakeholders to make informed investment decisions.

Loan Financing Calculator

Effective borehole drilling financial planning requires detailed models such as borehole drilling cash flow, cost analysis, and investment models. By integrating loan repayment schedules with borehole drilling operational cost models, companies can accurately forecast expenses and revenue, ensuring financial viability. A comprehensive financial forecast for borehole drilling, including break-even and profitability analysis, allows for precise budgeting and risk assessment. Seamless linkage of loan balances to the income statement and balance sheet empowers organizations to monitor repayments and cash flow impacts, enhancing borehole drilling project financial feasibility and supporting informed funding decisions.

BOREHOLE DRILLING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBIT, or Earnings Before Interest and Tax, is a key metric in borehole drilling financial projection models, reflecting operating income. It measures profitability by comparing revenues against operating expenses, excluding interest and tax. In borehole drilling financial feasibility studies and cost analysis models, EBIT reveals the project's ability to generate sustainable profits from core operations. This operating profit insight is vital for borehole drilling investment models and financial risk assessments, ensuring accurate borehole project revenue forecasts and effective budget planning for long-term financial viability.

Cash Flow Forecast Excel

A comprehensive borehole drilling cash flow model provides detailed analysis of all expenditures and revenues, enabling precise financial planning and forecasting. By breaking down operational costs, capital expenditures, and income streams, this model supports effective borehole project financial planning and budgeting. It highlights key cash inflow drivers and monitors outflows, enhancing financial viability and profitability analysis. Used properly, it becomes an essential tool for borehole drilling investment decisions, risk assessment, and maximizing returns—empowering business owners to optimize operations and ensure sustainable growth.

KPI Benchmarks

The 5-year borehole drilling financial projection model benchmarks key performance metrics against industry averages, enabling precise borehole project financial planning. Utilizing borehole drilling cost analysis and revenue models, this approach ensures robust borehole drilling budget planning and enhances financial viability assessments. By comparing operational costs and capital expenditures with best-in-class standards, companies gain critical insights into borehole drilling profitability and cash flow models. This benchmarking is essential for borehole drilling financial feasibility studies, supporting strategic decision-making, risk assessment, and optimized investment through a comprehensive borehole drilling funding and income statement model.

P&L Statement Excel

Our borehole drilling financial projection model offers comprehensive monthly and yearly profit and loss statements tailored for borehole project financial planning. It integrates revenue streams, borehole drilling cost analysis, operational expense budgeting, and profitability analysis to ensure precise financial forecasting. With detailed cash flow models and break-even analysis, this economic model empowers investors and operators to assess financial viability and risk. Interactive graphs and key financial ratios provide clear insights into capital expenditure, net profit, and overall financial returns—essential tools for effective borehole drilling budget planning and investment decision-making.

Pro Forma Balance Sheet Template Excel

The borehole drilling financial projection model offers a comprehensive overview of your project’s assets, liabilities, and equity accounts. Designed for precise borehole drilling cost analysis and budget planning, this model supports financial viability assessments and profitability analysis. It’s an essential tool for borehole project financial planning, enabling accurate cash flow forecasting, investment evaluation, and risk assessment. Streamline your borehole drilling financial feasibility study with this robust template to optimize funding strategies and maximize returns.

BOREHOLE DRILLING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The borehole drilling financial projection model integrates key metrics like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) for comprehensive project financial planning. WACC reflects the capital cost, balancing equity and debt, serving as a critical financial risk assessment tool for lenders. Meanwhile, DCF calculates the present value of future cash flows, essential for evaluating the financial viability and profitability of borehole drilling investments. This integrated financial forecast supports informed decision-making, optimizing borehole drilling budget planning and enhancing the accuracy of investment and funding models.

Cap Table

A comprehensive borehole drilling financial projection model incorporates detailed cap tables across multiple funding rounds, enabling precise tracking of ownership stakes and share dilution. By integrating equity shares, preferred shares, employee stock options, and convertible instruments, this model enhances borehole project financial planning and investment evaluation. Leveraging this robust structure supports accurate borehole drilling financial feasibility studies, cost analysis, and profitability assessments, empowering stakeholders to make informed decisions and optimize capital allocation for sustainable project growth.

BOREHOLE DRILLING FINANCIAL MODEL IN EXCEL TEMPLATE ADVANTAGES

Attract investors swiftly with a comprehensive borehole drilling financial projection model that ensures clear profitability insights.

Optimize cash flow and enhance profitability with a comprehensive borehole drilling financial projection model.

Gain precise control over profits and losses with the comprehensive borehole drilling financial projection model.

The borehole drilling financial projection model ensures accurate planning, minimizing risks and maximizing investment returns over five years.

Maximize success by assessing borehole drilling profitability with our detailed financial projection and cost analysis model.

BOREHOLE DRILLING FINANCIAL MODELING EXCEL TEMPLATE ADVANTAGES

Our borehole drilling financial projection model ensures accurate budgeting and maximizes investment profitability with real-time updates.

Easily adjust inputs anytime to optimize your borehole drilling financial projection model for accurate decision-making and growth.

The borehole drilling financial projection model ensures accurate key metrics analysis for optimized investment and profitability decisions.

Our borehole drilling financial model delivers accurate 5-year profit projections, enhancing investment decisions with GAAP or IFRS compliance.

The borehole drilling financial projection model offers clear, visual insights through an all-in-one, user-friendly dashboard.

The borehole drilling financial projection model offers instant, comprehensive five-year data on a single, user-friendly dashboard.

The borehole drilling financial projection model simplifies budgeting, ensuring accurate forecasts and maximizing investment profitability.

Simplify borehole drilling financial planning with our user-friendly, sophisticated model delivering reliable results and expert support.

The borehole drilling cash flow model identifies potential cash shortfalls early, ensuring proactive financial management and project success.

The borehole drilling financial projection model provides early warnings, ensuring proactive cash flow and investment decision-making.