Building Inspection Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Building Inspection Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Building Inspection Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BUILDING INSPECTION FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year building inspection financial performance model in Excel features a prebuilt three-statement system—including an income statement template, balance sheet, and building inspection cash flow model—designed for detailed financial forecasting and building inspection business financial planning. It integrates key financial charts, funding requirement models, and building inspection revenue projection models to support cost estimation, budget planning, and capital expenditure analysis. Ideal for evaluating startup ideas, this cost analysis and profit margin model empowers users to perform break-even analysis, expense tracking, and pricing strategy modeling to secure funding from banks, angels, grants, and VCs. Fully unlocked and customizable, it provides a robust financial framework to guide operational expenses, investment analysis, and overall financial risk assessment for building inspection ventures.

This comprehensive building inspection financial model Excel template effectively alleviates common pain points by simplifying cost estimation for building inspections, streamlining building inspection budget planning, and providing clear building inspection revenue projection models to forecast sales and profits accurately. It integrates building inspection cash flow models and building inspection expense tracking models to enhance operational expense management and capital expenditure analysis, reducing uncertainty in financial forecasting for building inspections. With embedded building inspection profit margin models and break-even analysis tools, it supports strategic pricing decisions through a building inspection pricing strategy model, while also delivering robust building inspection investment analysis and financial risk assessment to secure funding requirements and optimize business financial performance.

Description

Our building inspection financial model template offers comprehensive financial forecasting for building inspections, incorporating a building inspection cost analysis model and a building inspection revenue projection model to support startups or established businesses over a 60-month horizon. It facilitates detailed building inspection budget planning by integrating cost estimation for building inspections, operational expenses for building inspections, and capital expenditure for building inspections, while also enabling building inspection income statement template generation alongside building inspection cash flow model projections. With features such as building inspection profit margin model, building inspection break-even analysis, and building inspection financial risk assessment, the model ensures robust building inspection investment analysis and financial performance tracking through a building inspection expense tracking model and building inspection financial statement model, empowering users to develop an effective building inspection pricing strategy model and build a solid building inspection business financial plan supported by accurate sales forecast and funding requirement models.

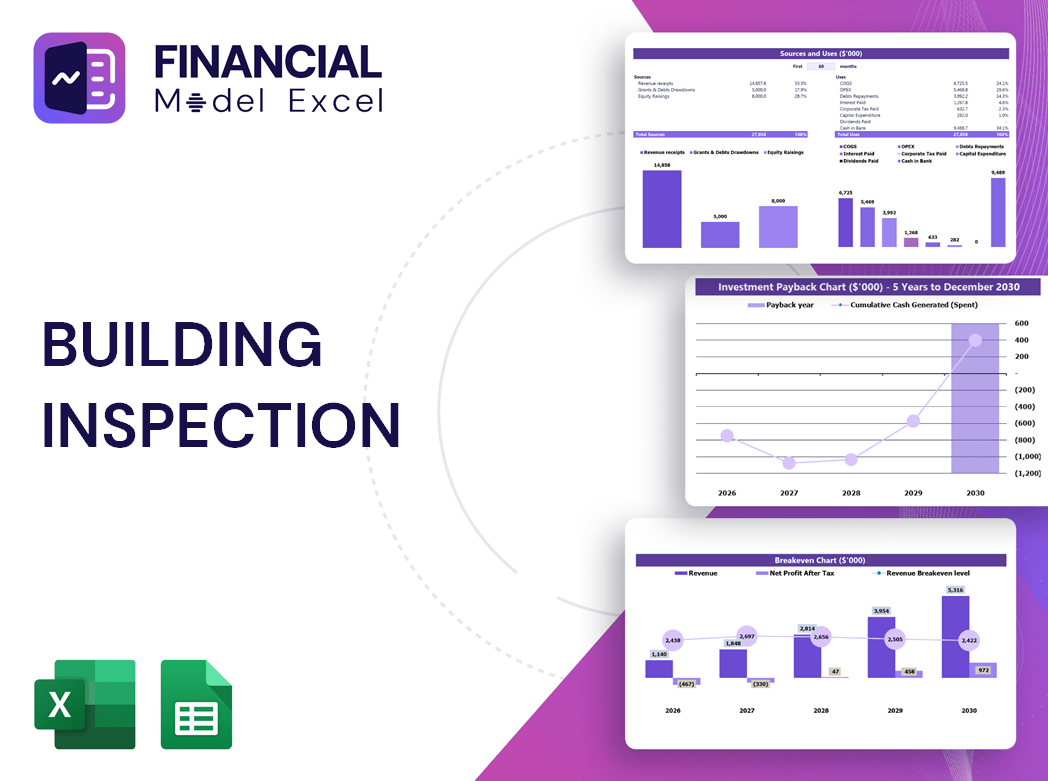

BUILDING INSPECTION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our building inspection financial performance model offers full customization, letting you adjust core parameters like operating expenses, hiring plans, and capital expenditure for building inspections. Seamlessly modify the building inspection income statement template, cash flow model, and revenue projection model to fit your unique business needs. With flexible forecasting methods and a 5-year financial forecasting for building inspections template, you can tailor every cell and formula. This comprehensive cost estimation and budget planning tool empowers precise building inspection investment analysis and pricing strategy, ensuring accurate break-even and profit margin modeling for sustained growth.

Dashboard

To conduct comprehensive financial forecasting for building inspections, leveraging a robust building inspection financial performance model is essential. Our startup pro forma template integrates critical elements such as income statement templates, expense tracking models, and sales forecast models—all presented through intuitive graphs and charts. This streamlined approach simplifies cost estimation for building inspections, revenue projection, and budget planning, enabling clients to analyze capital expenditure, operational expenses, and profit margin models efficiently. Enhance your building inspection business financial plan with precise data visualization for informed decision-making and strategic growth.

Business Financial Statements

When creating a building inspection financial statement model, clarity and usability are paramount. Whether developing a building inspection revenue projection model or a cost estimation for building inspections template, ensure your financial forecasting for building inspections is intuitive and comprehensive. A streamlined building inspection business financial plan with well-structured components—such as budget planning, cash flow models, and profit margin analysis—enhances collaboration and decision-making. An easy-to-follow pro forma template excel empowers teams to accurately track expenses, analyze investment risks, and forecast sales, driving effective building inspection financial performance and growth.

Sources And Uses Statement

The building inspection financial model offers a comprehensive profit and loss template, clearly outlining the use of funds to identify diverse funding sources. This model streamlines the company’s funding structure, supporting precise financial forecasting for building inspections. By integrating cost estimation, revenue projection, and expense tracking for building inspections, it empowers informed decision-making and enhances operational efficiency. Ideal for budget planning, investment analysis, and financial risk assessment, this tool ensures a solid foundation for sustainable growth and improved profit margins in the building inspection business.

Break Even Point In Sales Dollars

This 5-year building inspection financial forecasting model features an integrated break-even analysis, pinpointing when revenue surpasses total costs, signaling profit generation. Understanding this critical threshold enables investors and creditors to assess financial risks and benefits confidently. By analyzing the relationship between fixed and variable operational expenses for building inspections alongside revenue projections, businesses can make informed decisions. This comprehensive building inspection financial performance model is essential for strategic planning, ensuring sustainable profitability and effective budget management from project inception.

Top Revenue

When developing a building inspection revenue projection model, revenue stands as a critical element in startup cost analysis. It directly influences the company’s valuation within the pro forma projections. Therefore, financial forecasting for building inspections must prioritize accurate growth rate assumptions grounded in historical data. Incorporating a comprehensive building inspection financial performance model ensures strategic planning of future revenue streams. Our financial projection template excels in integrating essential components like cost estimation, cash flow modeling, and break-even analysis, empowering analysts to optimize building inspection budget planning and pricing strategy models effectively.

Business Top Expenses Spreadsheet

The Top Expenses tab in our 5-year building inspection cash flow model offers a clear snapshot of your highest costs, highlighting the top four expenses for quick insight. This comprehensive financial forecasting tool delivers detailed cost estimation for building inspections, including customer acquisition and fixed operational expenses. By accurately tracking your spending, you enhance your building inspection business financial plan, enabling effective budget planning and boosting profitability through informed financial risk assessment and expense management.

BUILDING INSPECTION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Each building inspection financial model Excel template incorporates start-up costs essential for early-stage strategic planning. Proper management of these initial capital expenditures and operational expenses for building inspections is crucial to prevent cash flow issues and funding shortfalls. Our comprehensive building inspection financial performance model features a built-in proforma that captures detailed expense tracking and financing data, enabling precise budget planning and cost estimation. Utilizing this model empowers businesses to develop accurate building inspection business financial plans and safeguard profitability from the outset.

CAPEX Spending

Capital expenditure (CAPEX) is a vital element in building inspection financial forecasting. Accurate cost estimation for building inspections enables professionals to establish a realistic startup budget and monitor investments effectively. Understanding initial expenditures is essential for developing a robust building inspection business financial plan, impacting cash flow models and revenue projections. Careful budget planning ensures optimal allocation of resources, supports accurate break-even analysis, and enhances overall financial performance. A well-structured CAPEX strategy is key to driving sustainable growth and maximizing the profit margin within the building inspection industry.

Loan Financing Calculator

A comprehensive loan amortization schedule is essential in building inspection financial planning, detailing periodic payments that reduce loan principal over time. Integrated within a three-way financial model—including building inspection cost analysis and revenue projection models—this schedule aligns loan terms, interest rates, and repayment timelines. Utilizing this amortization tool enhances financial forecasting for building inspections, enabling precise capital expenditure planning, expense tracking, and cash flow management. Ultimately, it empowers stakeholders to monitor outstanding balances and strategically manage funding requirements, supporting a robust building inspection business financial plan and optimizing profit margin and break-even analysis.

BUILDING INSPECTION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The building inspection financial performance model offers a clear, visual overview of vital financial metrics over a 5-year and 24-month horizon. Monitor EBITDA/EBIT to evaluate operational performance, track cash flows to manage inflows and outflows effectively, and forecast cash balance to ensure liquidity. This comprehensive model supports building inspection budget planning, financial forecasting, and cash flow management, empowering you to optimize cost estimation, profit margins, and overall business growth with precision.

Cash Flow Forecast Excel

The building inspection cash flow model provides a comprehensive pro forma template to effectively manage cash streams and ensure sufficient liquidity to meet liabilities. Lenders prioritize financial forecasting for building inspections to confirm that your startup’s financial plan can reliably cover loan repayments. Utilizing a robust building inspection financial performance model not only enhances credibility but also supports informed decision-making for operational expenses and capital expenditure. This strategic approach to cash flow forecasting empowers your business to maintain financial stability and achieve sustainable growth.

KPI Benchmarks

Elevate your building inspection business with our comprehensive financial forecasting and revenue projection model. Featuring a built-in benchmarking template, it allows seamless comparison of operational expenses, profit margins, and capital expenditures against industry peers. Quickly identify strengths and gaps through detailed cost estimation and cash flow analysis, enabling strategic budget planning and pricing adjustments. This dynamic building inspection financial performance model empowers you to optimize your business plan, enhance financial risk assessment, and drive sustainable growth. Make informed decisions with precision using our all-in-one building inspection business financial plan and break-even analysis tools.

P&L Statement Excel

This building inspection financial statement model generates a projected P&L forecast based on your assumptions, delivering accurate insights for strategic growth. Utilizing this pro forma profit and loss statement template, you can perform a comprehensive analysis of your building inspection business financial plan, identifying strengths and weaknesses in your financial performance. This empowers you to refine your cost estimation, pricing strategy, and overall budgeting, ensuring sustainable profitability and informed decision-making for future success.

Pro Forma Balance Sheet Template Excel

A comprehensive building inspection business financial plan must include a detailed balance sheet forecast. This essential report outlines current and long-term assets, liabilities, and shareholders’ equity, providing a clear snapshot of financial health. Integrating this forecast within your building inspection financial performance model enables precise financial ratio calculations, enhancing your cost estimation, profit margin analysis, and capital expenditure planning. Leveraging such detailed financial forecasting tools ensures informed decision-making for sustainable growth and effective budget planning in the building inspection industry.

BUILDING INSPECTION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive building inspection financial projection model includes a dynamic valuation report template, enabling users to conduct a Discounted Cash Flow valuation effortlessly. By inputting key Cost of Capital rates, you gain precise insights into your building inspection business financial plan, enhancing investment analysis and financial forecasting accuracy. Optimize your building inspection profit margin model and streamline capital expenditure decisions with this powerful tool.

Cap Table

The Cap Table within a startup’s financial plan offers a comprehensive view of financial flows, detailing all instruments involved in funding. It highlights how strategic decisions impact profitability, serving as a vital tool in building inspection business financial plans. Integrating this with models like building inspection revenue projection and cost analysis ensures precise financial forecasting, helping optimize profit margins and effectively manage operational expenses. This approach strengthens investment analysis and budget planning, empowering building inspection firms to make informed decisions that drive sustainable growth and financial performance.

BUILDING INSPECTION STARTUP COSTS SPREADSHEET ADVANTAGES

Streamline your pitch deck with a comprehensive financial summary crafted for your building inspection financial model.

The building inspection financial risk assessment model proactively identifies potential issues, ensuring timely, informed decision-making and profitability.

The building inspection financial model ensures accurate projections, preventing misunderstandings and optimizing your business’s financial planning.

Accurately forecast building inspection revenues and expenses to optimize profitability with our advanced financial model.

The building inspection financial model pinpoints strengths and weaknesses, enhancing strategic decision-making and profitability.

BUILDING INSPECTION STARTUP FINANCIAL MODEL TEMPLATE EXCEL FREE ADVANTAGES

Our simple-to-use building inspection profit margin model optimizes pricing strategy for maximum revenue and cost control.

Our building inspection financial model ensures quick, reliable forecasts with minimal experience, driving confident business decisions.

Our building inspection financial model proves your loan repayment ability through accurate revenue and expense forecasting.

Our building inspection cash flow model clearly demonstrates loan repayment ability, boosting lender confidence for approval.

The building inspection cash flow model enables early identification of potential cash shortfalls, ensuring proactive financial management.

The building inspection cash flow model acts as a proactive tool, ensuring accurate financial forecasting and risk mitigation.

Our building inspection financial forecasting model ensures accurate revenue projections to maximize investor confidence and lender support.

Accelerate funding and impress investors with a building inspection financial model capturing precise financial and operational metrics.

Save time and money with our building inspection financial forecasting model, optimizing revenue and controlling operational expenses efficiently.

Our building inspection financial model streamlines projections, eliminating complex formulas and costly consultants for effortless business growth planning.