Building Material Production Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Building Material Production Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Building Material Production Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BUILDING MATERIAL PRODUCTION FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year building material production cost analysis financial model is designed specifically for startups and entrepreneurs aiming to impress investors and secure funding. It features key financial charts, summaries, and crucial metrics focused on construction materials budgeting and production expense tracking, alongside advanced building supply chain financial forecasting. Tailored to the building material manufacturing profitability model, this tool supports material production cash flow management, construction cost control, and raw material procurement financial planning. Fully unlocked and editable, it enables businesses to optimize building components cost estimation, develop effective building materials pricing strategies, and conduct thorough construction materials investment analysis to achieve sustainable growth and attract banks or investors.

This ready-made building material production cost analysis financial model Excel template effectively addresses common pain points such as complex budgeting, inaccurate cost estimation, and inefficient supply chain financial forecasting by providing comprehensive input tables and automated calculations for construction materials budgeting and raw material procurement financial models. It streamlines production expense tracking and manufacturing overhead cost management, enabling precise construction cost control and optimized building materials inventory financial modeling. Users benefit from integrated sales projection and material production revenue forecast models, facilitating informed decision-making on pricing strategies and operational budgets, while the model’s investment analysis and financial performance features enhance profitability insights and production capacity planning with minimal manual effort.

Description

This comprehensive building materials operational budget model provides an integrated approach to construction raw materials financial planning by incorporating detailed building components cost estimation models along with production expense tracking financial models, enabling businesses to optimize their manufacturing overhead cost model while efficiently managing raw material procurement financial models. By leveraging construction supply financial analysis models and material production revenue forecast models, this financial tool assists in budgeting construction materials sales projection models and facilitates accurate building materials inventory financial models, ultimately supporting construction cost control financial models that enhance material manufacturing profitability models and guide building materials pricing strategy financial models for improved decision-making and sustainable growth.

BUILDING MATERIAL PRODUCTION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Effortlessly build a comprehensive construction materials budgeting financial model with our intuitive Excel template. Whether assessing your building material production cost analysis, forecasting raw material procurement, or planning manufacturing overhead costs, this tool empowers you to create detailed personnel, sales, expenses, investment, and funding projections. Fully customizable like a spreadsheet, it allows precise input for building components cost estimation and construction cost control. Streamline your building supply chain financial forecasting and gain clear insights into profitability and cash flow—all in one dynamic, easy-to-use financial projection startup model.

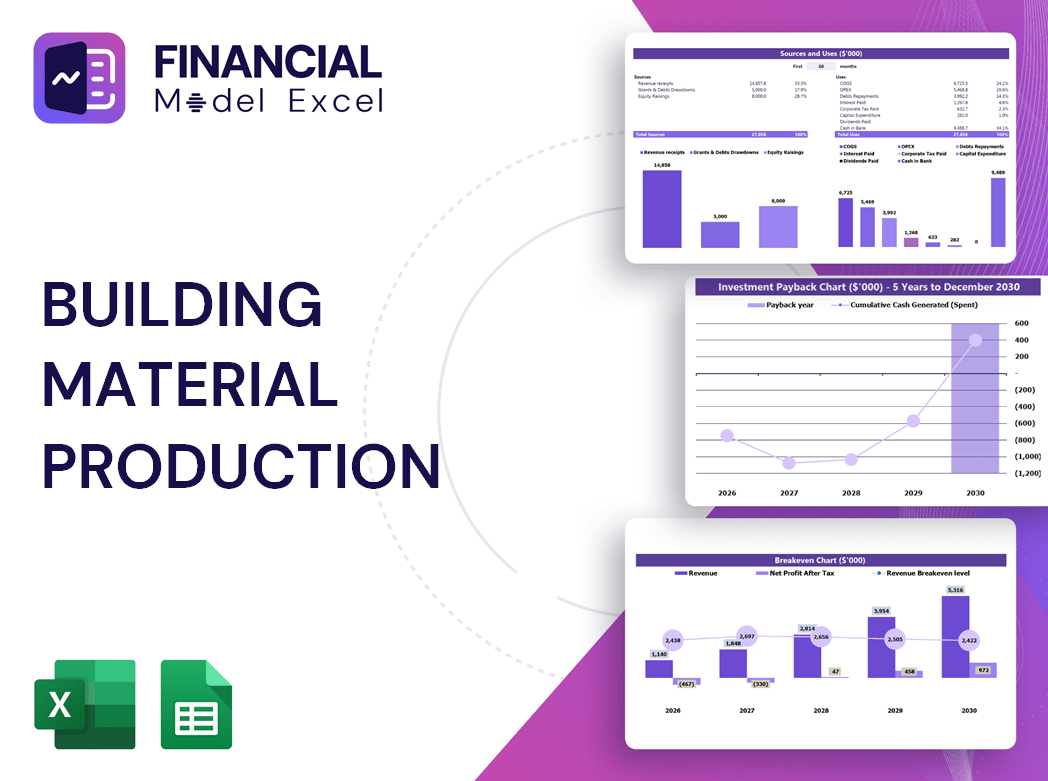

Dashboard

Access a dynamic dashboard featuring a comprehensive 5-year building materials financial forecasting model. Effortlessly analyze construction materials budgeting, production expense tracking, and supply chain financial planning. Share actionable insights on cost control, pricing strategy, and investment analysis with stakeholders to drive informed decisions. Optimize manufacturing overhead, raw material procurement, and production capacity planning—all within a user-friendly financial model designed to enhance your company’s profitability and operational efficiency.

Business Financial Statements

All three accounting statements play a crucial role in comprehensive financial analysis. A building material production cost analysis financial model offers detailed insight into core operations driving profitability. Meanwhile, construction raw materials financial planning tools like the projected balance sheet and material production cash flow model emphasize capital management, asset allocation, and structural efficiency. Integrating these models ensures precise budgeting, production expense tracking, and construction cost control, facilitating informed decision-making and strategic growth in the building supply chain and manufacturing sectors.

Sources And Uses Statement

A comprehensive sources and uses template Excel is essential for precise construction materials budgeting financial model and building supply chain financial forecasting. It enables clear tracking of all income sources and allocation points, supporting material manufacturing profitability models and construction raw materials financial planning. This tool enhances production expense tracking financial model efficiency, ensures accurate building components cost estimation, and strengthens construction cost control financial model efforts, ultimately optimizing building materials operational budget models and improving overall financial performance in material production cash flow models.

Break Even Point In Sales Dollars

Break-even analysis is a vital tool in construction materials budgeting financial models, pinpointing when total revenue covers all production and operational expenses. It highlights the intersection of fixed costs, variable costs, and sales revenue, offering clarity on profitability thresholds. Companies with lower fixed costs typically achieve break-even at fewer unit sales, optimizing their building materials cost estimation models. Integrating break-even insights into raw material procurement financial models enhances construction cost control and supports precise building supply chain financial forecasting for improved decision-making.

Top Revenue

In building materials financial planning, understanding the top line—total revenue from sales projections—and the bottom line—net income after production expenses and manufacturing overhead costs—is crucial. A robust building supply chain financial forecasting model tracks these metrics to drive material production cash flow and construction cost control. Investors use these trends from material manufacturing profitability models and raw material procurement financial models to assess a company’s growth potential. Effective budgeting and operational budget models ensure top-line growth translates into sustainable profitability, reinforcing success in the competitive construction materials market.

Business Top Expenses Spreadsheet

Maximize profitability by leveraging our Building Material Production Cost Analysis Financial Model. The top expense tab highlights your four largest costs, with remaining expenses grouped under “Other” for clear visibility. This streamlined view enables construction materials budgeting and financial planning professionals to identify key cost drivers and implement targeted strategies to optimize expenses annually. Whether you’re managing production overhead, raw material procurement, or supply chain financial forecasting, consistent expense tracking and cost control are essential for startups and established companies alike to enhance building products financial performance and ensure sustainable growth.

BUILDING MATERIAL PRODUCTION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Startup costs, a vital component of every pro forma template, arise before operations begin and require careful monitoring to prevent financial shortfalls. Our comprehensive building material production cost analysis financial model provides detailed insights into funding and expenditure. By regularly utilizing this construction materials budgeting financial model, businesses can achieve precise financial planning and forecasting, ensuring efficient allocation of resources and optimized cost control. This strategic approach supports robust financial performance and sustainable growth from day one.

CAPEX Spending

In building materials budgeting and production, specialized financial models are essential for accurate CAPEX calculation. Utilizing tailored formulas within construction materials cost estimation models enables precise tracking of capital expenditures, contributing to effective construction cost control. These models integrate CAPEX spending with profit and loss forecasts, enhancing material manufacturing profitability and operational budget planning. By leveraging production expense tracking and building supply chain financial forecasting, stakeholders gain clear insights into investment impacts, ensuring optimized resource allocation and sustainable growth in building material production.

Loan Financing Calculator

Our loan amortization schedule template seamlessly integrates with your business plan financial projections, providing precise tracking of loan repayments according to their terms. Equipped with dynamic formulas, it efficiently manages all loan types—monthly, quarterly, or annual—ensuring accurate repayment tracking. This tool supports comprehensive construction raw materials financial planning and enhances construction cost control financial models by maintaining clear visibility on loan obligations, facilitating effective budgeting within your building materials operational budget model. Optimize your financial forecasting with a reliable, adaptable loan amortization solution tailored to your building supply chain financial forecasting needs.

BUILDING MATERIAL PRODUCTION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Key performance indicators (KPIs) within a building materials cost estimation and financial forecasting model are essential for both company owners and investors. These metrics enable precise tracking of production expense, construction materials budgeting, and raw material procurement financial performance. By leveraging such insights, you can evaluate profitability, optimize cost control, and sharpen focus on strategic targets. This empowers you and your co-founders to drive operational efficiency, enhance building supply chain financial planning, and confidently steer business growth with data-driven decisions.

Cash Flow Forecast Excel

Today, a well-crafted material production cash flow model is essential for effective financial management in the building materials industry. Leveraging an Excel-based financial model enables precise tracking of cash inflows and outflows, enhancing budgeting accuracy and optimizing construction supply chain financial forecasting. This powerful tool supports production expense tracking, cost control, and investment analysis, empowering manufacturers to improve profitability and streamline operational budgets. Incorporating such models ensures strategic decision-making and sustainable growth in building material production and procurement.

KPI Benchmarks

This financial model Excel spreadsheet features a dedicated tab for comprehensive financial benchmarking. By comparing key financial indicators from industry peers, it enables in-depth analysis of your company’s performance. This benchmarking study provides valuable insights into competitiveness, operational efficiency, and productivity within the building materials or construction supply chain sector. Leveraging this tool supports informed decision-making in construction materials budgeting, cost control, and profitability forecasting, empowering businesses to optimize their financial planning and strengthen their market position.

P&L Statement Excel

Our construction cost control financial model streamlines building materials budgeting and production expense tracking with precision. Designed for comprehensive financial planning, it integrates building material production cost analysis, raw material procurement, and manufacturing overhead cost modeling. This dynamic model supports detailed building components cost estimation and material production cash flow forecasting, enabling accurate construction supply financial analysis. Empower your team with a robust tool for construction materials investment analysis and building supply chain financial forecasting—ensuring profitability and strategic pricing across your project lifecycle.

Pro Forma Balance Sheet Template Excel

Integrating the building materials financial performance model with production expense tracking financial model provides critical insights into the investment required to sustain forecasted sales and profits. Pairing a comprehensive balance sheet forecast with a profit and loss statement template enables precise construction cost control financial planning. This approach enhances the accuracy of building supply chain financial forecasting, empowering companies to strategically manage raw material procurement and optimize manufacturing overhead costs. Ultimately, it ensures robust financial health and supports informed decision-making in construction materials budgeting and investment analysis.

BUILDING MATERIAL PRODUCTION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our building materials financial model integrates key tools such as Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) calculators. WACC assesses the company’s capital costs from debt and equity, serving as a critical risk evaluation metric for lenders. The DCF enables precise forecasting of future cash flows, essential for investment analysis and construction supply financial planning. This comprehensive financial model supports construction materials budgeting, production expense tracking, and profitability forecasting, empowering informed decisions for cost control and revenue growth in building material production.

Cap Table

The cap table Excel serves as a vital tool for tracking ownership of securities—including common shares, preferred shares, warrants, and options. By integrating this data into a robust building supply chain financial forecasting model or construction materials budgeting financial model, companies can accurately monitor equity distribution. Regular updates ensure informed decisions, optimizing production expense tracking and enhancing profitability. Leveraging such detailed ownership insights supports strategic financial planning, ultimately driving stronger returns and sustainable growth within the construction materials and building product sectors.

BUILDING MATERIAL PRODUCTION BUSINESS PROJECTION TEMPLATE ADVANTAGES

The building material production cost analysis model ensures accurate budgeting, boosting financial confidence and loan approval success.

Financial models streamline budgeting and forecasting, empowering professionals to optimize construction material production costs effectively.

The financial model proactively identifies cash shortfalls, ensuring timely decisions and optimized construction budgeting.

The construction materials financial model enables precise forecasting, enhancing strategic planning and maximizing profitability.

Create a flexible 5-year financial model to optimize building material production costs and enhance profitability forecasting.

BUILDING MATERIAL PRODUCTION 5 YEAR FINANCIAL PROJECTION ADVANTAGES

Optimize cash flow and reduce costs with our comprehensive building materials budgeting financial model for smarter surplus cash management.

The material production cash flow model enables precise surplus cash forecasting, empowering strategic reinvestment and debt management.

Save time and money with our building material production cost analysis financial model for precise budgeting and forecasting.

Our construction materials budgeting financial model streamlines calculations, saving costs and empowering your strategic growth effortlessly.

Optimize costs and forecast profits effectively with our comprehensive building materials financial model for confident funding pitches.

Impress investors with a reliable building material production cost analysis model that ensures accurate budgeting and profitable forecasting.

Our building materials pricing strategy financial model optimizes costs and boosts your construction projects' profitability efficiently.

Effortlessly optimize budgeting and forecasting with this all-in-one financial model—no formulas, formatting, or consultants needed!

Optimize budgeting and enhance profitability with our comprehensive construction materials financial forecasting and cost control model.

A building material production cost analysis financial model empowers confident decisions by forecasting five-year cash flow impacts.