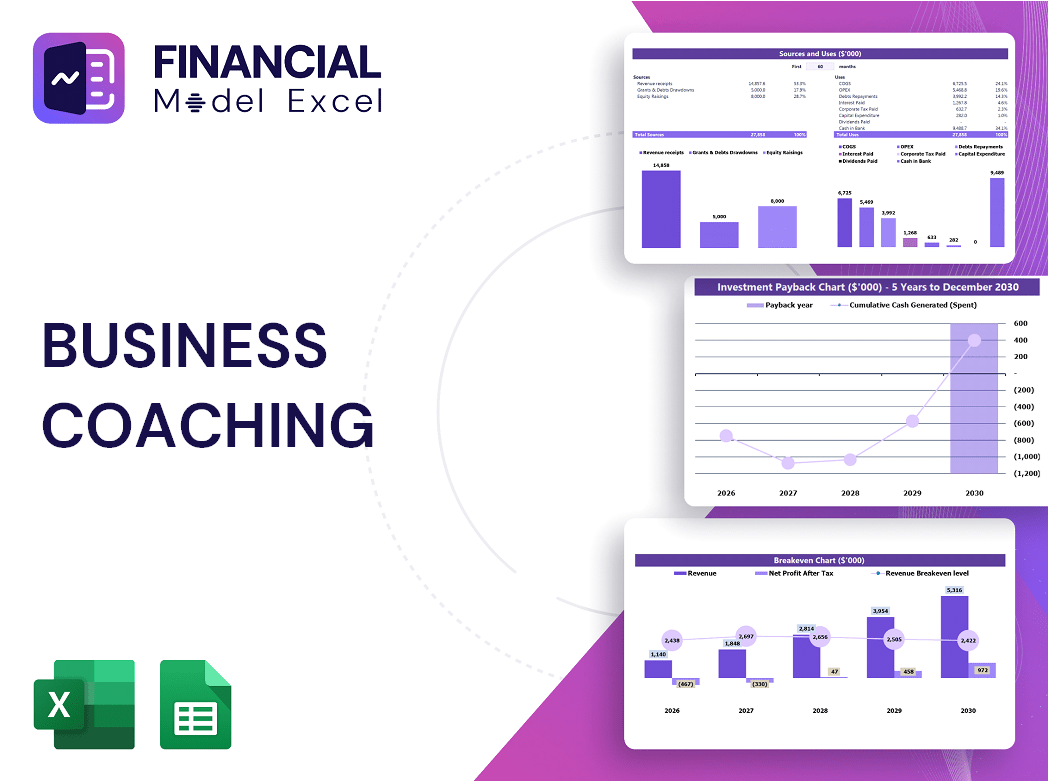

Business Coaching Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Business Coaching Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Business Coaching Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

BUSINESS COACHING FINANCIAL MODEL FOR STARTUP INFO

Highlights

The business coaching financial model Excel template is a comprehensive 5-year financial planning and forecasting tool designed specifically for the business coaching services industry. This financial model for business coaching services supports both startups and established small businesses by providing detailed financial projections for coaching business growth, including a business coaching revenue model, cash flow model, and expense model. It helps estimate startup costs, analyze cost structure, and optimize pricing models, ensuring effective financial strategies for business coaching. Fully unlocked and editable, the template offers robust financial modeling tools for coaching business financial performance analysis and sustainable financial reporting models.

The ready-made financial model for business coaching services addresses critical pain points by offering a comprehensive business coaching financial planning model that streamlines financial forecasting for business coaching, enabling precise business coaching financial analysis and reporting. By incorporating a detailed business coaching profit and loss model, cash flow model for business coaching, and business coaching expense model, it alleviates the burden of manual financial tracking, ensuring accurate business coaching financial performance monitoring. The package also includes a pricing model for business coaching and a business coaching cost structure model to optimize business coaching revenue models and enhance financial sustainability. With built-in financial modeling tools for coaching business, users can generate reliable financial projections for coaching business growth and make informed decisions supported by an insightful business coaching investment model and budget frameworks, ultimately delivering a holistic business coaching financial growth model that fosters robust financial strategies for business coaching success.

Description

The business coaching financial planning model is a comprehensive tool that integrates a detailed business coaching revenue model, expense model, and cash flow model for business coaching services, enabling precise financial forecasting for business coaching enterprises. It facilitates the development of a robust business coaching profit model and financial projections for coaching business growth over a 5-year period, incorporating critical financial strategies for business coaching sustainability and performance enhancement. This financial modeling tool supports business coaching budget model formulation, investment model assessment, and cost structure analysis, while providing dynamic business coaching financial reporting model functionalities to track profit and loss, optimize pricing model for business coaching, and enhance overall financial performance. Designed for startups and established coaching businesses alike, it delivers reliable financial analysis and KPIs, empowering informed decision-making and effective negotiation with investors through automated, adjustable input assumptions.

BUSINESS COACHING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive business coaching financial model integrates your profit and loss, balance sheet, and cash flow statements for accurate financial forecasting. Unlike simplified models relying on a single financial statement, our approach offers a complete financial analysis, enabling you to conduct scenario planning and assess how changes in your business coaching revenue or expense models impact overall financial performance. This dynamic financial projection tool ensures strategic financial planning, supports sustainable growth, and provides actionable insights into your coaching business’s profitability and cash flow. Elevate your financial strategies with our expertly designed business coaching profit and loss model.

Dashboard

The all-in-one dashboard in this financial forecasting template consolidates essential financial inputs and start-up metrics vital for comprehensive business coaching financial analysis. It integrates data from the profit and loss model, cash flow model, and balance sheet projections, enabling a clear overview of your coaching business's financial performance. Users can effortlessly visualize financial strategies through dynamic graphs and charts, empowering informed decision-making for sustainable growth and profitability in the business coaching revenue model.

Business Financial Statements

This comprehensive business coaching financial model integrates three essential statements: a monthly profit and loss template, a 5-year projected balance sheet, and a dynamic cash flow budgeting and forecasting tool—all in Excel. Designed for precision, it seamlessly links financial data across spreadsheets, enabling accurate financial projections for coaching businesses. Ideal for optimizing your business coaching revenue model and driving financial sustainability, this model supports in-depth financial analysis and strategic planning, empowering you to enhance financial performance and ensure long-term growth.

Sources And Uses Statement

The projected cash flow model for business coaching services reveals key sources and uses of funds essential for maintaining financial sustainability and driving revenue growth. Utilizing a robust financial planning model enables accurate financial forecasting for business coaching, ensuring optimal cash flow management and profitability. Incorporating tailored financial strategies and a precise business coaching expense model empowers coaches to enhance their financial performance, optimize their business coaching profit model, and make informed decisions that foster long-term financial growth and success.

Break Even Point In Sales Dollars

The break-even graph is essential in a business coaching financial model, pinpointing sales volume or revenue needed to cover fixed and variable costs. At this juncture, profits are zero; surpassing it triggers profitability, strengthening your business coaching profit model. Our customizable financial forecasting tools enable creation of a precise break-even chart, aligning with your business coaching budget model. This insight not only guides revenue strategies but also boosts investor confidence by clarifying timelines for return on investment. Effective financial planning for business coaching ensures sustainable growth and robust financial performance.

Top Revenue

In business coaching financial planning models, the top line—representing gross sales—is a critical metric. Growth in this revenue figure signals positive momentum in your business coaching revenue model, directly impacting financial forecasting and profitability. Investors closely monitor these fluctuations in revenue and earnings within the business coaching profit and loss model to assess financial performance and sustainability. Effective financial strategies for business coaching leverage detailed financial projections and cash flow models to drive consistent top-line growth, ensuring a robust business coaching financial growth model and long-term success.

Business Top Expenses Spreadsheet

To maximize your business coaching financial performance, controlling expenses is essential. Our comprehensive financial model for business coaching services breaks down major cost categories, enabling precise financial analysis and forecasting. Understanding your business coaching expense model empowers you to optimize cash flow, enhance your profit and loss model, and implement effective financial strategies for business coaching. By directing costs strategically, you ensure sustainable growth and profitable investments. Leverage our financial modeling tools for coaching business to drive financial sustainability and elevate your business coaching financial growth model.

BUSINESS COACHING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive business coaching financial planning model is essential for forecasting costs and evaluating your company’s growth potential. Utilizing a robust financial model for business coaching services enables precise financial forecasting, identifying weak areas, and optimizing your business coaching profit model. Implementing a strategic business coaching budget model enhances financial sustainability and supports effective business coaching financial reporting. Accurate cost budgeting and cash flow modeling strengthen your business coaching financial performance, making your startup more attractive for bank loans and investor funding through transparent financial projections for coaching business success.

CAPEX Spending

CAPEX represents a strategic investment in a business coaching financial model, supporting asset acquisition like equipment or office infrastructure to drive growth. Initial startup costs often fund new service launches or expansion within the business coaching profit model. Rather than impacting the income statement directly, these investments appear as assets in the financial projections for coaching business, with depreciation gradually recognized over time. Employing robust financial modeling tools for coaching business ensures accurate financial forecasting, enhancing the business coaching financial sustainability and optimizing cash flow models for long-term success.

Loan Financing Calculator

Start-ups and growing coaching businesses must integrate a detailed loan payback schedule into their financial modeling tools. This schedule outlines loan amounts, maturity terms, and timelines, essential for accurate financial forecasting for business coaching. Incorporating interest expenses and principal repayments into the cash flow model for business coaching ensures precise cash flow analysis and reflects debt levels on the pro forma balance sheet. These financial strategies for business coaching support robust financial planning models, enabling sustainable growth and informed business coaching financial performance management.

BUSINESS COACHING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings growth and net earnings expansion are key metrics in financial forecasting for business coaching services. Tracking these through a detailed business coaching profit and loss model provides critical insights into your coaching business's financial performance. Utilizing financial modeling tools and a robust pro forma projection, you can effectively monitor sales, revenue growth, and overall cash flow. Implementing a strategic business coaching financial growth model ensures sustainable development, helping you optimize your pricing model, expense structure, and investment strategies for long-term profitability and financial sustainability.

Cash Flow Forecast Excel

A well-designed cash flow model for business coaching is essential for accurate financial forecasting and sustainable growth. Utilizing financial modeling tools for coaching businesses enables precise projections of revenue, expenses, and investments, crucial for loan applications and capital raises. Integrating a comprehensive business coaching profit and loss model ensures strategic financial planning, empowering startups to optimize their cost structure and revenue model. Ultimately, a robust financial planning model drives informed decisions, enhances financial performance, and secures long-term success in the competitive coaching industry.

KPI Benchmarks

The Benchmarking tab is a vital component of our financial forecasting model for business coaching. It evaluates industry and financial benchmarks to assess your business coaching financial performance accurately. By comparing your coaching business against top performers, it offers valuable insights into market standards. This enables targeted financial analysis and highlights areas for improvement within your business coaching profit and loss model, ultimately supporting sustainable growth and enhanced financial strategies.

P&L Statement Excel

Leverage our comprehensive profit and loss model tailored for business coaching to create accurate financial statements effortlessly. This financial forecasting tool empowers you to monitor your business coaching financial performance daily, ensuring informed management decisions. With our pro forma income statement template, you can perform in-depth business coaching financial analysis, pinpointing strengths and addressing weaknesses within your financial model. Enhance your business coaching profit model and achieve sustainable financial growth by integrating this essential financial reporting solution. Optimize your financial strategies and secure a resilient cash flow model for your coaching services today.

Pro Forma Balance Sheet Template Excel

Our comprehensive 5-year financial projections for business coaching integrate monthly and yearly balance sheets with cash flow models, profit and loss templates, and key financial inputs. This dynamic financial forecasting for business coaching offers a holistic view of your startup's assets, liabilities, equity accounts, and overall financial performance. Designed to support strategic financial planning, this model ensures financial sustainability and informed decision-making, empowering you to optimize your business coaching revenue model and drive long-term growth.

BUSINESS COACHING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive business coaching financial model offers a pre-built valuation template designed to deliver critical data investors demand. Key metrics like Weighted Average Cost of Capital (WACC) highlight the minimum required return on invested capital, reassuring stakeholders of your venture’s financial viability. Additionally, our cash flow model for business coaching emphasizes free cash flow, demonstrating available liquidity, while discounted cash flow provides the present value of all anticipated future cash flows. This robust financial forecasting for business coaching empowers informed decision-making and strengthens financial strategies for sustainable growth and profitability.

Cap Table

The pro forma cap table, integrated within a comprehensive pro forma template Excel, serves as an essential financial modeling tool for startups and early-stage ventures. It offers a transparent breakdown of the company's securities, detailing investor shares, valuations, and dilution progression. This financial reporting model empowers business coaching firms to enhance their financial planning, optimize investment strategies, and improve financial forecasting for sustained growth and profitability. Utilizing such precise financial analysis supports robust financial sustainability and informed decision-making within the business coaching financial growth model.

BUSINESS COACHING FINANCIAL MODEL XLS ADVANTAGES

Establish clear milestones and drive growth using a tailored financial model for business coaching startups.

Optimize profits and forecast growth accurately with a tailored financial model for business coaching services.

Optimize your coaching revenue with a financial model that ensures accurate projections and sustainable business growth.

Optimize startup loan repayments efficiently using a tailored business coaching financial model for precise financial planning.

Create a flexible 5-year profit-loss model to enhance financial forecasting and ensure sustainable business coaching growth.

BUSINESS COACHING STARTUP FINANCIAL PLAN TEMPLATE ADVANTAGES

A clear financial model for business coaching boosts profit and drives sustainable growth with easy-to-follow strategies.

Optimize profitability with a clear, color-coded business coaching financial model featuring detailed forecasting and transparent reporting.

A robust financial model for business coaching ensures accurate forecasting and maximizes sustainable profit growth effortlessly.

The financial model for business coaching services enables precise forecasting by easily adjusting inputs for optimal revenue growth.

A robust financial model for business coaching enables better decision making and drives sustainable financial growth.

Optimize decisions confidently using a cash flow model for business coaching to forecast staffing and equipment investments.

Optimize cash flow and improve business coaching financial performance with a tailored financial model for efficient accounts receivable management.

A tailored cash flow model for business coaching reveals payment delays, optimizing financial forecasting and boosting revenue stability.

Our business coaching financial model ensures confident forecasting and sustainable growth for your coaching services.

Our financial model empowers business coaching to forecast growth, manage cash flow, and optimize long-term profitability.