Car Insurance Services Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Car Insurance Services Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Car Insurance Services Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CAR INSURANCE SERVICES FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year car insurance financial forecast model in Excel integrates a car insurance profitability model with prebuilt consolidated income and expenditure templates, balance sheet, and cash flow models. It features key financial charts, summaries, and funding forecasts designed specifically for the automobile insurance premium calculation model, helping businesses evaluate startup ideas, plan pre-launch expenses through an auto insurance expense budgeting model, and secure financing from banks, angels, grants, and VC funds. Fully unlocked and editable, this auto insurance risk assessment and vehicle insurance underwriting financial model serves as a robust tool for detailed auto insurance revenue projection, car insurance claims forecasting, and operational cost management.

The car insurance financial forecast model Excel template addresses critical pain points by offering an integrated auto insurance revenue projection model and detailed vehicle insurance cost analysis model, enabling users to accurately estimate premiums through the automobile insurance premium calculation model while managing expenses efficiently with the car insurance expense budgeting model. This comprehensive tool includes a car insurance claims forecasting model and auto insurance risk assessment model to minimize unpredictability and enhance underwriting decisions via the vehicle insurance underwriting financial model. Additionally, it supports growth planning through the car insurance policyholder growth model and market insights with the auto insurance market analysis model, while the car insurance loss ratio model and automobile insurance cash flow model provide real-time profitability checks. By incorporating a robust car insurance pricing strategy model alongside an operational cost model and reserve estimation model, this financial framework effectively streamlines expense management and risk mitigation, empowering insurance providers to optimize their profit and loss outcomes and confidently project vehicle insurance sales performance under varied scenarios.

Description

Our comprehensive car insurance profitability model integrates an auto insurance revenue projection model with a detailed vehicle insurance cost analysis model to provide precise financial forecasts essential for decision-making. Utilizing an automobile insurance premium calculation model alongside a car insurance claims forecasting model, this tool enables thorough expense budgeting and operational cost management, ensuring effective risk assessment and underwriting through an auto insurance risk assessment model and vehicle insurance underwriting financial model. The inclusion of a car insurance policyholder growth model and vehicle insurance sales projection model supports strategic market analysis and pricing strategies, while the car insurance loss ratio model and auto insurance profit and loss model maintain financial health by estimating reserves and managing cash flow, thereby enhancing overall auto insurance financial planning and profitability.

CAR INSURANCE SERVICES FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Every car insurance business demands a dynamic financial forecast model tailored to its unique needs. Our expertly crafted auto insurance financial planning model balances complexity with flexibility, enabling you to seamlessly add, adjust, or remove financial data. Designed for scalability, this model supports unlimited scenario creation, empowering strategic decision-making. Whether refining your profitability model or projecting revenue, our template is a powerful, expandable solution for comprehensive vehicle insurance cost analysis and operational budgeting. Elevate your financial management with a tool built for precision and adaptability in the competitive automobile insurance landscape.

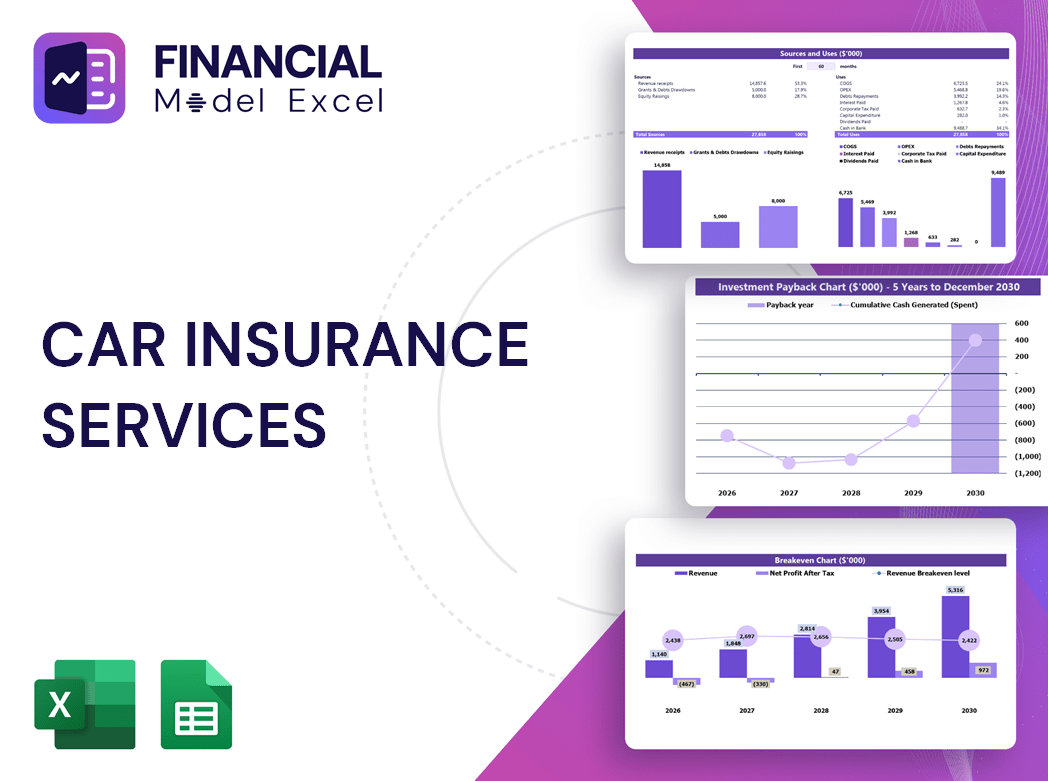

Dashboard

Our business plan Excel template features an integrated dashboard delivering comprehensive car insurance financial forecast models. Visualize key metrics—including auto insurance revenue projections, profitability analysis, and cash flow statements—through intuitive graphs and charts. It streamlines your vehicle insurance cost analysis and expense budgeting, ensuring precise auto insurance claims forecasting and risk assessment. Designed for accuracy and clarity, this dashboard empowers you to effectively manage underwriting models, pricing strategies, and policyholder growth projections, simplifying financial planning and decision-making for your automotive insurance business.

Business Financial Statements

Leverage our flexible car insurance financial forecast model to generate comprehensive, easy-to-understand Excel financial statements. Designed to incorporate diverse assumptions, this model supports detailed auto insurance revenue projections, expense budgeting, and profitability analysis. Ideal for investors and lenders, it streamlines your automobile insurance premium calculation and claims forecasting, ensuring accurate financial planning and informed decision-making. Elevate your auto insurance market analysis and operational cost management with a tool tailored for precision and clarity.

Sources And Uses Statement

The sources and uses of cash statement in the 5-year car insurance financial forecast model offers a clear overview of capital inflows ('Sources') and capital allocation ('Uses'). Ensuring these totals align is crucial for accurate automobile insurance cash flow management. This statement plays a vital role during recapitalization, restructuring, or mergers & acquisitions, supporting strategic decision-making in auto insurance profit and loss and expense management models. Its precision facilitates robust financial planning and strengthens the vehicle insurance underwriting financial model’s effectiveness.

Break Even Point In Sales Dollars

A break-even sales analysis integrates into auto insurance financial planning models by evaluating revenue, sales, and profitability. Distinguishing between sales, revenue, and profit is crucial: revenue represents total income from premium collections and service fees, while profit accounts for all fixed and variable expenses within the car insurance expense budgeting model. Leveraging this clarity enables accurate auto insurance revenue projection and enhances precision in the car insurance profitability model, supporting strategic decision-making and optimal financial outcomes.

Top Revenue

Accurate revenue modeling is essential for any thriving business, reflected in advanced car insurance financial forecast models. Our auto insurance revenue projection model integrates historical growth data with sophisticated assumptions, enabling precise vehicle insurance sales projections and profitability analysis. Financial analysts benefit from comprehensive tools like the car insurance pricing strategy model and automobile insurance cash flow model to forecast revenue streams confidently. Elevate your financial planning with our startup financial projection template—designed to capture all critical factors for reliable, data-driven revenue forecasts in the competitive auto insurance market.

Business Top Expenses Spreadsheet

The Top Expense tab delivers a comprehensive summary of your operational costs, crucial for developing a robust car insurance financial forecast model. By categorizing expenses, this report empowers precise budgeting and expense management for your auto insurance profit and loss model. Use these insights to monitor costs monthly, quarterly, or yearly, ensuring alignment with your vehicle insurance underwriting financial model. Proactively track deviations from projections to refine strategies, optimize your automobile insurance premium calculation model, and enhance overall profitability. This expense report is an essential tool in crafting a data-driven auto insurance financial planning model that drives sustainable growth.

CAR INSURANCE SERVICES FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The car insurance financial forecast model is an essential tool for managing startup costs and evaluating expense practicality. By integrating vehicle insurance cost analysis and car insurance expense budgeting models, it provides clear insights into profitability and operational efficiency. This comprehensive approach helps identify financial bottlenecks, enhance auto insurance revenue projections, and optimize premium calculations. Crucial for small businesses, these models support loan acquisition and investment opportunities by delivering precise expense management and forecasting, ensuring a solid foundation for sustainable growth in the competitive auto insurance market.

CAPEX Spending

The startup expenses play a crucial role in establishing initial costs and supporting accurate forecasting of capital expenditures. Integrating this with a car insurance profitability model or an auto insurance financial planning model enhances clarity in expense management and revenue projection. Utilizing tools like the profit and loss statement template, combined with vehicle insurance cost analysis and car insurance expense budgeting models, provides a comprehensive view of capital outflows and incoming investments. This approach empowers insurers to optimize operational costs, refine premium calculations, and drive strategic financial decisions with confidence.

Loan Financing Calculator

The auto insurance financial forecast model integrates a detailed loan amortization schedule, enabling precise tracking of periodic payments and outstanding balances. By incorporating an amortization calculator with principal, terms, and interest rate inputs, this vehicle insurance cash flow model enhances planning accuracy. Companies can efficiently manage loan repayments, aligning them with their car insurance expense budgeting model for optimized financial performance and profitability.

CAR INSURANCE SERVICES FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net Present Value (NPV) is a critical metric within the auto insurance financial forecast model, capturing the present value of future discounted cash flows. By summing the current worth of cash inflows across multiple periods, NPV enables insurers to assess the true value of future revenues and expenses. This powerful tool supports accurate automobile insurance cash flow modeling, enhancing profitability analysis and financial planning. Incorporating NPV helps optimize car insurance pricing strategy models and expense budgeting, ensuring informed decisions that drive sustainable growth and maximize long-term value.

Cash Flow Forecast Excel

A robust automobile insurance cash flow model is essential for effective financial planning. This auto insurance financial forecast model captures the company’s consolidated cash flow, highlighting current liquidity while identifying funding gaps. It integrates key factors such as payable and receivable days, annual revenue, working capital, and long-term debt to accurately project net cash flow and cash balances. With a dedicated cash flow forecasting sheet, this model empowers insurers to optimize cash flow management, ensuring sustainable profitability and strategic growth in a competitive auto insurance market.

KPI Benchmarks

Our car insurance financial forecast model includes a powerful benchmarking feature, enabling companies to perform in-depth comparative analysis. By leveraging auto insurance revenue projection and expense budgeting models, users can evaluate key financial indicators against industry standards. This insightful tool highlights strengths and identifies areas for improvement—such as claims forecasting or underwriting financials—empowering businesses to optimize profitability and pricing strategies. Regular benchmarking deepens understanding of operational costs and loss ratios, driving informed decisions that boost growth and long-term financial success in the competitive auto insurance market.

P&L Statement Excel

Accurately forecasting your auto insurance profit and loss is vital for strategic financial planning. Our comprehensive auto insurance profit and loss model simplifies complex calculations, providing clear insights into actual and projected revenue streams. Whether you're analyzing vehicle insurance sales projections or performing expense budgeting, this tool enhances your ability to manage profitability effectively. Streamline your automobile insurance cash flow analysis and make informed decisions with precision using our expertly crafted financial forecast model.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template in Excel provides a comprehensive snapshot of your car insurance financial forecast model, detailing key assets like buildings and equipment alongside liabilities and equity at a given date. This vital document supports your auto insurance revenue projection model by showcasing loan security within assets, reassuring banks and investors of your company’s financial stability. Integrating this with your vehicle insurance cost analysis model enhances operational insights, making it essential for strategic planning and securing funding in the competitive automobile insurance market.

CAR INSURANCE SERVICES FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive car insurance financial forecast model integrates two robust valuation methods: discounted cash flow (DCF) and weighted average cost of capital (WACC). Designed for precision, it empowers auto insurance revenue projection and profitability analysis by delivering accurate, data-driven forecasts of company performance. Ideal for strategic decision-making, this model supports advanced vehicle insurance cost analysis, expense management, and financial planning, ensuring optimized premium calculation and effective risk assessment for sustainable growth.

Cap Table

The cap table, integrated within a feasibility study template, is an essential tool for start-ups and early-stage ventures. It provides a detailed breakdown of the company’s securities, illustrating investor shares, valuation, and dilution over time. Coupled with models like the car insurance profitability model or auto insurance revenue projection model, businesses can strategically forecast financial outcomes, manage expenses, and optimize pricing strategies to drive growth and maximize returns. This comprehensive approach supports informed decision-making and strengthens overall financial planning.

CAR INSURANCE SERVICES FINANCIAL MODEL TEMPLATE ADVANTAGES

The car insurance financial forecast model ensures accurate budgeting, preventing misunderstandings and optimizing startup cost management.

The car insurance profitability model optimizes financial outcomes by accurately forecasting revenue and managing expenses efficiently.

Optimize profitability and minimize risks with our comprehensive car insurance financial forecast and expense management model.

Optimize your startup loan repayments confidently using the precise car insurance financial forecast model for strategic planning.

Boost your startup’s success with our car insurance financial model, optimizing profits and minimizing risks efficiently.

CAR INSURANCE SERVICES PRO FORMA FINANCIAL STATEMENTS TEMPLATE EXCEL ADVANTAGES

The automobile insurance cash flow model proactively identifies cash gaps and surpluses, ensuring optimized financial stability.

The automobile insurance cash flow model forecasts deficits and surpluses, enabling proactive financial decisions and growth opportunities.

Maximize profits with our car insurance profitability model featuring intuitive, all-in-one graphical dashboard visualization.

The car insurance financial forecast model offers instant, comprehensive 5-year projections on a single, user-friendly dashboard.

Optimize profitability by predicting upcoming changes with our advanced car insurance financial forecast model.

The automobile insurance cash flow model empowers precise forecasting for informed, profitable financial planning and strategic decision-making.

The car insurance profitability model empowers confident financial decisions through accurate profit forecasting and strategic planning.

Our car insurance profitability model empowers precise risk management and accurate five-year financial forecasting for strategic growth.

Our car insurance profitability model ensures precise financial forecasts, driving confident investor and lender decisions.

Accelerate funding by leveraging our car insurance financial forecast model for precise metrics and confident investor negotiations.