Civil Engineering Firm Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Civil Engineering Firm Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Civil Engineering Firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CIVIL ENGINEERING FIRM FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year civil engineering firm financial model Excel template integrates prebuilt consolidated pro forma profit and loss, balance sheet forecasting, and cash flow projection specifically tailored for civil engineering projects. It features key financial performance metrics, capital investment and cost management models, and an operational budget framework to support accurate civil engineering project cost estimation and revenue forecasting for consultants. Designed as a robust financial analysis and planning software tool, it enables detailed financial forecasting, expense tracking, working capital management, and investment appraisal, assisting firms in evaluating startup ideas, managing budgets, assessing financial risks, and securing funding from banks, venture capitalists, and grants with full editability.

This ready-made civil engineering firm financial model Excel template addresses key pain points by streamlining budget planning, cost estimation, and financial forecasting into a single, user-friendly tool that requires only basic Excel skills to operate. It offers comprehensive features such as cash flow projection, profit and loss model, balance sheet forecasting, and investment appraisal tailored to civil engineering projects, enabling precise expense tracking and revenue forecasting for engineering consultants. By integrating essential financial performance metrics and operational budget modeling, the template facilitates effective working capital management, financial risk assessment, and capital investment analysis, empowering firms to generate accurate financial statements and business valuations. This ensures that civil engineering companies can confidently present actionable financial plans to investors, optimize cost management, and make informed decisions to enhance profitability and long-term sustainability.

Description

This comprehensive financial model for civil engineering firms integrates a robust civil engineering project cost estimation model with detailed cash flow projection and expense tracking tools, enabling precise financial forecasting for civil engineering companies. Designed to support operational budget management and capital investment model analyses, it includes a full suite of financial statements—profit and loss model, balance sheet forecasting, and cash flow statements—facilitating thorough financial analysis and risk assessment tailored specifically for engineering firms. The model also offers revenue forecasting capabilities for civil engineering consultants and an investment appraisal model for project evaluation, while incorporating key civil engineering firm financial performance metrics and working capital management features. Equipped with financial planning software functionalities, this template empowers engineering consultants to perform accurate business valuation, financing options analysis, and profitability planning, providing a dynamic engineering firm financial statement model that streamlines decision-making and optimizes financial outcomes.

CIVIL ENGINEERING FIRM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Leverage this comprehensive civil engineering firm financial model to craft a strategic business roadmap. Integrating an operational budget model with cash flow projection and profit and loss insights, it enables clear financial forecasting for civil engineering companies. Ideal for start-ups, this 3-statement model excels at cash flow analysis and expense tracking, helping entrepreneurs assess cash burn rates and project funding milestones. Utilize this financial planning software for civil engineers to enhance cost management and optimize working capital, ensuring sustained growth and informed decision-making throughout your engineering projects.

Dashboard

Ensuring full transparency with stakeholders enhances trust and drives informed decision-making. Sharing your civil engineering firm’s cash flow projection and financial analysis templates empowers stakeholders to contribute valuable insights on optimizing cash flow and managing expenses. This collaborative approach deepens understanding of your project cost estimation models and startup financial plans, ultimately strengthening financial forecasting and performance metrics. Leverage operational budget models and investment appraisal tools to showcase your firm’s growth potential and build confidence throughout your engineering consulting financial projection process.

Business Financial Statements

Our comprehensive financial planning software for civil engineers integrates budget planning, cost estimation models, and cash flow projections tailored for civil engineering firms. With dynamic financial forecasting and analysis templates, it delivers clear reports, charts, and graphs that effectively communicate your project’s financial health. This tool simplifies capital investment modeling, expense tracking, and profit and loss assessments, empowering you to present compelling insights to investors and stakeholders while confidently managing risks and maximizing performance. Elevate your engineering business with precise financial statements and revenue forecasting designed specifically for the civil engineering sector.

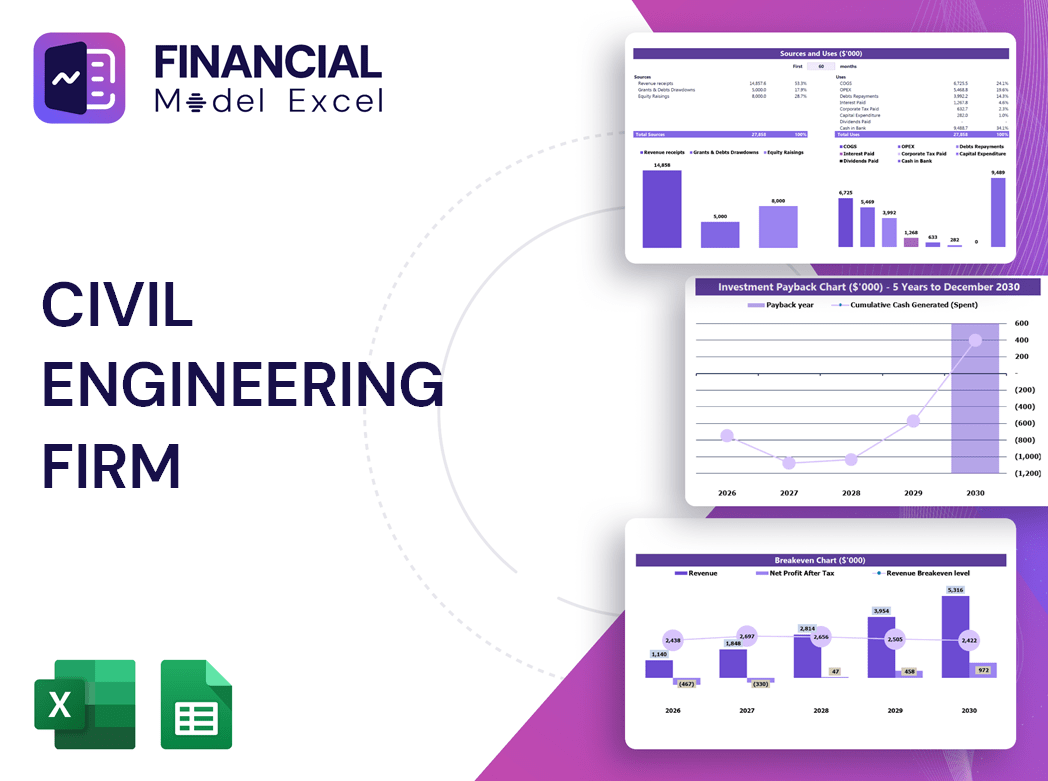

Sources And Uses Statement

This financial forecasting template for civil engineering firms provides a comprehensive sources and uses statement, clearly detailing all financial inflows and their allocation. Designed to support budgeting, cash flow projection, and expense tracking models, it empowers engineering businesses with precise financial analysis. Utilize this tool to enhance capital investment modeling, revenue forecasting, and working capital management, ensuring robust financial planning and risk assessment tailored to civil engineering projects. Streamline your firm’s financial performance metrics and operational budget with this essential asset for effective cost management and investment appraisal.

Break Even Point In Sales Dollars

Understanding your break-even point with a tailored financial model is crucial for civil engineering firms. It reveals the minimum sales needed to cover expenses, assessing business viability and guiding budget planning. Leveraging detailed financial forecasting and cost estimation models, you can identify opportunities to optimize profits and streamline expenses. Additionally, break-even analysis aids in predicting the timeline for return on investment, aligning stakeholder expectations through accurate cash flow projections and revenue forecasting. This holistic approach empowers engineering firms to enhance financial performance, make informed capital investments, and manage risks effectively.

Top Revenue

Gain clear visibility into your civil engineering firm’s annual revenue streams with our comprehensive financial forecasting template. The Top Revenue tab details income by service line, while the integrated Excel financial model offers in-depth revenue segmentation and bridge analyses. Designed for precise financial planning, this tool supports effective budget planning, project cost estimation, and cash flow projection—empowering engineering firms to optimize profitability and make informed strategic decisions. Elevate your firm’s financial performance with accurate forecasting tailored to the civil engineering sector.

Business Top Expenses Spreadsheet

In the Top Expenses section of our civil engineering firm financial projection model, track major costs across four customizable categories. Our 5-year cash flow projection template includes an 'Other' category for added flexibility, allowing you to tailor expense tracking to your firm’s unique needs. Whether incorporating historical financial data or developing a forward-looking financial forecasting plan, this tool supports comprehensive budget planning and cost management for engineering projects. Optimize your operational budget model with precision and enhance financial performance metrics with ease.

CIVIL ENGINEERING FIRM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are a critical component of any civil engineering firm’s financial planning. Our comprehensive financial model includes a detailed proforma for start-up costs, capturing both funding sources and expenses. This enables precise cost management and budget planning from day one, helping you avoid overspending and underfunding. Utilize this financial forecasting tool to monitor early expenses effectively and ensure strong financial performance for your engineering projects.

CAPEX Spending

Effective capital expense (CAPEX) budgeting with automated depreciation calculation is crucial for any 5-year financial forecasting model in civil engineering firms. Our financial planning software enables users to seamlessly apply straight-line or double-declining balance depreciation methods within their civil engineering project cost estimation models. This enhances accuracy in investment appraisal and long-term financial analysis, empowering engineering companies to optimize capital investment strategies and improve overall financial performance metrics.

Loan Financing Calculator

Start-ups and growing civil engineering firms must closely manage loan repayment schedules within their financial planning software. A detailed debt schedule, outlining loan amounts, maturities, and interest expenses, is vital for accurate cash flow projections and financial forecasting. Interest costs impact the cash flow statement, while principal repayments influence financing activities in a 5-year cash flow projection model. This integrated approach ensures precise cash flow projection and balance sheet forecasting, empowering engineering firms to optimize working capital management and drive sustainable growth.

CIVIL ENGINEERING FIRM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net Present Value (NPV) is a critical metric in financial forecasting for civil engineering companies. It discounts future cash flows to their present value, enabling precise evaluation of project viability within a civil engineering project cost estimation model. NPV answers: “What is today’s value of $1 received in the future?” Summing these discounted cash flows across periods delivers the NPV, guiding capital investment decisions and risk assessment. Leveraging an engineering firm financial statement model or financial planning software for civil engineers ensures accurate budget planning and enhances financial performance metrics in your firm.

Cash Flow Forecast Excel

In civil engineering firms, effective cash flow projection is vital for sustaining operations and securing investment. A well-designed cash flow model reveals the company’s liquidity status, highlighting available funds and identifying potential shortfalls. Integrating this into a comprehensive financial analysis template enables precise budget planning, expense tracking, and financial forecasting. Utilizing specialized financial planning software tailored for civil engineering ensures accurate profit and loss modeling, capital investment appraisal, and working capital management—empowering firms to optimize financial performance and support informed decision-making.

KPI Benchmarks

Our pro forma projection features a custom-designed financial analysis template tailored for civil engineering firms. Leveraging industry-specific benchmarks and key financial performance metrics, this tool offers actionable insights into your company’s standing compared to top performers in the sector. Empower your team with precise civil engineering project cost estimation models and cash flow projections to focus resources effectively. Enhance your budget planning, financial forecasting, and investment appraisal with this comprehensive solution, driving optimal results and sustained growth in today’s competitive engineering landscape.

P&L Statement Excel

For precise financial forecasting and comprehensive budget planning, an advanced financial model tailored for civil engineering firms is essential. Our Excel-based profit and loss model offers detailed monthly or yearly pro forma statements for up to five years, enabling accurate cash flow projections and sales analysis. This robust tool serves as a critical diagnostic asset, highlighting financial risks and operational weaknesses. Ideal for civil engineering project cost estimation, expense tracking, and revenue forecasting, it empowers firms to optimize capital investment, manage working capital efficiently, and enhance overall financial performance with confidence and clarity.

Pro Forma Balance Sheet Template Excel

Enhance your civil engineering firm’s financial planning with our comprehensive pro forma balance sheet template in Excel. Seamlessly linked to cash flow projections, pro forma income statements, and essential financial inputs, this tool empowers precise budget planning, cost estimation, and operational forecasting. Optimize your capital investment models, expense tracking, and profit and loss analysis with an integrated approach designed specifically for engineering businesses. Ideal for financial forecasting, risk assessment, and performance metric tracking, this template elevates your firm’s strategic decision-making and financial management to new heights.

CIVIL ENGINEERING FIRM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive civil engineering firm financial model includes a startup valuation template designed to deliver critical data for investors and lenders. Featuring weighted average cost of capital (WACC), it highlights the minimum expected return on invested funds. The free cash flow projection showcases available cash beyond operational needs, while the discounted cash flow analysis calculates the present value of future business cash flows. This financial forecasting tool empowers civil engineering companies with precise investment appraisal and financial planning insights for confident decision-making.

Cap Table

Our financial planning software for civil engineers includes a comprehensive cap table—a vital spreadsheet delineating your company’s ownership structure. It details shares, options, investor purchase prices, and ownership percentages, providing clear insights essential for effective budget planning and investment appraisal. This tool supports accurate financial forecasting for civil engineering companies, enabling precise cash flow projection and capital investment modeling. Empower your firm with expert financial analysis templates and robust project cost estimation models designed specifically for the engineering sector. Streamline expense tracking, balance sheet forecasting, and profit and loss management to enhance your civil engineering firm’s financial performance metrics.

CIVIL ENGINEERING FIRM PRO FORMA INCOME STATEMENT TEMPLATE EXCEL ADVANTAGES

Financial forecasting for civil engineering firms ensures accurate cash flow projections and optimizes investment decisions confidently.

Optimize asset acquisition confidently using the civil engineering firm financial model for precise, data-driven financial projections.

Optimize cash flow and profitability with our financial forecasting model designed for civil engineering firms.

Accurately compute startup costs and optimize budgeting with the civil engineering firm financial model pro forma Excel template.

The financial model empowers civil engineering firms to optimize budgets and enhance project cost accuracy confidently.

CIVIL ENGINEERING FIRM BUSINESS PLAN TEMPLATE XLS ADVANTAGES

Our financial model for civil engineering firms saves you time by streamlining budget planning and cost estimation efficiently.

Our civil engineering financial model accelerates accurate budgeting, boosting project efficiency and profitability effortlessly.

Optimize cash flow projection for your civil engineering firm with our precise, easy-to-use financial planning software.

A well-structured financial model streamlines hypothesis testing, enhancing accurate budget planning and strategic decision-making.

Optimize civil engineering budgets with our financial model’s real-time dashboard for clear, actionable insights and projections.

Streamline decisions with our three-way financial model dashboard, delivering instant, comprehensive data for civil engineering firms.

Optimize your civil engineering firm’s budget planning with our financial model to avoid cash flow shortfalls and maximize profits.

Accurate cash flow projection models help civil engineering firms anticipate shortfalls, ensuring financial stability and strategic planning.

Optimize your civil engineering firm’s budget planning with our financial model for exceptional value and precise forecasting.

Optimize your civil engineering firm’s profits with a proven, affordable financial model—no hidden fees or subscriptions.