Combat Training Center Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Combat Training Center Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Combat Training Center Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COMBAT TRAINING CENTER FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year combat training center financial model provides a robust framework for financial planning, featuring essential tools such as a combat training center budget forecast, expense analysis, and revenue model to support business planning and fundraising efforts. Designed specifically for startups and entrepreneurs, this financial strategy integrates key financial charts, operational budget models, and funding forecasts, enabling detailed financial projections for combat training centers. The model also includes a financial dashboard to monitor performance, a cash flow model for liquidity management, and a financial feasibility study to attract banks or investors, ensuring a thorough combat training center investment and funding model for successful business growth.

The combat training center financial model template in Excel addresses key pain points such as time-consuming manual budgeting and complex expense analysis by providing an integrated combat training center budget forecast and detailed expense breakdown, enabling streamlined operational budget modeling. It offers a comprehensive financial forecasting framework that incorporates revenue models, cash flow projections, and investment evaluation, reducing uncertainty in financial planning for combat centers. The built-in financial dashboard enhances real-time financial analysis for combat training centers, facilitating quick assessment of profitability models and cost structures, while ensuring an actionable combat training center financial feasibility study to support funding decisions and strategic investment planning.

Description

The combat training center financial model serves as a comprehensive financial planning tool designed to support startups and established facilities in creating accurate financial projections for combat training centers. This adaptable financial strategy includes a detailed combat training center revenue model and expense analysis, allowing for precise combat training center budget forecasts and cash flow modeling. By incorporating multiple revenue streams and a thorough cost structure of combat training centers, the model facilitates financial feasibility studies and operational budget planning. Its flexible framework supports various what-if scenarios, enabling stakeholders to optimize financial performance, assess investment opportunities, and implement effective combat training center funding models to ensure sustainable profitability.

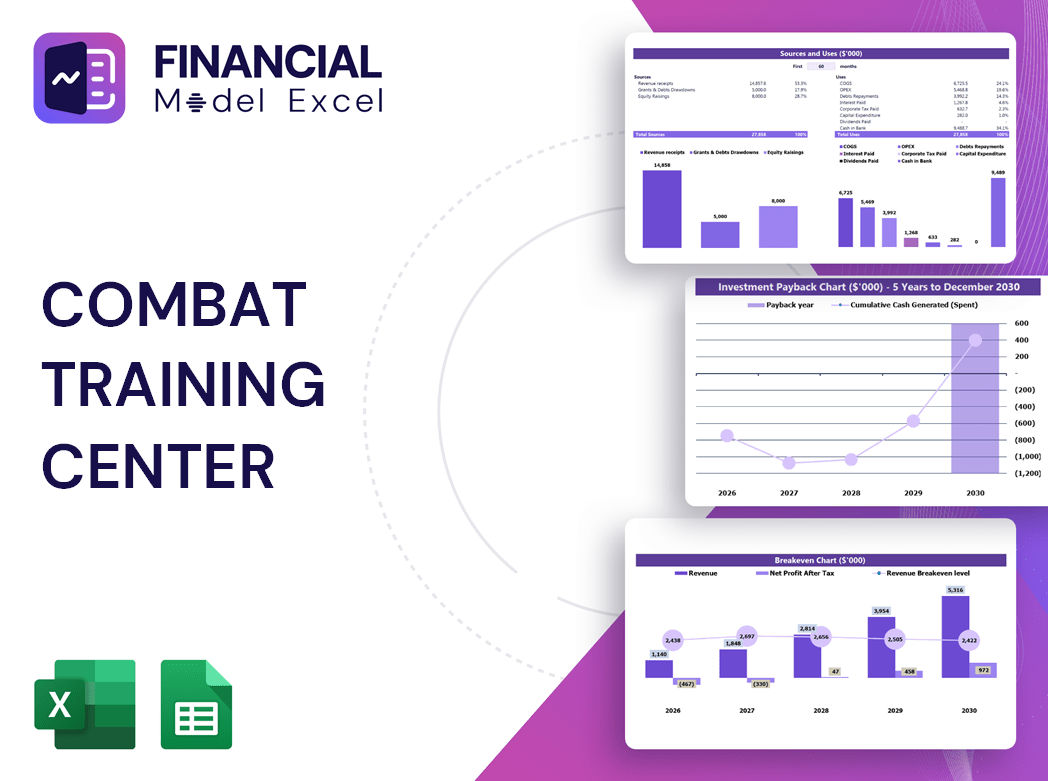

COMBAT TRAINING CENTER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a comprehensive three-way financial model tailored for combat training centers, integrating profit and loss projections, balance sheet templates, and cash flow forecasts. This dynamic financial planning tool enables precise financial forecasting for combat training programs, capturing the cost structure, revenue models, and expense analysis. Automatically generated accounting statements and key performance indicators feed into an intuitive financial dashboard, empowering strategic decision-making and financial feasibility assessment. Optimize your combat training facility’s financial strategy with this robust model designed to project profitability, support budget forecasts, and ensure sustainable operational success.

Dashboard

The Dashboard tab offers a comprehensive financial overview of your combat training center, showcasing key financial statements and performance indicators through dynamic graphs, ratios, and charts. This tool enables in-depth financial analysis, supporting strategic decisions within your combat training center financial plan, budget forecast, and investment models. Easily monitor your facility’s cash flow, expense analysis, and profitability model to ensure optimal operational and financial performance.

Business Financial Statements

Our comprehensive combat training center financial model integrates consolidated financial statements, including profit and loss projections, pro forma balance sheets, and cash flow statements. These essential reports can be generated monthly or annually, providing actionable insights for financial forecasting and strategic planning. Additionally, the model supports rolling projections by seamlessly combining current data from Excel with accounting platforms like QuickBooks, Xero, and FreshBooks. This robust financial planning tool is designed to enhance budget forecasts, expense analysis, and overall financial performance for combat training facilities.

Sources And Uses Statement

The Sources and Uses of Capital tab provides a detailed overview of funding origins alongside planned expenditures within the combat training center financial model. This section clearly outlines capital inflows and aligns them with targeted investment activities, supporting accurate financial forecasting for combat training facilities. By integrating thorough financial projections and expense analysis, it enhances strategic financial planning and ensures a robust combat training center budget forecast. This transparency is vital for optimizing the cost structure and driving the overall financial performance of combat training centers.

Break Even Point In Sales Dollars

The break-even point marks when a combat training center’s revenue fully covers its costs, indicating neither profit nor loss. Utilizing a break-even revenue calculator is essential in the financial planning process, providing valuable insight into the relationship between fixed costs, variable costs, and revenue. Combat training centers with lower fixed expenses typically achieve break-even more quickly. Incorporating this analysis into a combat training center budget forecast or financial model enhances strategic decision-making and supports a robust combat training center profitability model.

Top Revenue

In a combat training center financial plan, understanding the top line and bottom line is crucial. The top line reflects total revenue from combat training center operations, signaling growth when increasing. This drives stronger financial projections for combat training centers by boosting overall financial performance. Conversely, the bottom line reveals net income after expenses, highlighting profitability in the combat training center expense analysis. A robust combat training center profitability model balances revenue growth and expense control, ensuring sustainable success. Utilizing these insights in the combat training center budget forecast and financial strategy supports informed decision-making and long-term facility viability.

Business Top Expenses Spreadsheet

The Top Revenue tab in the combat training center financial forecast template delivers a clear, concise overview of your facility’s revenue streams. It provides an annual summary, showcasing detailed revenue depth and the revenue bridge to support effective financial planning. This tool is essential for developing a robust combat training center revenue model, enhancing your financial projections and optimizing the combat training business financial model for sustained profitability.

COMBAT TRAINING CENTER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our combat training center financial model offers a streamlined, automated solution for precise expense analysis and budget forecasting. Designed for ease of use, it efficiently projects fixed costs—such as R&D and SG&A—while minimizing manual updates through end-to-end formulas. This comprehensive financial planning tool supports your combat training center’s budget forecast, cash flow modeling, and profitability analysis, empowering informed decision-making and strategic growth. Optimize your financial performance with a robust combat training facility financial plan tailored for operational efficiency and investment success.

CAPEX Spending

In combat training center financial planning, understanding the top line and bottom line is crucial. The top line reflects total revenue, indicating growth potential in your combat training center revenue model. Conversely, the bottom line shows net income after expenses, highlighting profitability within your combat training center expense analysis. Effective financial forecasting for combat training programs relies on tracking these metrics in your combat training center budget forecast and cash flow model. Prioritizing both top-line growth and bottom-line strength ensures a robust financial strategy for combat centers, driving sustainable success and investor confidence.

Loan Financing Calculator

Our combat training center financial plan features an integrated loan amortization schedule, meticulously designed to calculate principal and interest payments. This financial model for combat training facilities enables precise forecasting of loan repayment amounts, factoring in interest rates, loan duration, and payment frequency. By incorporating this into your combat training center budget forecast, you gain clear insights into cash flow management and expense analysis, supporting robust financial strategy and enhancing the financial feasibility study of your training operations. This tool ensures accurate financial projections for combat training centers, optimizing both profitability and operational budgeting.

COMBAT TRAINING CENTER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The EBITDA metric in a combat training center financial model evaluates operating performance by excluding interest, taxes, depreciation, and amortization. Serving as a key indicator in the combat training center budget forecast, EBITDA is calculated as Revenue minus operating Expenses (excluding the aforementioned items). This measure provides clear insight into the core financial health and profitability model of combat training facilities, supporting robust financial projections and strategic planning. Utilizing EBITDA within the combat training center financial plan enables more accurate expense analysis and strengthens the facility’s overall financial feasibility study.

Cash Flow Forecast Excel

Our combat training center cash flow model is a vital financial tool, providing clear visibility into your facility’s liquidity and funding needs. This comprehensive template tracks payables, receivables, working capital, long-term debt, and net cash, delivering precise financial forecasting for combat training programs. Designed to support your combat training center financial plan, it generates accurate cash flow projections, essential for budgeting, expense analysis, and investment decisions. Optimize your combat training center’s operational budget model and enhance financial strategy with this professional financial dashboard, ensuring sound financial performance and sustainable profitability.

KPI Benchmarks

This comprehensive combat training center financial model features a benchmarking template, empowering business owners to analyze industry and financial data effectively. It offers clear insights into their center’s financial performance versus competitors, highlighting key market players. By leveraging this tool, owners can evaluate strategic options within their combat training center financial plan, optimize their budget forecast, and identify high-impact opportunities. This model serves as a vital resource for informed decision-making, enhancing financial feasibility and driving operational success in combat training facilities.

P&L Statement Excel

The proforma income statement is a key component of the combat training center financial plan, offering valuable insights into profitability relative to operational costs. While the projected profit and loss statement provides a snapshot of revenue potential, it doesn’t capture the full picture—excluding critical aspects like cash flow, capital structure, and asset-liability balance. For a comprehensive financial analysis for combat training centers, this statement is most effective when integrated with other financial models such as the combat training center cash flow model and expense analysis, ensuring a robust financial forecasting strategy and enhanced profitability modeling.

Pro Forma Balance Sheet Template Excel

Your combat training center financial model highlights key assets such as buildings and equipment within the balance sheet forecast. It also details liabilities and equity at a specific date, providing a clear snapshot of financial health. Crucially, the loan security section plays a pivotal role in the pro forma balance sheet, serving as a fundamental metric lenders require when evaluating loan applications. Integrating this into your combat training center financial plan strengthens your funding model and enhances financial feasibility, ensuring robust financial projections and informed decision-making.

COMBAT TRAINING CENTER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive combat training center financial model offers integrated valuation methods to enhance your financial planning. It enables precise financial forecasting through both discounted cash flow (DCF) and weighted average cost of capital (WACC) calculations. Designed to support combat training center budget forecasts and financial performance analysis, this model empowers decision-makers with robust insights for revenue modeling, expense analysis, and cash flow management. Optimize your combat training facility’s financial strategy with this dynamic tool, ensuring accurate financial projections and a solid foundation for investment and operational budget planning.

Cap Table

Implementing a comprehensive combat training center financial model enhances success by providing precise tracking of all financial data—from equity structures to investor holdings. Utilizing a financial dashboard and cash flow model ensures transparency in the combat training center’s revenue streams, expenses, and funding sources. This strategic financial planning, including expense analysis and profitability modeling, empowers leaders to make informed decisions, optimize budget forecasts, and strengthen operational budgets. Ultimately, a robust financial strategy for combat centers is essential to maximize financial performance and secure sustainable growth in training facility operations.

COMBAT TRAINING CENTER FINANCIAL PLANNING MODEL ADVANTAGES

The financial model ensures sustainable budgeting, maximizing profitability and funding efficiency for combat training centers.

Enhance sales strategy using the combat training center financial model’s precise 5-year cash flow projection template.

The Combat Training Center Financial Model enhances clarity and accuracy, preventing misunderstandings in budget and forecasting processes.

Attract investors confidently using our combat training center financial model with precise 3-year projection templates in Excel.

Identify potential shortfalls in the combat training center financial model to proactively optimize cash balances and ensure stability.

COMBAT TRAINING CENTER 3 WAY FINANCIAL MODEL TEMPLATE ADVANTAGES

The combat training center financial model optimizes budget forecasting, boosting profitability and strategic decision-making efficiency.

A robust combat training center financial model empowers strategic decisions by forecasting cash flow and minimizing operational risks.

Our financial model simplifies budgeting, boosting profitability and strategic planning for combat training centers with ease.

Enhance precision and clarity with our color-coded Combat Training Center Financial Model, featuring 15+ focused, easy-to-navigate tabs.

Our combat training center financial model ensures accurate forecasting, maximizing profitability and securing investor confidence efficiently.

Boost investor confidence and secure funding faster with a precise financial model tailored for combat training centers.

Our combat training center financial model delivers precise key metrics analysis to optimize budgeting and maximize profitability.

Streamline decision-making with our 5-year combat training center financial model, delivering real-time, GAAP-compliant insights.

The combat training center financial model saves you time by streamlining budgeting and forecasting for optimal decision-making.

The combat training center financial model streamlines budgeting, enabling focus on training excellence and strategic growth.