Commercial Office Building Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Commercial Office Building Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Commercial Office Building Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COMMERCIAL OFFICE BUILDING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Generate a comprehensive 5-year commercial real estate financial model featuring an office building investment analysis with detailed cash flow projections, expense modeling, and revenue forecasts. This commercial property valuation model and real estate pro forma financial model template in Excel enables thorough investment return analysis and commercial lease financial analysis, supporting your real estate development feasibility study. Equipped with a financial dashboard and core metrics in GAAP/IFRS formats, this unlocked, fully editable commercial office space budgeting tool simplifies office building funding and finance planning, while streamlining commercial asset financial planning and property management financial templates for a seamless evaluation of your startup costs and business profitability.

This commercial real estate financial model Excel template addresses common pain points by providing a comprehensive office building investment analysis and commercial property valuation model, enabling users to generate accurate office building revenue forecasts and expense modeling with ease. It simplifies complex commercial lease financial analysis and streamlines cash flow projection for office space, while the property management financial template integrates office building capital expenditure modeling and funding strategies to enhance commercial asset financial planning. Designed to support real estate development financial models and real estate discounted cash flow analysis, this ready-made tool improves investment return analysis commercial property and facilitates detailed commercial building income statement reporting. By leveraging this commercial real estate budgeting template, users can confidently conduct real estate financial feasibility studies, optimize cash flow scenarios, and implement a property investment profitability model that supports long-term financial goals without requiring advanced accounting skills.

Description

The commercial real estate financial model offers a comprehensive 5-year office building investment analysis, integrating a robust commercial property valuation model and office space cash flow projection to ensure precise revenue forecasts and expense modeling. This real estate development financial model excels in producing detailed commercial lease financial analysis and office building income statements, while its real estate pro forma financial model features a discounted cash flow analysis and investment return analysis for commercial property. Equipped with a commercial office space budgeting tool and office property capital expenditure model, the template facilitates effective commercial asset financial planning and property management financial oversight. Users benefit from an adaptable and dynamic office building funding and finance model that streamlines commercial real estate budgeting templates and provides essential financial performance ratios, KPIs, and feasibility study components critical for securing bank approvals and investor confidence.

COMMERCIAL OFFICE BUILDING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

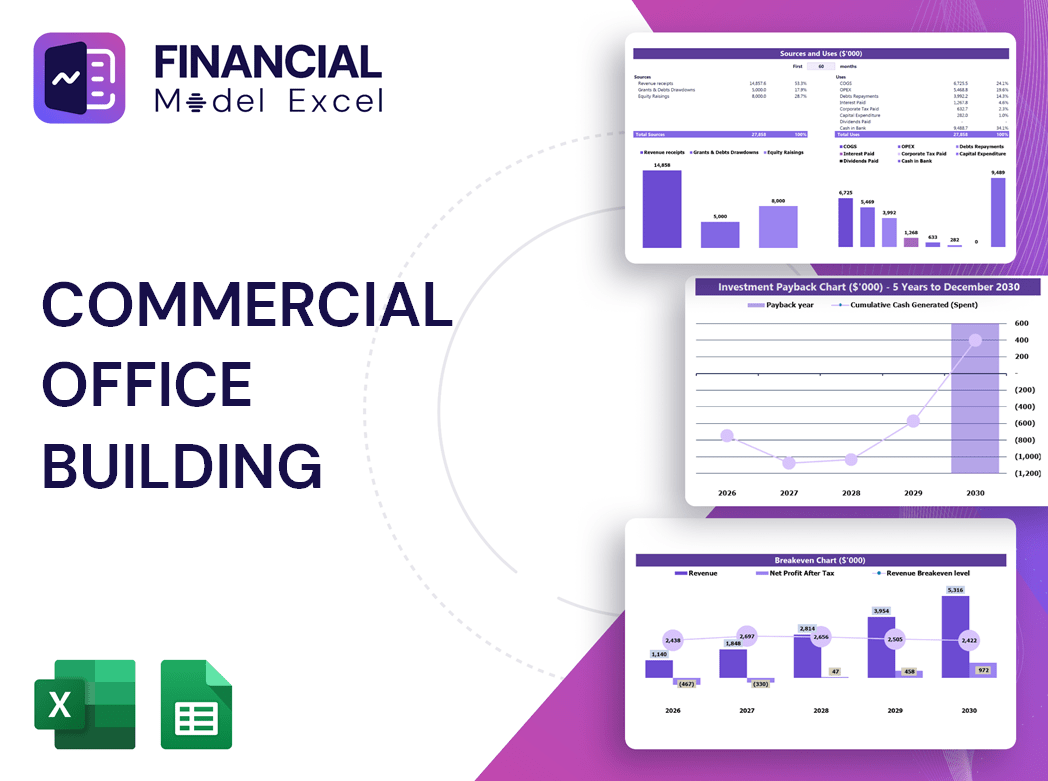

Our commercial real estate financial model delivers precise office building investment analysis and cash flow projections, empowering informed decisions today. This advanced real estate pro forma financial model generates comprehensive three-statement forecasts—including income statement, balance sheet, and cash flow statement—tailored for commercial property valuation. Featuring a 5-year office building revenue forecast and expense modeling, it calculates key startup KPIs based on your assumptions. All critical commercial asset financial planning metrics are conveniently visualized in a sleek, user-friendly dashboard, making it the ultimate commercial lease financial analysis and budgeting tool for real estate development and investment return analysis.

Dashboard

Our comprehensive commercial real estate financial model features an advanced dashboard highlighting key financial indicators across specific timeframes. It delivers detailed office building revenue forecasts, projected cash flow statements, and profit forecasts, enabling precise investment return analysis for commercial properties. This all-in-one commercial property valuation model and office space cash flow projection tool empowers investors and property managers to optimize budgeting, expense modeling, and financial planning with confidence.

Business Financial Statements

A comprehensive commercial real estate financial model integrates profit and loss forecasts with balance sheet projections and cash flow statements. The office building income statement offers detailed insights into operating performance, while the balance sheet and cash flow analysis emphasize capital structure and asset management. Utilizing a real estate pro forma financial model and office space cash flow projection together enables a holistic commercial property valuation model, enhancing investment return analysis and supporting strategic decision-making for office building funding and finance models. This integrated approach ensures accurate commercial asset financial planning and optimized property investment profitability.

Sources And Uses Statement

Companies rely on sources and uses templates in Excel to clearly map out funding origins and cash flow allocations. These templates provide an essential foundation for commercial real estate financial models, enabling precise office building investment analysis, commercial property valuation, and real estate discounted cash flow analysis. By integrating these tools, businesses enhance property management financial planning, optimize office space cash flow projections, and streamline commercial lease financial analysis. Ultimately, this approach drives informed decision-making and maximizes investment return analysis for commercial properties.

Break Even Point In Sales Dollars

The break-even point (BEP) calculation is a vital component of any commercial real estate financial model. It determines the revenue threshold that covers all business costs, including taxes, signaling when an office building investment begins generating profit. Utilizing this metric in your office building cash flow projection or commercial property valuation model ensures accurate investment return analysis and real estate financial feasibility study. A comprehensive break-even chart guides strategic decision-making, helping developers and investors optimize commercial asset financial planning and confidently navigate office property capital expenditure models.

Top Revenue

Accurate revenue forecasting is critical in any commercial real estate financial model, especially for office building investment analysis. Our advanced real estate pro forma financial model incorporates historical growth and detailed office space cash flow projection, ensuring precise commercial property valuation modeling. Financial analysts benefit from built-in assumptions for comprehensive commercial lease financial analysis and office building revenue forecast. Whether managing capital expenditures or conducting real estate financial feasibility studies, this commercial real estate budgeting template empowers investors with reliable investment return analysis commercial property tools to optimize property management and maximize profitability.

Business Top Expenses Spreadsheet

In the Top Expenses section of our five-year commercial real estate financial model, expenses are categorized into four key areas for precise office building expense modeling. Additionally, an ‘Other’ category allows you to input custom data, tailored to your specific office building investment analysis needs. This flexible approach ensures comprehensive commercial property valuation and supports accurate office space cash flow projections, enhancing your commercial asset financial planning and real estate development financial model for optimal investment return analysis.

COMMERCIAL OFFICE BUILDING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurate expense forecasting is vital for effective commercial real estate financial planning. Our real estate development financial model Excel template enables users to project office building expense modeling, budget costs, and conduct investment return analysis for up to five years. It integrates key parameters such as income percentages, payroll, fixed and variable expenses, COGS, and wages. This comprehensive office building funding and finance model offers detailed commercial property valuation, cash flow projection, and commercial lease financial analysis—providing investors and property managers with a powerful tool to enhance profitability and streamline commercial asset financial planning.

CAPEX Spending

CAPEX start-up costs represent significant investments in acquiring and optimizing assets essential for a firm’s success. In commercial real estate financial models, these capital expenditures are critical inputs within the real estate pro forma financial model and must be accurately reflected in both the commercial building income statement and office space cash flow projections. Typically, CAPEX funds improve technology, equipment, or office property capital expenditure models, driving operational efficiency. Proper allocation ensures precise office building expense modeling and supports robust investment return analysis for commercial property, underpinning sound commercial asset financial planning and real estate discounted cash flow analysis.

Loan Financing Calculator

The loan amortization schedule in this commercial real estate financial model outlines systematic repayment of principal and interest over the loan term. It provides a clear, detailed breakdown of periodic payments, essential for comprehensive office building investment analysis. This schedule integrates seamlessly with your commercial lease financial analysis and office space cash flow projection, ensuring precise tracking of debt service. Ideal for real estate development financial modeling and investment return analysis, it supports accurate commercial property valuation and enhances your office building revenue forecast, empowering informed financial planning and budgeting decisions throughout the property management lifecycle.

COMMERCIAL OFFICE BUILDING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Key performance indicators (KPIs) within a commercial real estate financial model provide critical insights for entrepreneurs and investors alike. These metrics offer a swift evaluation of office building investment analysis, cash flow projections, and expense modeling, ensuring real-time assessment of financial performance and operational efficiency. When indicators in commercial property valuation models or commercial lease financial analyses signal concerns, stakeholders can promptly identify issues, enabling proactive strategies to optimize revenue forecasts and mitigate risks. Utilizing these KPIs enhances investment return analysis commercial property and strengthens commercial asset financial planning for sustained success.

Cash Flow Forecast Excel

A comprehensive office space cash flow projection is vital for effective financial management. This commercial real estate financial model enables precise allocation of funds, ensuring timely payment of salaries and efficient control over operational expenses. By integrating office building expense modeling and revenue forecasting, it supports accurate commercial property valuation and investment return analysis. Utilize this strategic tool to enhance your commercial asset financial planning and optimize overall profitability in your office building investments.

KPI Benchmarks

The 3-year commercial real estate financial model includes a dedicated benchmarking study tab. This comprehensive financial analysis compares your office building investment metrics against industry peers, providing crucial insights into competitiveness, efficiency, and productivity. By leveraging this real estate financial feasibility study, users can enhance their commercial property valuation model and optimize office space cash flow projections. This powerful tool supports informed decisions on commercial lease financial analysis, office building revenue forecasts, and investment return analysis, ultimately driving superior commercial asset financial planning and maximizing property investment profitability.

P&L Statement Excel

Ensure your commercial real estate financial model captures profitability with our comprehensive projected profit and loss template. Tailored for office building investment analysis, this 5-year forecast integrates key assumptions to deliver accurate office building revenue forecasts, expense modeling, and net profit insights post-tax. Ideal for startups and seasoned investors alike, it simplifies commercial property valuation, cash flow projections, and investment return analysis, empowering confident decisions through real estate discounted cash flow analysis and commercial lease financial analysis. Elevate your financial planning with this essential tool for commercial office space budgeting and development feasibility studies.

Pro Forma Balance Sheet Template Excel

Creating a 5-year projected balance sheet in Excel is vital for any commercial real estate financial model, linking the income statement and cash flow projections seamlessly. While investors focus on income and cash flow, the forecasted balance sheet in an office building investment analysis ensures accurate real estate discounted cash flow analysis. It aids in validating net income estimates and profitability through key metrics like return on equity and invested capital. Incorporating this in your commercial property valuation model enhances transparency and confidence, supporting sound commercial asset financial planning and robust investment return analysis.

COMMERCIAL OFFICE BUILDING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our commercial real estate financial model excels in delivering precise office building investment analysis through advanced real estate discounted cash flow analysis and office space cash flow projection. Utilizing a comprehensive commercial property valuation model, it effectively integrates weighted average cost of capital (WACC), discounted cash flows (DCF), and free cash flows (FCF) for accurate investment return analysis commercial property. This real estate pro forma financial model is essential for office building revenue forecasting, expense modeling, and funding strategies, empowering stakeholders with a robust commercial lease financial analysis and property management financial template for confident decision-making and optimized commercial asset financial planning.

Cap Table

In commercial real estate financial modeling, maintaining an accurate equity cap table is essential. This table outlines ownership of securities—common stock, preferred shares, options, and warrants—providing clarity for investment return analysis and commercial lease financial analysis. Keeping this data organized supports informed decisions in office building funding and finance models, property investment profitability evaluations, and real estate development financial models. Whether conducting a real estate financial feasibility study or using a commercial property valuation model, a precise cap table ensures seamless capital management and strategic growth in your office building investment analysis.

COMMERCIAL OFFICE BUILDING FINANCIAL MODEL STARTUP ADVANTAGES

Maximize investment returns with our comprehensive commercial real estate financial model for precise office building revenue forecasts.

Attract investors confidently with a precise commercial real estate financial model delivering clear 3-year projections in Excel.

Generate growth inspiration with a commercial office building financial model that optimizes investment returns and cash flow projections.

Optimize your sales strategy with a commercial office building financial model delivering precise, actionable financial projections.

The commercial real estate financial model precisely calculates break-even and maximizes ROI for confident investment decisions.

COMMERCIAL OFFICE BUILDING FINANCIAL EXCEL TEMPLATE ADVANTAGES

Optimize investment returns with a commercial real estate financial model that predicts the influence of upcoming market changes.

The commercial real estate financial model empowers precise cash flow forecasting and informed investment decision-making through scenario analysis.

Optimize your commercial real estate financial model with insightful dashboards for clear, all-in-one investment analysis and forecasting.

The comprehensive financial model dashboard instantly displays all key reports and variables, streamlining your commercial real estate analysis.

Maximize returns with our commercial real estate financial model, delivering precise investment analysis and cash flow projections for investors ready.

Optimize investment decisions with our commercial real estate financial model, featuring comprehensive proforma and cash flow templates.

The commercial real estate financial model saves time and money by streamlining investment analysis and accurate cash flow projections.

Effortlessly optimize your commercial real estate strategy with our 5-year cash flow projection template—no consultants required.

Maximize profits with our 5-year commercial real estate financial model for accurate investment return and cash flow projection.

Generate a fully-integrated 5-year commercial office building financial model with automatic monthly aggregation and comprehensive annual summaries.