Community Bank Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Community Bank Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Community Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COMMUNITY BANK FINANCIAL MODEL FOR STARTUP INFO

Highlights

The Community Bank Financial Model is an essential tool for startups and established institutions seeking to raise capital, offering comprehensive financial modeling for community banks. It enables precise bank financial performance modeling and facilitates detailed community bank budgeting models, allowing users to develop accurate cash flow projections and revenue forecasts. This model supports thorough financial analysis for community banks, including loan portfolio financial modeling, deposit growth projections, and interest income modeling, while also incorporating community bank expense forecasting and profitability analysis. Ideal for enhancing business plans or evaluating a bank prior to sale, it offers full customization to unlock insights into community bank capital planning, risk assessment financial models, stress testing bank financials, and asset liability management for robust, data-driven decision-making.

This community bank financial forecast model offers a comprehensive solution to common challenges faced by community banks, such as accurately projecting revenue, managing loan portfolios, and forecasting expenses. By integrating detailed community bank financial projections with bank balance sheet modeling and interest income financial models, it eliminates guesswork from budgeting and capital planning processes. The model’s robust asset liability management and risk assessment financial model features aid in stress testing bank financials, ensuring resilience under various economic scenarios. Additionally, the community bank cash flow model and deposit growth financial model streamline liquidity management, while profitability analysis and bank market share financial model components provide clarity for strategic decision-making. Overall, this ready-made Excel template alleviates the burden of manual calculations, accelerating community bank financial statement modeling and enhancing confidence in funding pursuits through transparent, data-driven insights.

Description

This comprehensive community bank financial forecast model provides a robust framework for detailed financial projections, including profit and loss statements, balance sheet modeling, and cash flow analysis tailored for community banking. Designed to support community bank budgeting models and revenue projections over a 5-year horizon, it integrates loan portfolio financial models and deposit growth financial models to enhance asset liability management and interest income forecasting. The model features stress testing of bank financials, risk assessment financial modeling, and capital planning to ensure resilience under varying economic conditions, while offering critical community bank profitability analysis, expense forecasting, and financial statement modeling. By consolidating key financial performance ratios and KPIs, this tool streamlines financial analysis for community banks, enabling optimized bank financial performance models and effective market share financial modeling to drive strategic decision-making and sustainable growth.

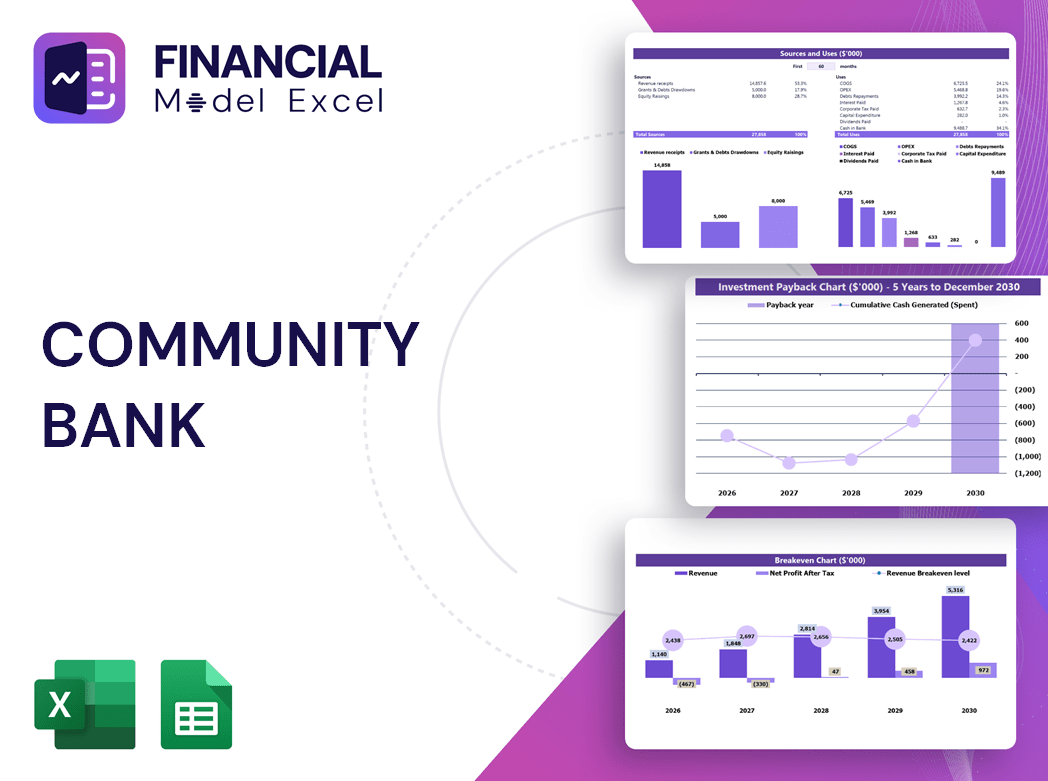

COMMUNITY BANK FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Elevate your investor meetings with our comprehensive community bank financial forecast model. Featuring customizable sheets for financial assumptions, detailed cash flow projections, and built-in bank financial performance models, this pro-forma Excel template streamlines community banking financial projections and expense forecasting. Designed for clarity and precision, it offers investor-friendly reporting that enhances your community bank profitability analysis, capital planning, and risk assessment. Optimize your financial modeling for community banks with a tool that integrates loan portfolio models, deposit growth forecasting, and asset liability management—empowering confident decisions and transparent communication.

Dashboard

Looking for a comprehensive community bank financial forecast model? This all-in-one dashboard delivers a clear snapshot of your bank’s key metrics at any point in time. Access community banking financial projections, including revenue breakdowns, cash flow forecasting, profitability analysis, and loan portfolio insights—all visualized through intuitive charts and graphs. Enhance your financial modeling for community banks with streamlined bank balance sheet modeling, deposit growth forecasts, and expense forecasting. Empower your team with actionable data from this powerful community bank budgeting and capital planning tool, designed to optimize financial performance and support strategic decision-making.

Business Financial Statements

Our community bank financial statement model integrates three linked Excel templates: the Income Statement tracks revenues, expenses, and interest income; the Balance Sheet provides a real-time snapshot of assets, liabilities, and equity, ensuring balance; and the Cash Flow Statement details cash inflows and outflows from operations, investments, and financing. Together, they form a cohesive financial forecasting and budgeting model, empowering community banks with precise financial analysis, profitability insights, and robust asset liability management for strategic capital planning and stress testing.

Sources And Uses Statement

Our community bank financial forecast model offers a flexible, reliable framework to analyze capital flows through detailed sources and uses statements. Tailored for community banking financial projections, this model helps in precise asset liability management and cash flow planning. By clearly outlining funding timelines and allocation strategies, it supports sound decision-making in capital planning and expense forecasting. Whether assessing loan portfolio financial models or deposit growth forecasts, this tool enhances financial analysis for community banks, accommodating unique operational needs without requiring advanced expertise. It’s the essential bank financial performance model for strategic growth and risk assessment.

Break Even Point In Sales Dollars

A community bank financial forecast model goes beyond simple revenue tracking by integrating sales, revenue, and profit distinctions essential for accurate financial planning. Understanding that revenue represents total sales income, while profit accounts for revenue minus fixed and variable expenses, is crucial. Utilizing comprehensive financial modeling for community banks—incorporating revenue projections, expense forecasting, and profitability analysis—enables precise budgeting and strategic decision-making that drive sustainable growth and financial stability.

Top Revenue

In community banking financial projections, the top line represents revenue growth—a crucial metric in any bank financial performance model. Investors and analysts focus on this figure within community bank financial statement models to gauge strength in interest income, deposit growth, and loan portfolio expansion. Consistent top-line growth signals robust community bank profitability analysis and supports accurate community bank budgeting models. Monitoring these trends quarterly and annually enhances financial analysis for community banks, underpinning asset liability management models and stress testing bank financials to ensure sustainable success.

Business Top Expenses Spreadsheet

To enhance your community bank’s performance, effective expense management is crucial. Our comprehensive community bank expense forecasting model breaks down major cost categories, enabling precise financial analysis for community banks. By leveraging this bank financial performance model, you gain clarity on expense trends, optimize operations, and improve profitability. Understanding your financial projections and directing costs strategically empowers your institution to avoid losses and drive sustainable growth. Utilize our financial modeling for community banks to make informed decisions that strengthen your bank’s financial health and future success.

COMMUNITY BANK FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive community banking financial forecast model empowers you to accurately project revenue, expenses, and capital needs. Designed for effective financial analysis for community banks, this tool streamlines bank financial performance modeling and risk assessment. Easily identify potential challenges and optimize resource allocation with clear deposit growth financial projections and loan portfolio insights. Essential for community bank budgeting and capital planning, it supports stress testing bank financials and enhances profitability analysis, making it a vital asset for investors and creditors seeking confident, data-driven decisions.

CAPEX Spending

Capital expenditure (CAPEX) is a critical component within community bank financial forecasting models, reflecting investments in property, plant, and equipment (PPE). In community banking financial projections and bank financial performance models, CAPEX budgets are integrated by accounting for depreciation, asset additions, and disposals. Advanced financial modeling for community banks also incorporates leased fixed assets to ensure accurate capital planning and expense forecasting. This comprehensive approach enhances the reliability of community bank budgeting models, supporting precise asset liability management, loan portfolio financial modeling, and overall profitability analysis.

Loan Financing Calculator

Our community bank financial projections model features an integrated loan portfolio financial model with a detailed loan amortization schedule. It accurately calculates principal and interest payments based on loan amount, interest rate, term, and payment frequency. This comprehensive bank financial performance model supports precise community bank budgeting, enhances loan portfolio analysis, and improves interest income forecasting, empowering better financial planning and risk assessment for sustainable growth.

COMMUNITY BANK FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our community bank financial forecast model delivers comprehensive financial projections, including revenue growth rate, gross margin, and EBITDA margin—key indicators of sales and profitability. It also offers robust community bank cash flow modeling, tracking essential KPIs such as cash burn rate, runway, and capital requirements. Tailored for community banking, this model supports expense forecasting, loan portfolio analysis, and capital planning, enabling precise risk assessment and stress testing bank financials. Optimize your institution’s performance by focusing on critical metrics that drive profitability and sustainable growth.

Cash Flow Forecast Excel

Effective cash flow planning and forecasting are crucial for any community bank’s financial success. Utilizing a sophisticated community bank cash flow model enables accurate tracking of inflows and outflows, supporting strong bank financial performance. This financial modeling for community banks aids in optimizing capital turnover, revenue projections, and expense forecasting. By leveraging these tools, bank leaders can enhance profitability analysis, strengthen asset liability management, and make informed decisions for capital planning. Whether managing loan portfolios or deposit growth, a well-designed financial model is essential for sustainable growth and competitive market share.

KPI Benchmarks

This community bank financial forecast model includes a dedicated tab for comprehensive financial benchmarking. It enables in-depth financial analysis for community banks by comparing your bank’s performance against key industry indicators. Utilizing this bank financial performance model helps assess competitiveness, efficiency, and productivity, empowering strategic decision-making. Leverage this tool to enhance your community bank’s financial projections, optimize asset liability management, and drive sustainable growth with confidence.

P&L Statement Excel

The profit and loss projection is a vital component of financial modeling for community banks, offering clear insights into profitability relative to operating costs. While essential for community banking financial projections and profitability analysis, it provides limited visibility into cash flow, capital planning, and asset liability management. To fully assess bank financial performance, the profit and loss forecast should be integrated with comprehensive community bank financial statement models, including bank balance sheet modeling and community bank cash flow models. This holistic approach ensures accurate deposit growth financial modeling, expense forecasting, and stress testing of bank financials for informed decision-making.

Pro Forma Balance Sheet Template Excel

A community bank financial forecast model, including a detailed bank financial performance model and balance sheet modeling, is essential for projecting assets, liabilities, and equity at any point. When combined with income and expense forecasting, these tools enable accurate community banking financial projections and profitability analysis. Utilizing loan portfolio financial models and deposit growth financial models helps assess capital needs and operational funding. This comprehensive financial analysis for community banks supports strategic decisions, enhances asset liability management, and ensures robust capital planning, ultimately driving sustainable growth and risk mitigation in a dynamic market environment.

COMMUNITY BANK FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive community bank financial forecast model to deliver precise insights your investors demand. Utilize advanced financial modeling for community banks, including bank financial performance models and community bank cash flow models, to illustrate key metrics like weighted average cost of capital (WACC) and free cash flow valuation. Showcase discounted cash flow projections that accurately reflect future cash flows relative to the present, enhancing transparency in capital planning and profitability analysis. Empower your stakeholders with robust financial analysis for community banks, ensuring confident decision-making supported by detailed revenue projections and risk assessment financial models.

Cap Table

Our comprehensive community bank financial forecast model empowers you to analyze market value, share capital, and investment potential with precision. Designed for robust financial modeling for community banks, it includes detailed proformas covering bank financial statement models, loan portfolio financial models, and deposit growth forecasting. This all-in-one tool supports accurate community bank profitability analysis and capital planning, enabling confident financial decisions. Access our full startup financial plan today to leverage advanced community bank budgeting models and risk assessment financial models essential for strategic growth and market competitiveness. Invest wisely with expert community banking financial projections at your fingertips.

COMMUNITY BANK STARTUP PRO FORMA TEMPLATE ADVANTAGES

Accelerate informed decision-making with our community bank financial model, enhancing accuracy and strategic financial planning.

Gain clear insights with the community bank cash flow model to optimize financial performance and drive strategic growth.

Enhance decision-making with our community bank financial model, delivering accurate forecasts and insightful profitability analysis.

Community bank financial forecasting models enable precise budgeting, boosting profitability and preventing overdue payments effectively.

Our community banking financial forecast model reveals strengths and weaknesses, empowering smarter, data-driven strategic decisions.

COMMUNITY BANK FINANCIAL MODELING FOR STARTUPS ADVANTAGES

Optimize growth and minimize risks with our community bank financial forecast model for accurate, reliable financial projections.

Community bank cash flow models enable proactive forecasting to identify gaps, optimize liquidity, and drive sustainable growth.

Optimize community bank profitability with precision financial modeling, ensuring robust forecasts and avoiding costly cash flow shortfalls.

Community bank cash flow models enable proactive planning, preventing shortfalls and ensuring steady financial performance.

Unlock precise community bank financial projections to drive strategic growth and maximize profitability with our advanced modeling tools.

A community bank cash flow model enables precise forecasting to minimize risk and support sustainable growth decisions confidently.

Our community bank financial forecast model empowers precise projections, enhancing profitability and strategic decision-making confidently.

Streamline community bank financial forecasting with our all-in-one model—no formulas, programming, or costly consultants needed.

Simple-to-use community bank financial forecast model boosts accuracy and supports strategic, data-driven decision-making.

Streamline community bank financial forecasting with a user-friendly model delivering fast, reliable insights—no Excel expertise needed.