Condominium Development Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Condominium Development Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Condominium Development Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CONDOMINIUM DEVELOPMENT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This sophisticated 5-year condominium development financial model provides a comprehensive real estate financial planning tool designed for all sizes and stages of residential projects. With minimal financial modeling experience required, the template enables users to perform detailed condo project cash flow analysis, construction cost estimation, and sales revenue projection to assess project profitability and facilitate effective condominium funding and budgeting. It serves as an essential financial feasibility study for condos, incorporating real estate development profitability models, expense tracking, and investment return calculations, ensuring quick and reliable results to secure funding from banks, angel investors, grants, and VC funds. Fully unlocked and customizable, this pro forma model supports thorough property development financial forecasting and scenario planning, helping developers minimize financial risks and optimize ROI.

The ready-made condominium development budgeting financial model in Excel addresses common pain points by simplifying complex tasks such as condo project cash flow analysis, condominium construction cost estimation, and condo sales revenue projection, allowing users to effortlessly manage property development financial forecasting. It integrates real estate financial planning tools and a residential development investment model to enable precise real estate cash flow projection and comprehensive condominium development expense tracking, eliminating the need for advanced financial expertise. By providing a real estate pro forma model for condos and a property development ROI calculation model, this template facilitates accurate financial feasibility studies for condos, investment return modeling, and risk assessment, ultimately streamlining real estate project financial risk assessment and condo development cost breakdown, which enhances decision-making and boosts confidence throughout all development phases.

Description

This condominium development budgeting financial model offers a comprehensive real estate financial planning tool designed for detailed condo project cash flow analysis and property development financial forecasting over a 5-year horizon. Incorporating condominium construction cost estimation, condo development cost breakdown, and sales revenue projection, this model facilitates a thorough financial feasibility study for condos, integrating real estate development profitability model components and residential development investment model metrics. The template provides dynamic real estate cash flow projection models and funding analysis, with automated updates on key financial performance ratios and KPIs crucial for lenders and investors to assess project viability. It supports condominium development expense tracking, property development ROI calculation models, and includes a robust real estate pro forma model condos, enabling scenario planning and financial risk assessment for residential property ventures.

CONDOMINIUM DEVELOPMENT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Unlock precision with our advanced yet user-friendly 3-year condominium development financial model Excel template. Designed for real estate professionals, it offers comprehensive condo project cash flow analysis, construction cost estimation, and sales revenue projection—all fully customizable to fit your unique residential development investment model. Whether conducting a financial feasibility study for condos or performing property development ROI calculations, this powerful tool streamlines real estate financial planning and expense tracking. Tailor every sheet effortlessly to enhance your condominium development budgeting and forecasting, ensuring confident decision-making across various real estate pro forma model scenarios. Elevate your project’s profitability and funding analysis today.

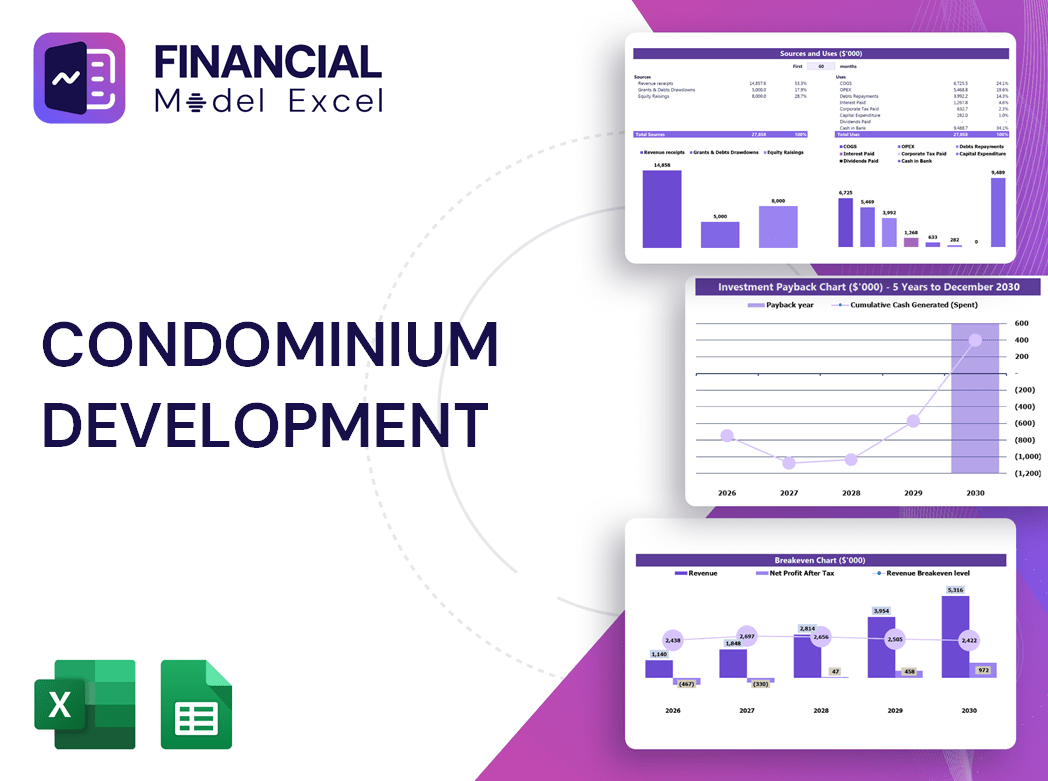

Dashboard

Our comprehensive financial dashboard within the real estate financial modeling for condos offers precise condominium development budgeting and cash flow analysis. Utilizing dynamic charts and graphs, it delivers accurate condominium project funding analysis and expense tracking. Designed for detailed property development financial forecasting, this tool empowers stakeholders with insightful real estate cash flow projection models and condo sales revenue projections, driving informed decisions. Ideal for residential development investment models and real estate project financial risk assessment, it streamlines financial feasibility studies and ROI calculations, ensuring robust condominium construction cost estimation and profitability modeling throughout the development lifecycle.

Business Financial Statements

Our comprehensive real estate financial modeling template integrates key components essential for condominium development budgeting and financial forecasting. It features an Income Statement outlining revenue, expenses, depreciation, taxes, and interest income; a projected Balance Sheet detailing assets, liabilities, and equity to ensure financial equilibrium; and a Cash Flow Statement providing in-depth condo project cash flow analysis. These tools empower developers with accurate real estate investment return models, property development ROI calculations, and condominium project funding analysis for informed decision-making and profitability assessment.

Sources And Uses Statement

The Sources and Uses of Cash tab in a condominium development budgeting financial model is essential for effective real estate financial planning. It clearly outlines primary funding sources alongside detailed condominium development expense tracking, providing crucial insight into cash flow dynamics. This real estate cash flow projection model enables precise condo project cash flow analysis, ensuring optimal allocation of funds. Particularly vital for residential development investment models and financial feasibility studies for condos, it empowers developers to monitor funding and budgeting tools, manage construction cost estimation, and assess project financial risk—driving informed decisions and maximizing real estate investment returns.

Break Even Point In Sales Dollars

Our real estate financial modeling for condos includes a comprehensive break-even analysis, delivering detailed profit projections across various sales levels. This tool organizes results into clear reports, enhancing your condominium development budgeting and financial planning. Additionally, it provides critical insights into the safety margin, helping you understand how much sales can decline before losses occur. Ideal for condo project cash flow analysis and residential development investment models, this feature supports accurate financial feasibility studies and strengthens your property development ROI calculation model with precision and confidence.

Top Revenue

In condominium development budgeting, the top line—representing condo sales revenue projection—is critical for real estate financial planning tools. It indicates growth in sales and directly influences the real estate investment return model and overall project profitability. Analysts and investors closely monitor this metric through property development financial forecasting and condo project cash flow analysis to assess financial feasibility and guide funding strategies. Robust real estate pro forma models for condos ensure accurate condominium development expense tracking, enabling informed decisions that enhance investment returns and mitigate financial risks in residential development projects.

Business Top Expenses Spreadsheet

Effective condominium development budgeting relies on precise real estate financial modeling for condos to ensure profitability. Our detailed condo project cash flow analysis highlights the top expense categories, enabling clear condominium development expense tracking and cost optimization. By focusing on major costs and grouping others efficiently, this approach supports accurate property development financial forecasting and real estate financial planning tools. Start-ups and established firms alike benefit from this streamlined expense monitoring, enhancing financial feasibility studies for condos and driving smarter, data-driven decisions to maximize ROI in residential development investment models.

CONDOMINIUM DEVELOPMENT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurately tracking start-up costs is crucial in any condominium development financial model. These expenses begin accruing before operations launch, making early monitoring essential. Our comprehensive real estate financial planning tools offer a pro forma model designed specifically for condo projects, enabling precise condominium funding and budgeting. This template streamlines condominium construction cost estimation, expense tracking, and cash flow analysis—empowering you to create detailed cost breakdowns and optimize your residential development investment model for maximum profitability and financial feasibility.

CAPEX Spending

A capital expenditure (CAPEX) budget is crucial in real estate financial modeling for condos, guiding investments in construction, equipment, or other assets. It supports residential development investment models by forecasting expenditures essential for launching new projects or expanding existing ones. Rather than impacting the profit & loss statement directly, CAPEX is capitalized in the real estate pro forma model for condos and depreciated over time. Utilizing condominium development budgeting and expense tracking tools ensures accurate cash flow analysis and enhances financial feasibility studies for condos, optimizing project funding and boosting real estate development profitability.

Loan Financing Calculator

A comprehensive pro forma template delivers stakeholders clear insights into periodic payments for amortizing loans. It details essential components such as loan amount, interest rate, maturity term, payment intervals, and amortization methods. Common methods include straight-line, declining balance, annuity, bullet, balloon, and negative amortization. Utilizing precise loan amortization within real estate financial modeling for condos ensures accurate condominium development budgeting, enhances financial feasibility studies, and supports effective condo project cash flow analysis. This expertise empowers residential development investment models and real estate financial planning tools to optimize condominium project funding and profitability.

CONDOMINIUM DEVELOPMENT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings Before Interest and Taxes (EBIT) is a key metric in real estate financial modeling for condos, measuring a project's operational profitability before financing and tax expenses. Within condominium development budgeting and financial feasibility studies, EBIT highlights the core earning power of ongoing operations, excluding irregular or non-operational costs. This financial planning tool enables accurate condo project cash flow analysis and real estate development profitability modeling, ensuring investors assess true operational performance for informed residential development investment decisions.

Cash Flow Forecast Excel

The condo project cash flow analysis is a vital component of any real estate financial modeling for condos. This detailed cash flow projection model breaks down operating, investing, and financing activities, ensuring alignment with the projected balance sheet for accurate residential development investment modeling. Each line item integrates seamlessly across the condominium development budgeting and real estate pro forma model condos, providing reliable financial forecasting tools. Accurate cash flow reconciliation guarantees a balanced 3-year financial projection, supporting thorough financial feasibility studies and robust condominium project funding analysis for optimized property development ROI calculation.

KPI Benchmarks

The startup financial projection template’s benchmark tab evaluates key performance indicators critical for effective financial planning. By highlighting average values and conducting comparative analyses, it identifies relative strengths and weaknesses, guiding strategic decision-making. This comprehensive financial scenario planning ensures startups select optimal methods to drive positive outcomes. Accurate tracking and control of these indicators are essential, as they form the foundation for robust financial feasibility studies, cash flow projections, and investment return models. Ultimately, this process empowers startups with the insights needed to secure funding, manage risks, and achieve sustainable growth.

P&L Statement Excel

Navigating condominium development budgeting demands precision and clarity. Our real estate financial modeling tool streamlines profit and loss projections, offering a robust pro forma model tailored for condos. With comprehensive condo project cash flow analysis and construction cost estimation, it empowers developers to conduct detailed financial feasibility studies and real estate development profitability modeling. This solution simplifies complex reporting, enabling accurate condo sales revenue projections and insightful financial risk assessments. Designed for residential development investment modeling, it’s your essential resource for condominium funding and budgeting, ensuring confident, data-driven decisions throughout the property development financial forecasting process.

Pro Forma Balance Sheet Template Excel

We included the projected balance sheet template as an essential component of real estate financial planning tools. This report highlights current and long-term assets, liabilities, and equity, providing a comprehensive snapshot of the condominium development’s financial health. Utilizing this template enhances property development financial forecasting and supports accurate condo project cash flow analysis. It’s invaluable for conducting real estate project financial risk assessment and developing robust real estate investment return models, ensuring informed decision-making for residential development investment models and condominium funding and budgeting tools.

CONDOMINIUM DEVELOPMENT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive condominium development budgeting model integrates advanced real estate financial modeling for condos, combining discounted cash flow (DCF) and weighted average cost of capital (WACC) calculations. This dual approach enhances property development financial forecasting by delivering precise condo project cash flow analysis and real estate investment return insights. Designed as a powerful real estate financial planning tool, it supports accurate condominium construction cost estimation, sales revenue projection, and project funding analysis—empowering stakeholders with robust financial feasibility studies and real estate pro forma models to maximize residential development profitability and optimize project funding and budgeting strategies.

Cap Table

Our real estate financial modeling for condos seamlessly integrates the cap table within the cash flow analysis. This comprehensive condominium development budgeting tool maps funding rounds to financial instruments like equity and convertible notes, providing clear insights into ownership structure. It effectively tracks the impact of strategic decisions on shareholder dilution, enabling precise condominium project funding analysis. This ensures robust financial feasibility studies and enhances the accuracy of real estate investment return models, empowering developers with actionable data for informed decision-making throughout residential development investment planning.

CONDOMINIUM DEVELOPMENT EXCEL PRO FORMA TEMPLATE ADVANTAGES

Effortlessly forecast condo project cash flow and optimize budgeting with our advanced condominium development financial model.

The financial model empowers accurate condo project forecasting, maximizing profitability and minimizing real estate investment risks effectively.

Streamline your condominium development budgeting with our financial model, enhancing accuracy and investor confidence effortlessly.

Optimize your condo project funding and repayments with our comprehensive condominium development 3-way financial model template.

Maximize profitability and minimize risks using our comprehensive condominium development financial model Excel template.

CONDOMINIUM DEVELOPMENT 5 YEAR FINANCIAL PROJECTION TEMPLATE EXCEL ADVANTAGES

Our condo financial model saves you time by streamlining budgeting, cash flow analysis, and profitability forecasting efficiently.

Our real estate financial model streamlines budgeting and forecasting, maximizing profitability and accelerating condo development success.

Real estate financial modeling for condos ensures accurate forecasting, gaining stakeholders' trust through transparent, data-driven insights.

A comprehensive condo development financial model boosts investor confidence by delivering clear, insightful monthly cash flow forecasts.

Our real estate financial modeling for condos ensures accurate cash flow analysis, maximizing profitability and investment confidence.

Streamlined financial models enable efficient scenario testing and clear insights for confident condominium development decisions.

Our real estate financial model proves your condo project's profitability and ensures confident loan repayment assurance.

Utilize real estate cash flow projection models to confidently demonstrate loan repayment and secure approval from lenders.

Optimize your condo development budgeting with a 5-year financial model for accurate forecasting and increased investment confidence.

Unlock accurate 5-year condominium development forecasting with automated, integrated financial modeling and dynamic annual summary aggregation.