Construction Equipment Leasing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Construction Equipment Leasing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Construction Equipment Leasing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CONSTRUCTION EQUIPMENT LEASING FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year construction equipment leasing financial projection model is designed specifically for early-stage startups seeking to impress investors and secure capital. Featuring a detailed financial forecasting model for equipment leasing, it includes an equipment leasing income statement model, construction machinery leasing revenue model, and equipment lease cash flow model to provide a robust financial valuation and profitability analysis. The template also incorporates essential tools such as a capital expenditure model for equipment leasing, construction equipment lease amortization schedule, and lease agreement financial modeling for construction equipment, enabling startups to perform thorough financial risk assessments and operational cost analysis. Fully unlocked and editable, this construction equipment rental financial model ensures business owners can confidently present a construction asset leasing financial plan to banks or investors and maximize their chances of getting funded.

The construction equipment leasing financial projection model addresses common pain points by providing a comprehensive and user-friendly framework that streamlines complex calculations, eliminating the need for advanced financial expertise. It simplifies equipment leasing cost analysis and integrates a capital expenditure model for equipment leasing, enabling accurate budgeting and forecasting without the typical errors found in manual financial planning. This model enhances decision-making through built-in construction machinery leasing revenue models and equipment leasing operational financial models, allowing users to perform thorough construction equipment lease profitability analysis and equipment lease financial risk assessment with ease. Automatic updates of all key financial statements—including the equipment leasing income statement model and cash flow projection—save time and reduce errors, while the inclusion of lease agreement financial modeling for construction equipment and amortization schedules ensures precise tracking of liabilities and assets. Overall, it serves as a vital tool to organize, analyze, and forecast financial performance from the outset, empowering businesses to confidently attract investors and optimize operational efficiency.

Description

The construction equipment leasing financial projection model offers a comprehensive 3-way financial framework tailored for start-ups and small to medium enterprises in the construction machinery leasing sector. This adaptable financial forecasting model for equipment leasing integrates key components such as an equipment leasing income statement model, equipment lease cash flow model, and construction equipment lease profitability analysis, allowing businesses to accurately project sales forecasts, cash inflows and outflows, and conduct equipment leasing cost analysis. Additionally, it supports lease agreement financial modeling for construction equipment and includes tools like the construction machinery rental cash flow projection and capital expenditure model for equipment leasing to facilitate sound financial planning, company valuation, and operational financial management.

CONSTRUCTION EQUIPMENT LEASING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive construction equipment leasing financial projection model includes everything investors need—detailed financial assumptions, dynamic Excel reporting, precise cash flow budgeting, and complete profitability analyses. Designed with a user-friendly interface, this five-year financial forecasting model for equipment leasing ensures seamless presentations and robust capital expenditure planning. Whether you’re preparing a construction machinery leasing revenue model or conducting equipment lease financial risk assessments, our compact template delivers professional-grade financial reports to drive confident investment decisions.

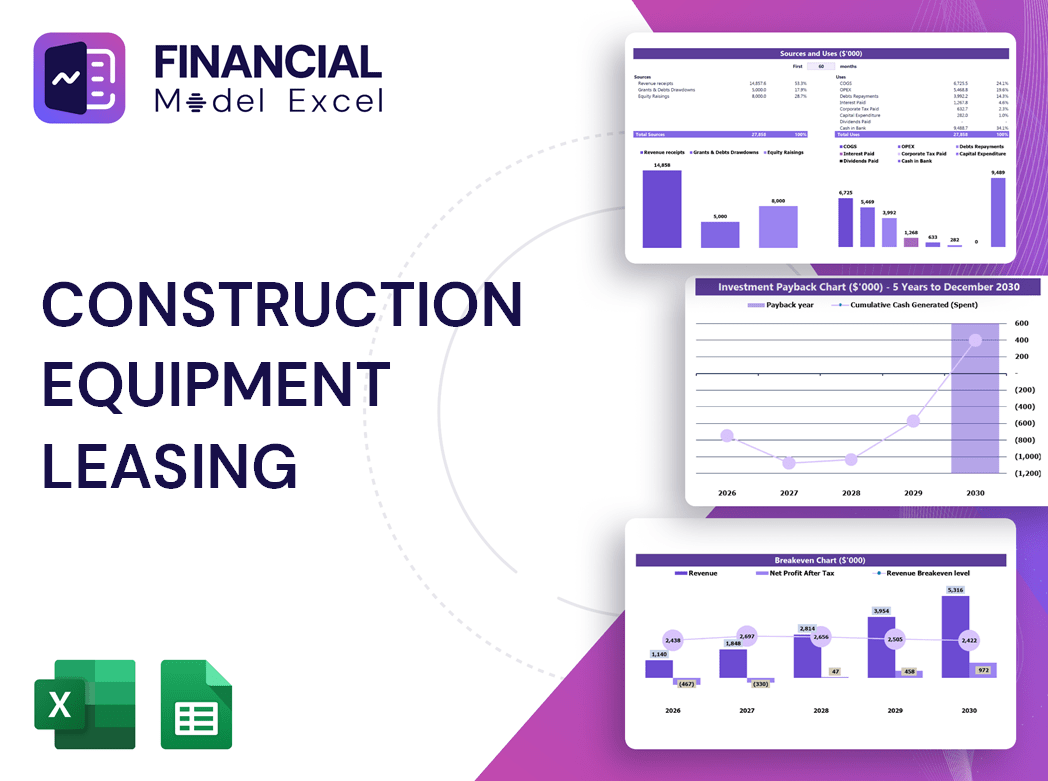

Dashboard

Our construction equipment leasing financial projection model features a dynamic dashboard designed for precise financial forecasting and reporting. This professional tool elevates your equipment leasing business financial plan by enabling accurate construction equipment rental financial modeling, including cash flow projections, profitability analysis, and budget management. Instantly assess startup financial statements and operational metrics, empowering strategic decisions and building stakeholder confidence. With integrated equipment lease cash flow models and expense tracking, this comprehensive solution simplifies complex lease agreement financial modeling, ensuring your construction machinery leasing revenue model drives sustainable growth and maximizes financial valuation.

Business Financial Statements

Our comprehensive equipment leasing financial projection model consolidates key data from multiple spreadsheets to deliver an integrated financial overview. Featuring a detailed construction equipment lease budgeting model, projected balance sheet, P&L forecast, and cash flow projection, our solution is expertly crafted to support your startup’s pitch deck. Whether you’re developing a construction equipment rental financial model or conducting lease agreement financial modeling for construction equipment, our financial plan ensures accurate, professional insights to enhance your equipment leasing business financial plan and drive informed decision-making.

Sources And Uses Statement

The sources and uses of funds statement within this equipment leasing business financial plan offers a comprehensive overview of all capital inflows and spending allocations. Leveraging a robust construction equipment rental financial model, it ensures precise financial forecasting and cash flow management. This detailed analysis supports effective budgeting, capital expenditure planning, and profitability assessment, empowering stakeholders to make informed decisions in the competitive construction machinery leasing sector.

Break Even Point In Sales Dollars

Break-even represents the critical point where a construction equipment leasing business covers all costs through its revenue, achieving neither profit nor loss. Understanding break-even sales is essential in the equipment leasing financial projection model, as it highlights the relationship between fixed costs, variable costs, and revenue streams. Companies with lower fixed costs typically experience a more favorable cost-volume-profit dynamic within their construction equipment rental financial model. Incorporating break-even analysis into your equipment leasing financial plan ensures accurate forecasting and profitability insights, vital for optimizing your construction machinery leasing revenue model and enhancing overall financial performance.

Top Revenue

In the construction equipment leasing financial projection model, use the Top Revenue tab to generate a demand report for your products or services, revealing each scenario’s profitability and financial appeal. This insight guides strategic planning and growth. Additionally, the financial forecasting model for equipment leasing enables development of a revenue bridge that tracks factors affecting revenue—like sales volume and unit price—over time. Forecasts by period (e.g., weekdays vs. weekends) support accurate resource allocation for your sales team, optimizing operational efficiency and maximizing profitability in your equipment leasing business financial plan.

Business Top Expenses Spreadsheet

Utilize the Top Expenses tab to generate a detailed construction equipment leasing financial projection model. This internal expense report breaks down costs by category, streamlining cost analysis and tax preparation. By tracking monthly, quarterly, or annual expenses, you can compare actual spending against forecasts, enabling accurate equipment leasing cost analysis and financial forecasting. These insights support your construction machinery leasing revenue model and guide strategic planning for profitability and growth in your equipment leasing business financial plan.

CONSTRUCTION EQUIPMENT LEASING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our construction equipment leasing financial projection model offers a streamlined, automated solution for accurate expense forecasting, including R&D and SG&A. Designed for ease of use, this equipment leasing business financial plan features end-to-end formulas that minimize manual updates. Whether preparing a construction equipment rental financial model or conducting a cash flow projection, this comprehensive financial forecasting model for equipment leasing ensures precise budgeting and profitability analysis, empowering you to optimize your lease agreement financial modeling with confidence and efficiency.

CAPEX Spending

The Top Revenue tab in this construction equipment leasing financial projection model enables users to forecast demand by product or service, simulating profitability and financial viability across scenarios. Analyze revenue depth and bridges while evaluating forecasted demand—such as weekday versus weekend usage—to optimize resource allocation, including manpower and inventory. This comprehensive equipment leasing business financial plan empowers precise budgeting, revenue modeling, and cash flow projection, enhancing strategic decision-making for maximum operational efficiency and profitability.

Loan Financing Calculator

A construction equipment leasing financial projection model delivers a detailed amortization schedule, empowering stakeholders with clear insights on periodic payments for amortizing loans. This schedule outlines key elements such as loan amount, interest rate, maturity term, payment intervals, and amortization methods. Common approaches include straight-line, declining balance, annuity, bullet, balloon, and negative amortization. Integrating this into your equipment leasing business financial plan ensures accurate financial forecasting, enabling precise lease agreement financial modeling and robust profitability analysis for construction machinery rentals.

CONSTRUCTION EQUIPMENT LEASING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The construction equipment leasing financial projection model integrates gross profit margin analysis to evaluate profitability effectively. This key metric, derived by dividing gross profit by net sales, provides critical insights into the financial health of equipment leasing operations. Incorporating this ratio within the equipment leasing income statement model enables precise profitability analysis, supporting informed decision-making for optimized revenue generation and cost management in construction machinery rental and leasing businesses.

Cash Flow Forecast Excel

This construction equipment leasing financial projection model features a dedicated cash flow sheet, essential for tracking your company’s liquidity and financing needs. Based on payable and receivable days, yearly income, working capital, long-term debt, and net cash, it delivers precise cash flow forecasts. Integrating these inputs, the equipment lease cash flow model provides beginning and ending cash balances, supporting robust financial planning. Ideal for construction equipment rental financial models and lease profitability analysis, this template empowers businesses to optimize cash management and confidently navigate capital expenditure and operational challenges.

KPI Benchmarks

A benchmarking study in construction equipment leasing leverages a 3-way financial model to evaluate a company’s performance through key metrics like profit margins, cost per unit, and productivity. By comparing these indicators against industry peers using financial models such as equipment leasing income statement models and cash flow projections, firms gain actionable insights. This essential strategic tool helps businesses optimize their construction machinery leasing revenue models, refine cost analysis, and enhance profitability. For startups, benchmarking guides effective financial forecasting and risk assessment, aligning operations with best practices to drive sustainable growth in the competitive equipment leasing market.

P&L Statement Excel

To ensure profitability in construction equipment leasing, leveraging a comprehensive construction equipment leasing financial projection model is essential. This model integrates forecasted profit and loss statements, enabling accurate assessment of potential profits and losses. Ideal for startups seeking significant future returns, the financial model for construction equipment rental offers detailed annual reporting, after-tax balance calculations, and net profit analysis. Utilizing such an equipment leasing business financial plan empowers stakeholders with precise construction equipment lease budgeting models and insightful construction machinery leasing revenue models to drive informed strategic decisions.

Pro Forma Balance Sheet Template Excel

The financial projection model for construction equipment leasing integrates monthly and yearly balance sheets with cash flow forecasts, profit and loss statements, and key inputs. This comprehensive equipment leasing financial plan offers a clear, real-time overview of your assets, liabilities, and equity accounts. By leveraging this construction equipment rental financial model, users can perform in-depth profitability analysis, budget accurately, and optimize capital expenditure. It’s an essential tool for financial forecasting, risk assessment, and operational planning within the equipment leasing business.

CONSTRUCTION EQUIPMENT LEASING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Simplify your construction equipment leasing financial projection model with our intuitive pro forma income statement template. Effortlessly execute discounted cash flow analysis, incorporating key inputs like discount rate and WACC, to generate accurate financial valuation models for equipment leasing. Designed to streamline construction machinery leasing revenue model development and equipment leasing profitability analysis, this template empowers your financial forecasting and lease agreement financial modeling processes—making complex capital expenditure and cash flow models accessible and precise. Elevate your equipment leasing business financial plan with confidence and efficiency using this essential financial tool.

Cap Table

A comprehensive construction equipment leasing financial projection model is crucial for strategic planning. It integrates data on shares, options, and capital sources, enabling precise ownership percentage calculations for investors. This equipment leasing business financial plan supports detailed profitability analysis, cash flow forecasting, and capital expenditure modeling. By leveraging a construction machinery leasing revenue model alongside lease agreement financial modeling, companies can optimize their equipment leasing cost analysis and perform robust financial valuation. Ultimately, this enhances decision-making, risk assessment, and supports sustainable growth within the equipment leasing sector.

CONSTRUCTION EQUIPMENT LEASING STARTUP COSTS SPREADSHEET ADVANTAGES

Easily optimize profits with our construction equipment leasing financial model featuring dynamic Income Statement and Balance Sheet projections.

The construction equipment leasing financial model empowers strategic decisions by revealing strengths and weaknesses in five-year projections.

The construction equipment leasing financial model enables precise forecasting and maximizes profitability through insightful scenario analysis.

Optimize startup expenses efficiently with our construction equipment leasing financial projection model for precise budgeting and profitability.

Optimize your startup loan repayments confidently with our 5-year construction equipment leasing financial projection model.

CONSTRUCTION EQUIPMENT LEASING THREE WAY FINANCIAL MODEL ADVANTAGES

Achieve accurate budgeting and maximize profits with our comprehensive construction equipment leasing financial projection model.

Maximize funding success with a construction equipment leasing financial model that ensures precise forecasting and investor confidence.

Maximize profitability with our financial forecasting model for equipment leasing, featuring print-ready, actionable reports.

Our construction equipment leasing financial model delivers comprehensive, print-ready reports ensuring accurate profitability and cash flow insights.

Our construction equipment leasing financial projection model ensures accurate, timely forecasts preferred by banks and external stakeholders.

The construction equipment leasing financial model streamlines loan approvals by providing clear, detailed financial projections to banks.

The construction equipment leasing financial projection model saves you time by streamlining accurate budgeting and profitability analysis.

The construction equipment leasing financial model streamlines budgeting, maximizing profits while minimizing financial management time and risk.

Optimize cash flow and profitability with our construction equipment leasing financial projection model to efficiently manage accounts receivable.

The equipment lease cash flow model enables precise tracking of late payments, optimizing cash flow management and forecasting accuracy.