Construction Equipment Rental Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Construction Equipment Rental Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Construction Equipment Rental Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL MODEL FOR STARTUP INFO

Highlights

Generate a comprehensive 5-year construction equipment rental startup financial plan with our advanced Excel financial model, featuring a detailed equipment rental income statement model, cash flow pro forma, and construction equipment rental expense breakdown. This robust construction equipment rental business forecast incorporates financial modeling for construction equipment leasing, equipment rental profit and loss projection, and construction equipment rental capital requirements to provide a complete equipment rental financial viability study. Utilize this financial dashboard with core metrics structured in GAAP/IFRS formats to perform in-depth equipment rental break-even analysis and ROI calculation. Perfect for preparing a construction machinery rental revenue model and equipment rental balance sheet projection, this unlocked template allows full customization to support your equipment rental funding model and secure financing from banks or investors.

This construction equipment rental financial model Excel template addresses critical pain points such as complex equipment rental cash flow analysis, ambiguous cost structure management, and unreliable financial projections by offering a ready-made startup financial plan that simplifies the equipment rental profit and loss projection and rental equipment income statement model. It eliminates guesswork through comprehensive construction equipment rental expense breakdowns and capital requirements assessment while supporting detailed equipment leasing financial scenario analysis for better decision-making. Designed to enhance clarity, this model facilitates equipment rental break-even analysis, ROI calculation, and a complete equipment rental balance sheet projection to ensure precise monitoring of financial viability and funding needs, ultimately streamlining the construction equipment rental business forecast for both operators and investors.

Description

Our comprehensive construction equipment rental financial projection template integrates detailed expense breakdowns, cash flow analysis, and revenue models to provide a robust financial plan for equipment rental startups. This financial modeling tool facilitates accurate equipment rental profit and loss projections, capital requirement assessments, and break-even analysis to ensure sustainable growth and sound investment decisions. By utilizing our construction machinery rental revenue model alongside equipment leasing financial scenario analysis, users can measure ROI, forecast business valuation, and optimize their construction equipment rental cost structure for improved financial viability and operational efficiency.

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This construction equipment rental financial projection model offers a streamlined, user-friendly Excel template designed for ease and accuracy. All key assumptions are clearly organized on a single sheet, while automated formulas update cash flow, income statement, and balance sheet projections across 15+ interconnected sheets. Simply input your parameters in the highlighted cells, and the model will generate a comprehensive profit and loss forecast, expense breakdown, and cash flow analysis—empowering your construction equipment rental startup financial plan and funding strategy with precision and clarity.

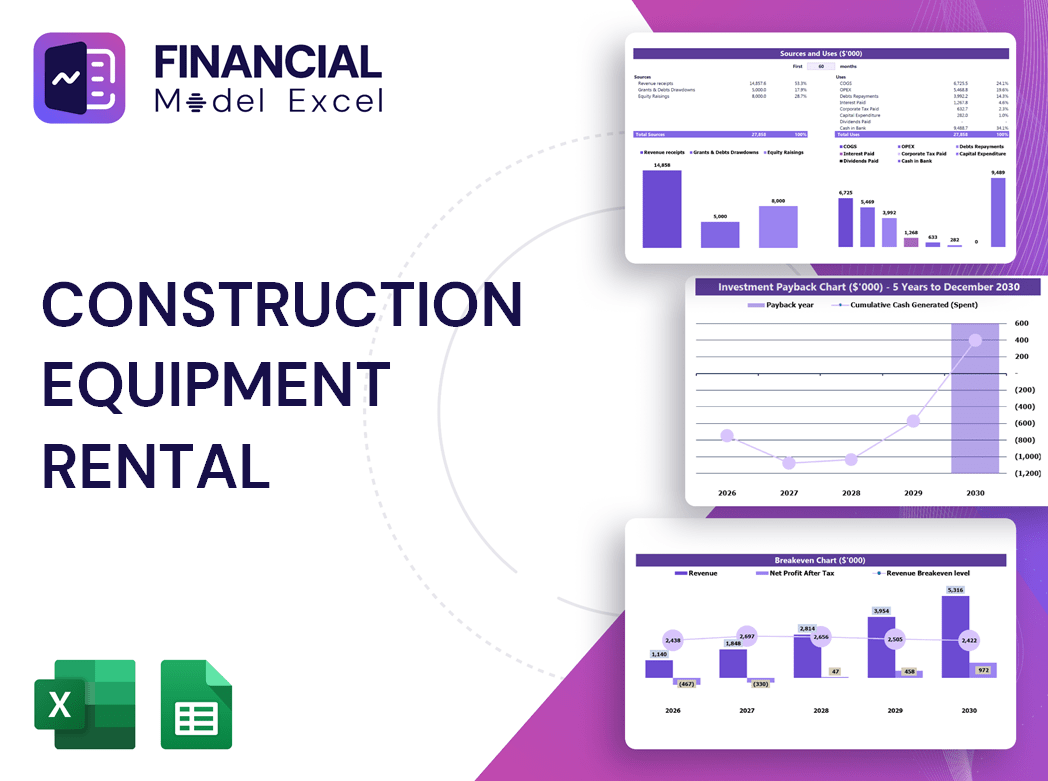

Dashboard

Our construction equipment rental financial projection dashboard is a powerful tool for in-depth financial modeling and analysis. Featuring intuitive charts and graphs, it delivers precise insights into your rental equipment income statement model, cash flow analysis, and expense breakdown. Tailored for startups and established companies alike, this dashboard supports construction equipment rental business forecasts, ROI calculations, and break-even analysis. By providing comprehensive visibility into capital requirements and cost structure, it empowers stakeholders to make informed decisions and develop robust financial plans, ensuring the long-term financial viability of your equipment rental company.

Business Financial Statements

This construction equipment rental startup financial plan offers a comprehensive, pre-built Excel template featuring a forecast income statement, projected balance sheet, and cash flow analysis. Designed for easy customization, it supports monthly or annual views and seamlessly integrates with QuickBooks, Xero, FreshBooks, and other accounting tools. Perfect for financial modeling, budgeting, and expense breakdowns, this template empowers you to develop a detailed equipment rental business forecast, capital requirements assessment, and profit and loss projection—ensuring a robust financial viability study and strategic planning for your construction equipment rental venture.

Sources And Uses Statement

Companies prioritize sources and uses of cash statements, as they clearly outline funding origins and cash flow directions essential for strategic planning. In construction equipment rental financial projections, integrating these statements enhances the financial plan’s accuracy, supporting robust cash flow analysis and capital requirement assessments. This approach strengthens the equipment rental business forecast and aids in effective financial modeling for construction equipment leasing, ensuring sound budget templates, expense breakdowns, and ROI calculations. Ultimately, leveraging sources and uses of cash statements drives informed decision-making and improves the financial viability of construction equipment rental startups and established companies alike.

Break Even Point In Sales Dollars

Our 5-year construction equipment rental financial projection includes a detailed break-even analysis, essential for determining the optimal pricing strategy. This financial modeling tool enables startups and established companies to identify the precise revenue point needed to cover all costs, ensuring profitability. Incorporating this analysis into your financial plan for equipment rental company enhances budgeting accuracy and supports informed decision-making for pricing, capital requirements, and cash flow management. Leverage this equipment rental break-even analysis to drive sustainable growth and maximize ROI in the competitive construction machinery rental market.

Top Revenue

The Top Revenue tab in a construction equipment rental startup financial plan offers a comprehensive overview of your service revenues. This essential tool delivers an annual breakdown, highlighting key metrics such as revenue depth and revenue bridge. Integrating this data into your financial modeling for construction equipment leasing ensures accurate forecasting and informed decision-making. Use this model to enhance your equipment rental business forecast, optimize cash flow analysis, and strengthen your financial plan for equipment rental company success.

Business Top Expenses Spreadsheet

In the Top Expenses section of our construction equipment rental startup financial plan template, you can efficiently categorize major costs into four key areas. Our comprehensive financial modeling for construction equipment leasing also includes an ‘Other’ category, fully customizable to fit your unique expense breakdown. Easily input historical data or project forward with a detailed five-year construction equipment rental business forecast. This flexible budget template empowers your equipment rental cash flow analysis and enhances accuracy in your profit and loss projection, ensuring a robust financial plan for your equipment rental company’s sustainable growth.

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

An Excel financial model is an essential tool for construction equipment rental startups, enabling precise financial planning and cost projections. By utilizing budget templates and expense breakdowns, companies can optimize resource allocation and enhance their rental equipment cash flow analysis. This model supports comprehensive financial forecasting, including profit and loss projections, ROI calculations, and break-even analysis, empowering businesses to identify risks early. Such detailed financial scenarios strengthen funding proposals, convincing investors and lenders of the venture’s viability. Ultimately, a robust financial plan for equipment rental companies ensures strategic growth and sustainable profitability.

CAPEX Spending

A comprehensive construction equipment rental startup financial plan hinges on meticulous capital expenditure planning. Utilizing a 3-year financial projection template in Excel, this model captures detailed CAPEX costs within the projected balance sheet over five years. This approach is critical for accurate financial modeling, enabling precise equipment rental cash flow analysis, expense breakdowns, and ROI calculations. By integrating these elements, the financial plan for an equipment rental company ensures robust construction equipment rental business forecast and supports informed decision-making for funding and growth strategies.

Loan Financing Calculator

Our construction equipment rental financial projection template features a built-in loan amortization schedule with advanced formulas, delivering a precise repayment timeline for multiple debts. Each installment transparently delineates principal and interest amounts, customizable by month, quarter, or year. This robust tool supports your equipment rental business forecast, enabling detailed cash flow analysis, expense breakdowns, and ROI calculations. Ideal for startup financial plans and comprehensive financial modeling, it empowers you to manage capital requirements, perform break-even analysis, and develop a sound financial plan for your equipment rental company with confidence and clarity.

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Investment (ROI) is a critical metric within any construction equipment rental financial projection. It quantifies profitability by comparing net investment gains against total investment costs, providing clear insight into the efficiency of your capital allocation. Integrating ROI calculation into your construction equipment rental startup financial plan or equipment rental business forecast enables precise evaluation of cash flow performance and long-term viability. Leveraging this KPI within a comprehensive equipment rental profit and loss projection or financial modeling for construction equipment leasing ensures informed decision-making and optimized return in the competitive rental equipment market.

Cash Flow Forecast Excel

Present a clear snapshot of your construction equipment rental startup financial plan with this streamlined table—ideal for embedding in reports and investor pitches. It highlights essential metrics including cash flow analysis, profit and loss projections, capital requirements, and ROI calculations. Use this construction equipment rental business forecast tool to communicate your financial viability, break-even analysis, and revenue model with confidence. Tailored for contractors aiming to secure funding or track performance, this concise financial overview simplifies complex modeling into actionable insights.

KPI Benchmarks

A benchmarking study is a vital component of a construction equipment rental startup financial plan. It evaluates key performance indicators—such as profit margins, cost structure, and productivity—by comparing them against industry peers. This approach offers critical insights for financial modeling, equipment rental cash flow analysis, and ROI calculation. Leveraging benchmarking allows startups to identify best practices, optimize their expense breakdown, and enhance financial viability. Ultimately, it supports strategic decision-making and strengthens the construction equipment rental business forecast, ensuring a robust financial plan for equipment rental companies aiming for sustainable growth.

P&L Statement Excel

A well-designed rental equipment income statement model is essential for precisely calculating net operating profit margin and overall net profit. Integrating this into your construction equipment rental financial projection provides clear insight into profitability. It supports comprehensive financial modeling for construction equipment leasing by highlighting revenue streams and expense breakdowns, forming the foundation of your construction equipment rental startup financial plan. This approach ensures informed decision-making, optimizing equipment rental profit and loss projections to drive sustainable business growth.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet is essential in any construction equipment rental startup financial plan. It details current and long-term assets, liabilities, and shareholders’ equity, providing a comprehensive snapshot of the company’s financial health. This critical component supports accurate equipment rental cash flow analysis, cost structure evaluation, and ROI calculation. Incorporating a detailed balance sheet projection enhances the financial modeling for construction equipment leasing and strengthens the overall construction equipment rental business forecast, enabling informed decisions on capital requirements and profitability potential.

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive 3-way financial model integrates two robust valuation methodologies—Discounted Cash Flow (DCF) and Weighted Average Cost of Capital (WACC)—to deliver an accurate construction equipment rental business forecast. This approach ensures a precise financial projection, enabling thorough equipment rental cash flow analysis and ROI calculation. Ideal for startups and established companies alike, it supports detailed construction equipment rental expense breakdowns, capital requirements assessment, and equipment rental profit and loss projection. Empower your financial planning and funding strategies with this advanced model, designed for superior financial viability study and strategic decision-making in the equipment rental industry.

Cap Table

A comprehensive financial plan for a construction equipment rental startup must include a detailed cap table model. This essential spreadsheet outlines company share distribution, investor ownership percentages, and investment pricing. Integrated within the 5-year financial projection, the cap table tracks ownership dilution over time, providing clarity for stakeholders. Combining this with equipment rental cash flow analysis and expense breakdowns ensures accurate financial modeling for construction equipment leasing, supporting sound business forecasts and investment decisions.

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL MODEL TEMPLATE EXCEL ADVANTAGES

The financial model enhances team alignment by providing clear projections and informed decision-making for equipment rental startups.

Our financial model ensures accurate construction equipment rental forecasts, enhancing profitability and strategic decision-making confidently.

Show lenders your repayment reliability with our precise construction equipment rental financial projection model.

Financial modeling for construction equipment rentals streamlines collaboration with attorneys and consultants, ensuring informed, confident decisions.

Take control of cash flow and optimize profits with our precise construction equipment rental financial modeling tools.

CONSTRUCTION EQUIPMENT RENTAL FINANCIAL FORECAST TEMPLATE EXCEL ADVANTAGES

Optimize your construction equipment rental budget with precise financial modeling, ensuring controlled spending and maximum profitability.

A construction equipment rental cash flow analysis empowers precise financial forecasting, enhancing budgeting and future profitability decisions.

Our financial model saves you time by streamlining construction equipment rental business forecasts and optimizing cash flow analysis.

Our construction equipment rental financial model saves time on forecasts, boosting focus on growth and customer satisfaction.

Our construction equipment rental financial model ensures accurate forecasts, optimizing growth and maximizing long-term profitability.

A construction equipment rental financial projection empowers strategic growth with accurate cash flow and expense forecasting.

Our financial model ensures precise forecasts and funding clarity, empowering construction equipment rental startups to thrive confidently.

Our construction equipment rental financial model ensures accurate forecasts, boosting investor confidence and strategic decision-making.

The financial model ensures better decision making by accurately projecting construction equipment rental profitability and cash flow.

Optimize decisions confidently using construction equipment rental cash flow scenarios in your financial projection Excel template.