Cooperative Bank Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Cooperative Bank Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Cooperative Bank Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

COOPERATIVE BANK FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year cooperative bank financial projection model includes a detailed cash flow model, balance sheet model, and income statement model, providing a robust cooperative bank budgeting and expense projection model designed to support accurate financial forecasting for cooperative banks. Equipped with scenario analysis and financial sensitivity analysis capabilities, this cooperative bank financial planning model enables in-depth risk assessment and investment analysis, ensuring a thorough cooperative bank profitability model and asset and liability management model. Perfect for securing funding from banks, angels, grants, and VC funds, the editable financial dashboard and core metrics are presented in GAAP/IFRS formats to streamline cooperative bank financial modeling and reporting.

The cooperative bank financial projection model Excel template addresses critical pain points by offering an all-encompassing financial modeling solution tailored specifically for cooperative banks, integrating budgeting, cash flow, and loan portfolio financial models to streamline complex data into actionable insights. This ready-made model facilitates comprehensive financial forecasting cooperative bank operations with synchronized income statements, balance sheets, and cash flow models, enabling precise asset and liability management and risk assessment financial modeling. It simplifies revenue and expense projection, enhances profitability and financial performance model cooperative bank analysis, and supports scenario analysis and financial sensitivity analysis to anticipate market fluctuations. With built-in cooperative bank investment analysis and cost analysis models, users gain transparent visibility into interest income models and expense drivers, empowering informed decision-making and efficient cooperative bank financial planning, all presented in a user-friendly Excel interface with dynamic data visualizations for rapid interpretation of evolving financial health.

Description

This cooperative bank financial projection model offers a comprehensive suite of features tailored to streamline financial modeling for cooperative banks, including a robust budgeting model and detailed financial forecasting cooperative bank functionalities. It incorporates a loan portfolio financial model cooperative bank component to assess credit risk, alongside a cooperative bank cash flow model to ensure optimal liquidity management. Additionally, the risk assessment financial model cooperative bank facilitates thorough scenario analysis cooperative bank financial model exercises, supporting strategic decision-making with precise financial sensitivity analysis cooperative bank tools. Users benefit from integrated cooperative bank cost analysis model and cooperative bank revenue model modules that provide deep insights into profitability and expenditure trends, complemented by asset and liability management model cooperative bank capabilities and a cooperative bank balance sheet model for accurate financial statement modeling. This all-in-one cooperative bank financial planning model also enables investment analysis and projects financial performance, enabling stakeholders to forecast interest income model cooperative bank and evaluate overall cooperative bank profitability model metrics effectively.

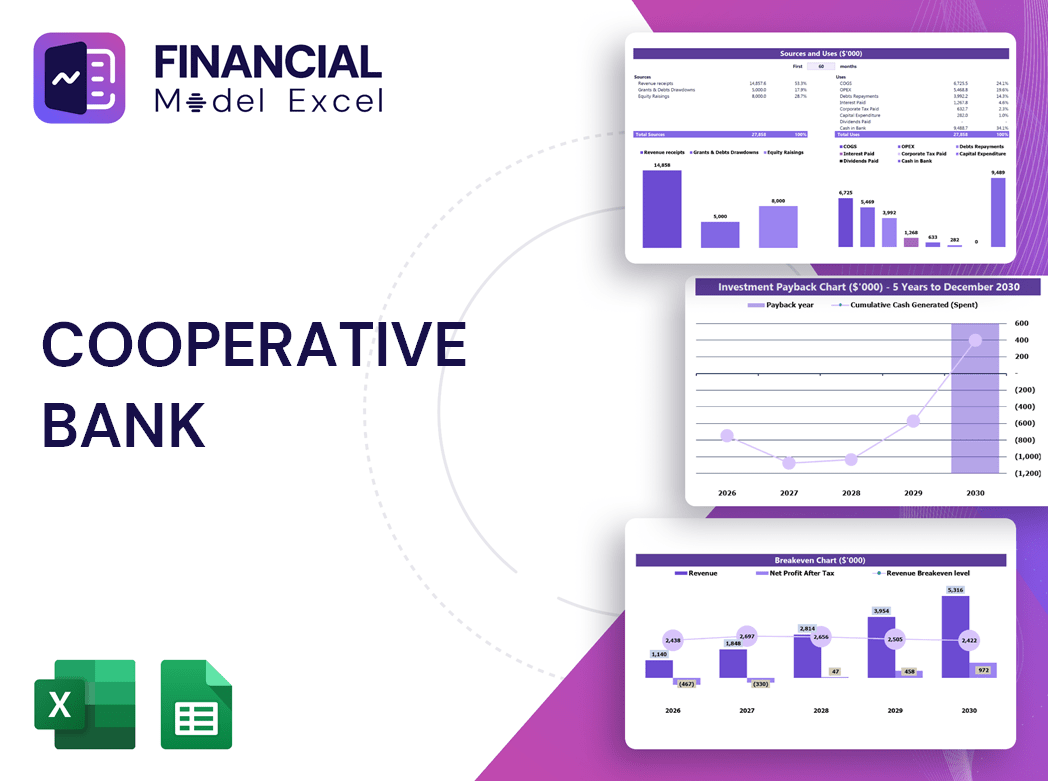

COOPERATIVE BANK FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This comprehensive cooperative bank financial projection model offers a modular approach to financial modeling for cooperative banks. It covers essential components like financial statements, operating costs, revenue projections, and startup valuation multiples. The editable 5-year cash flow and budgeting model allows seamless adjustments to inputs, supporting tailored financial forecasting and scenario analysis. Designed for ease, this cooperative bank financial planning model enables detailed asset and liability management, loan portfolio analysis, and risk assessment, empowering informed decision-making and strategic growth in a dynamic market environment.

Dashboard

Our cooperative bank financial projection model offers an intuitive Excel-based dashboard, providing a comprehensive overview of your bank’s budgeting, cash flow, and revenue models. Easily share detailed financial forecasts, risk assessments, and scenario analyses with stakeholders to enhance transparency and strategic decision-making. Designed for accuracy and clarity, this tool supports effective financial planning, profitability tracking, and asset and liability management, empowering your cooperative bank to optimize performance and drive sustainable growth.

Business Financial Statements

Accurate financial forecasting for cooperative banks relies on intuitive and easy-to-understand models such as the cooperative bank financial projection model and cooperative bank budgeting model. Utilizing comprehensive tools like the loan portfolio financial model and cooperative bank cash flow model ensures clear visualization of future performance. Effective financial modeling for cooperative banks, including scenario analysis and risk assessment models, enhances decision-making by presenting pro forma projections that are both insightful and accessible. Prioritizing clarity in the cooperative bank financial planning model guarantees that stakeholders can confidently interpret and act on the financial statements generated.

Sources And Uses Statement

The cooperative bank financial projection model integrates a sources and uses of funds statement, detailing the bank’s funding origins and strategic allocation. This essential component enhances financial planning by clearly illustrating cash inflows and outflows. Leveraging this within a comprehensive cooperative bank budgeting model supports precise financial forecasting and cash flow management. It empowers cooperative banks to optimize their loan portfolio, perform rigorous risk assessment, and improve overall financial performance. By adopting this model, cooperative banks gain a powerful tool for asset and liability management, profitability analysis, and scenario-based financial sensitivity assessments.

Break Even Point In Sales Dollars

This cooperative bank financial projection model includes a comprehensive break-even analysis tab that forecasts when the institution will shift to profitability. Utilizing advanced financial modeling for cooperative banks, it integrates forecasted revenues and expenses to pinpoint the period when overall income surpasses costs. This cooperative bank budgeting model empowers strategic decision-making by accurately projecting cash flows, revenue, and expenses. With scenario analysis and risk assessment capabilities, the model ensures robust financial planning, enabling cooperative banks to optimize profitability and achieve sustainable growth.

Top Revenue

Our cooperative bank financial projection model enables dynamic scenario analysis, helping you evaluate profitability across various products and services. With advanced financial forecasting and revenue modeling, you can accurately project demand fluctuations—such as weekday versus weekend activity—to optimize resource allocation. This cooperative bank budgeting and cash flow model supports precise operational planning, ensuring agile decision-making. By leveraging our comprehensive financial planning model, including expense projection and loan portfolio analysis, banks can enhance profitability, manage risks effectively, and drive sustainable growth with confidence.

Business Top Expenses Spreadsheet

Effective financial management is crucial for cooperative banks seeking sustainable growth. Utilizing a cooperative bank cost analysis model enables precise monitoring and categorization of expenses, ensuring comprehensive oversight—including an 'other' category for miscellaneous costs. Integrating this with a cooperative bank budgeting model enhances financial forecasting and supports strategic cost control. By mastering expense projection and risk assessment through financial modeling for cooperative banks, institutions can optimize profitability and cash flow. This disciplined approach to financial planning empowers cooperative banks to maximize returns and achieve long-term success with confidence and clarity.

COOPERATIVE BANK FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Initial costs are critical in shaping a cooperative bank’s financial future. Our cooperative bank financial projection model, integrating a comprehensive three-statement framework, highlights these upfront expenses to ensure balanced budgeting and prevent underfunding. This cooperative bank expense projection model, featured in our feasibility study Excel template, delivers precise cost and funding insights. Designed for effective financial planning, it supports cooperative banks in managing expenses, optimizing cash flow, and enhancing profitability. Rely on this financial modeling tool to drive accurate forecasting, risk assessment, and strategic investment decisions tailored to cooperative banks’ unique needs.

CAPEX Spending

A cooperative bank financial projection model includes CAPEX forecasting to guide strategic investments in equipment, technology, or expansion initiatives. This cooperative bank budgeting model classifies such capital expenditures as assets on the projected balance sheet, while depreciation expenses are recognized over time in the financial statement model. Integrating CAPEX forecasts within a cooperative bank cash flow model and loan portfolio financial model ensures accurate financial planning, supporting sustainable growth and profitability. This approach enhances asset and liability management and drives comprehensive financial forecasting for cooperative banks, aligning investment analysis with risk assessment and cost analysis models for optimal financial performance.

Loan Financing Calculator

Start-ups and growing cooperative banks often require loans to expand, making accurate loan portfolio financial models essential. Integrating a detailed repayment schedule within a cooperative bank financial projection model ensures precise tracking of interest income and principal payments. This input enhances the cooperative bank cash flow model, balance sheet model, and expense projection model, providing a holistic view of financial performance. By leveraging financial forecasting and scenario analysis, cooperative banks can monitor impacts on profitability and risk, enabling data-driven strategic decisions and robust financial planning for sustainable growth.

COOPERATIVE BANK FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Gross Profit Margin (GPM) is a key metric in cooperative bank financial planning models, representing operating profitability by dividing gross profit by net sales. This measure provides critical insight into a cooperative bank’s revenue efficiency and cost management. Integrating GPM into financial forecasting and cooperative bank profitability models enables precise assessment of financial performance, enhancing decision-making in budgeting, cash flow, and risk assessment. Utilizing a comprehensive cooperative bank financial projection model ensures accurate scenario analysis and strengthens overall financial health.

Cash Flow Forecast Excel

A cooperative bank cash flow model offers a detailed projection of cash movements across operating, investing, and financing activities. This financial forecasting cooperative bank tool highlights cash inflows and outflows over a specific period, providing clarity and precision in budgeting and planning. By integrating with cooperative bank financial projection models, it supports effective cash management, enhances risk assessment, and drives informed decision-making to optimize financial performance and profitability.

KPI Benchmarks

The cooperative bank financial projection model’s benchmark tab evaluates key performance indicators—both financial and operational—against industry averages. Utilizing these benchmarks enhances financial forecasting for cooperative banks by identifying best practices and highlighting performance gaps. This cooperative bank financial planning model serves as a crucial strategic tool, enabling banks to optimize budgeting, cost analysis, and profitability. By leveraging benchmarking, cooperative banks can refine their revenue models, improve asset and liability management, and strengthen risk assessment—all essential for sustainable growth and financial resilience.

P&L Statement Excel

The cooperative bank financial projection model is an essential tool for comprehensive financial planning. By leveraging this model, institutions can enhance profitability through accurate revenue forecasting, expense projection, and risk assessment. It supports effective budgeting, cash flow management, and loan portfolio analysis, enabling informed decision-making. Utilizing scenario analysis and sensitivity assessment, cooperative banks can optimize their asset and liability management while improving overall financial performance. This financial modeling for cooperative banks ensures sustainable growth and long-term success by providing clear insights into all critical financial indicators.

Pro Forma Balance Sheet Template Excel

Our cooperative bank balance sheet model offers a precise snapshot of assets, liabilities, and equity, essential for robust financial planning. Integrated with our cooperative bank cash flow model and expense projection features, it empowers financial forecasting and scenario analysis. This comprehensive financial statement model facilitates effective budgeting and asset-liability management, enhancing risk assessment and profitability insights. Streamline your cooperative bank’s financial modeling with our dynamic excel templates, designed for accurate financial performance tracking and strategic decision-making.

COOPERATIVE BANK FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The cooperative bank financial projection model integrates key tools such as Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC offers a critical risk assessment financial model for cooperative banks by analyzing the weighted cost of equity and debt. Meanwhile, the DCF method underpins the cooperative bank investment analysis model, accurately valuing future cash flows to guide strategic decisions. Together, these models enhance financial forecasting and support robust cooperative bank budgeting and profitability planning.

Cap Table

The cooperative bank financial projection model is a vital tool for strategic planning, offering clear insights into ownership structure and equity distribution. This comprehensive model includes key components such as cooperative bank revenue, expense projection, and loan portfolio financial models, enabling accurate financial forecasting and budgeting. By integrating risk assessment and asset and liability management models, it ensures robust financial performance analysis. Utilizing scenario and sensitivity analysis within this framework empowers cooperative banks to optimize profitability, streamline cash flow, and enhance investment strategies, ultimately driving sustainable growth and financial stability.

COOPERATIVE BANK FINANCIAL MODELLING EXCEL TEMPLATE ADVANTAGES

Avoid cash flow shortfalls with the cooperative bank financial model, optimizing budgeting and forecasting for sustained profitability.

The cooperative bank financial projection model empowers strategic decisions by forecasting outcomes and optimizing future financial performance.

The cooperative bank financial projection model ensures accurate budgeting and enhances strategic decision-making for sustained profitability.

The cooperative bank cash flow model clearly tracks incoming and outgoing funds, enhancing precision in financial management.

Enhance decision-making by reassessing assumptions using the cooperative bank financial projection model for accurate profit-loss insights.

COOPERATIVE BANK BUSINESS FORECAST TEMPLATE ADVANTAGES

Enhance accuracy and efficiency with our cooperative bank financial projection model’s convenient all-in-one dashboard.

Our cooperative bank financial projection model ensures accurate forecasts with comprehensive reports, dynamic KPIs, and insightful performance reviews.

The cooperative bank financial projection model enables accurate forecasting, improving strategic decision-making and maximizing profitability.

Streamline cooperative bank financial planning with our clear, color-coded model, enhancing accuracy and strategic forecasting.

Boost cooperative bank growth with accurate financial forecasting and dynamic scenario analysis for confident decision-making.

The cooperative bank cash flow model reveals optimal growth options by forecasting cash impacts and exploring diverse funding scenarios.

The cooperative bank financial projection model delivers accurate forecasts and insightful reports for effective financial planning and growth.

Our cooperative bank financial projection model streamlines reporting by delivering lender-ready, fully compliant financial statements instantly.

Gain confidence in the future with our cooperative bank financial projection model, ensuring accurate budgeting and profitability insights.

Our cooperative bank financial projection model enables precise cash flow management, risk prevention, and five-year strategic forecasting.