Craft Beer Brewing Lessons Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Craft Beer Brewing Lessons Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Craft Beer Brewing Lessons Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CRAFT BEER BREWING LESSONS FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year craft beer business plan financial model offers an in-depth brewery profitability model, incorporating startup cash flow statements, expense breakdowns, and revenue projections to help you thoroughly evaluate your brewing startup financial forecast. Equipped with a craft beer market analysis financials dashboard and core metrics formatted in GAAP/IFRS, this editable template enables precise craft brewery break-even analysis, beer production cost analysis, and craft beer pricing strategy modeling. Additionally, it supports brewery funding financial projections and microbrewery financial planning, making it an essential tool for developing a detailed craft beer startup investment plan and optimizing your beer brewing operational budget.

This ready-made craft beer business plan financial model in Excel addresses key pain points by offering a comprehensive brewing startup financial forecast that eliminates the complexity of manual calculations, ensuring accuracy and time efficiency. It integrates craft brewery revenue projections and beer production cost analysis to provide clear visibility into profitability through its brewery profitability model and beer brewing profit margin model. The template features a craft beer pricing strategy model and craft beer sales forecasting, enabling precise market-driven decision-making, while the craft brewery expense breakdown and beer brewing operational budget streamline expense management. With a built-in brewery funding financial projections tool and craft beer startup investment plan, users can confidently plan capital requirements, supported by a robust craft beer distribution financial model and beer production capacity planning to optimize resources. The automated beer brewing cash flow model paired with craft brewery break-even analysis ensures effective cash management and financial sustainability over a 5-year horizon, simplified through automatic aggregation of monthly and annual financial summaries into a comprehensive financial summary report.

Description

Our comprehensive craft beer business plan financial model provides an integrated 60-month brewing startup financial forecast incorporating craft brewery revenue projections, beer production cost analysis, and brewing equipment investment model to deliver precise craft brewery break-even analysis and brewery profitability modeling. Designed for both startups and established microbreweries, this craft beer sales forecasting tool includes a detailed craft brewery expense breakdown, beer brewing operational budget, and cash flow model that facilitates informed decision-making for initial capital investments and working capital requirements. With features such as craft beer pricing strategy model, brewery funding financial projections, and craft beer distribution financial model, users can simulate various scenarios, optimize beer production capacity planning, and achieve a sustainable beer brewing profit margin model. The flexible brewery financial statement template and KPIs charts enable seamless negotiation with investors and efficient financial planning without requiring advanced financial expertise.

CRAFT BEER BREWING LESSONS FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive craft beer business plan financial model includes three key financial statements: the income statement, cash flow statement, and balance sheet. Brewing startups often develop a 5-year brewing startup financial forecast to capture changes in their beer brewing cash flow model and brewery profitability model. Regardless of business size, creating an accurate craft brewery financial planning projection annually ensures effective resource allocation and validates the impact of strategic decisions. This approach supports precise microbrewery financial planning, enhancing craft brewery break-even analysis and optimizing beer production cost analysis for sustained growth.

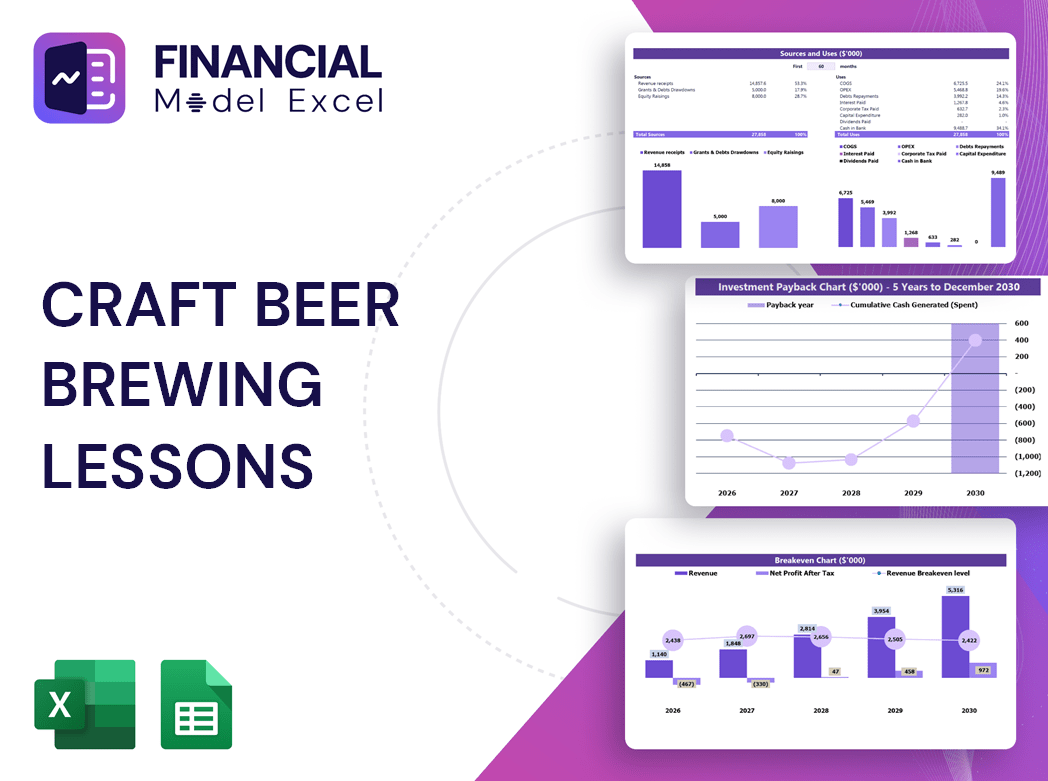

Dashboard

The 5-year craft beer business plan financial model features an intuitive dashboard presenting key brewery financial statements from startup inception onward. It visualizes essential metrics like cash flow pro forma, income and expenditure templates, and annual revenue breakdowns through dynamic charts and graphs. This comprehensive brewery financial planning tool enables detailed craft brewery expense breakdowns, beer production cost analysis, and brewery profitability modeling—empowering microbrewery owners to forecast sales, optimize pricing strategies, and track operational budgets with clarity and precision.

Business Financial Statements

A comprehensive craft beer business plan relies heavily on detailed financial modeling to ensure success. Incorporating key elements from historical and projected brewery financial statements into dynamic charts enhances clarity and investor appeal. Our Excel-based brewing startup financial forecast template features automated craft beer sales forecasting, brewery profitability models, and beer production cost analysis. These visually engaging financial charts simplify complex data, supporting microbrewery financial planning, craft beer pricing strategy models, and brewery funding projections. Empower your craft brewery with precise beer brewing cash flow models and expense breakdowns, making your investment plan and break-even analysis compelling and data-driven for investors.

Sources And Uses Statement

The sources and uses of funds statement within this craft beer business plan financial model provides a comprehensive overview of the brewery’s funding origins and allocation of capital. Designed to support microbrewery financial planning and brewery funding financial projections, it ensures transparent tracking of investment inflows and operational expenditures. This detailed expense breakdown aligns with beer brewing operational budgets and supports informed decisions for brewing startup financial forecasts, enhancing accuracy in craft brewery break-even analysis and profitability modeling.

Break Even Point In Sales Dollars

Break-even analysis is essential for craft breweries to identify the point where total revenue equals all production and operational costs, signaling neither profit nor loss. Utilizing tools like CVP charts in Excel enables precise evaluation of fixed and variable costs against revenue projections. Breweries with lower fixed costs typically demonstrate more flexible cost-volume-profit relationships, aiding in effective brewery financial planning and profitability modeling. Integrating break-even analysis within a comprehensive craft beer business plan and financial model ensures informed decision-making for startup investment, production capacity planning, and optimizing beer brewing profit margins.

Top Revenue

In craft brewery financial planning, the topline—representing revenue or gross sales—is a critical metric in your craft beer business plan financial model. Investors focus on topline growth, as it drives profitability and strengthens brewery funding financial projections. Monitoring quarterly and annual trends in craft brewery revenue projections and beer brewing profit margin models ensures informed decision-making. Effective beer production cost analysis and craft beer pricing strategy models further enhance brewery profitability models, empowering startups to optimize cash flow and achieve sustainable growth in the competitive craft beer market.

Business Top Expenses Spreadsheet

The Top Revenue tab in the craft beer business plan financial model offers a streamlined view of your brewery’s product revenue streams. It provides a clear, annual breakdown of craft brewery revenue projections, highlighting revenue depth and the revenue bridge. This essential feature supports microbrewery financial planning by delivering concise insights into sales forecasting and profitability models, enabling informed decisions on pricing strategies and operational budgets. Perfect for brewing startups, this tool enhances your brewery funding financial projections with transparent, organized data tailored to maximize your craft beer venture’s financial success.

CRAFT BEER BREWING LESSONS FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Initial costs are crucial in launching a successful craft brewery, making a comprehensive craft beer startup investment plan and brewery financial planning essential. Our craft beer brewing lessons financial model, featuring a detailed P&L template in Excel, captures these foundational expenses to ensure balanced spending. By integrating brewery funding financial projections and expense breakdowns, the model helps prevent underfunding and financial losses. This three-statement financial model streamlines cost management and supports strategic decision-making for sustainable growth and profitability in your brewing startup.

CAPEX Spending

The CAPEX plan is essential for crafting a comprehensive brewing startup financial forecast. It accurately outlines initial startup costs and capital expenditures, supporting detailed beer production cost analysis and craft beer market analysis financials. Integrated with profit and loss statement templates, it highlights capital investments and incoming funds critical for brewery funding financial projections. This approach ensures precise microbrewery financial planning, enabling robust brewery profitability models and informed craft beer startup investment plans, ultimately driving smarter decisions in craft beer business plan financial models.

Loan Financing Calculator

Our comprehensive brewery financial planning includes an advanced loan amortization schedule embedded in the craft beer business plan financial model. This sophisticated tool provides detailed repayment breakdowns—highlighting principal versus interest—across monthly, quarterly, or annual instalments. Designed to seamlessly integrate with your brewing startup financial forecast, it empowers precise cash flow management and supports informed decisions on brewing equipment investment and brewery funding financial projections.

CRAFT BEER BREWING LESSONS FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Customer acquisition cost is a vital metric in any brewing startup financial forecast. Accurately incorporating this cost into your craft beer business plan financial model ensures realistic craft brewery revenue projections and profitability analysis. It’s calculated by dividing total marketing expenses by the number of new customers acquired within the year. Integrating this metric within your beer brewing cash flow model and craft beer pricing strategy model enables more precise brewery funding financial projections and enhances overall microbrewery financial planning. Understanding customer acquisition cost is essential for optimizing your craft brewery expense breakdown and driving sustainable growth.

Cash Flow Forecast Excel

The Cash Flow statement is a vital component of any craft beer business plan financial model, reflecting your brewing startup’s ability to generate cash. This beer brewing cash flow model tracks inflows and outflows, providing clear insights into your craft brewery’s liquidity. Key inputs—such as receivable and payable days, working capital, long-term debt, and net cash—drive accurate cash flow projections. Ideal for microbrewery financial planning, this Excel template supports effective cash management and helps ensure your brewery’s profitability model and funding financial projections stay on target.

KPI Benchmarks

Benchmarking is a crucial element in a craft beer business plan financial model, enabling breweries to evaluate key metrics like profit margins, cost per unit, and productivity. By comparing these indicators against industry peers, craft breweries gain valuable insights into their operational efficiency and profitability. Whether for a brewing startup financial forecast or an established microbrewery’s cash flow model, benchmarking guides strategic decisions. This financial planning tool helps optimize beer production cost analysis, refine pricing strategy models, and improve brewery break-even analysis, ultimately driving sustainable growth and competitive advantage in the craft beer market.

P&L Statement Excel

Accurate financial planning is essential for any craft brewery’s success. Our brewery financial statement template streamlines the complex process of calculating monthly profit and loss, empowering you with clear insights into actual and projected revenues. Designed to support your craft beer business plan financial model and brewing startup financial forecast, this tool simplifies cash flow management, expense breakdowns, and profitability analysis—helping you optimize your craft brewery’s financial health with confidence and precision.

Pro Forma Balance Sheet Template Excel

A craft beer business plan’s pro forma balance sheet details the startup’s assets and liabilities at a specific point, highlighting net worth divided between equity and borrowed funds. Complementing this, the brewing startup financial forecast—including profit and loss projections—tracks operational performance over time. Using a comprehensive craft brewery financial model, businesses gain insights into liquidity, solvency, and turnover ratios essential for informed decision-making. This foundation supports brewery funding financial projections, beer production cost analysis, and brewery profitability models, ensuring strategic financial planning and sustainable growth within the competitive craft beer market.

CRAFT BEER BREWING LESSONS FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our craft beer business plan financial model features two robust valuation methods: discounted cash flow (DCF) and weighted average cost of capital (WACC). This integrated approach provides precise brewery financial planning by forecasting cash flows and assessing capital costs, enabling brewing startups to make informed decisions. Ideal for microbrewery financial planning and craft brewery break-even analysis, this model supports comprehensive beer production cost analysis and brewery profitability assessments, empowering entrepreneurs to strategically drive growth and secure funding.

Cap Table

The Equity Cap Table in the craft beer business plan’s financial model provides a clear snapshot of all financial instruments involved in funding. It tracks the flow of investments and equity stakes, offering critical insights into how strategic decisions impact profitability. This essential tool supports informed microbrewery financial planning by illustrating ownership distributions and potential returns, ensuring transparency for stakeholders. Integrating the cap table with brewery profitability models and cash flow forecasts strengthens your brewing startup financial forecast, enhancing investor confidence and guiding sustainable growth in the competitive craft beer market.

CRAFT BEER BREWING LESSONS PRO FORMA INCOME STATEMENT TEMPLATE EXCEL ADVANTAGES

The craft beer financial model empowers startups to optimize profits through precise revenue projections and cost analysis.

Accurately estimate upcoming craft beer brewing lesson expenses with our precise financial model for smarter planning.

The financial model empowers craft breweries to accurately forecast revenues, optimize expenses, and maximize profitability.

The 5-year financial model enhances strategic planning, maximizing craft brewery profitability and investment confidence.

The craft beer financial model empowers precise forecasting, optimizing profitability and guiding strategic brewery investments confidently.

CRAFT BEER BREWING LESSONS 5 YEAR PROJECTION PLAN ADVANTAGES

Our integrated financial model optimizes craft brewery profitability, attracting investors with precise revenue and cost forecasts.

Our craft beer financial model integrates all data, delivering clear, investor-ready insights that boost brewery funding success.

Optimize your craft brewery’s success with our dynamic financial model—update anytime for precise, real-time business insights.

Easily refine your craft brewery financial model by adjusting inputs to optimize forecasts from launch through growth phases.

Our craft beer financial model ensures precise revenue projections, avoiding cash flow problems for sustainable brewery growth.

The beer brewing cash flow model enables proactive cash management, ensuring timely decisions and sustainable business growth.

Our craft brewery financial model simplifies complex data, empowering confident, profitable business decisions with precision and ease.

Streamline your craft beer financial planning with our ready-to-use model—no formulas, coding, or costly consultants needed.

Our craft brewery financial model simplifies forecasting, driving smarter investment and maximizing profitability with practical insights.

Optimize your craft brewery's profitability with our simple yet sophisticated financial model and pro forma templates.