Credit Card Processing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Credit Card Processing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Credit Card Processing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CREDIT CARD PROCESSING FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year credit card processing business plan model serves as a robust financial projection for credit card processing startups, incorporating detailed credit card transaction cost analysis, credit card fee structure modeling, and payment processing financial analysis. Designed for entrepreneurs and fundraising efforts, it features key financial charts, revenue forecasts, credit card processing profit margins, and credit card processing cash flow model components, providing an invaluable credit card merchant services model overview. The template supports financial modeling for payment gateways and merchant acquiring, enabling users to review credit card processing income statements, credit card merchant account financials, and payment processor expense models with ease. Before purchasing, consider leveraging this editable credit card processing financial model budget template to ensure a thorough credit card transaction volume forecast and credit card service fee projections tailored to your business needs.

This ready-made financial model for credit card payment processing addresses critical pain points by offering a comprehensive credit card processing budget template that allows users to easily customize credit card fee structure modeling, adjust payment processor expense models, and forecast credit card transaction volume for up to five years. By integrating credit card processing income statement projections with detailed credit card transaction cost analysis, the model provides clarity on credit card processing profit margins and cash flow dynamics, enabling users to confidently evaluate project feasibility and optimize their credit card merchant services model. Its flexible design supports financial modeling for payment gateways and merchant acquiring, empowering businesses to perform robust credit card service fee projections and revenue forecasts without the ambiguity typically associated with complex financial model setups.

Description

The credit card processing financial model incorporates a comprehensive credit card payment processing model alongside detailed credit card transaction cost analysis and fee structure modeling to provide an accurate credit card processing revenue forecast and payment processing financial analysis. This financial model for payment gateway businesses integrates a pro forma income statement, balance sheet template, and cash flow proforma to deliver a robust credit card processing income statement, highlighting critical metrics such as free cash flows, internal rate of return, and break-even points. By leveraging credit card merchant services model elements, the model facilitates precise financial projection for credit card processing, including credit card service fee projections, credit card processing profit margins, and credit card transaction volume forecast, while also accounting for payment processor expense model considerations and working capital requirements. Designed to aid in financial modeling for merchant acquiring and create a reliable credit card processing business plan model, this tool simplifies monthly sales and expense forecasting and supports strategic financial decision-making for optimizing credit card merchant account financials and ensuring sustainable cash flow through effective credit card processing cash flow modeling.

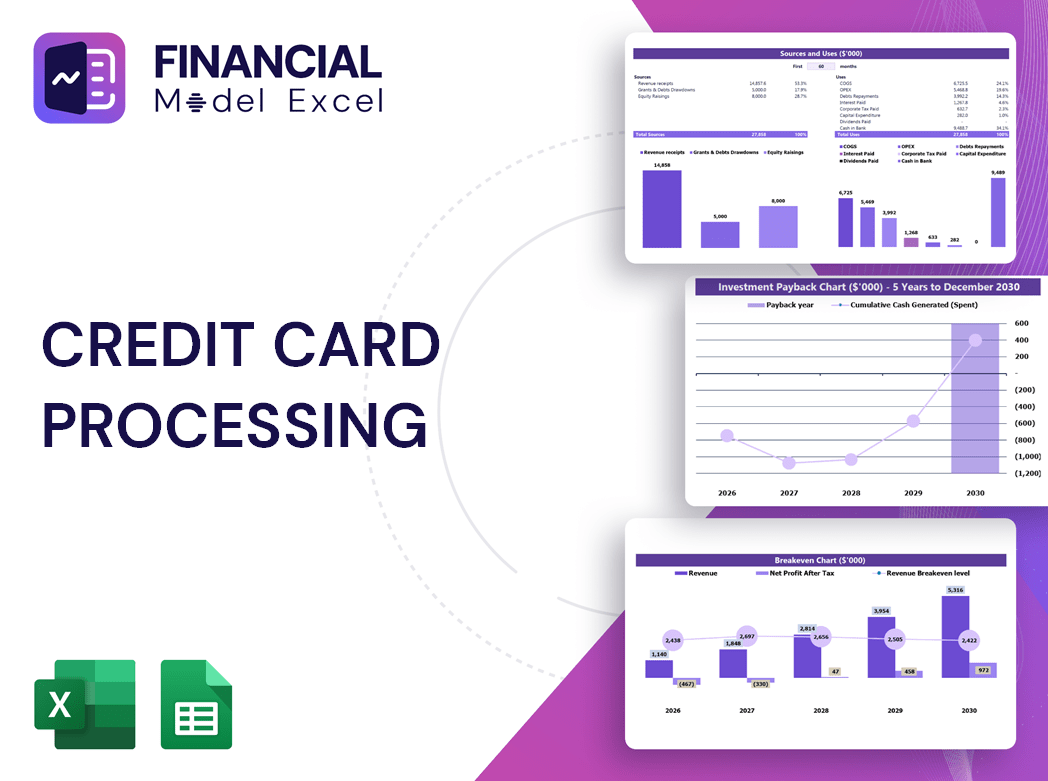

CREDIT CARD PROCESSING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Looking to validate your credit card merchant services model or secure funding? Our comprehensive financial model for payment gateways offers a user-friendly, customizable Excel template to build detailed credit card processing revenue forecasts, cost analyses, and cash flow models. Designed for both experts and beginners, it enables you to project sales, expenses, and funding over five years—monthly or yearly. Simply input your assumptions, and the template generates accurate credit card payment processing financial statements and feasibility studies instantly, empowering your credit card processing business plan with reliable financial insights.

Dashboard

Looking for a comprehensive view of your credit card processing business at a glance? Our all-in-one financial model Excel offers an intuitive dashboard featuring key metrics, including credit card processing revenue forecasts, transaction volume analysis, profit margins, and cash flow projections. Track your credit card payment processing model’s core financials, fee structure modeling, and merchant account financials effortlessly. Visualize startup insights, annual revenue breakdowns, and detailed profitability forecasts through clear charts and graphs—empowering strategic decisions with precision and confidence in your payment processing financial analysis.

Business Financial Statements

Our credit card payment processing model features an integrated Excel financial statement structure, including pre-built templates for pro forma balance sheets, income statements, and cash flow forecasts tailored to payment processors. Each credit card processing financial analysis template is precisely defined and interconnected, ensuring seamless data flow across credit card merchant services models and financial projections for credit card processing. This comprehensive financial modeling for payment gateways empowers accurate credit card processing revenue forecasts, expense modeling, and profit margin analysis, providing a robust foundation for budgeting, business planning, and transaction cost analysis in merchant acquiring environments.

Sources And Uses Statement

The financial projection template for credit card payment processing offers a reliable framework to manage cash flows and optimize financial activities. Ideal for both startups and established businesses, it provides clear insights into credit card processing revenue forecasts and transaction cost analysis. This model not only supports strategic growth and enhanced profit margins but also delivers comprehensive credit card processing income statements and fee structure modeling. Armed with this financial modeling for payment processors, business owners can confidently attract investors and drive dynamic market promotion, ensuring sustained financial health and scalability.

Break Even Point In Sales Dollars

Our credit card processing financial model features a dynamic break-even chart template, allowing you to pinpoint the exact transaction volume or revenue needed to cover fixed and variable costs. Once this threshold is surpassed, your payment processing business moves into profitability. This tool is essential for credit card merchant services models, offering clear insights into profit margins and cash flow. Investors rely on this financial projection for credit card processing to assess return timelines and investment viability, making it a vital component of your credit card processing business plan model.

Top Revenue

Our credit card processing financial model offers an advanced revenue forecast and transaction cost analysis to help you evaluate profitability across scenarios. This dynamic credit card payment processing model enables precise financial projection for credit card processing by analyzing revenue streams, fee structures, and transaction volume forecasts. With this tool, you can perform in-depth payment processing financial analysis to optimize operations—adjusting resources based on demand fluctuations like weekdays versus weekends. Ideal for credit card merchant services modeling, it empowers agile decision-making and maximizes profit margins through comprehensive cash flow and expense modeling.

Business Top Expenses Spreadsheet

Accurate financial projection for credit card processing is crucial for sustainable growth. A robust credit card processing revenue forecast hinges on detailed credit card transaction cost analysis and precise credit card fee structure modeling. Utilizing a comprehensive credit card merchant services model and payment processing financial analysis ensures reliable cash flow models and profit margin insights. Financial modeling for payment processors empowers management to devise strategic plans, while proforma templates leverage historical data and growth assumptions to produce dependable forecasts. This disciplined approach supports an effective credit card processing business plan model, driving value and long-term success in the payment gateway ecosystem.

CREDIT CARD PROCESSING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive financial projection template for credit card payment processing models empowers you to accurately estimate costs, analyze credit card transaction fees, and forecast revenue streams. Designed for payment processors and merchant services, this tool offers clear insights into cash flow, profit margins, and expense models. Easily identify risks and opportunities within your credit card processing business plan model, enabling strategic resource allocation. Trusted by investors and creditors alike, this essential financial modeling resource ensures your credit card processing income statements and fee structure projections are both precise and actionable.

CAPEX Spending

Capital expenditures (CAPEX) are a crucial component of any credit card processing business, impacting both the financial projection for credit card processing and the overall credit card processing cash flow model. As one of the most significant capital-intensive expenses, CAPEX serves as a key indicator of operational quality and long-term growth. Analyzing historical CAPEX within the payment processing financial analysis—especially through cash flow forecasts and projected balance sheet models—is essential for accurate credit card processing budget templates and informed decision-making in the credit card merchant services model. Effective CAPEX management drives sustainable profitability and robust financial health.

Loan Financing Calculator

The loan amortization schedule within this financial planning model clearly outlines the company's repayment journey, detailing each periodic installment’s principal and interest components. This comprehensive schedule extends through the entire loan term, providing a transparent view until full repayment is achieved. Ideal for credit card processing financial analysis, it supports accurate credit card transaction cost analysis and enhances credit card processing cash flow modeling by projecting precise payment obligations over time.

CREDIT CARD PROCESSING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBIT, or operating income, reflects a company’s core earning potential from ongoing operations, excluding interest and taxes. In financial modeling for payment processors and credit card merchant services models, EBIT serves as a key metric to assess operational efficiency. By isolating income from regular activities, it provides a clear view of profitability, supporting accurate credit card processing income statements, credit card processing profit margins, and payment processing financial analysis. This focus enables precise financial projections and insightful credit card processing revenue forecasts, essential for strategic planning and budgeting within credit card payment processing models.

Cash Flow Forecast Excel

An Excel template cash flow model provides a clear depiction of cash balance fluctuations throughout a period. It highlights critical inflows and outflows, offering valuable insights for financial modeling for payment processors and developing accurate credit card processing cash flow models. This tool enhances payment processing financial analysis, enabling businesses to optimize credit card processing profit margins and improve credit card service fee projections with precision.

KPI Benchmarks

Our 5-year financial projection template for credit card payment processing models offers industry benchmarks and comprehensive financial analysis. By leveraging credit card processing revenue forecasts and transaction cost analysis, clients gain clear insights into their performance versus top competitors. This enables strategic focus on key areas to optimize credit card processing profit margins and enhance overall financial outcomes. Use this tool to refine your credit card merchant services model and drive sustained growth.

P&L Statement Excel

The profit and loss projection template is a vital component of credit card processing financial analysis. It captures revenue and expense trends, including non-cash items like depreciation, which impact long-term credit card processing profit margins. Unlike the credit card processing cash flow model that tracks actual cash movement, this income statement offers a comprehensive view of financial health. Integrating this within your credit card merchant services model or financial projection for credit card processing enables accurate credit card service fee projections and informed decision-making for sustainable growth.

Pro Forma Balance Sheet Template Excel

The credit card processing business plan model hinges on a comprehensive financial projection for credit card processing, incorporating a detailed credit card transaction cost analysis and fee structure modeling. A pro forma balance sheet provides a snapshot of assets, liabilities, and equity, essential for assessing credit card merchant account financials and liquidity ratios. Coupled with the credit card processing income statement and cash flow model, these elements offer critical insights into profit margins and payment processor expense models, enabling accurate credit card processing revenue forecasts and strategic financial modeling for payment gateways and merchant acquiring.

CREDIT CARD PROCESSING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Net Present Value (NPV) represents the discounted value of all future cash flows from a credit card processing business plan, incorporating both inflows and outflows across the investment's lifespan. Our comprehensive credit card processing financial model integrates critical components such as investment required, equity raised, net income, EBITDA, WACC, and growth rate. Designed for precise credit card payment processing revenue forecast and credit card processing cash flow modeling, this three-statement template empowers payment processors with robust financial projection and credit card transaction cost analysis tools to optimize profit margins and enhance overall merchant services performance.

Cap Table

Our comprehensive financial model for payment processors offers a clear view of your company’s credit card merchant account financials. It details equity shares, preferred shares, options, and key credit card fee structure modeling elements, providing precise insights into ownership percentages and capital deployment. This robust credit card processing business plan model supports accurate payment processing financial analysis and credit card processing income statements, empowering stakeholders to optimize credit card processing profit margins and forecast transaction volumes confidently.

CREDIT CARD PROCESSING FINANCIAL MODEL FOR STARTUP ADVANTAGES

Gain precise control and optimize profits with a comprehensive credit card processing financial model and projections spreadsheet.

Show investor confidence with a precise credit card processing financial model Excel template for transparent, reliable insights.

Unlock strategic growth and profitability with our comprehensive credit card processing financial model for startups.

Leverage our financial model for payment processors to accurately forecast growth and optimize credit card processing profit margins.

Optimize growth and profitability by forecasting all three financial statements with our credit card processing financial model.

CREDIT CARD PROCESSING FINANCIAL PROJECTION MODEL EXCEL ADVANTAGES

Our credit card processing cash flow model identifies cash gaps and surpluses proactively, enhancing your financial stability.

A credit card processing cash flow model enables proactive financial planning to prevent deficits and maximize growth opportunities.

Our financial model for payment processors delivers precise profit margin forecasts, empowering investors to make confident decisions.

Our financial model delivers precise credit card processing forecasts with comprehensive income statements and cash flow analyses.

This financial model empowers startups to optimize credit card processing profit margins through precise transaction cost analysis.

The financial model for payment gateway delivers clear, insightful projections that enhance investor confidence and strategic planning.

Our financial model for payment processors delivers accurate forecasts, optimizing credit card processing profit margins effectively.

The financial model enables dynamic credit card processing forecasts, optimizing profitability and strategic planning throughout your business lifecycle.

Our financial model for payment processors delivers accurate forecasts, optimizing credit card processing profit margins effectively.

Easily refine your credit card processing financial model to optimize 5-year cash flow projections and boost business growth.