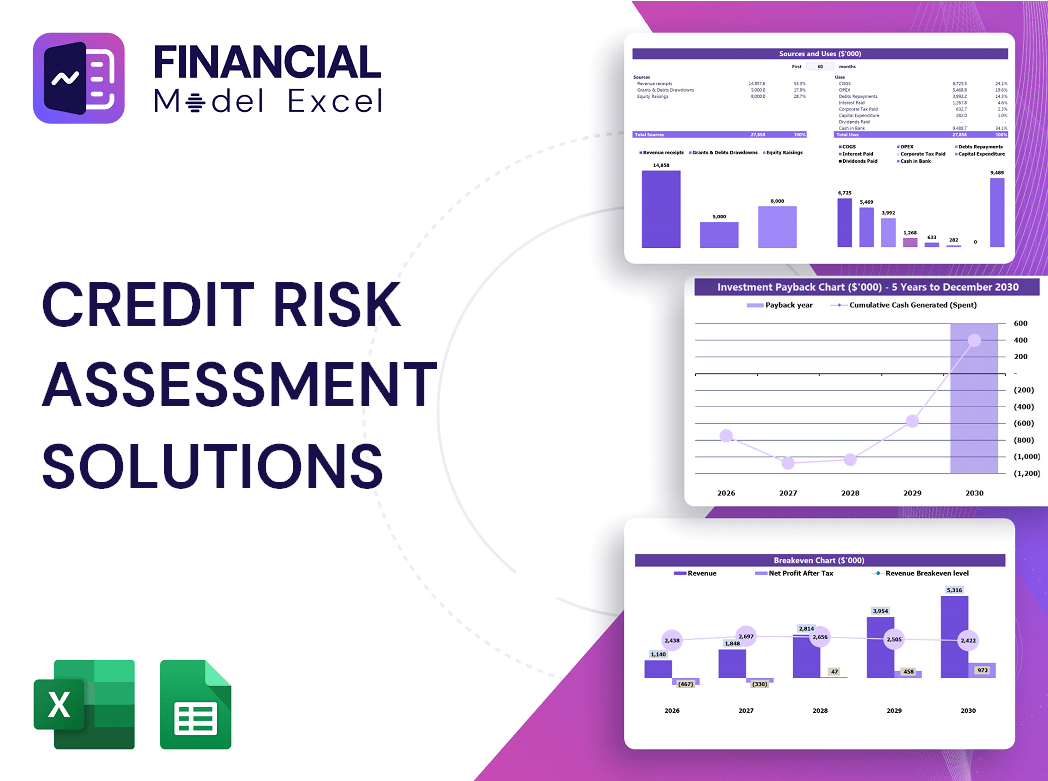

Credit Risk Assessment Solutions Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Credit Risk Assessment Solutions Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Credit Risk Assessment Solutions Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CREDIT RISK ASSESSMENT SOLUTIONS FINANCIAL MODEL FOR STARTUP INFO

Highlights

A comprehensive credit risk assessment solution financial model, including an Excel template for startups or established companies, is essential for effective financial modeling for creditworthiness and credit risk monitoring solutions. This model enables users to implement quantitative credit risk models and predictive credit risk models to evaluate funding requirements, perform cash flow projections, and develop detailed budgets for future years. By integrating financial risk assessment frameworks and credit risk forecasting financial models, businesses can enhance their business plans, conduct profit and loss projections, and apply credit risk mitigation strategies models to secure funding from investors, banks, angels, grants, and VC funds. This unlocked financial credit analysis model allows full customization to support credit scoring system financial models, financial default risk modeling, and comprehensive credit portfolio risk assessment.

This ready-made financial model in Excel template acts as a comprehensive credit risk evaluation tool, addressing critical pain points such as the complexity and time consumption of building financial credit analysis models from scratch. It integrates advanced financial risk modeling techniques and predictive credit risk models to deliver accurate credit risk forecasting, default risk modeling, and quantitative credit risk models, ensuring robust credit scoring system financial model functionality. By automating monthly and annual summaries, it enhances credit risk monitoring solutions and supports precise credit portfolio risk assessment, enabling users to implement effective credit risk mitigation strategies models. Additionally, its built-in risk assessment metrics in finance and financial risk management models streamline financial modeling for creditworthiness, yielding actionable insights for decision-makers and reducing errors in financial model for loan risk and debt risk evaluations.

Description

This credit risk assessment solutions financial model incorporates advanced credit risk prediction models and financial credit analysis models to provide a comprehensive framework for evaluating creditworthiness and default risk. Built with robust risk assessment metrics in finance and credit scoring system financial models, it allows users to leverage financial risk modeling techniques to forecast loan risk and debt risk accurately. The model facilitates credit portfolio risk assessment and employs quantitative credit risk models alongside credit risk monitoring solutions to enable efficient financial risk management. Featuring a 5-year forecast, this financial modeling for creditworthiness tool integrates predictive credit risk models and credit risk decision models, delivering automated updates to key performance indicators such as cash flow, break-even points, and profit-loss statements, ensuring informed decision-making and effective credit risk mitigation strategies.

CREDIT RISK ASSESSMENT SOLUTIONS FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Business owners and managers can streamline their credit risk evaluation using advanced financial models that consolidate all assumptions about revenues, expenses, and operations into a single comprehensive framework. Leveraging predictive credit risk models and credit risk analytics tools, this approach offers a complete overview of business performance while enhancing credit risk forecasting and financial risk management. By integrating quantitative credit risk models and financial credit analysis techniques, decision-makers gain actionable insights for effective credit risk mitigation and portfolio risk assessment, ensuring confident, data-driven financial decisions.

Dashboard

A comprehensive dashboard integrating critical risk assessment metrics in finance is essential for effective credit risk evaluation. Our dashboard combines key financial credit analysis models and predictive credit risk models, allowing users to navigate financial statements and input specific timeframes. Leveraging advanced financial risk modeling techniques and credit risk forecasting models, it enables dynamic analysis and strategic decision-making. This powerful financial model for loan risk drives precise credit risk mitigation strategies, empowering your company to optimize credit portfolio risk assessment and enhance overall financial risk management.

Business Financial Statements

A comprehensive financial model incorporates key financial statements essential for credit risk evaluation tools. The Income Statement details revenues and expenses, including non-cash items, aiding predictive credit risk models. The Balance Sheet presents assets, liabilities, and shareholders’ equity, foundational for financial credit analysis models and credit portfolio risk assessment. Meanwhile, the Cash Flow Statement tracks cash inflows and outflows across operational, investing, and financing activities, critical for financial risk management models and credit risk forecasting. Together, these statements empower quantitative credit risk models and credit risk monitoring solutions to deliver accurate financial risk assessment frameworks and mitigation strategies.

Sources And Uses Statement

The source and use of funds statement is essential in financial risk management models, providing a clear overview of capital inflows (sources) and outflows (uses). Ensuring these totals balance is crucial for accuracy in credit risk evaluation tools and financial credit analysis models. This statement plays a vital role in scenarios involving recapitalization, restructuring, or M&A, informing credit risk decision models and credit portfolio risk assessment. By integrating financial modeling for creditworthiness and credit risk forecasting financial models, businesses can enhance risk assessment metrics in finance and implement effective credit risk mitigation strategies.

Break Even Point In Sales Dollars

This financial model leverages advanced credit risk evaluation tools and financial risk modeling techniques to forecast profitability milestones. Featuring a dynamic break-even chart, it utilizes predictive credit risk models and cost-volume-profit (CVP) analysis to identify when projected revenues surpass expenses, signaling a shift to profitability. Designed as a startup pro forma template, this financial risk management model integrates credit risk forecasting and quantitative credit risk models to support strategic financial decisions, enabling precise credit portfolio risk assessment and enhancing overall credit risk mitigation strategies. Ideal for financial modeling for creditworthiness and loan risk evaluation.

Top Revenue

The Top Revenue tab in the 5-year projection template leverages advanced financial credit analysis models to present detailed insights on each of your offerings. Utilizing predictive credit risk models and credit risk forecasting financial models, it delivers an annual breakdown of your revenue streams, highlighting revenue depth and bridge metrics. This powerful financial model for loan risk enhances your financial risk management strategies by integrating risk assessment metrics in finance, enabling precise credit portfolio risk assessment and informed decision-making. Elevate your business plan with robust credit risk analytics tools for comprehensive financial modeling and risk evaluation.

Business Top Expenses Spreadsheet

Our financial model for startups integrates advanced credit risk evaluation tools and risk assessment metrics in finance to optimize major expenses efficiently. By consolidating the top four expense categories and grouping others as “miscellaneous,” users can easily monitor trends, enabling precise financial risk management. Leveraging predictive credit risk models and credit risk forecasting financial models, this approach supports startups and established companies alike in planning and controlling costs. Effective financial modeling for creditworthiness ensures sustained profitability through strategic cost oversight and enhanced credit portfolio risk assessment.

CREDIT RISK ASSESSMENT SOLUTIONS FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our advanced financial model for startups integrates cutting-edge credit risk evaluation tools and financial risk modeling techniques to accurately assess costs, risks, and key financial ratios. Leveraging predictive credit risk models and credit risk analytics tools, it highlights critical areas requiring attention and resource allocation. This robust framework not only identifies potential financial challenges but also supports strategic decision-making with reliable credit risk forecasting and mitigation strategies. Empower your business with our comprehensive financial credit analysis models designed to optimize financial risk management and ensure sustainable growth.

CAPEX Spending

A startup’s CAPEX budget represents strategic investment in business growth—whether manufacturing equipment, office assets, or vehicles. These capital expenses focus on launching new product lines or scaling operations. Rather than immediate profit impact, CAPEX is recorded as an asset in the balance sheet forecast, with depreciation spreading the cost over time. Integrating financial risk modeling techniques and credit risk evaluation tools ensures these investments align with robust credit risk monitoring solutions, optimizing financial risk management models and enhancing predictive credit risk models for sustainable growth.

Loan Financing Calculator

Start-ups and growing companies rely on advanced credit risk evaluation tools and financial models to monitor and manage loan repayment schedules effectively. These schedules provide detailed, line-by-line insights into loan amounts, maturity terms, and interest expenses, which are crucial for accurate cash flow projections. Integrating financial default risk modeling and credit portfolio risk assessment enhances the precision of cash flow forecasts, while principal repayments inform financing activities. Utilizing predictive credit risk models and credit risk monitoring solutions empowers businesses to optimize financial risk management and ensure robust creditworthiness through dynamic financial modeling.

CREDIT RISK ASSESSMENT SOLUTIONS FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Enhance your company’s financial health with advanced credit risk analytics tools and quantitative credit risk models. Our comprehensive financial model integrates credit risk evaluation tools and financial risk modeling techniques to visualize key risk assessment metrics in finance. Utilize predictive credit risk models and financial credit analysis models to monitor loan risk and assess creditworthiness effectively. This dynamic credit risk forecasting financial model presents critical performance indicators through insightful graphs, empowering informed decision-making and robust financial risk management strategies. Elevate your credit portfolio risk assessment and mitigate default risk confidently with our cutting-edge financial risk assessment frameworks.

Cash Flow Forecast Excel

Leverage advanced credit risk evaluation tools and financial modeling techniques to enhance your cash flow analysis. A robust financial model for loan risk integrates predictive credit risk models and credit risk monitoring solutions, enabling precise forecasting and risk assessment metrics in finance. This approach supports effective credit portfolio risk assessment and financial default risk modeling, providing entrepreneurs with reliable, data-driven insights. Streamline decision-making with quantitative credit risk models that optimize profitability and mitigate debt risk. Embrace financial credit analysis models to build resilient strategies and ensure sustainable financial performance with confidence and precision.

KPI Benchmarks

The Benchmarking tab is a vital component of our pro forma template, integrating advanced financial risk assessment frameworks and credit risk analytics tools. It calculates industry benchmarks alongside key risk assessment metrics in finance, enabling precise evaluation of company performance. Leveraging predictive credit risk models and credit portfolio risk assessment, it offers valuable insights into top-performing companies within the sector. This empowers users to identify areas for improvement effectively, enhancing financial credit analysis models and refining credit risk mitigation strategies for stronger overall financial risk management.

P&L Statement Excel

Leverage our advanced credit risk evaluation tools and financial risk modeling techniques to generate precise, forecasted income statements. Our pro forma template integrates predictive credit risk models and financial credit analysis models, empowering you to conduct comprehensive credit risk forecasting and portfolio risk assessment. Equipped with robust risk assessment metrics in finance, you can confidently monitor, evaluate, and mitigate credit risk through data-driven insights. This financial model for loan risk enhances your ability to make informed daily management decisions, ensuring a deep understanding of your company’s financial strengths and vulnerabilities for effective risk management.

Pro Forma Balance Sheet Template Excel

We included a 5-year pro forma balance sheet in Excel to support robust financial modeling for creditworthiness and risk assessment. This essential report outlines current and long-term assets, liabilities, and equity, providing the foundation for applying credit risk evaluation tools and financial risk modeling techniques. By leveraging this data, you can enhance credit scoring systems, perform quantitative credit risk analysis, and implement effective credit risk mitigation strategies. The projected balance sheet enables accurate calculation of risk assessment metrics in finance, empowering informed decision-making with predictive credit risk models and comprehensive financial risk management models.

CREDIT RISK ASSESSMENT SOLUTIONS FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our pro forma Excel template integrates advanced financial modeling techniques, featuring discounted cash flow (DCF) and weighted average cost of capital (WACC) calculations. These tools provide robust financial risk assessment frameworks, enabling precise evaluation of a company’s forecasted performance. Ideal for credit risk evaluation, our model supports financial credit analysis by combining predictive credit risk models and risk assessment metrics in finance, empowering informed decision-making and effective credit risk mitigation strategies.

Cap Table

The Cap Table Model offers comprehensive insights into a company’s financial structure, detailing ownership stakes, share distribution, and capital allocation. By integrating credit risk evaluation tools and financial modeling for creditworthiness, it provides a clear view of equity shares, preferred shares, and options. This essential financial model supports credit risk prediction models and credit portfolio risk assessment, enabling precise financial risk management and credit risk monitoring solutions. Harnessing these frameworks, the Cap Table aids in optimizing credit risk mitigation strategies and enhances overall financial default risk modeling for informed decision-making.

CREDIT RISK ASSESSMENT SOLUTIONS FINANCIAL MODEL TEMPLATE FOR BUSINESS PLAN ADVANTAGES

Financial risk modeling techniques provide accurate credit risk evaluation, enhancing decision-making and mitigating loan default risks efficiently.

Our financial model accelerates accurate credit risk evaluation, enhancing decision-making and boosting portfolio profitability efficiently.

Start a new business confidently with our credit risk assessment financial model, ensuring precise and proactive decision-making.

Optimize lending decisions and prevent losses with advanced credit risk assessment solutions and financial forecast models in Excel.

Plan upcoming cash gaps confidently using Excel-based credit risk assessment financial models for precise risk forecasting.

CREDIT RISK ASSESSMENT SOLUTIONS FEASIBILITY STUDY TEMPLATE EXCEL ADVANTAGES

Enhance accounts receivable management using advanced credit risk evaluation tools for precise financial decision-making.

Leverage predictive credit risk models to accurately forecast late payments and optimize your cash flow management effectively.

Our predictive credit risk models deliver precise, actionable insights for smarter, faster financial risk management decisions.

Our financial model delivers sophisticated credit risk assessment with minimal planning, requiring only basic Excel skills for reliable results.

Financial credit analysis models save time and money by streamlining credit risk evaluation with precise, data-driven insights.

The credit risk forecasting financial model simplifies planning with no formulas, programming, or costly consultants needed.

Our simple-to-use credit risk evaluation tools enhance accuracy and efficiency in financial risk management models.

This financial model delivers quick, reliable credit risk evaluation with minimal planning and basic Excel skills required.

Investors ready: leverage predictive credit risk models to enhance accuracy and optimize financial risk management strategies.

Enhance accuracy and profitability with our comprehensive financial model featuring integrated credit risk evaluation tools and complete reporting.