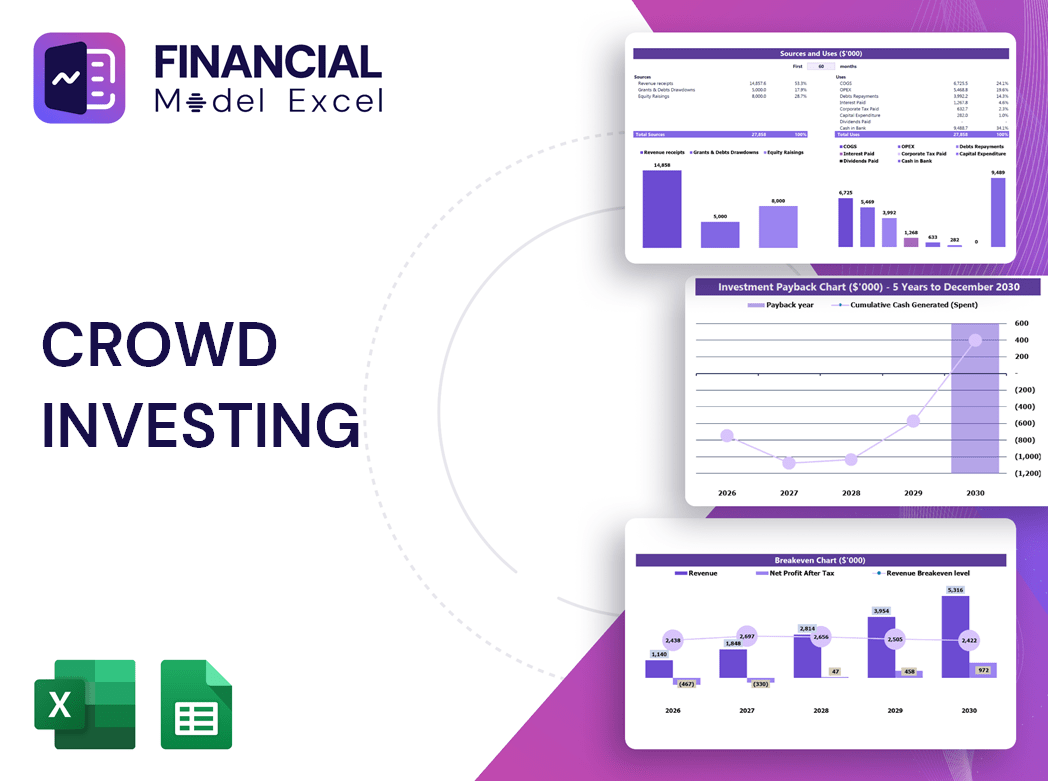

Crowd Investing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Crowd Investing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Crowd Investing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CROWD INVESTING FINANCIAL MODEL FOR STARTUP INFO

Highlights

This highly versatile and user-friendly crowd investing financial modeling tool serves as an essential financial planning model for crowd investing, incorporating a comprehensive financial projection model for crowd investing that includes profit and loss projections, a crowd investing cash flow model, and a detailed balance sheet with monthly and annual timelines. Ideal for startups or existing businesses, this equity crowd investing financial model excel template enables thorough financial analysis and scenario modeling, allowing users to evaluate their startup ideas, plan startup costs, and leverage crowd investing portfolio financial models and financial risk models for crowd investing. Fully unlocked and editable, it seamlessly supports financial dashboard models and crowd investing capital structure modeling to ensure precise investment return forecasting and strategic equity distribution.

The equity crowd investing financial model template addresses common pain points by providing an intuitive, ready-made solution that eliminates the need for advanced Excel skills or deep financial analysis expertise, enabling entrepreneurs to generate accurate financial projections, cash flow models, and investment return forecasts with ease; equipped with comprehensive features such as a crowd investing valuation model, capital structure analysis, and financial risk modeling, this tool streamlines complex scenario planning and budgeting processes, while offering a dynamic crowd investing financial dashboard model to visualize key metrics, thus empowering startups and investors alike to make informed decisions and confidently manage their crowd investment portfolios.

Description

This comprehensive crowd investing financial model features a robust three-statement framework designed for financial planning and detailed financial analysis within the equity crowd investing sector. Spanning a 5-year projection period, it incorporates a financial projection model for crowd investing encompassing projected profit and loss statements, cash flow modeling, and pro forma balance sheets, alongside a break-even revenue calculator and diagnostic sheets. Leveraging a discounted cash flow (DCF) valuation approach and free cash flow calculations, this financial projection model accurately estimates company valuation while delivering vital financial performance ratios and KPIs critical for attracting investors and satisfying lender requirements. Additionally, the model includes advanced crowd investing cash flow and portfolio financial models to evaluate investment returns and capital structure, thereby supporting strategic decision-making for startup crowd investing ventures and facilitating effective financial risk assessments and scenario planning.

CROWD INVESTING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive crowd investing financial model offers robust financial modeling for startups and established businesses alike. Featuring an equity crowd investing financial model, it includes pro forma income statements, cash flow spreadsheets, and balance sheets tailored for crowd investing. This financial projection model for crowd investing delivers detailed monthly and annual performance reviews, enabling precise financial planning and investment return analysis. Ideal for creating accurate crowd investing valuation models and managing capital structure, our tool empowers investors and entrepreneurs with clear insights for informed decision-making.

Dashboard

Elevate your presentation with our crowd investing financial modeling tools. Simply input your data into our comprehensive three-statement financial model, designed specifically for crowd investing. Instantly generate professional, detailed financial projections—including cash flow, equity distribution, and investment return models—ready to copy and paste directly into your pitch deck. Whether you're developing a startup crowd investing financial model or a crowd investment forecasting model, our intuitive platform ensures your numbers are accurate, compelling, and investor-ready. Streamline your financial analysis and planning with confidence using our tailored crowd investing financial dashboard model.

Business Financial Statements

This crowd investing financial model seamlessly generates comprehensive annual financial statements. Simply input your assumptions, and our advanced financial projection model for crowd investing delivers accurate, dynamic forecasts. Designed for precision and ease, it empowers investors and startups with reliable insights—making financial planning, cash flow analysis, and valuation effortless. Elevate your crowd investment strategy with this all-in-one financial modeling tool tailored for impactful decision-making.

Sources And Uses Statement

The Use of Funds statement, integral to our crowd investing financial modeling tools, transparently details the sources and allocation of capital within a company. This essential component of the financial planning model for crowd investing provides stakeholders with clear insights into fund origins and their strategic deployment. By integrating this statement into the crowd investing valuation and budgeting models, businesses enhance financial projection accuracy and investor confidence, ensuring informed decision-making throughout the investment lifecycle.

Break Even Point In Sales Dollars

This comprehensive break-even analysis leverages a robust financial projection model for crowd investing, calculating the annual revenue required to cover both fixed and variable costs. It also estimates the precise number of months needed to reach break-even, empowering investors with actionable insights. Integrating seamlessly with crowd investing financial modeling tools, this report supports informed decision-making and strategic financial planning within your crowd investing portfolio.

Top Revenue

In crowd investing financial modeling, the topline—representing revenue or gross sales—and the bottom line—profit or EBITDA—are critical metrics in any financial projection model for crowd investing. Investors leverage crowd investing financial dashboard models to track these figures closely, assessing growth trends quarterly and annually. Top-line growth in a startup crowd investing financial model signals increased sales, driving improved investment returns and overall valuation. Accurate financial analysis models for crowd investing enable stakeholders to forecast performance, optimize equity distribution, and make informed decisions aligned with capital structure and risk management strategies.

Business Top Expenses Spreadsheet

The crowd investing financial analysis model outlines annual company expenses across four key categories. Our financial planning model for crowd investing details targeted costs, including customer acquisition, unforeseen expenditures, and employee salaries. This precision-driven approach ensures accurate budgeting within the crowd investing portfolio financial model, enhancing forecasting and investment return predictions.

CROWD INVESTING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

The crowd investing financial projection model is an essential tool for accurately forecasting expenses and identifying necessary financial resources. Leveraging this financial planning model for crowd investing enables strategic cost management, highlighting potential savings and focus areas. Additionally, our crowd funding financial model template supports effective pitching to investors and strengthens loan application processes, ensuring clarity and confidence. Harness the power of advanced crowd investing financial analysis models to optimize budgeting, improve investment returns, and drive sustainable growth.

CAPEX Spending

Capital expenditure (CapEX) is a critical element within any crowd investing financial projection model. It enables financial analysts to accurately forecast investments in fixed assets, manage depreciation, and account for additions or disposals related to property, plant, and equipment (PPE). Incorporating CapEX within a financial planning model for crowd investing ensures comprehensive tracking of asset growth, including assets acquired through financial leasing. This precise CapEX budgeting enhances the crowd investing valuation model’s accuracy, fostering informed investment decisions and robust financial scenario analysis for startup and equity crowd investing portfolios.

Loan Financing Calculator

A comprehensive crowd investing financial projection model features an amortization schedule detailing periodic loan payments. It outlines key elements such as loan amount, interest rate, maturity term, payment frequency, and amortization method. Common methods include straight-line, declining balance, annuity, bullet, balloon, and negative amortization. Utilizing a robust financial modeling for crowd investing ensures transparent forecasting and risk assessment, empowering stakeholders with accurate insights into loan repayment structures within equity crowd investing financial models.

CROWD INVESTING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The gross profit margin in a crowd investing financial analysis model is a key indicator of profitability, calculated by dividing gross profit by net sales. This metric provides investors with critical insights into a startup’s financial health and operational efficiency. Utilizing a robust financial projection model for crowd investing, stakeholders can accurately evaluate a company’s ability to generate profits, supporting informed decisions and effective financial planning models tailored for crowd investment scenarios.

Cash Flow Forecast Excel

Effective crowd investing financial analysis models prioritize accurate cash flow budgeting and forecasting. This 5-year financial projection model for crowd investing highlights consolidated funds and funding gaps, empowering startups with clear insights. Featuring a dedicated cash flow template, it tracks and analyzes all cash inflows and outflows, factoring in Payable and Receivable Days, revenue, working capital, debt, and net cash. This comprehensive crowd investing cash flow model ensures precise net cash flow calculations alongside opening and closing balances—crucial for optimizing financial planning and attracting investors through transparent financial projection and risk assessment.

KPI Benchmarks

Benchmarking is a vital component of financial modeling for crowd investing, enabling startups to evaluate performance using standardized financial indicators like profit margins and cost efficiency. Our crowd investment forecasting model leverages benchmarking to compare businesses within the same industry, highlighting competitive positioning and growth opportunities. Integrating this into a financial projection model for crowd investing empowers companies to optimize strategies, enhance productivity, and attract investors by demonstrating clear, data-driven insights. Ultimately, benchmarking within a crowd investing valuation model fosters strategic decision-making, ensuring startups remain agile and competitive in dynamic market environments.

P&L Statement Excel

This crowd investing financial projection model empowers both professionals and beginners to gain clear insights into income and expenses. By leveraging this equity crowd investing financial model, users can develop robust financial strategies, ensuring informed decision-making. Its intuitive design simplifies complex financial analysis, making it an essential tool for effective financial planning and forecasting in crowd investing ventures.

Pro Forma Balance Sheet Template Excel

The crowd investing financial projection model offers a clear snapshot of a startup’s assets, liabilities, and net worth at a specific point in time. Combining the crowd investing cash flow model with a forecasted income statement, it reveals operational performance and financial position over a period. This equity crowd investing financial model highlights key metrics—liquidity, solvency, and turnover ratios—essential for informed investment decisions. Using advanced crowd investor financial modeling tools ensures accurate valuation, risk assessment, and capital structure analysis, empowering stakeholders to optimize returns and strategically plan crowd investment portfolios.

CROWD INVESTING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive financial modeling for crowd investing offers a ready-made pre-revenue valuation template tailored for startups. It provides all essential data investors need to make informed funding decisions. The Weighted Average Cost of Capital (WACC) accurately measures expected returns on invested capital, while the free cash flow valuation highlights cash available to shareholders and creditors. Leveraging a discounted cash flow approach, our crowd investing financial analysis model projects future cash flows in today’s terms, ensuring precise financial forecasting and robust investment planning for early-stage ventures.

Cap Table

The equity crowd investing financial model includes a comprehensive cap table template essential for startups. It clearly outlines the company’s ownership structure, detailing equity shares, preferred shares, options, and stakeholders’ valuations. This crowd investing capital structure model provides investors with transparency on ownership percentages and investment value. Integrating this into your financial planning model for crowd investing ensures precise equity distribution and supports informed decision-making within your startup’s investment strategy.

CROWD INVESTING 5 YEAR FINANCIAL PROJECTION TEMPLATE ADVANTAGES

The financial projection model for crowd investing ensures timely payments by accurately forecasting profit and loss.

Boost investor confidence with a precise crowd investing financial model projecting cash flow for strategic growth.

The startup crowd investing financial model compellingly demonstrates your ability to repay loans confidently and accurately.

Identify potential shortfalls early with our crowd investing financial model for accurate cash balance forecasting.

Reduce risk and maximize returns with our precise crowd investing financial projection and risk modeling tools.

CROWD INVESTING STARTUP FINANCIAL PLAN TEMPLATE ADVANTAGES

Empower confident decisions with our advanced crowd investing financial projection model ensuring precise forecasting and optimized returns.

Our crowd investing financial model empowers precise planning, risk management, and five-year forecasting for lasting success.

Our simple-to-use crowd investing financial dashboard model enables clear, data-driven decisions for optimal investment returns.

Our crowd investing financial model delivers fast, accurate forecasts with minimal Excel skills for any business stage.

Our crowd investing financial model delivers precise forecasting and risk analysis, empowering investors with confident decisions.

Unlock precise investment insights with our crowd investing financial model, featuring comprehensive templates and dynamic dashboards.

The crowd investing financial model enhances stakeholder trust through transparent, accurate investment forecasting and risk analysis.

A crowd investing cash flow model ensures clear future insights, boosting stakeholder trust and accelerating investment growth.

Get a robust crowd investing financial model that ensures accurate forecasting and scalable investment analysis.

This robust crowd investing financial model ensures precise cash flow projections, empowering tailored, strategic investment decisions.