Crypto Investment Advisory Firm Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Crypto Investment Advisory Firm Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Crypto Investment Advisory Firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CRYPTO INVESTMENT ADVISORY FIRM FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year crypto investment advisory financial forecasting model provides startups and entrepreneurs with a robust blockchain investment advisory financial plan designed to impress investors and secure funding. Featuring key financial charts, summaries, and critical metrics, this crypto advisory firm revenue forecasting template includes detailed budget modeling, cash flow analysis, and risk analysis financial models for crypto investments. Engineered specifically for crypto asset management financial modeling, it enables precise evaluation of startup costs and financial projections, empowering users to develop a strong financial strategy model for crypto firms and optimize profitability through an integrated crypto investment advisory profit model and valuation model.

This ready-made crypto investment advisory financial forecasting model effectively alleviates common pain points by offering a comprehensive financial planning structure tailored to crypto firms, enabling precise revenue forecasting, risk analysis, and cash flow management. Designed as an intuitive Excel template, it streamlines the creation of investment portfolio financial models and expense tracking, reducing time spent on complex manual calculations while improving accuracy. Its integrated crypto asset management financial model supports robust financial strategy development, enhancing visibility into profit margins and valuation metrics, which are critical for informed decision-making. The model’s customizable dashboard empowers users with real-time financial performance insights, simplifying budget modeling and investment return projections without requiring extensive financial expertise. This eliminates the typical frustration of disparate tools and fragmented data, thus providing crypto advisory firms with a cohesive and user-friendly solution to optimize their financial operations and growth planning.

Description

This crypto investment advisory financial forecasting model provides a comprehensive framework for financial planning and analysis tailored to blockchain investment advisory firms, integrating detailed profit and loss projections, cash flow models, and expense tracking to support informed decision-making. The model includes five-year financial statements such as projected income statements, startup cash flow, and pro forma balance sheets, accompanied by a valuation model utilizing discounted cash flow (DCF) and free cash flow metrics to assess firm value and investment returns. This crypto asset management financial model incorporates risk analysis and key performance indicators essential for evaluating financial performance, profitability, and liquidity, while the investment portfolio financial model supports revenue forecasting and budget modeling to optimize resource allocation and growth strategies. Designed to facilitate strategic financial planning for crypto advisory businesses, this tool also features a dynamic financial dashboard to visualize critical financial data and enhance the firm's overall financial strategy modeling.

CRYPTO INVESTMENT ADVISORY FIRM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive crypto investment advisory financial model includes all essential elements for investor meetings—financial assumptions, detailed statements, precise calculations, and a robust cash flow forecasting model. Designed with an intuitive, investor-friendly interface, this 5-year cash flow projection template empowers your blockchain investment advisory firm to present clear, professional financial projections. Whether for portfolio management, risk analysis, or revenue forecasting, our compact financial planning tool ensures you effectively showcase your firm’s financial strategy and performance, driving confident investment decisions.

Dashboard

Our crypto investment advisory firm financial dashboard offers an all-in-one solution for fast, accurate financial forecasting and reporting. Designed for blockchain investment advisory firms, it streamlines financial modeling, budget planning, and risk analysis. This comprehensive tool enables users to access and analyze detailed financial data, perform valuation and cash flow modeling, and generate actionable insights. Ideal for enhancing financial strategy and investment portfolio management, it supports transparent decision-making and optimizes profitability with ease. Experience efficient financial projections and revenue forecasting tailored specifically for crypto advisory businesses—all at your fingertips.

Business Financial Statements

Our crypto investment advisory financial model streamlines your financial planning with automated, user-friendly Excel templates. Simply input your assumptions into our comprehensive blockchain investment advisory financial forecasting model, and it generates accurate annual reports, including cash flow, revenue forecasting, and expense models. Designed specifically for crypto asset management and advisory firms, this tool supports robust risk analysis, investment portfolio financial modeling, and profit projections. Empower your crypto advisory firm with precise financial strategy models and real-time performance dashboards—all tailored to optimize your business growth and valuation effortlessly.

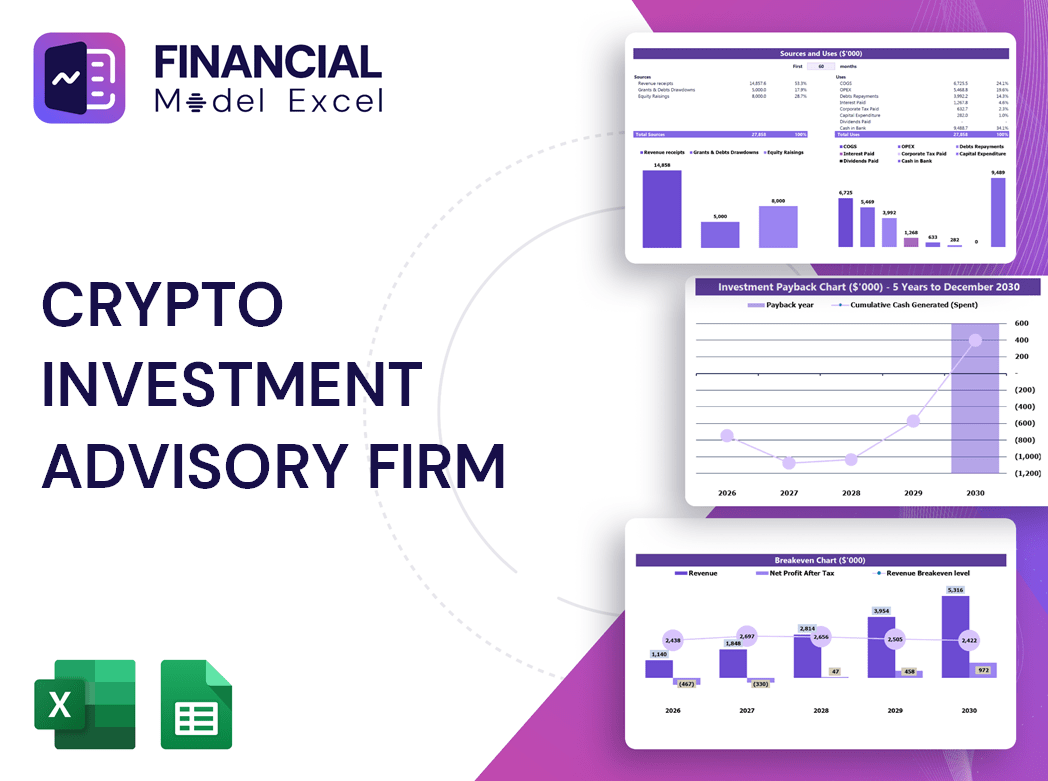

Sources And Uses Statement

A comprehensive crypto investment advisory firm financial model, complete with a detailed sources and uses table, offers clear insights into income streams and expenditure patterns. This essential financial planning tool empowers crypto advisory firms to optimize budget modeling, forecast revenue, and enhance cash flow management. By integrating risk analysis and investment portfolio financial models, firms can strategically drive profitability and deliver robust financial projections, ensuring sustainable growth in the dynamic blockchain investment advisory space.

Break Even Point In Sales Dollars

Our crypto investment advisory firm financial model includes a robust break-even analysis tool that assesses fixed and variable costs against revenue streams. This enables precise determination of the break-even point (BEP), signaling when your crypto advisory firm will begin generating positive returns. Integrated within our financial forecasting model for crypto advisory firms, this tool offers clear graphical and mathematical insights, pinpointing the necessary sales volume and price to cover all expenses. Ideal for strategic planning, risk analysis, and optimizing profit models, it empowers blockchain investment advisory businesses to make informed, data-driven financial decisions.

Top Revenue

In developing a crypto investment advisory firm’s financial forecasting model, revenue stands as the cornerstone of the financial strategy model. Accurate revenue projections drive enterprise valuation within the budget modeling framework. Financial analysts must apply rigorous assumptions on growth rates grounded in historical data to refine revenue forecasts. Utilizing a comprehensive crypto advisory firm financial dashboard or pro forma template ensures precise financial planning and risk analysis. This approach empowers firms to optimize their crypto asset management financial model, enhancing investment portfolio performance and supporting sustainable profitability in the evolving blockchain investment advisory landscape.

Business Top Expenses Spreadsheet

The Top Expenses tab in our 5-year crypto advisory firm cash flow model categorizes annual expenses into four key groups, offering a detailed financial planning and expense analysis. This comprehensive budget modeling highlights both fixed costs and customer acquisition expenses, essential for accurate financial forecasting. Leveraging this financial strategy model enables crypto investment advisory firms to gain full visibility into spending origins, empowering effective cost control and optimized resource allocation for sustained profitability and growth.

CRYPTO INVESTMENT ADVISORY FIRM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Safeguard your crypto investment advisory firm with our comprehensive 3-way financial model, designed for precise expense, investment, and funding oversight. Utilize our dynamic financial forecasting model to customize time horizons, monitor costs, and control expenditures effectively. Our crypto advisory firm budget modeling empowers you to avoid unnecessary outflows while enhancing financial planning and risk analysis. Stay confident with accurate financial projections and a robust crypto advisory firm cash flow model—ensuring your business remains resilient against financial uncertainties and positioned for sustainable growth in the evolving blockchain investment landscape.

CAPEX Spending

This 5-year crypto investment advisory financial forecasting model features integrated CapEx calculations with automated formulas, enabling precise capital expenditure estimates. By leveraging data from profit and loss statements and pro forma balance sheets, the model supports strategic financial planning and budgeting for crypto advisory firms. Ideal for startups, this comprehensive financial dashboard enhances cash flow modeling, investment portfolio analysis, and risk assessment—empowering crypto asset management firms to optimize their revenue forecasting and overall financial performance with confidence.

Loan Financing Calculator

Our comprehensive crypto investment advisory financial model includes a detailed loan amortization schedule, essential for precise financial planning. Designed for five-year projections, this schedule integrates pre-built formulas to track each installment’s principal and interest components. Ideal for blockchain investment advisory financial plans, it enables firms to forecast cash flow, manage expenses, and optimize their financial strategy model effectively. With this tool, crypto advisory firms gain clarity on repayment timelines, enhancing risk analysis and improving overall financial performance models for sustained profitability and investor confidence.

CRYPTO INVESTMENT ADVISORY FIRM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Earnings growth is a key metric within our comprehensive crypto investment advisory firm financial model. Entrepreneurs rely on this bottom-up financial forecasting model to track sustained growth over time. By leveraging detailed profit and loss statements, our crypto advisory firm financial plan highlights critical indicators like sales and revenue expansion, providing clear insights into financial performance. This robust financial strategy model empowers crypto advisory firms to make informed decisions, optimize profitability, and confidently navigate the evolving blockchain investment landscape.

Cash Flow Forecast Excel

A comprehensive crypto investment advisory firm financial model prioritizes cash flow forecasting, focusing solely on cash inflows and outflows—crucial for managing liquidity effectively. Unlike profit and loss statements that include non-cash expenses, this cash flow model offers precise monthly or annual projections up to five years. Fully integrated within the crypto advisory business financial model template, it supports robust financial planning, risk analysis, and revenue forecasting, empowering blockchain investment advisory firms to optimize their financial strategy and confidently steer their crypto asset management toward sustained profitability and growth.

KPI Benchmarks

The financial benchmarking feature in our crypto investment advisory firm financial model enables comprehensive comparative analysis. By evaluating key financial metrics against industry peers, firms gain critical insights into performance gaps and opportunities. This blockchain investment advisory financial plan supports data-driven decisions to optimize profits, manage risks, and enhance portfolio returns. Leveraging financial modeling for crypto advisory firms, clients receive clear guidance to refine strategies and accelerate growth. Accurate benchmarking empowers startups to continuously elevate their financial performance and build a resilient, scalable crypto investment advisory business.

P&L Statement Excel

For a crypto investment advisory firm, leveraging a comprehensive financial forecasting model is essential to navigate future growth confidently. Our financial projections encompass profit and loss statements, gross profit margin analysis, and detailed revenue forecasting, providing a clear picture of your firm’s financial trajectory. By utilizing this crypto advisory firm financial model, businesses can deepen insights into profit drivers, optimize investment portfolio management, and strengthen risk analysis. This strategic approach empowers crypto advisory firms to build sustainable growth, enhance financial performance, and secure a competitive edge in the evolving blockchain investment landscape.

Pro Forma Balance Sheet Template Excel

The three-way financial model offers a comprehensive snapshot of a crypto investment advisory firm’s financial position by seamlessly integrating the pro forma balance sheet, cash flow model, and profit and loss forecast. This interconnected framework ensures all financial statements flow coherently, providing accurate financial forecasting and a robust foundation for strategic planning. Ideal for blockchain investment advisory financial plans, it supports precise revenue forecasting, risk analysis, and investment portfolio modeling—empowering crypto advisory firms to optimize performance and drive growth confidently.

CRYPTO INVESTMENT ADVISORY FIRM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our crypto investment advisory financial model integrates key tools like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) calculators. WACC measures the cost of capital from debt and equity, serving as a crucial risk analysis financial model for crypto investment firms and influencing bank loan approvals. The DCF method projects the value of future cash flows, empowering blockchain investment advisory firms and crypto asset management teams to make informed investment decisions. This comprehensive financial strategy model enhances financial forecasting and drives optimal portfolio performance in the crypto advisory sector.

Cap Table

The cap table is an essential financial model for crypto investment advisory firms, providing a comprehensive overview of company ownership and equity structure. It details share distribution—common and preferred shares, options—and highlights investor stakes and capital allocation. Integrated within a broader financial forecasting model, the cap table supports precise valuation, cash flow analysis, and risk assessment. By offering transparency into equity composition, it empowers crypto advisory firms to optimize financial planning, streamline portfolio management, and enhance investment return modeling. This vital tool ensures informed decision-making and robust financial performance in the dynamic crypto investment landscape.

CRYPTO INVESTMENT ADVISORY FIRM BUDGET FINANCIAL MODEL ADVANTAGES

The crypto investment advisory financial model delivers clear projections, enhancing strategic decisions and maximizing profitability effortlessly.

The crypto investment advisory financial model confidently predicts cash shortages and surpluses, optimizing strategic financial planning.

Gain clear insights into cash flow and maximize profits with the crypto investment advisory firm financial model’s precision.

Identify potential shortfalls in cash balances to optimize decision-making and maximize growth in crypto investment advisory firms.

The crypto advisory firm financial model accurately forecasts cash flow, optimizing investment strategies and maximizing profitability.

CRYPTO INVESTMENT ADVISORY FIRM FINANCIAL PROJECTION STARTUP ADVANTAGES

A robust crypto investment advisory financial model enables better decision making through precise forecasting and risk analysis.

Enhance decision-making with our crypto advisory firm cash flow model, forecasting impacts to optimize staff and equipment investments.

Our crypto investment advisory financial model enhances accurate forecasting, optimizing profitability and strategic decision-making.

A crypto advisory firm budget model enables precise, flexible forecasting, optimizing financial strategy and maximizing investment returns.

Optimize returns and manage risks effectively with our precise crypto investment advisory firm financial modeling solutions.

A crypto investment advisory financial model ensures precise forecasting, boosting investor confidence and maximizing funding success.

Our crypto advisory financial model identifies cash shortfalls early, enabling proactive management and maximizing investment returns.

The crypto investment advisory financial model provides proactive cash flow insights, enhancing decision-making and risk management efficiency.

Our crypto investment advisory financial model delivers precise forecasting and clear, print-ready reports for informed decision-making.

Our crypto advisory financial model delivers comprehensive, print-ready reports for precise income, cash flow, and ratio analysis.