Customs Compliance Services Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Customs Compliance Services Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Customs Compliance Services Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

CUSTOMS COMPLIANCE SERVICES FINANCIAL MODEL FOR STARTUP INFO

Highlights

This five-year horizon business plan integrates a comprehensive customs compliance financial model designed specifically for early-stage startups seeking to impress investors and raise capital. The financial model for customs brokerage includes detailed customs compliance cost analysis, expense modeling, and revenue forecasting, enabling precise financial projections and budgeting. With features like a customs compliance service pricing model, cash flow model, and financial KPIs dashboard, this template supports thorough financial scenario planning and profitability modeling, providing a robust financial plan for customs consulting businesses. Fully unlocked and editable, it empowers users to evaluate customs compliance services valuation and optimize financial performance within the customs clearance and risk management landscape.

This ready-made customs compliance financial model Excel template effectively addresses the common pain points faced by customs brokerage and consulting businesses by offering comprehensive customs compliance cost analysis, expense modeling, and revenue modeling, enabling precise financial forecasting for customs services. It streamlines budgeting with a robust customs compliance budgeting model and enhances decision-making through an intuitive financial dashboard for customs compliance KPIs. The model supports profitability analysis with a customs compliance service pricing model and facilitates cash flow management using a dedicated cash flow model tailored for customs compliance operations. Additionally, it incorporates financial scenario planning and risk management features, allowing users to evaluate various customs clearance financial analysis scenarios, improve financial performance insights, and confidently present a well-structured customs compliance service business model to investors without requiring advanced financial expertise.

Description

Our comprehensive financial model for customs brokerage and customs compliance services offers an all-in-one solution for customs compliance cost analysis, financial forecasting customs services, and a robust customs compliance budgeting model. Designed to streamline operational management and investor relations, this profitability model customs compliance enables accurate financial projections, including cash flow model customs compliance and customs clearance financial analysis. The model incorporates detailed customs compliance expense modeling, a customs compliance revenue model, and advanced customs risk management financial model features, helping you develop a precise financial plan customs consulting. Additionally, it provides essential financial KPIs, a financial dashboard customs compliance, and a customizable customs compliance service pricing model to enhance financial performance customs compliance and enable strategic financial scenario planning customs with clarity and confidence.

CUSTOMS COMPLIANCE SERVICES FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Seeking clarity on your customs compliance business potential or funding needs? Our financial model for customs brokerage delivers a comprehensive, high-level three-statement framework—fast. Easily build startup cost spreadsheets and generate month-by-month financial forecasting customs services, including sales, expenses, investments, funding, and cash flow projections. Customize data with editable tables and dynamic assumptions to perform financial scenario planning customs, enhancing your profitability model customs compliance. Analyze various scenarios like in Excel to optimize your customs compliance budgeting model and ensure strategic success with insightful financial KPIs and expense modeling tailored for customs compliance services.

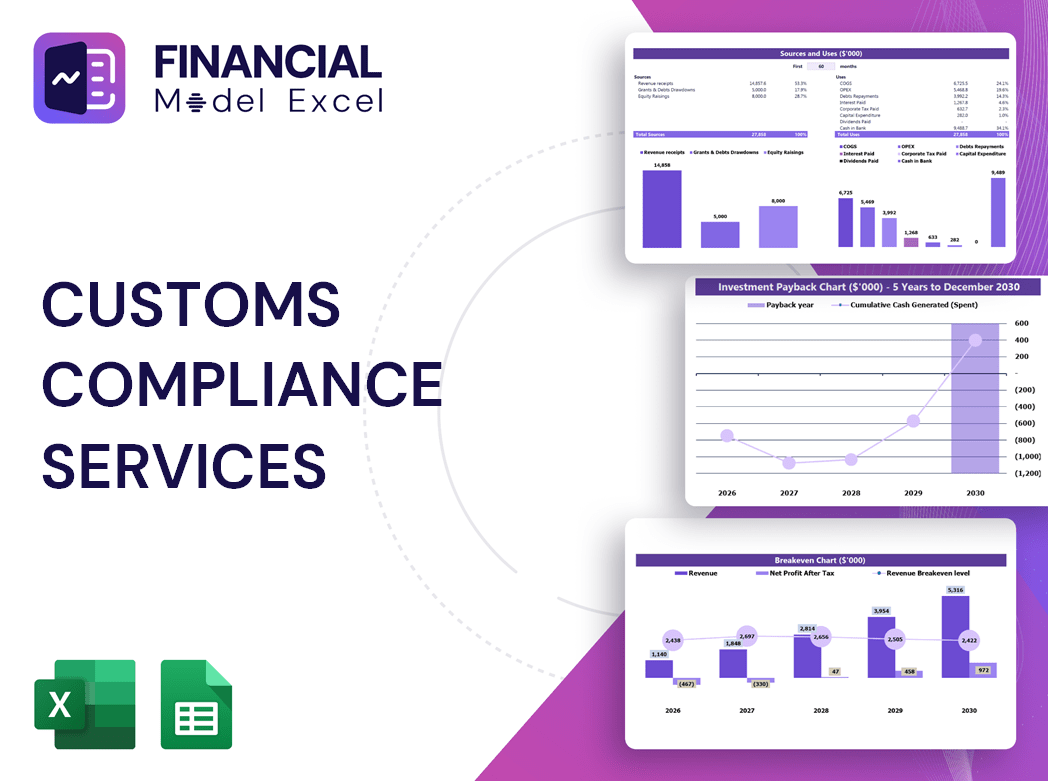

Dashboard

Gain instant insights with a dynamic financial dashboard tailored for customs compliance. Effortlessly visualize your company’s financial forecasting customs services, including customs compliance cost analysis and cash flow modeling. Share comprehensive financial projections and profitability models with stakeholders, enhancing transparency and strategic decision-making. Streamline customs brokerage financial modeling and optimize your customs compliance budgeting model, driving improved financial performance and risk management. Empower your team with clear, actionable data from your customs compliance service pricing model and revenue forecasts—all in one intuitive platform. Elevate your customs compliance financial KPIs and scenario planning for sustained business growth.

Business Financial Statements

A comprehensive customs compliance financial model integrates profit and loss forecasts with cash flow modeling and balance sheet projections to deliver a full-spectrum analysis. The P&L forecast reveals core operating profitability, while the projected balance sheet and cash flow model emphasize capital management, asset allocation, and liquidity. Leveraging financial forecasting for customs services and customs compliance budgeting models enables strategic financial scenario planning, optimizing the profitability model customs compliance and enhancing decision-making in customs brokerage financial modeling and risk management. This holistic approach ensures robust financial performance and informed customs compliance service pricing models.

Sources And Uses Statement

This financial forecasting customs services model expertly analyzes cash flow, revealing the sources and uses of funds with precision. It empowers customs compliance professionals to understand cash movement and distribution clearly, enhancing budgeting accuracy and expense modeling. By integrating customs compliance financial KPIs and profitability insights, this financial plan for customs consulting drives strategic decision-making and optimizes financial performance within customs brokerage operations.

Break Even Point In Sales Dollars

Our 5-year customs compliance financial model pinpoints the sales or revenue needed to cover all fixed and variable costs, achieving break-even. Beyond this point, your customs compliance revenue model shifts from zero profit to positive earnings. With our customizable break-even chart in Excel, you can visualize the minimum sales threshold to ensure profitability. This powerful tool aids investors in assessing the financial performance and profitability model of customs compliance services, enabling precise financial forecasting and cash flow modeling to estimate ROI timelines and optimize customs brokerage financial planning.

Top Revenue

Utilize the Top Revenue tab to generate a demand report within your customs compliance financial model, showcasing profitability and financial performance across different scenarios. This insight supports strategic decision-making for your customs compliance services business model. The financial Excel template also enables development of a revenue bridge, pinpointing key drivers like sales volume and unit pricing that impact revenue over time. This comprehensive customs compliance revenue model aids in accurate financial forecasting for customs services, optimizing resource planning and enhancing financial scenario planning for sales and operational teams.

Business Top Expenses Spreadsheet

The Top Expenses tab in this Excel financial model provides a clear classification of company costs across four key categories. Featuring a dynamic chart, it visualizes annual expenses such as customer acquisition, payroll, and other operating costs. This detailed customs compliance expense modeling is essential for startups and planners to accurately forecast financial performance and support strategic decision-making. Leveraging this customs brokerage financial modeling tool enhances budgeting, cash flow projections, and profitability analysis, ensuring more precise financial planning and risk management within customs compliance services.

CUSTOMS COMPLIANCE SERVICES FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive customs compliance financial model must include start-up costs, which arise before strategic operations begin. Proper management of these expenses is critical to prevent uncontrolled losses or funding shortfalls. Our 5-year customs compliance budgeting model features an integrated proforma income statement template in Excel, enabling entrepreneurs to accurately forecast and control start-up costs. Leverage this financial forecasting customs services tool to ensure robust cash flow management and secure your business’s financial stability from day one.

CAPEX Spending

Financial experts utilize advanced financial models for customs compliance to accurately track CAPEX spending, ensuring precise management of investments in property, plant, and equipment (PPE). This includes depreciation, asset additions, and disposals, as well as assets under financial leasing. Incorporating customs compliance expense modeling and cash flow models helps optimize budgeting and financial forecasting for customs services. Such comprehensive financial planning supports robust customs compliance cost analysis and enhances overall financial performance, contributing to a profitability model tailored for customs brokerage and consulting businesses.

Loan Financing Calculator

Our comprehensive financial model for customs brokerage includes a dynamic loan amortization schedule, seamlessly integrating pre-built formulas to project precise repayment timelines. This powerful tool captures installment amounts, principal, and interest across monthly, quarterly, or annual periods—enabling accurate customs compliance budgeting models and financial forecasting customs services. Designed to enhance cash flow modeling and financial performance customs compliance, it empowers businesses with clear financial scenario planning and customs compliance expense modeling for informed decision-making and optimized profitability.

CUSTOMS COMPLIANCE SERVICES FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Understanding the cost of acquiring new customers is vital for startups and growing customs compliance service providers. This key metric, calculated by dividing total marketing expenses by the number of new customers acquired annually, directly impacts your customs compliance financial plan. Lower acquisition costs enhance profitability and are seamlessly integrated within our customs compliance financial model and budgeting framework. Leveraging this metric in your financial forecasting for customs services empowers effective decision-making, optimized cash flow models, and targeted financial scenario planning to drive sustainable growth and maximize the value of your customs brokerage operations.

Cash Flow Forecast Excel

The cash flow model for customs compliance tracks money movement, highlighting inflows from services and outflows for expenses. This financial dashboard offers a clear view of the company’s liquidity over a specified accounting period. By integrating customs compliance expense modeling with cash flow analysis, organizations can enhance financial forecasting for customs services. This essential tool supports effective budgeting, profitability modeling, and risk management, empowering customs brokers and consulting firms to optimize financial performance and ensure sustained operational success.

KPI Benchmarks

Our financial dashboard for customs compliance integrates a projected income statement template with benchmark analysis, comparing your key financial KPIs against industry averages. This customized financial model for customs brokerage enables precise customs compliance cost analysis and profitability modeling. By leveraging financial scenario planning and customs compliance expense modeling, businesses can align their budgeting and forecasting with best practices. Ideal for startups and established firms alike, this financial performance tool drives strategic decision-making and optimizes customs compliance services valuation, ensuring robust cash flow management and competitive service pricing models.

P&L Statement Excel

This comprehensive 3-way financial model for customs brokerage empowers both professionals and newcomers to confidently navigate customs compliance financial projections. Featuring an intuitive profit and loss statement template, it delivers in-depth insights into income and expenses, crucial for informed customs compliance budgeting and expense modeling. Harness this tool for precise financial forecasting in customs services, enabling strategic decision-making and enhancing financial performance. Elevate your customs compliance service business model with robust scenario planning, profitability analysis, and a dynamic financial dashboard tailored to optimize your customs brokerage financial modeling and customs compliance KPIs.

Pro Forma Balance Sheet Template Excel

Included within our financial forecasting customs services template, the pro forma balance sheet Excel is essential for comprehensive customs compliance financial projections. It details a company’s current and long-term assets, liabilities, and equity, enabling precise customs compliance cost analysis and profitability modeling. This projected balance sheet supports financial scenario planning customs service providers rely on to evaluate financial performance customs compliance, optimize budgeting via a customs compliance budgeting model, and enhance the customs compliance revenue model. Unlock critical insights for customs brokerage financial modeling and strategic decision-making with this indispensable financial dashboard customs compliance tool.

CUSTOMS COMPLIANCE SERVICES FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Net Present Value (NPV) represents the discounted value of all future cash flows—both positive and negative—over an investment’s lifespan. Our comprehensive financial model for customs brokerage integrates critical metrics such as Investment Required, Equity Raised, Net Income, WACC, EBITDA, Growth Rate, and Future Values. This robust financial forecasting tool empowers customs compliance professionals to perform precise cost analysis, profitability modeling, and scenario planning, ensuring informed decision-making and optimized financial performance within customs compliance services.

Cap Table

Our financial model for customs brokerage includes a comprehensive cap table template covering four financing rounds. It clearly illustrates how new investor shares influence investment income, providing detailed insights into ownership structure changes and dilution effects after each round. This financial dashboard for customs compliance enables precise financial forecasting and scenario planning, supporting strategic decision-making in customs compliance budgeting models and profitability assessments.

CUSTOMS COMPLIANCE SERVICES FINANCIAL PLAN STARTUP ADVANTAGES

The 3-way financial model for customs compliance predicts issues early, enhancing risk management and profitability forecasting.

Optimize profitability and cash flow with the comprehensive financial model for customs compliance services in Excel.

Gain stakeholder trust with a robust financial model optimizing customs compliance profitability and cash flow forecasting.

Evaluate your startup’s success confidently with a comprehensive customs compliance services financial model template in Excel.

A financial model for customs brokerage empowers precise cash flow forecasting, enhancing profitability and compliance management.

CUSTOMS COMPLIANCE SERVICES BUSINESS PLAN FINANCIAL TEMPLATE ADVANTAGES

Streamline customs compliance budgeting with our financial model, boosting accuracy and profitability for your brokerage services.

Unlock precise customs compliance financial forecasting effortlessly with our user-friendly, sophisticated financial model and expert support.

Our financial model for customs compliance accurately predicts cash shortfalls, enabling proactive cash flow management and risk reduction.

The customs compliance financial model enables proactive cash flow management, driving accurate forecasting and maximizing profitability.

Our integrated financial model ensures precise customs compliance forecasting, maximizing profitability and attracting savvy investors confidently.

Our financial model for customs brokerage ensures accurate forecasting and investor-ready, streamlined compliance cost analysis.

Optimize customs compliance profitability and budgeting with our precise financial model designed for strategic decision-making.

A customs compliance cash flow model enables proactive financial management, ensuring timely decisions and sustainable business growth.

Unlock accurate profitability insights and drive growth with our advanced financial model for customs brokerage—great value for money.

Leverage our proven customs compliance financial model for accurate projections, transparent costs, and no hidden fees.