Data Recovery Service Provider Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Data Recovery Service Provider Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Data Recovery Service Provider Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DATA RECOVERY SERVICE PROVIDER FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year financial modeling template offers a detailed financial forecast for data recovery services, incorporating revenue models, cost analysis, and expense tracking to optimize data recovery business budget plans. Designed specifically for early-stage startups, it includes break-even analysis, cash flow models, and financial performance metrics to enhance the financial plan template for data recovery companies. With customizable financial statements and scenario analysis, this tool supports pricing strategy development, investment analysis, and operating budget management, empowering data recovery service providers to refine their profit margins and confidently approach banks or investors to raise capital and secure funding.

This ready-made financial model for data recovery service providers addresses common pain points by streamlining financial planning processes such as expense tracking, cost analysis, and revenue modeling into a user-friendly Excel template. It simplifies the creation of comprehensive financial statements, cash flow models, and break-even analyses, eliminating the complexity often faced when developing a financial forecast or operating budget for data recovery businesses. By incorporating scenario analysis and investment analysis features, it empowers users to test pricing strategies, optimize profit margins, and accurately evaluate financial KPIs, thereby enhancing decision-making and supporting robust financial plans tailored specifically to the data recovery service industry.

Description

Our comprehensive financial modeling for data recovery companies integrates a detailed financial forecast for data recovery services, encompassing revenue models for data recovery providers alongside cost analysis for data recovery service firms. This dynamic cash flow model for data recovery businesses includes a break-even analysis data recovery business tool, enabling precise tracking of expense tracking for data recovery services and outlining startup costs within a robust data recovery service startup financial plan. The model further incorporates investment analysis for data recovery providers, scenario analysis for data recovery financial models, and a pricing strategy for data recovery services that optimize profit margins and operating budget data recovery services. With financial statements for data recovery service providers and financial performance metrics data recovery firms embedded, users benefit from a financial plan template for data recovery companies designed to deliver insightful data recovery service financial KPIs and provider valuation models, all supported by an interactive cash flow chart template and sensitivity adjustments based on daily sales assumptions.

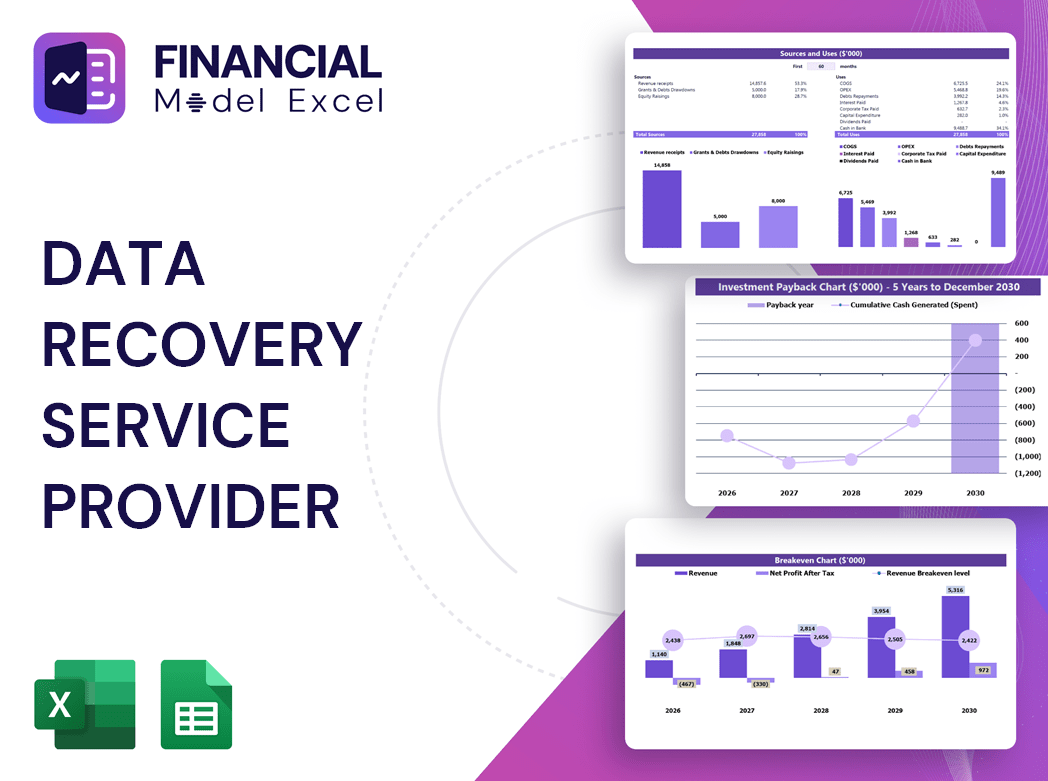

DATA RECOVERY SERVICE PROVIDER FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive financial forecast for data recovery services integrates the pro forma income statement, projected balance sheet, and cash flow model into one dynamic tool. While simplified models relying solely on the income statement exist, they often miss critical insights. Employing a full three-statement financial model enables accurate scenario analysis, revealing how changes in your pricing strategy, expense tracking, or revenue model impact profit margins, cash flow, and overall financial performance. This approach is essential for robust financial planning, investment analysis, and optimizing your data recovery business budget plan with precision and confidence.

Dashboard

This startup financial projections dashboard offers a comprehensive view of key financial metrics tailored for data recovery service providers. It highlights critical insights including revenue models, cash flow forecasts, profit margin analysis, and cumulative cash flows. Designed for data recovery businesses, this tool supports effective financial planning by integrating expense tracking, break-even analysis, and profitability forecasts—empowering companies to optimize budgeting and make informed investment decisions with clarity and confidence.

Business Financial Statements

When your financial modeling for data recovery companies is accurately completed, with updated key financial and operational assumptions linked within the startup financial plan template, forecasting key financial statements becomes seamless. This ensures a reliable financial forecast for data recovery services, allowing you to confidently analyze revenue models, profit margins, and cash flow. The intuitive 3-statement financial model streamlines expense tracking and break-even analysis, providing an easy-to-use tool ready for stakeholder review and investment analysis. Trust this approach to enhance your data recovery business budget plan and drive informed financial decisions.

Sources And Uses Statement

Any robust financial plan template for data recovery companies, including those with detailed sources and uses of funds statements, provides critical insights into revenue streams and expense tracking. This foundation supports accurate financial forecasting for data recovery services, enabling effective cost analysis, cash flow modeling, and investment analysis. Utilizing such models enhances profitability management, informs pricing strategy for data recovery services, and drives data-driven decision-making for sustainable growth in competitive markets.

Break Even Point In Sales Dollars

Understanding your break-even analysis through a precise financial model for data recovery services is crucial. It reveals the minimum sales needed to cover expenses, validating your business viability. Utilizing a financial plan template for data recovery companies, this insight enables targeted cost analysis and expense tracking to enhance profit margins. Moreover, forecasting break-even sales aids in realistic investment recovery timelines, vital for managing stakeholder expectations. By leveraging detailed financial statements and scenario analysis, data recovery providers can optimize their revenue model and cash flow, ensuring sustainable growth and informed decision-making.

Top Revenue

The Top Revenue tab in our financial plan template for data recovery companies presents a clear, detailed breakdown of your service offerings. Utilizing this 5-year financial forecast, you can analyze annual revenue streams, assess revenue depth, and track revenue bridges effectively. This powerful financial modeling tool supports precise revenue modeling and pricing strategy development, empowering data recovery service providers to optimize profit margins and improve cash flow. Harness this template to enhance your data recovery business budget plan and elevate your financial performance metrics with confidence.

Business Top Expenses Spreadsheet

The company’s expenses are detailed within the business plan forecast template, organized into four key categories, including an added “Other” section for supplementary costs. Leveraging a financial modeling template for startups enables precise historical data analysis spanning up to five years. This structured approach supports comprehensive cost analysis for data recovery service firms and enhances accuracy in financial projections. Integrating these insights into your data recovery business budget plan or financial forecast for data recovery services ensures robust financial performance metrics and informed decision-making.

DATA RECOVERY SERVICE PROVIDER FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are essential for your data recovery company’s growth, but strategic management ensures sustainable success. Our financial plan template for data recovery companies features pro forma statements designed for precise expense tracking, cost analysis, and balanced account management. With integrated financial modeling for data recovery businesses, you can confidently develop budgets, forecast cash flow, analyze profit margins, and execute pricing strategies. Begin your financial journey equipped with robust tools and a revenue model for data recovery providers that drives informed decisions and long-term profitability.

CAPEX Spending

Capital budgeting analysis in a data recovery service financial model captures total investments in property, plant, equipment, and fixed assets—key drivers of operational competitiveness. Our report details CAPEX spending, linking it to efficiency gains and asset performance aligned with the capital expenditure plan. Note, this excludes salaries and operating expenses. Capital expenditures vary widely across the industry, making it essential to consider these differences when evaluating financial forecasts, cost analyses, and break-even models for data recovery businesses. This approach ensures informed decisions grounded in robust financial planning and investment analysis.

Loan Financing Calculator

Start-ups in the data recovery sector often require loans to scale operations. Integrating loan commitments into a comprehensive financial model—including repayment schedules, maturity terms, and interest payments—is vital for accurate cash flow forecasting and cost analysis. This data recovery service financial plan template ensures seamless updates across cash flow models, balance sheets, and financial statements, enhancing scenario analysis and financial performance metrics. With precise expense tracking and break-even analysis, companies gain actionable insights to optimize profit margins and strengthen their revenue model, enabling informed strategic decisions for sustained growth and investment appeal.

DATA RECOVERY SERVICE PROVIDER FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Investment (ROI) is a critical profitability metric featured in the 5-year cash flow model for data recovery businesses. It measures the efficiency of investments by comparing net cash inflows against total investment costs. In financial modeling for data recovery companies, ROI provides clear insight into the success of investment activities, helping stakeholders evaluate profitability and guide strategic decisions. Incorporating ROI into your financial forecast and budget plan ensures a robust financial performance analysis, optimizing profit margins and supporting sustainable growth in data recovery service firms.

Cash Flow Forecast Excel

A pro forma cash flow model is crucial for data recovery startups, enabling strategic planning to maximize profitability and operational efficiency. This financial forecast not only guides budgeting and expense tracking but also strengthens your financial plan template for securing bank loans and attracting investors. By illustrating your revenue model and break-even analysis, it highlights your company’s repayment potential and overall financial health. Integrating this cash flow projection with financial performance metrics and scenario analysis ensures informed decision-making and positions your data recovery business for sustainable growth.

KPI Benchmarks

Our financial benchmarking study tab in the feasibility study template empowers data recovery companies to conduct insightful comparative analysis using key financial performance metrics. By inputting financial data, firms can evaluate their position against industry standards in areas like profit margins, cash flow models, and expense tracking. This tool highlights strengths and reveals opportunities for improvement within financial KPIs, enabling providers to refine their revenue models, pricing strategies, and cost analyses. Regular benchmarking fosters deeper financial understanding, guiding data recovery businesses toward sustainable growth and enhanced profitability.

P&L Statement Excel

To ensure profitability in a data recovery service, leveraging a comprehensive pro forma profit and loss statement is essential. This financial modeling tool enables accurate forecasting of both revenues and expenses, guiding startups toward sustainable growth. Our 5-year financial projection template delivers detailed annual reports, encompassing key metrics such as net profit and after-tax balances. Utilizing this financial plan template for data recovery companies empowers providers to optimize their pricing strategy, monitor profit margins, and make informed investment decisions, ultimately driving long-term success and financial stability.

Pro Forma Balance Sheet Template Excel

A projected balance sheet for data recovery startups offers a clear snapshot of assets, liabilities, and equity over time, essential for financial forecasting. Utilizing our financial plan template, you can seamlessly integrate this into your data recovery business budget plan, supporting accurate cash flow models and break-even analysis. This valuable tool aids in investment analysis, expense tracking, and scenario analysis for data recovery financial models, empowering providers to optimize profit margins and enhance financial performance metrics. Elevate your financial strategy with a robust balance sheet projection, tailored for data recovery service firms.

DATA RECOVERY SERVICE PROVIDER FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The financial plan template for data recovery startups includes a comprehensive valuation model featuring discounted cash flow analysis. Users can easily input cost of capital rates to generate accurate investment analysis and project financial performance metrics. This tool supports detailed financial modeling for data recovery companies, enabling precise cash flow forecasting and robust revenue modeling to optimize profit margins and pricing strategies.

Cap Table

The Cap Table within the 5-year cash flow projection template offers a comprehensive view of financial instruments driving funding activities. It enables data recovery service providers to analyze how strategic decisions impact profit margins and overall financial performance. Integrating this with financial modeling for data recovery companies ensures accurate investment analysis and enhances the financial forecast for data recovery services, supporting informed budgeting and revenue modeling. This tool is essential for optimizing expense tracking and refining pricing strategies, ultimately strengthening the financial plan template tailored for data recovery business growth.

DATA RECOVERY SERVICE PROVIDER P&L TEMPLATE EXCEL ADVANTAGES

Accurately estimating expenses with a financial model optimizes budgeting and boosts profitability for data recovery service providers.

Financial modeling for data recovery companies enhances strategic alignment and drives informed, profitable business decisions efficiently.

Optimize cash flow and profitability by leveraging a three-statement financial model for data recovery service providers.

Financial modeling for data recovery companies boosts clarity, drives informed decisions, and optimizes profit margins effectively.

A 3-statement financial model template boosts credibility, impressing investors with clear, precise data recovery business projections.

DATA RECOVERY SERVICE PROVIDER BUSINESS PROJECTION TEMPLATE ADVANTAGES

Optimize growth with a 5-year financial model tailored for precise forecasting and strategic planning in data recovery services.

Gain strategic insights with a fully integrated 5-year financial model, automating data recovery service projections monthly.

Our simple-to-use financial model enhances accurate forecasting and boosts profitability for data recovery service providers.

Empower your data recovery business with a sophisticated financial model delivering quick, reliable insights regardless of experience level.

Enhance funding success with a precise financial model showcasing robust revenue, profit margins, and cash flow projections.

Impress investors with a robust financial model delivering clear projections, strong profit margins, and confident data recovery business growth.

Optimize profitability and cash flow with our financial modeling tailored for data recovery service providers—We do the math.

Streamline financial modeling for data recovery with our template—no coding, formatting, or costly consultants required.

Optimize cash flow and spot payment issues early with a precise financial model for data recovery services.

A robust cash flow model helps data recovery firms identify unpaid invoices and accelerate revenue collection effectively.