Deli Restaurant Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Deli Restaurant Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Deli Restaurant Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DELI RESTAURANT FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive deli restaurant startup financial model includes a detailed 5-year deli restaurant cash flow model and revenue projection model, featuring an integrated deli restaurant budget forecasting model and cost analysis model to help you accurately track expenses and forecast profits. The deli restaurant financial performance model offers a robust financial dashboard model with core metrics in GAAP/IFRS formats, enabling precise deli restaurant break-even analysis, profit margin insights, and operational budget planning. Fully unlocked and customizable, this deli restaurant financial statements template supports investment analysis, pricing strategy modeling, and funding requirement assessments—empowering you to evaluate your deli restaurant business financial forecast and confidently plan startup costs.

The deli restaurant financial planning model addresses key pain points by offering a comprehensive deli restaurant budget forecasting model that simplifies expense tracking and cost analysis, ensuring accurate deli restaurant revenue projection and deli restaurant profit margin model calculations. This ready-made deli restaurant cash flow model and deli restaurant break-even analysis enable you to anticipate and manage cash requirements effectively, while the deli restaurant sales forecast model and deli restaurant operational budget model provide actionable insights for sustainable growth. Integrating deli restaurant financial performance model metrics with a deli restaurant startup financial model and deli restaurant capital expenditure model helps streamline investment analysis and funding requirement planning. Additionally, the deli restaurant income statement model and deli restaurant financial dashboard model are designed to visualize financial statements and key KPIs clearly, aiding decision-makers in optimizing the deli restaurant pricing strategy model and delivering a seamless financial management experience.

Description

This deli restaurant financial planning model offers a comprehensive framework that integrates a detailed deli restaurant budget forecasting model, revenue projection model, and expense tracking model, ensuring precise financial control and strategic growth planning. Featuring a dynamic deli restaurant startup financial model with a full suite of deli restaurant financial statements templates—including projected profit and loss statements, cash flow models, and balance sheets—this tool facilitates accurate deli restaurant cost analysis and deli restaurant break-even analysis to optimize profit margins. Additionally, the deli restaurant financial dashboard model consolidates critical KPIs and operational budget models to drive informed decision-making while the deli restaurant capital expenditure model and funding requirement model support investment analysis and financing strategies essential for sustainable business expansion.

DELI RESTAURANT FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Designed for all financial expertise levels, our deli restaurant startup financial model is the ideal solution. User-friendly, flexible, and comprehensive, it offers customizable sheets for budget forecasting, revenue projection, cost analysis, and profit margin modeling. Perfect for creating detailed deli restaurant financial statements, break-even analysis, and cash flow models, this template empowers you to build accurate business financial forecasts and insightful operational budgets, ensuring confident planning and strategic growth.

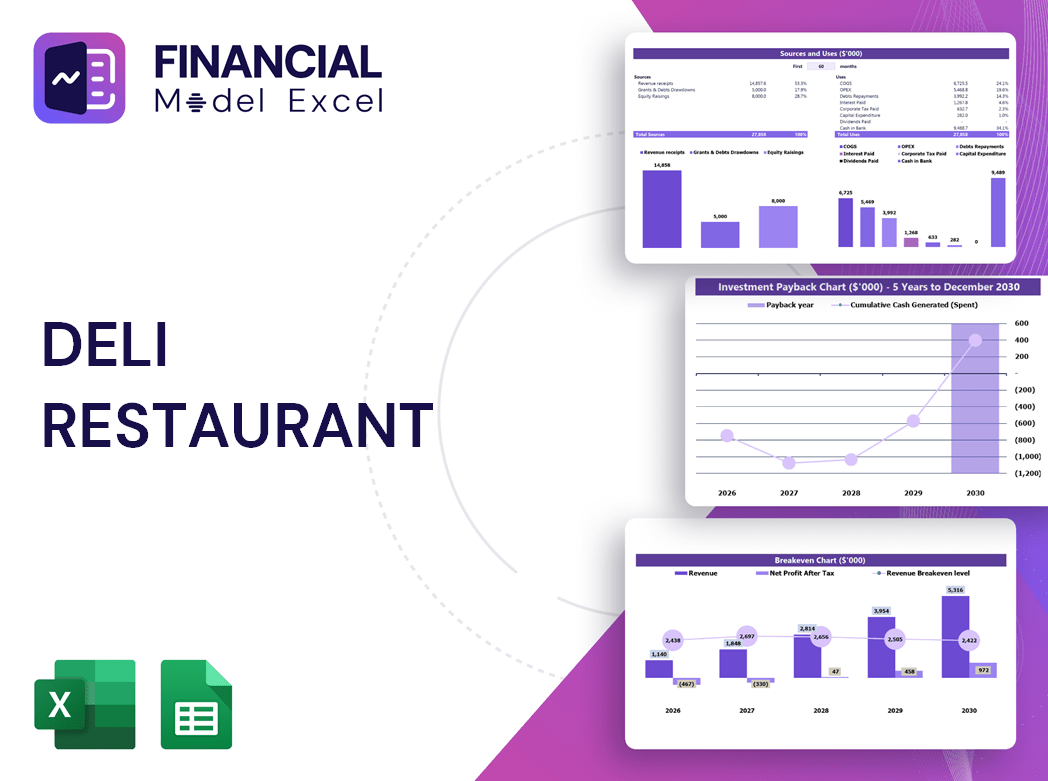

Dashboard

Our deli restaurant financial dashboard model offers a dynamic and visually engaging tool for comprehensive financial planning and analysis. Designed to integrate with our 5-year deli restaurant revenue projection and budget forecasting models, it delivers precise charts and graphics that simplify complex financial data. This dashboard empowers stakeholders to conduct in-depth financial performance reviews, supporting informed decisions on cost analysis, profit margin optimization, and cash flow management. By providing clear insights, it enhances forecasting accuracy and strategic planning, ensuring your deli restaurant’s financial health and growth are consistently on track.

Business Financial Statements

This deli restaurant financial planning model features pre-built, consolidated financial statements—including a monthly profit and loss template, pro forma balance sheet for startups, and a comprehensive cash flow model. Designed for flexibility, these deli restaurant financial statements templates can be customized for monthly or annual forecasts. Additionally, users can seamlessly integrate data from popular accounting platforms like QuickBooks, Xero, and FreshBooks, enhancing accuracy in your deli restaurant budget forecasting model, revenue projection, and expense tracking for optimal financial performance and strategic decision-making.

Sources And Uses Statement

The deli restaurant financial planning model’s sources and uses of funds statement provides a clear overview of all funding origins and their strategic allocation. This essential component ensures transparent tracking of capital inflows and outflows, supporting accurate budget forecasting and expense management. By integrating with the deli restaurant cash flow model and capital expenditure model, it empowers owners to optimize resource deployment and enhance overall financial performance. This comprehensive financial snapshot is vital for informed decision-making, funding requirement assessments, and sustaining profitable growth in a competitive market.

Break Even Point In Sales Dollars

Our deli restaurant financial planning model seamlessly integrates with your financial statements, automatically performing break-even analysis. This dynamic worksheet calculates break-even sales levels, break-even units, and return on investment, empowering management with clear insights into profitability timelines. By leveraging this deli restaurant break-even analysis within your budget forecasting and revenue projection models, you gain precise financial visibility to drive informed decisions and optimize your deli’s financial performance.

Top Revenue

The deli restaurant financial planning model’s Top Revenue tab showcases detailed pro forma projections for each offering. Gain clear annual insights into your revenue streams, including comprehensive revenue depth and bridge analysis. This deli restaurant business financial forecast template empowers strategic decision-making by delivering precise sales forecast models and revenue projection models, ensuring your financial planning is accurate and actionable.

Business Top Expenses Spreadsheet

Effective financial planning is essential for both start-up and established delis to sustain profitability. Our deli restaurant financial planning model includes a comprehensive Top Expense Report, highlighting the four largest cost categories alongside aggregated 'other' expenses. This deli restaurant cost analysis model enables management to monitor, track, and optimize major expenses, ensuring informed budgeting and strategic decision-making. By leveraging this deli restaurant budget forecasting model, users can identify trends in expense fluctuations year-over-year, driving improved financial performance and long-term business success.

DELI RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our deli restaurant startup financial model streamlines budget forecasting and expense tracking, ensuring precise control over initial costs. This comprehensive financial planning model covers investment analysis, cost analysis, and revenue projections, empowering you to optimize profit margins and cash flow. With integrated financial statements templates and sales forecast models, it offers a clear view of your deli’s operational budget and funding requirements. Harness this professional tool to confidently navigate break-even analysis and financial performance, safeguarding your business from overspending and maximizing growth potential.

CAPEX Spending

The deli restaurant capital expenditure (CAPEX) model outlines all investments aimed at enhancing business performance, excluding routine operating costs like salaries. This focused CAPEX schedule highlights key areas where strategic spending drives growth and efficiency. Including detailed capital expenditure reports in your deli restaurant financial planning model ensures clarity on resource allocation, aligning investment decisions with business objectives. Tailoring the CAPEX plan within your deli restaurant financial forecast is essential, as capital needs vary widely across operations. This precision supports informed budgeting and optimizes long-term financial health.

Loan Financing Calculator

Our deli restaurant financial planning model features a comprehensive loan amortization schedule, seamlessly integrating principal and interest calculations. This robust tool accurately determines your payment amounts based on loan principal, interest rate, term length, and payment frequency. Designed to enhance your deli restaurant budget forecasting model, it ensures precise cash flow management and supports sound financial decision-making throughout your business lifecycle.

DELI RESTAURANT FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net Present Value (NPV) is a vital metric within a deli restaurant financial planning model, representing the current worth of future cash flows discounted back to today. This key figure answers questions like, “What is today’s value of $1 received years later?” By aggregating discounted cash inflows over multiple periods, NPV provides an accurate assessment of your deli restaurant’s long-term profitability and investment potential, empowering informed decisions within your revenue projection, cash flow, and investment analysis models.

Cash Flow Forecast Excel

The deli restaurant cash flow model is a crucial component of your startup financial planning model, designed to track and analyze cash inflows and outflows accurately. This 5-year cash flow projection template incorporates key inputs like payables, receivables, working capital, and long-term debt to forecast net cash flow and cash balances. Ideal for budget forecasting and financial performance analysis, this model empowers deli owners to manage cash effectively, ensuring liquidity and supporting funding requirements. Optimize your deli restaurant’s financial health with this comprehensive, easy-to-use cash flow management tool.

KPI Benchmarks

This deli restaurant financial planning model features a dedicated tab for comprehensive financial benchmarking. It conducts an in-depth financial performance analysis, comparing your deli’s key metrics against industry standards. Utilizing this deli restaurant financial dashboard model empowers you to evaluate competitiveness, operational efficiency, and productivity accurately. This insight drives informed decisions, optimizing your deli’s budget forecasting, revenue projection, and profit margin strategies for sustained growth and success.

P&L Statement Excel

The deli restaurant budget forecasting model enables precise income statement preparation, streamlining profit and loss projections. Custom-built to analyze key financial health indicators, this pro forma model supports accurate revenue projections and cost analysis. With clear insights into profitability, the deli restaurant financial planning model empowers informed decision-making and strategic growth.

Pro Forma Balance Sheet Template Excel

Comparing the deli restaurant startup financial model’s projected balance sheet with the projected income statement model accurately identifies the investment required to sustain forecasted sales and profitability. This integrated approach, combining the deli restaurant profit margin model and cost analysis model, is essential for precise budget forecasting and informed decision-making. Leveraging these financial planning models ensures a comprehensive view of the deli restaurant’s future financial health, enabling strategic capital allocation and robust cash flow management for sustained growth and success.

DELI RESTAURANT FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive deli restaurant financial planning model in Excel includes a robust valuation report template, enabling users to effortlessly perform Discounted Cash Flow (DCF) analysis. Simply input key Cost of Capital rates to generate precise revenue projections, profit margin insights, and cash flow forecasts. Ideal for budgeting, cost analysis, and investment assessments, this model streamlines financial performance tracking and strategic decision-making for deli restaurant startups and established businesses alike.

Cap Table

A comprehensive deli restaurant financial planning model includes a pro forma cap table that tracks multiple funding rounds, offering clear insights into ownership stakes and equity dilution. This essential tool integrates equity shares, preferred shares, employee stock options, convertible bonds, and more, empowering stakeholders to make informed decisions. By incorporating this cap table within your deli restaurant’s startup financial model, you enhance accuracy in budget forecasting, investment analysis, and funding requirement planning—ensuring a robust financial foundation for growth and profitability.

DELI RESTAURANT BUSINESS REVENUE MODEL TEMPLATE ADVANTAGES

Optimize startup costs and operations confidently with a comprehensive deli restaurant financial planning model.

The deli restaurant financial planning model proactively identifies potential challenges, ensuring timely solutions and sustained profitability.

Start a new deli restaurant confidently with a financial model that ensures precise budgeting and profit forecasting.

The deli restaurant financial planning model empowers precise budgeting, boosting profitability and strategic growth confidently.

Maximize your deli’s success with a comprehensive financial model for precise forecasting and profitable growth.

DELI RESTAURANT FINANCIAL MODEL STARTUP ADVANTAGES

The deli restaurant cash flow model empowers you to efficiently manage surplus cash and optimize financial stability.

The deli restaurant cash flow model empowers managers to strategically plan surplus cash for growth and debt management.

Our deli restaurant financial planning model saves you time by streamlining budget forecasting and profit margin analysis efficiently.

The deli restaurant cash flow model streamlines finances, boosting focus on growth, customers, and product excellence.

Our deli restaurant financial dashboard model offers clear, graphical visualization for streamlined budgeting, forecasting, and performance analysis.

The deli restaurant financial dashboard model enables instant, seamless access to all essential reports and projections in one place.

The deli restaurant financial planning model empowers precise budgeting and profit optimization for sustainable business growth.

The deli restaurant financial planning model enables dynamic input adjustments to optimize forecasts from launch through ongoing operations.

Our deli restaurant financial planning model simplifies budgeting, boosting accuracy and empowering smarter business decisions.

Deli restaurant financial models simplify budgeting and forecasting—no formulas, formatting, or costly consultants needed!