Delivery Service Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Delivery Service Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Delivery Service Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DELIVERY SERVICE FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year delivery service financial plan modeling template is designed for businesses of any size or development stage, requiring minimal financial planning experience and basic Excel skills. It provides a robust delivery startup financial assumptions framework, enabling users to create accurate courier service budget forecasts, last mile delivery revenue models, and parcel delivery cost analysis. Perfect for securing funding from banks, angel investors, grants, and VC funds, this fully unlocked financial tool allows complete customization of delivery logistics financial metrics, delivery operation financial dashboards, and delivery service break-even analysis to ensure reliable and insightful business projections.

This ready-made delivery service financial plan modeling Excel template alleviates common pain points by offering a comprehensive and user-friendly solution for logistics company financial projections and courier service budget forecast needs, streamlining parcel delivery cost analysis and last mile delivery revenue model calculations. It incorporates a detailed delivery business cash flow model alongside a delivery operation financial dashboard that simplifies tracking shipment service expense breakdowns and fleet management financial forecasts. Through automated delivery service break even analysis, express delivery pricing strategy integration, and on demand delivery financial templates, users can effortlessly generate accurate package delivery income statements and delivery logistics financial metrics. This model also supports delivery startup financial assumptions and delivery route profitability models, reducing the complexity of e-commerce delivery financial forecasts and enabling seamless courier service funding plans and delivery service investment analyses, ultimately empowering transportation service profit model optimization without requiring advanced financial expertise.

Description

Our comprehensive delivery service financial plan modeling tool offers detailed logistics company financial projections, including a courier service budget forecast and last mile delivery revenue model, enabling precise parcel delivery cost analysis and delivery startup financial assumptions assessment. It integrates a transportation service profit model and delivery business cash flow model to optimize fleet management financial forecasts and implement an express delivery pricing strategy tailored for on demand delivery financial templates. By providing shipment service expense breakdown, delivery operation financial dashboard, and delivery service break even analysis, the model supports package delivery income statement preparation and delivery logistics financial metrics tracking. This versatile framework facilitates e-commerce delivery financial forecasts, delivery service investment analysis, delivery route profitability model evaluation, and courier service funding plan development, ensuring seamless and informed decision-making for delivery enterprises.

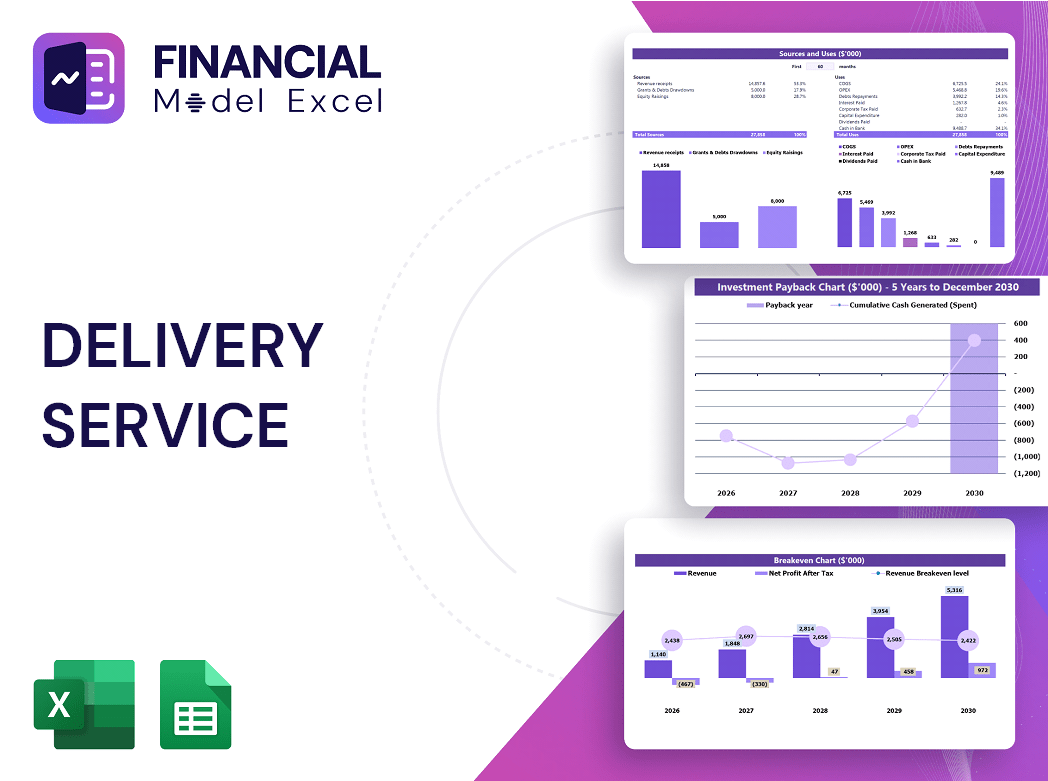

DELIVERY SERVICE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover a versatile and user-friendly delivery service financial plan modeling template designed to elevate your logistics company’s financial projections. This powerful Excel-based tool provides comprehensive courier service budget forecasts, delivery business cash flow models, and last mile delivery revenue models. Whether you're refining your delivery startup financial assumptions or analyzing parcel delivery costs, this template adapts effortlessly to your needs. Perfect for developing transportation service profit models, delivery route profitability analyses, and express delivery pricing strategies, it empowers you to make data-driven decisions and maximize profitability with ease.

Dashboard

Access to a comprehensive delivery operation financial dashboard, featuring detailed parcel delivery cost analysis and delivery business cash flow models, is essential. Utilizing Excel-based logistics company financial projections and delivery service break even analysis enables clear visualization of your courier service budget forecast and shipment service expense breakdown. This empowers you to effectively share critical insights with stakeholders, supporting informed decisions and driving growth through data-driven delivery service investment analysis and delivery route profitability models.

Business Financial Statements

This delivery service financial plan template offers comprehensive tools for logistics companies, including customizable budget forecasts, cash flow models, and income statements. With built-in shipment service expense breakdowns and delivery route profitability models, it streamlines your courier service funding plan. Advanced visualization features transform complex data into clear charts and dashboards, perfect for investor presentations. Ideal for last mile delivery revenue modeling and express delivery pricing strategies, this template empowers delivery startups to confidently perform break-even analyses and financial projections, ensuring informed, data-driven decisions that fuel growth and profitability.

Sources And Uses Statement

The Sources and Uses of Funds statement is a vital component in delivery service financial plan modeling. Essential for both startups and established logistics companies, it streamlines courier service budget forecasts and delivery startup financial assumptions. Banks and investors rely on this document during loan applications and funding reviews, as it clearly outlines the delivery business cash flow model and investment strategies. Incorporating this statement into your delivery operation financial dashboard enhances transparency, showcasing precise parcel delivery cost analysis and delivery route profitability models critical for successful transportation service profit modeling and sustainable growth.

Break Even Point In Sales Dollars

The break-even analysis within your delivery service financial plan modeling identifies the sales volume needed to cover all fixed and variable costs, ensuring zero profit or loss. Once revenues exceed this point, your logistics company financial projections shift to profitability. Our delivery operation financial dashboard includes a dynamic break-even chart, illustrating the minimum service sales required to cover expenses. This CVP graph empowers investors to assess the necessary sales volume and timeline for ROI, enhancing the delivery startup financial assumptions and investment analysis with clear, actionable insights.

Top Revenue

This delivery service financial plan model features a dedicated tab for in-depth revenue analysis, breaking down income streams by product and service. Designed to support logistics company financial projections and delivery startup financial assumptions, it offers clear insights into delivery business cash flow models and last mile delivery revenue models. This comprehensive approach enables precise delivery operation financial dashboard reporting, facilitating strategic decision-making for profitability and growth.

Business Top Expenses Spreadsheet

The Top Expenses tab in our delivery startup financial template empowers users to efficiently organize and analyze key costs. Expenses are categorized into four primary segments plus an adjustable 'Other' category, enabling tailored input that aligns with your logistics company financial projections. This flexible structure supports comprehensive parcel delivery cost analysis and enhances delivery service break even analysis—essential for precise delivery business cash flow modeling and informed decision-making.

DELIVERY SERVICE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our delivery service financial plan modeling template offers a robust cost budget creation methodology, enabling detailed parcel delivery cost analysis and logistics company financial projections up to 60 months ahead. Expenses are precisely categorized—COGS, variable/fixed costs, wages, and CAPEX—streamlining your delivery operation financial dashboard. With built-in forecasting curves, you can customize expense growth based on revenue percentages or fixed rates, perfectly suited for courier service budgets or last mile delivery revenue models. This user-friendly tool automates accounting treatments, ensuring accurate delivery business cash flow model and shipment service expense breakdown for smart, strategic decision-making.

CAPEX Spending

The Top Revenue tab in this delivery service financial model expertly consolidates and presents key revenue metrics for each product or service offering. It provides a clear, annual summary of your revenue streams, incorporating detailed revenue depth and bridge analyses. This insight supports precise delivery startup financial assumptions, enhances your delivery business cash flow model, and informs your delivery logistics financial metrics, boosting strategic planning and growth forecasts.

Loan Financing Calculator

Start-ups and growing delivery businesses must meticulously manage their loan payback schedules within their financial forecasts. A detailed breakdown of loan amounts, maturity terms, and interest expenses is essential for accurate delivery service cash flow models. Interest costs directly impact cash flow projections, while principal repayments influence financing activities in the delivery business cash flow model. Integrating this data into delivery logistics financial metrics ensures precise balance sheet forecasts, supporting robust delivery startup financial assumptions and enabling informed investment and funding decisions. Effective loan management is key to sustaining profitability in courier service budget forecasts and transportation service profit models.

DELIVERY SERVICE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on equity (ROE) is a key delivery service financial metric derived from both the balance sheet forecast and profit and loss statement. It quantifies how effectively a logistics company generates profits from shareholder equity, highlighting the efficiency of capital utilization. Incorporating ROE analysis within your delivery business cash flow model or courier service budget forecast provides valuable insights for delivery service investment analysis, enabling better financial planning and strategic decision-making.

Cash Flow Forecast Excel

A comprehensive delivery business cash flow model is essential for accurate financial planning. This template integrates operating, investing, and financing cash flows, forming a vital component of a logistics company financial projections. By aligning with the balance sheet forecast, it ensures cohesive delivery operation financial dashboard metrics. Effective use of this parcel delivery cost analysis tool supports robust last mile delivery revenue models and delivery service break even analysis—crucial for delivery startup financial assumptions and investment decisions. Harnessing this cash flow budget forecast empowers transportation service profit modeling and strengthens express delivery pricing strategies for sustainable growth.

KPI Benchmarks

A comprehensive five-year delivery service financial plan integrates key performance indicators with industry-wide benchmarks to provide insightful financial projections. This benchmarking, vital for logistics company financial modeling and delivery startup financial assumptions, enables businesses to compare their package delivery income statement and delivery operation financial dashboard against established standards. Leveraging industry averages supports strategic management by identifying best practices and optimizing the delivery business cash flow model, fostering improved profitability and informed decision-making within courier service budget forecasts and delivery route profitability models.

P&L Statement Excel

Regularly updating your delivery service financial plan modeling, including monthly delivery business cash flow models and courier service budget forecasts, is essential to maximize profitability. Leveraging projected P&L forecasts and delivery logistics financial metrics helps entrepreneurs gain clear insights into costs, revenues, and profit margins. A comprehensive projected profit and loss statement template empowers transportation and last mile delivery startups to plan performance, evaluate financial health, and optimize investment strategies. This data-driven approach enables precise expense breakdowns, revenue modeling, and break-even analysis—key components for sustained growth and strategic decision-making in logistics companies.

Pro Forma Balance Sheet Template Excel

Our delivery service financial plan modeling includes a comprehensive balance sheet proforma, tailored for startups in logistics and courier services. This financial template offers clear insights into assets, liabilities, and equity, enabling stakeholders to assess the company’s financial position accurately. By linking revenue growth from last mile delivery or express delivery pricing strategies to the income statement and cash flow models, it highlights how operational changes impact overall financial health. Perfect for crafting logistics company financial projections, this tool supports delivery business cash flow analysis, expense breakdowns, and profitability modeling to drive informed investment and funding decisions.

DELIVERY SERVICE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This delivery service financial plan template offers two integrated valuation methods, allowing you to perform either a discounted cash flow (DCF) or weighted average cost of capital (WACC) analysis. Designed for logistics companies and courier services, it enables precise financial projections and robust delivery business cash flow modeling. Ideal for delivery startups, this tool supports comprehensive delivery operation financial dashboards and facilitates insightful break-even analysis, ensuring accurate delivery route profitability models and confident investment decisions. Streamline your shipment service expense breakdown and optimize your express delivery pricing strategy with this versatile financial forecasting solution.

Cap Table

Our cap table Excel serves as a dynamic tool for accurately allocating a delivery startup’s financial assets over time. It provides crucial insights into delivery service financial assumptions and investment analysis, helping stakeholders visualize potential returns. By integrating with your logistics company financial projections and delivery business cash flow model, it empowers informed decision-making and strategic planning, making it an indispensable asset for investors seeking clarity on profitability and growth.

DELIVERY SERVICE FINANCIAL MODEL TEMPLATE FOR STARTUP ADVANTAGES

Optimize growth and profitability using the delivery service financial model’s precise 5-year cash flow projections.

Boost sales confidently using a delivery service financial model for precise forecasting and strategic decision-making.

Optimize asset acquisition confidently using the delivery service financial model pro forma template for precise financial projections.

Our delivery startup financial model ensures accurate projections, optimizing budgets and accelerating profitable growth.

Maximize funding accuracy using our delivery service financial model with a 3-year projection template in Excel.

DELIVERY SERVICE FINANCIAL PROJECTIONS SPREADSHEET ADVANTAGES

Optimize cash flow and enhance growth by using our delivery service financial model to expertly manage accounts receivable.

Our delivery business cash flow model reveals late payments’ impact, enhancing proactive financial and operational decision-making.

Our simple-to-use delivery service financial model ensures accurate forecasts, maximizing profitability and informed decision-making.

This delivery service financial model delivers fast, reliable insights with minimal Excel skills, ideal for any business stage.

Optimize profits and reduce costs with our delivery business cash flow model—great value for money guaranteed.

Unlock accurate delivery operation financial forecasts with our proven, affordable Excel model—no hidden fees, one-time payment.

Run different scenarios with our delivery service financial model to optimize profits and drive strategic growth confidently.

Our delivery business cash flow model enables dynamic scenario testing to optimize financial decisions and predict cash impacts precisely.

Get a robust delivery service financial model that drives precise forecasts and maximizes your logistics profit potential.

This robust delivery service financial model empowers precise profit forecasting and customizable insights for strategic business growth.