Digital Banking Platforms Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Digital Banking Platforms Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Digital Banking Platforms Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DIGITAL BANKING PLATFORMS FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year financial model template for digital banking platforms integrates a robust digital banking revenue model and expense modeling for digital banking platforms, featuring prebuilt consolidated forecasted profit and loss statements, balance sheets, and digital banking cash flow models. It includes key financial metrics for digital banking and financial performance indicators digital banks rely on to conduct revenue streams in digital banking analysis, financial forecasting for digital banks, and break-even analysis digital banking platform evaluations. Perfect for startups aiming to refine their digital banking business model financials, optimize digital banking cost structure analysis, and enhance digital banking budgeting techniques, this unlocked template facilitates investment analysis for digital banks and supports digital banking valuation models critical for securing funding from banks or investors.

This ready-made financial model Excel template alleviates the challenge of creating accurate digital banking revenue models and financial projections for online banks by offering a fully integrated 3-statement framework that supports detailed financial forecasting for digital banks up to five years. It simplifies complex expense modeling for digital banking platforms and streamlines the analysis of digital banking cost structure, ensuring precise break-even analysis and profit margin analysis tailored to the unique operational cost modeling needs of digital banks. The model enhances digital banking budgeting techniques and investment analysis for digital banks by providing monthly and annual views of cash flow, enabling robust digital banking cash flow modeling that helps identify key financial metrics for digital banking and financial performance indicators. This comprehensive solution addresses the pain points of tracking revenue streams in digital banking, managing subscription revenue models, and conducting digital banking valuation models, allowing users to confidently perform financial planning with reliable financial projections and digital platform financial risk assessment tools that reflect real-world monthly cycles.

Description

This comprehensive digital banking financial model serves as a robust tool for financial forecasting for digital banks, incorporating a detailed digital banking business model financials framework that enables accurate financial projections for online banks over a five-year horizon. By integrating key financial metrics for digital banking, including revenue streams in digital banking, expense modeling for digital banking platforms, and break-even analysis digital banking platform, it provides a thorough digital banking cost structure analysis and profit margin analysis digital banks. The model facilitates investment analysis for digital banks and operational cost modeling, while embedding digital banking budgeting techniques and financial performance indicators digital banks to ensure meticulous financial planning and cash flow management. With built-in subscription revenue model options and customizable input assumptions, this model simplifies digital banking valuation models and digital platform financial risk assessment, delivering actionable insights for management and investors regardless of prior financial expertise.

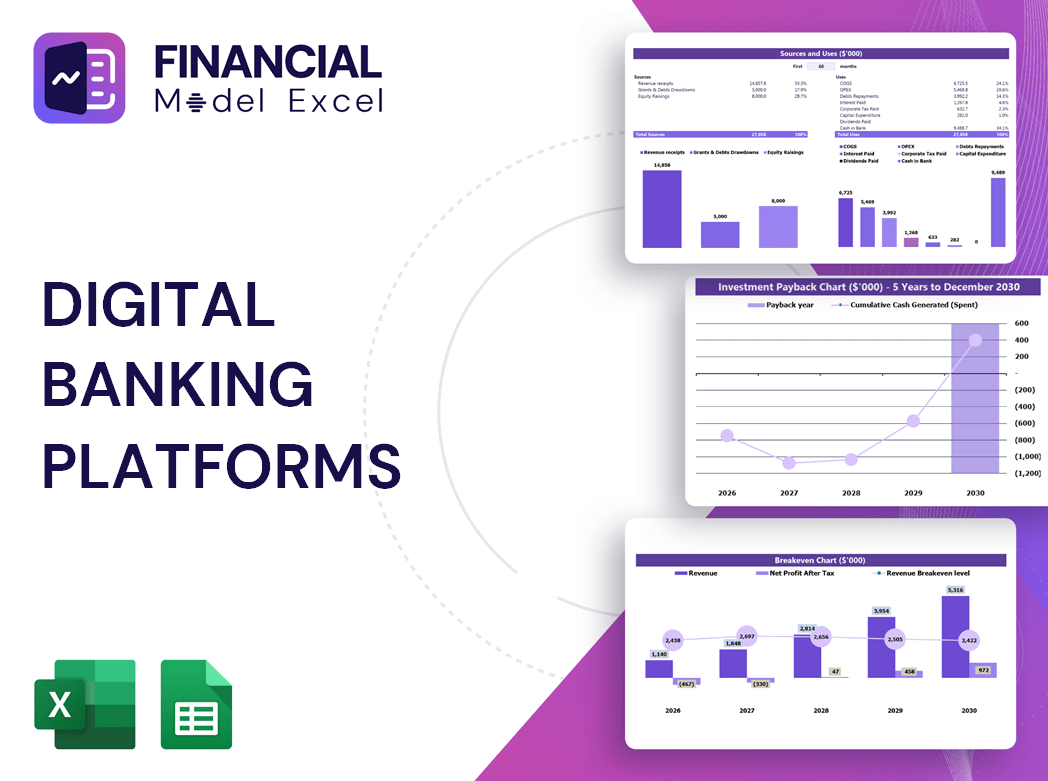

DIGITAL BANKING PLATFORMS FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive digital banking financial model offers a 5-year cash flow projection tailored for startups and established institutions. It integrates essential proformas including P&L templates, balance sheets, and detailed cash flow forecasts. Designed to enhance financial planning, it features monthly and annual business summaries alongside in-depth performance review reports. Ideal for financial forecasting, expense modeling, and profitability analysis, this tool supports effective budgeting and investment analysis within digital banking platforms. Elevate your revenue streams and operational cost management with key financial metrics and break-even analysis embedded in our robust digital banking business model financials.

Dashboard

The all-in-one dashboard in this digital banking financial model integrates key financial inputs and core start-up metrics essential for comprehensive financial forecasting and performance analysis. It consolidates data from the balance sheet, pro forma income statement, and digital banking cash flow model, enabling precise evaluation of revenue streams, expense modeling, and profitability metrics. Users can effortlessly visualize financial performance indicators and break-even analysis through intuitive graphs and charts, empowering informed decision-making and strategic financial planning for online banks and digital banking platforms.

Business Financial Statements

Our financial planning startup delivers a comprehensive digital banking financial model, integrating key financial statements—pro forma balance sheets, profit and loss projections, and cash flow forecasts—into a unified report. Leveraging advanced digital banking cost structure analysis and revenue streams insights, our tool streamlines financial forecasting for digital banks. Expertly crafted for your pitch deck, it offers robust financial projections, expense modeling, and break-even analysis, empowering your digital banking business model with precise budgeting techniques and investment analysis to maximize profitability and growth.

Sources And Uses Statement

The source and use of funds statement, integral to digital banking financial planning tools, offers a clear snapshot of funding sources and their allocation. Balanced to ensure sources equal uses, this document is essential for digital banks during recapitalization, restructuring, or M&A processes. Accurate expense modeling for digital banking platforms and investment analysis hinges on this statement, supporting effective financial forecasting and profitability modeling. Leveraging this tool enhances decision-making and aligns with key financial metrics for digital banking, ensuring strong financial performance indicators and robust digital banking business model financials.

Break Even Point In Sales Dollars

A break-even analysis within digital banking platforms requires a thorough revenue and sales evaluation. Distinguishing between sales, revenue streams in digital banking, and profit is critical for accurate financial forecasting for digital banks. Revenue represents total income generated, while profit reflects earnings after deducting all fixed and variable expenses. Leveraging digital banking financial planning tools and cost structure analysis ensures precise break-even calculations, empowering online banks to optimize their digital banking revenue model and enhance profitability through informed expense modeling and investment analysis.

Top Revenue

Our business plan forecast template features a dedicated tab to conduct in-depth revenue streams analysis tailored to your digital banking business model financials. Users can dissect revenue streams by product or service, enabling precise financial projections for online banks. This tool supports digital banking revenue model optimization and enhances financial forecasting for digital banks, empowering informed decision-making through key financial metrics for digital banking and profit margin analysis. Elevate your strategic planning with clear insights into your digital bank profitability model and revenue streams in digital banking.

Business Top Expenses Spreadsheet

Our five-year financial projection template Excel offers an efficient solution for tracking digital banking operational cost modeling and expense management. It features four detailed sections plus an “Other” category, allowing users to input additional costs. This tool supports comprehensive financial forecasting for digital banks by clearly illustrating changes in expenses and revenue streams over time. Incorporate this template to enhance your digital banking business model financials, streamline expense modeling for digital platforms, and drive more accurate break-even analysis and profitability models for sustainable growth.

DIGITAL BANKING PLATFORMS FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive digital banking financial model is essential for accurate financial forecasting and expense modeling. It enables startups to analyze revenue streams in digital banking while assessing operational cost structures and profit margin analysis. Utilizing such tools facilitates break-even analysis and investment analysis for digital banks, highlighting key financial metrics and potential risks. Effective budgeting techniques within the model support funding strategies, enhancing financial projections for online banks and overall business performance. This approach ensures informed decision-making, driving digital bank profitability and sustainable growth.

CAPEX Spending

The capital expenditure forecast is a crucial component of the digital banking financial model, detailing investments needed to maintain and scale platform growth. Excluding headcount and operational costs, this analysis highlights optimal asset allocation by assessing value contribution. Since capex varies across business types, incorporating this expense modeling into your digital banking business model financials ensures accurate financial forecasting and informed investment decisions, ultimately enhancing profitability and sustainable growth.

Loan Financing Calculator

Effective financial forecasting for digital banks demands meticulous monitoring of loan portfolios, repayment schedules, and use of proceeds. Employing advanced digital banking financial planning tools with detailed line-by-line breakdowns of outstanding amounts, maturity dates, and covenants ensures accurate expense modeling for digital banking platforms. Integrating loan repayment schedules—which distinctly outline interest and principal milestones—directly influences the digital banking cash flow model and key financial metrics. Clear linkage of closing debt balances to balance sheets and cash flow statements enhances transparency, enabling precise assessment of financial obligations within revenue streams in digital banking and supporting robust digital bank profitability models.

DIGITAL BANKING PLATFORMS FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The growth of net income is a crucial financial performance indicator for digital banks, reflecting effective expense modeling and revenue streams management. Utilizing a comprehensive digital banking financial model or financial projections template enables entrepreneurs to track this growth accurately. Net income expansion signifies rising sales, prudent cost control, and improved profitability, key elements within the digital banking profitability model. By leveraging financial forecasting for digital banks and break-even analysis, stakeholders can confidently assess their platform’s development and long-term viability in a competitive market.

Cash Flow Forecast Excel

The digital banking cash flow model is essential among key financial metrics for digital banking, ensuring sufficient cash inflows to cover operational costs such as staff salaries and overheads. This financial projection highlights accumulated cash reserves, enabling accurate break-even analysis for digital banking platforms. By leveraging digital banking financial planning tools and expense modeling for digital banking platforms, institutions can assess financial performance indicators for digital banks and avoid unnecessary financing. Integrating these insights supports a robust digital banking business model financials framework and strengthens investment analysis for digital banks.

KPI Benchmarks

A comprehensive digital banking financial model leverages key financial metrics and performance indicators to evaluate a platform’s profitability and operational efficiency. By conducting detailed digital banking cost structure analysis and break-even analysis, startups can make informed strategic decisions. Comparative benchmarking highlights average and relative values, guiding financial forecasting for digital banks and revenue streams optimization. This rigorous approach to expense modeling and cash flow projections empowers leaders to implement effective budgeting techniques and investment analysis, driving sustainable growth and maximizing profit margins within the digital banking business model financials.

P&L Statement Excel

This expertly crafted pro forma income statement template empowers you to master financial forecasting for digital banks without needing advanced expertise. With user-friendly Excel design, even basic computer skills suffice to navigate it. Gain comprehensive insights into revenue streams, expense modeling, and profit margin analysis, enabling strategic decisions to boost digital banking profitability. Leverage this tool for accurate financial projections and enhanced business model financials, driving improved performance and sustainable growth.

Pro Forma Balance Sheet Template Excel

We incorporate the projected balance sheet into our digital banking financial planning tools because it’s essential for comprehensive financial forecasting. This report highlights current and long-term assets, liabilities, and equity—critical components for accurate digital banking cost structure analysis and investment analysis. Utilizing the balance sheet template empowers businesses to calculate key financial metrics for digital banking, enabling precise profit margin analysis and informed decision-making within revenue streams in digital banking.

DIGITAL BANKING PLATFORMS FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive digital banking cash flow model provides a detailed investment analysis, accurately forecasting your potential returns. By integrating revenue streams in digital banking with expense modeling for digital banking platforms, we factor in all costs and revenues alongside precise cash flow timing. This robust financial projection for online banks supports informed decision-making, highlighting key financial metrics for digital banking and ensuring a clear view of profitability. With this tool, you gain critical insight into digital banking revenue models and operational cost structures, empowering strategic financial planning and maximizing investment value.

Cap Table

The pro forma cap table, integrated within an Excel pro forma template, is an essential financial planning tool for start-ups and early-stage digital banks. It provides a detailed breakdown of securities, investor ownership, valuation, and dilution over time. This asset supports accurate financial forecasting for digital banks, enhancing investment analysis and facilitating strategic decision-making. By leveraging such tools, digital banking ventures can optimize their digital banking revenue model and improve financial performance indicators, ensuring a robust foundation for sustainable growth and profitability.

DIGITAL BANKING PLATFORMS FINANCIAL MODEL IN EXCEL TEMPLATE ADVANTAGES

Accurately forecast all three financial statements using our digital banking financial model for confident, data-driven decisions.

The digital banking financial model ensures precise forecasting, enhancing profitability and preventing costly misunderstandings.

Unlock precise cash flow insights with our digital banking financial model for optimized revenue and cost management.

Plan confidently and bridge cash gaps efficiently with our advanced digital banking platform financial model in Excel.

Attract investors confidently using a comprehensive digital banking financial model for accurate revenue and cost forecasting.

DIGITAL BANKING PLATFORMS FINANCIAL MODEL STARTUP ADVANTAGES

The digital banking revenue model optimizes profitability through precise financial forecasting and expense modeling.

A clear digital banking financial model enables efficient hypothesis testing and enhances strategic decision-making accuracy.

Integrated digital banking financial models empower investors with clear insights into profitability and sustainable revenue streams.

Our digital banking financial model integrates all elements, delivering clear, investor-ready insights that drive confident decision-making.

Get a robust digital banking revenue model that drives accurate forecasting and maximizes profitability with scalable financial insights.

This robust financial model empowers precise digital banking revenue forecasting and profitability analysis for strategic growth planning.

Our digital banking profitability model empowers startups with accurate financial forecasting and optimized revenue streams for growth.

Our financial model highlights profitability and growth potential, empowering clear digital banking investment decisions.

Unlock precise growth insights with our digital banking revenue model for smarter, data-driven financial planning and profitability.

Unlock accurate financial projections and profitability insights with this user-friendly yet sophisticated digital banking revenue model.