Digital Mortgage Lending Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Digital Mortgage Lending Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Digital Mortgage Lending Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DIGITAL MORTGAGE LENDING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Creates a comprehensive 5-year digital mortgage lending financial model featuring detailed financial projections, including projected profit and loss templates, financial statements, and key financial KPIs in both GAAP and IFRS formats. This financial model supports robust financial forecasting for digital mortgage lending, incorporating cost analysis, cash flow modeling, and mortgage lending expense forecasting to optimize budgeting and enhance the digital mortgage lending profitability model. The fully editable feasibility study template enables thorough investment analysis digital mortgage lending, risk assessment, and valuation modeling to effectively evaluate your startup idea and plan startup costs with precision.

This ready-made digital mortgage lending financial model template serves as a comprehensive pain reliever by simplifying complex financial forecasting for digital mortgage lending, allowing users to effortlessly conduct cost analysis, revenue modeling, and break-even analysis within one integrated tool. With built-in mortgage lending business model financials and financial KPI tracking, it enables efficient budget planning, cash flow modeling, and expense forecasting, minimizing the time-intensive process of mortgage lending financial scenario modeling. The model’s clear visualization through colorful charts and executive summaries enhances investment analysis and risk assessment in digital mortgage lending, empowering users to optimize costs, refine profitability models, and produce accurate financial projections that save effort while improving decision-making confidence for startups and investors alike.

Description

The digital mortgage lending financial model development offers an integrated framework for financial forecasting, combining revenue modeling with in-depth cost analysis to deliver precise financial projections in mortgage lending. This model includes comprehensive mortgage lending business model financials, encompassing expense forecasting, break-even analysis, and cash flow modeling for mortgage lending operations. By incorporating risk assessment in digital mortgage lending and investment analysis digital mortgage lending components, it provides valuable insights into profitability and financial KPIs for digital mortgage lending, facilitating effective budget planning and digital mortgage lending cost optimization. Utilizing a bottom-up approach, the model derives revenues through pricing strategies, while detailed digital mortgage loan underwriting financials ensure accuracy in profit and loss statement templates and cash flow forecasting tools. This mortgage lending financial scenario modeling and valuation model for digital mortgage lending enable stakeholders to gauge the business’s true worth through discounted cash flow methods, enhancing decision-making and securing long-term financial success.

DIGITAL MORTGAGE LENDING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This modular digital mortgage lending financial model delivers comprehensive financial projections, integrating accounting statements, operating costs, cap table, and startup valuation tools. Designed for flexibility, it supports detailed financial forecasting, revenue modeling, and break-even analysis tailored to mortgage lending. Easily editable with unlocked cells and formulas, it empowers accurate cash flow modeling, expense forecasting, and risk assessment. Ideal for investment analysis and budget planning, this template streamlines cost optimization and delivers clear financial KPIs, ensuring adaptable, precise scenario modeling for your digital mortgage lending business.

Dashboard

Our digital mortgage lending financial model template features an intuitive dashboard that consolidates key financial metrics and KPIs for streamlined decision-making. With embedded calculations for revenue modeling, cost analysis, cash flow forecasting, and risk assessment, it simplifies financial projections and scenario modeling. Effortlessly track expenses, optimize budgeting, and evaluate profitability to drive strategic growth. This comprehensive tool empowers mortgage lending professionals to confidently monitor performance, conduct break-even analysis, and enhance investment insights—accelerating success in the evolving digital mortgage lending landscape.

Business Financial Statements

Our advanced digital mortgage lending financial model streamlines your financial forecasting and cash flow modeling. Simply update your key assumptions, and the model automatically generates comprehensive business financial reports—including revenue models, cost analysis, and profitability projections. Designed for precision in mortgage lending expense forecasting and risk assessment, this tool supports strategic decision-making with dynamic financial KPI tracking and break-even analysis. Optimize your budget planning and investment analysis effortlessly using our professional mortgage lending business model financials, empowering you to maximize profitability and operational efficiency with ease.

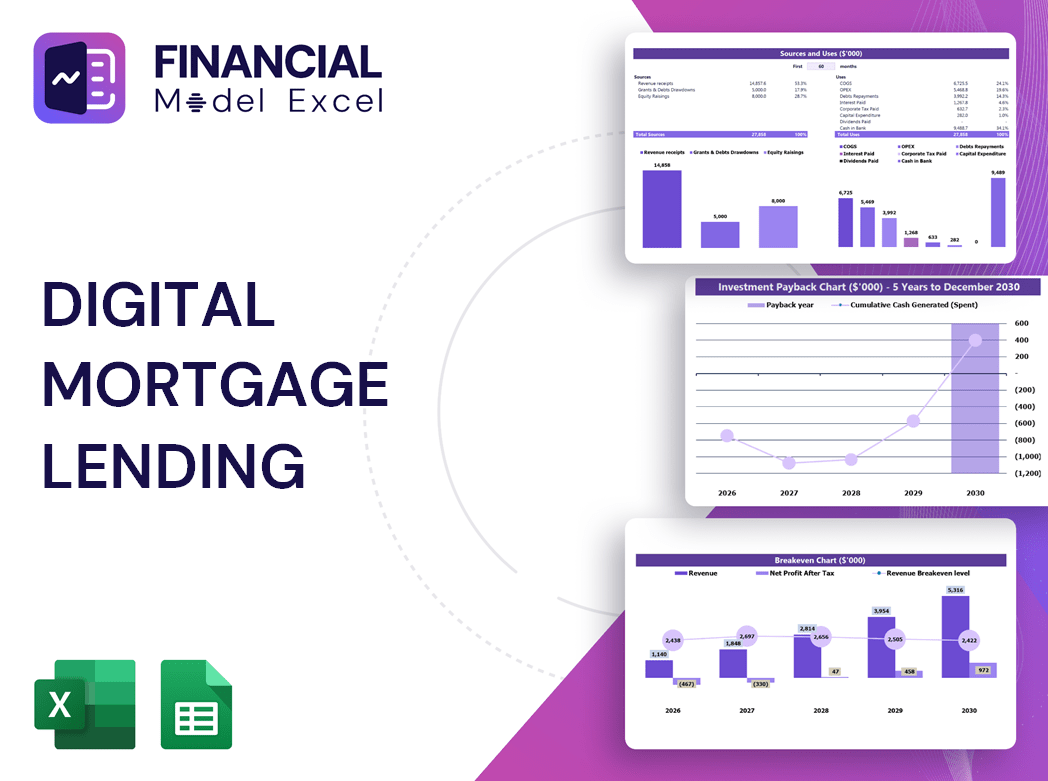

Sources And Uses Statement

The sources and uses statement within this digital mortgage lending financial model template clearly outlines the origin of funds and their strategic allocation. This essential component supports accurate financial forecasting, cost analysis, and investment analysis, enabling stakeholders to evaluate profitability and optimize expenses. By integrating detailed cash flow modeling and risk assessment, the model provides robust financial projections and KPIs to drive informed decision-making and enhance the mortgage lending business model’s sustainability and growth.

Break Even Point In Sales Dollars

Understanding your break-even analysis in digital mortgage lending empowers informed decision-making and stakeholder confidence. This financial model pinpoints the minimum revenue needed to cover expenses, revealing your business model's viability. With detailed financial projections and cost analysis, you can identify opportunities for digital mortgage lending cost optimization and profit enhancement. Additionally, the break-even calculator forecasts when investments will be recovered, crucial for managing stakeholder expectations. Utilizing this structured financial forecasting and revenue modeling supports strategic planning, risk assessment, and ensures sustainable growth in your digital mortgage lending venture.

Top Revenue

Effective financial forecasting for digital mortgage lending is crucial for sustainable growth and profitability. Accurate revenue modeling and cost analysis form the backbone of a robust digital mortgage lending financial model, directly influencing investment analysis and valuation. Utilizing comprehensive mortgage lending business model financials and KPI tracking enables precise cash flow modeling and expense forecasting. These insights empower management to optimize budgets, assess risks, and implement cost optimization strategies. Leveraging detailed pro forma templates with well-founded assumptions ensures reliable financial projections, driving confident decision-making and enhancing the digital mortgage lending revenue model's long-term success.

Business Top Expenses Spreadsheet

In the Top Expenses section of our pro forma financial model template, key cost categories for digital mortgage lending are clearly outlined, with a dedicated "Other" category for customizable expenses vital to your business. This flexible approach supports comprehensive cost analysis and digital mortgage lending budget planning. Utilize our five-year financial forecasting tool to monitor your mortgage lending financials and track profitability trends over time, empowering strategic decision-making and precise financial KPI management.

DIGITAL MORTGAGE LENDING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive financial projections model for digital mortgage lending integrates expense forecasting with revenue and profitability analysis, enabling precise identification of critical business areas. Utilizing advanced financial model templates, including cost analysis and cash flow modeling, empowers strategic budget planning and risk assessment. Accurate financial KPI tracking and break-even analysis strengthen your mortgage lending business model financials, making your investment case compelling. This dynamic tool is essential for optimizing costs, enhancing financial scenario modeling, and securing investor confidence in your digital mortgage lending venture.

CAPEX Spending

Startup expenses are a critical metric in financial forecasting for digital mortgage lending. They enable analysts to accurately assess initial capital requirements and monitor investment progress. These costs directly impact the mortgage lending business model financials, influencing cash flow modeling and budget planning. Capital expenditures tied to startup activities are integral to projected financial statements, supporting effective cost analysis and investment analysis. Understanding and optimizing startup expenses is essential for building a robust digital mortgage lending profitability model and ensuring precise financial KPI tracking from the outset.

Loan Financing Calculator

Our digital mortgage lending financial model includes a dynamic loan amortization schedule template, designed to track loan repayments accurately per their terms. Integrated within our mortgage lending business model financials, this template features automated formulas to record each loan’s details, repayment dates, and frequencies—whether monthly, quarterly, or annually. This ensures precise financial forecasting, cash flow modeling, and expense forecasting, empowering your digital mortgage lending revenue model with reliable data for profitability analyses and risk assessment. Optimize your financial KPI and budget planning seamlessly with our versatile mortgage lending financial model templates.

DIGITAL MORTGAGE LENDING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Gross profit margin, featured in digital mortgage lending financial model templates, is a critical indicator of profitability. It’s calculated by dividing gross profit by net sales, offering clear insight into revenue efficiency. Utilizing this metric within financial forecasting and mortgage lending business model financials enables precise cost analysis and revenue optimization. By integrating gross profit margin into cash flow modeling and break-even analysis for digital mortgage lending, lenders can enhance financial projections and investment analysis, ultimately driving sustainable growth and profitability.

Cash Flow Forecast Excel

Present a concise overview of your annual financials and critical financial KPIs for digital mortgage lending. This comprehensive table seamlessly integrates financial forecasting, cost analysis, and profitability modeling, making it an essential tool for investment analysis and budget planning. Ideal for reports and pitches, it highlights cash flow modeling, expense forecasting, and break-even analysis to demonstrate robust mortgage lending business model financials. Elevate your financial scenario modeling and valuation with this ready-to-use template designed for digital mortgage lending success.

KPI Benchmarks

The benchmark tab in a financial model template evaluates a company’s performance by calculating and comparing key financial KPIs. Highlighting average values enables precise comparative analysis, essential for startups in digital mortgage lending. This process supports strategic management by guiding cost optimization, revenue modeling, and risk assessment. Thorough financial forecasting and scenario modeling ensure informed decisions, maximizing profitability and cash flow. Accurate tracking of these metrics empowers mortgage lending businesses to select effective strategies, optimize budgets, and forecast expenses confidently—paving the way for sustainable growth and long-term success in digital mortgage lending.

P&L Statement Excel

In digital mortgage lending, a robust financial forecasting and revenue model is essential to accurately assess profitability and drive strategic decisions. The income statement, as part of comprehensive mortgage lending business model financials, offers critical insights into bottom-line performance. Without detailed financial projections and cost analysis, companies risk operating blindly despite apparent growth. Utilizing advanced financial KPI tools, cash flow modeling, and expense forecasting ensures authenticity and clarity, empowering firms to optimize costs and enhance profitability in today’s competitive market.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet is a vital component of your digital mortgage lending financial model, detailing key assets—like property and equipment—alongside liabilities and equity at a specific point in time. For startups, projecting a clear balance sheet that highlights loan security within the assets section is essential. This financial snapshot supports investment analysis and enhances financial forecasting, enabling accurate assessment of risk and profitability in digital mortgage lending. By integrating this into your mortgage lending business model financials, you demonstrate strong financial discipline and build confidence with banks and stakeholders.

DIGITAL MORTGAGE LENDING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive digital mortgage lending financial model template designed for pre-revenue startups. It integrates detailed financial forecasting, including cash flow modeling and revenue projections, to present clear investment analysis. Key metrics like weighted average cost of capital (WACC) demonstrate the minimum required return for investors. Free cash flow valuation highlights available cash for stakeholders, while discounted cash flow offers an accurate assessment of future earnings in today’s terms. This model empowers you with essential financial KPIs and scenario planning to optimize cost structures and drive profitability in digital mortgage lending.

Cap Table

Our financial plan includes a comprehensive cap table template, detailing ownership stakes across key milestones. This tool offers clear visibility into equity distribution and provides investors with precise insights into potential returns at exit. Integrated with financial forecasting for digital mortgage lending, it supports strategic decision-making, ensuring alignment with revenue models and profitability goals. Designed to complement cash flow modeling and risk assessment frameworks, our cap table enhances transparency and bolsters investor confidence throughout your startup’s growth journey.

DIGITAL MORTGAGE LENDING FINANCIAL PLAN FOR BUSINESS PLAN ADVANTAGES

Optimize growth and accuracy by reassessing assumptions with a digital mortgage lending financial model and projections.

Streamline startup cost planning and ensure accuracy with our digital mortgage lending financial model’s 5-year cash flow projection template.

Run diverse scenarios effortlessly with our digital mortgage lending financial model Excel template for accurate, dynamic forecasting.

The digital mortgage lending financial model minimizes risk, ensuring confident investment and optimal opportunity assessment.

Empower your strategy with a digital mortgage lending financial model that enhances forecasting accuracy and maximizes profitability.

DIGITAL MORTGAGE LENDING BUSINESS PROJECTION TEMPLATE ADVANTAGES

Streamline decision-making with a convenient all-in-one dashboard for precise digital mortgage lending financial model development and forecasting.

Our digital mortgage lending financial model optimizes profits with comprehensive forecasts, KPIs, and customizable scenario analyses.

Optimize cash flow with our digital mortgage lending financial model for precise budget planning and cost control.

Optimize digital mortgage lending profitability with precise cash flow modeling, enabling proactive budgeting and financial forecasting.

Run different scenarios with our digital mortgage lending financial model to optimize profitability and reduce investment risks.

Financial forecasting for digital mortgage lending enables dynamic scenario analysis, optimizing cash flow and enhancing profitability decisions.

Save time and money with our digital mortgage lending financial model, optimizing costs and forecasting profitability accurately.

Digital mortgage lending financial models simplify startup projections, enabling effortless, accurate planning without complex formulas or costly consultants.

We optimize digital mortgage lending with precise financial models, enhancing profitability and informed investment decisions.

Streamline digital mortgage lending profitability with our ready-to-use financial model—no formulas, programming, or costly consultants needed.