Driving Instructor Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Driving Instructor Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Driving Instructor Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

DRIVING INSTRUCTOR FINANCIAL MODEL FOR STARTUP INFO

Highlights

Highly versatile and user-friendly driving instructor financial model designed for comprehensive financial planning for driving instructor services, including startup financial plans, cash flow analysis for driving instructor businesses, and detailed profit and loss models. This template supports driving school revenue projection financial models with monthly and annual timelines, offering driving instructor expense tracking models and break-even analysis to optimize budgeting and cost management. Ideal for startups or existing driving schools, it facilitates financial forecasting for driving instructors and helps prepare driving instructor business growth projections and financial KPI models, enabling entrepreneurs to confidently get funded by banks, angels, grants, and VC funds. Fully unlocked and editable to tailor driving instructor pricing strategy financial models and driving lesson profitability financial models to your unique needs.

This driving instructor financial model Excel template effectively addresses common pain points by providing a comprehensive driving instructor budget plan and expense tracking model that simplifies financial planning for driving instructor services, enabling precise cost management and budget allocation. Its built-in driving school revenue projection financial model and income forecast model allow users to perform detailed financial forecasting for driving instructors, while the cash flow analysis driving instructor business tool ensures smooth management of inflows and outflows to prevent liquidity issues. The integrated profit and loss model for driving instructors alongside break-even analysis helps identify the minimum performance level required for profitability, and advanced features like driving instructor pricing strategy financial model and tuition fee financial model support strategic decisions to maximize lesson profitability. Additionally, the template’s financial scenario analysis for driving instructors and business growth projections offer actionable insights for risk mitigation and scaling, making it an invaluable tool for startup financial plans and ongoing financial statement modeling, ultimately enhancing the driving instructor business valuation model accuracy.

Description

This driving instructor financial model offers a comprehensive framework for financial planning, incorporating essential elements such as a driving school revenue projection financial model, profit and loss model for driving instructors, and cash flow analysis driving instructor business tools. It features a detailed driving instructor budget plan alongside expense tracking and cost management models, enabling precise financial forecasting for driving instructors and informed decision-making. The model supports driving instructor income forecast modeling and pricing strategy development, while also delivering break-even analysis driving instructor financial model insights and financial KPI tracking to optimize profitability. Additionally, it includes startup financial planning, tuition fee financial modeling, and business growth projections, ensuring a robust financial scenario analysis for driving instructors aiming to enhance business valuation and secure sustainable success.

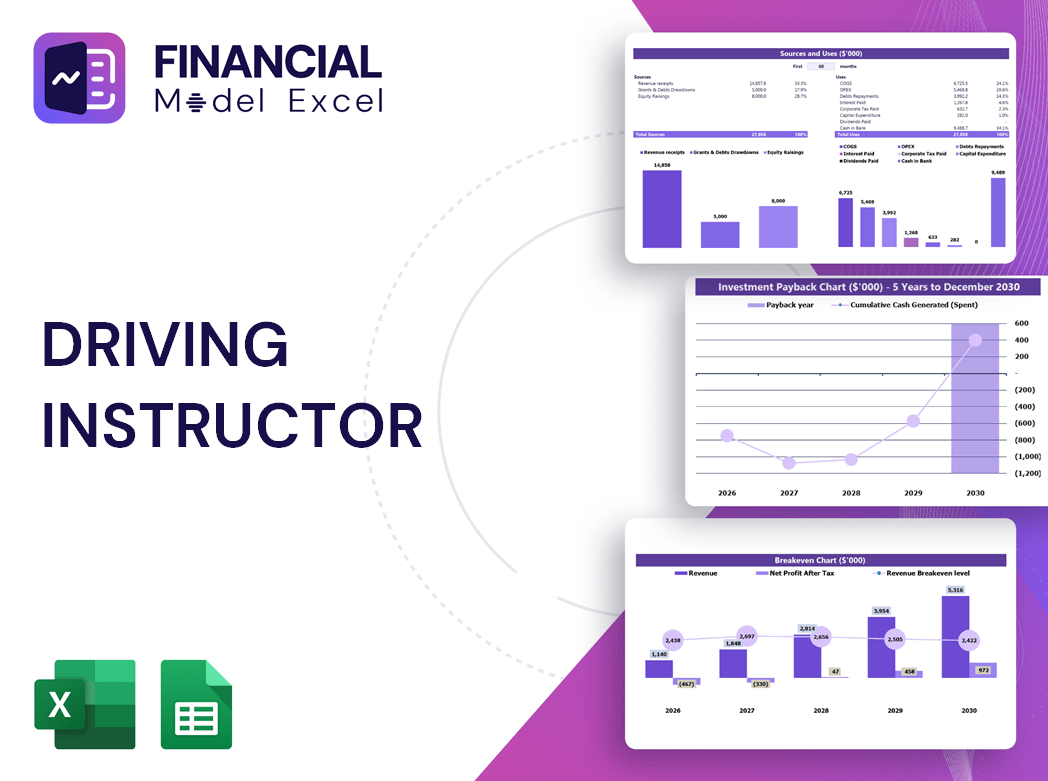

DRIVING INSTRUCTOR FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A robust driving instructor financial model excels in versatility, organization, and scenario adaptability. This dynamic 5-year financial projection template empowers driving schools with comprehensive revenue projections, expense tracking, and profit and loss analysis. Designed for seamless customization, it supports financial forecasting, break-even analysis, pricing strategy development, and cash flow analysis tailored to your business. Easily adjust income forecasts, cost management, and budget allocation to match your unique driving instructor services. Experience greater financial planning confidence and drive sustainable business growth with this powerful, expandable financial model.

Dashboard

Transform your driving instructor startup financial plan into a compelling, dynamic tool with precise business inputs. Our driving school revenue projection financial model and cash flow analysis ensure your numbers captivate investors, not bore them. Easily customize your driving instructor budget plan, expense tracking model, and break-even analysis to showcase clear profitability and growth projections. Ready to elevate your pitch deck with professional, data-driven insights that highlight your business potential? Copy, paste, and impress—financial forecasting for driving instructors has never been this engaging and effective.

Business Financial Statements

This comprehensive driving instructor startup financial plan Excel template streamlines your budgeting, expense tracking, and revenue projections. Easily input your assumptions to generate accurate profit and loss models, cash flow analyses, and break-even forecasts tailored for driving school growth. Designed for financial planning and KPI monitoring, it empowers you to optimize pricing strategies, manage costs, and confidently project business valuation. Simplify your financial scenario analysis with this user-friendly model that transforms your data into actionable insights, helping you drive your driving instructor business toward sustained profitability and expansion.

Sources And Uses Statement

The sources and uses of funds statement within a driving instructor financial model is a vital tool for accurately pinpointing funding streams and identifying cash leakage points. Integrating this with a driving instructor expense tracking model and cash flow analysis ensures precise financial forecasting for driving instructors. This approach supports effective budget allocation, cost management, and enhances driving school revenue projections, enabling strategic financial planning and sustainable business growth.

Break Even Point In Sales Dollars

This driving instructor financial model features an integrated break-even analysis, pinpointing the exact sales volume or tuition fees needed to cover all fixed and variable expenses. This essential tool empowers driving schools with accurate financial forecasting and expense tracking, ensuring profitability is within reach. By leveraging this break-even analysis within your budget plan and cost management model, you gain valuable insights into pricing strategies and business growth projections. Make informed decisions with confidence, driving your business toward sustainable success.

Top Revenue

Optimize your driving instructor business with our comprehensive financial model designed for precise revenue projections. Our easy-to-use template features specialized tabs for detailed analysis, allowing you to break down income by service category or product. Utilize this driving school revenue projection financial model to enhance financial forecasting, manage expenses, and refine pricing strategies. Gain clear insights into profitability and cash flow, empowering informed decisions for sustained business growth and efficient budget allocation. Elevate your financial planning and achieve your business goals with accurate, category-specific revenue analysis tailored for driving instructors.

Business Top Expenses Spreadsheet

The Top Expenses tab in this driving instructor financial forecasting model highlights your four highest expenses for an instant overview. It offers a comprehensive breakdown of costs, including customer acquisition and fixed expenses. Utilizing this driving instructor expense tracking model empowers you to manage your budget effectively, optimize your cost management strategy, and enhance overall profitability. With clear visibility into your spending, you can confidently drive business growth and refine your financial planning for driving instructor services.

DRIVING INSTRUCTOR FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Safeguard your driving instructor business with our comprehensive financial modeling tools. Our financial forecasting for driving instructors enables precise expense tracking, budget allocation, and cash flow analysis. With customizable pro-forma statements, you can project revenues, control costs, and perform break-even analysis effortlessly. Avoid overspending and optimize your driving school’s profitability using our driving instructor startup financial plan and income forecast model. Equip your business with data-driven insights to manage investments, tuition fees, and financial KPIs—ensuring sustainable growth and financial stability. Stay ahead with strategic financial planning tailored specifically for driving instructor services.

CAPEX Spending

A robust 5-year cash flow projection for driving instructors hinges on a strategic capital expenditure (CAPEX) plan. Utilizing straight-line or double depreciation methods within the driving instructor financial model empowers users to precisely forecast CAPEX. This approach enhances financial forecasting, enabling better expense tracking and control of capital outlays. Integrating CAPEX forecasts into your cash flow analysis driving instructor business ensures accurate profit and loss modeling and supports informed budget allocation decisions, ultimately driving sustainable business growth projections and optimized financial planning for driving instructor services.

Loan Financing Calculator

Our driving instructor startup financial plan features a detailed loan amortization schedule, seamlessly integrated into the financial model. This schedule provides precise repayment breakdowns, outlining principal and interest amounts due monthly, quarterly, or annually. Designed for accurate financial forecasting and expense tracking, it supports effective budget allocation and cash flow analysis. Empower your driving school with this essential tool to optimize loan management and enhance profitability through informed financial planning and growth projections.

DRIVING INSTRUCTOR FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The five-year driving instructor financial model delivers a comprehensive profit and loss forecast, highlighting EBIT—earnings before interest and tax. This key metric, derived from your assumptions, offers invaluable insight into your driving school’s true profit potential. Utilize this model for precise financial forecasting, effective budget allocation, and informed decision-making to drive sustainable business growth and maximize profitability.

Cash Flow Forecast Excel

Leverage a cash flow analysis driving instructor business model to master financial forecasting and optimize your startup’s budget plan. This powerful tool tracks income and expenses, enabling precise expense tracking and driving instructor tuition fee financial modeling. By analyzing cash inflows and outflows, you can refine your pricing strategy, enhance capital turnover, and boost profitability. Integrating this with your driving instructor profit and loss model ensures informed decision-making and supports sustainable business growth projections. Embrace financial planning tools tailored for driving instructors to streamline operations and maximize revenue potential effectively.

KPI Benchmarks

The benchmark tab in a driving instructor financial model evaluates business effectiveness, forming the foundation for competitive analysis. This critical step supports strategic financial planning, especially in driving instructor startup financial plans and business growth projections. By leveraging key financial KPIs, such as expense tracking and revenue forecasting, instructors can refine pricing strategies and optimize budget allocation. Regularly monitoring these indicators enables proactive responses to market trends, ensuring sustained profitability and a strong competitive position in the driving school industry.

P&L Statement Excel

For driving instructors seeking precise financial insights, a monthly profit and loss model in Excel delivers key metrics like gross profit percentage, ensuring clear expense tracking. Annual reports offer comprehensive data, including net income, taxes, and cost of services, vital for driving school revenue projections. Utilizing a 5-year projected income and expenditure financial model enables reliable long-term financial forecasting, supporting informed decision-making. This approach enhances budget planning, cash flow analysis, and profitability assessment, empowering driving instructor businesses to optimize growth and manage costs effectively.

Pro Forma Balance Sheet Template Excel

The driving instructor financial model’s pro forma balance sheet offers a clear snapshot of assets and liabilities, reflecting the business’s true worth at any given time. Paired with the profit and loss forecast, it reveals operational results and financial health over a set period. This model differentiates between business equity and investor equity, while providing essential KPIs like turnover and liquidity ratios. Used alongside driving instructor expense tracking and cash flow analysis, it empowers precise financial planning, budget allocation, and revenue projection—key to driving school growth and profitability with confidence.

DRIVING INSTRUCTOR FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive driving instructor startup financial plan integrates two powerful valuation methods: discounted cash flow (DCF) and weighted average cost of capital (WACC). This dual approach enhances accuracy in forecasting driving school revenue projections and supports informed financial planning for driving instructor services. By combining these models, you gain deeper insights into business valuation, profitability, and cash flow analysis, empowering strategic decisions for sustainable growth and optimized budget allocation. Elevate your driving instructor business with a robust financial model designed to drive success and maximize returns.

Cap Table

A pro forma cap table is essential for driving instructor businesses, offering a clear snapshot of ownership distribution among investors. It details common and preferred shares, along with security pricing, providing comprehensive insights for precise financial planning. Integrating this with your driving instructor budget plan or financial forecasting enhances your business valuation model, ensuring informed decisions on cost management and revenue projections. This powerful tool supports accurate financial scenario analysis, helping optimize profitability and streamline your driving school’s growth strategy.

DRIVING INSTRUCTOR FINANCIAL PLAN TEMPLATE EXCEL ADVANTAGES

Our driving instructor financial model ensures precise expense tracking and effective budget management for maximum profitability.

Optimize profits and growth with the driving instructor financial model’s accurate forecasting and expense tracking capabilities.

Empower your driving school’s growth with a precise financial model for accurate forecasting and effective budget planning.

Maximize profits and streamline cash flow with our driving instructor 5-year financial projection model.

Financial forecasting for driving instructors drives smart budgeting and boosts profitability with precise expense and revenue insights.

DRIVING INSTRUCTOR THREE WAY FINANCIAL MODEL ADVANTAGES

Our driving instructor financial model accurately proves your loan repayment ability, boosting lender confidence and securing funding.

Utilize a driving instructor cash flow analysis model to confidently secure loans by proving repayment ability and financial stability.

Gain confidence in the future with a driving instructor financial model optimizing revenue, expenses, and growth projections.

Our driving instructor financial model ensures accurate forecasting, risk prevention, and optimized cash flow for sustained growth.

Accelerate investor confidence with our driving instructor financial model, optimizing profitability and streamlining budget plans efficiently.

Optimize your driving school’s success with a comprehensive financial model featuring forecasted statements and key performance ratios.

Streamline decisions with a convenient all-in-one dashboard for driving instructor financial forecasting and budget planning.

Optimize your driving school’s growth with a comprehensive financial model featuring detailed forecasts, cash flow, and KPIs.

Optimize driving school revenue with our comprehensive driving instructor financial forecasting model for confident growth decisions.

A clear, well-structured driving instructor financial model simplifies testing new strategies and improves decision-making efficiency.