Eco Friendly Building Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Eco Friendly Building Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Eco Friendly Building Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ECO FRIENDLY BUILDING FINANCIAL MODEL FOR STARTUP INFO

Highlights

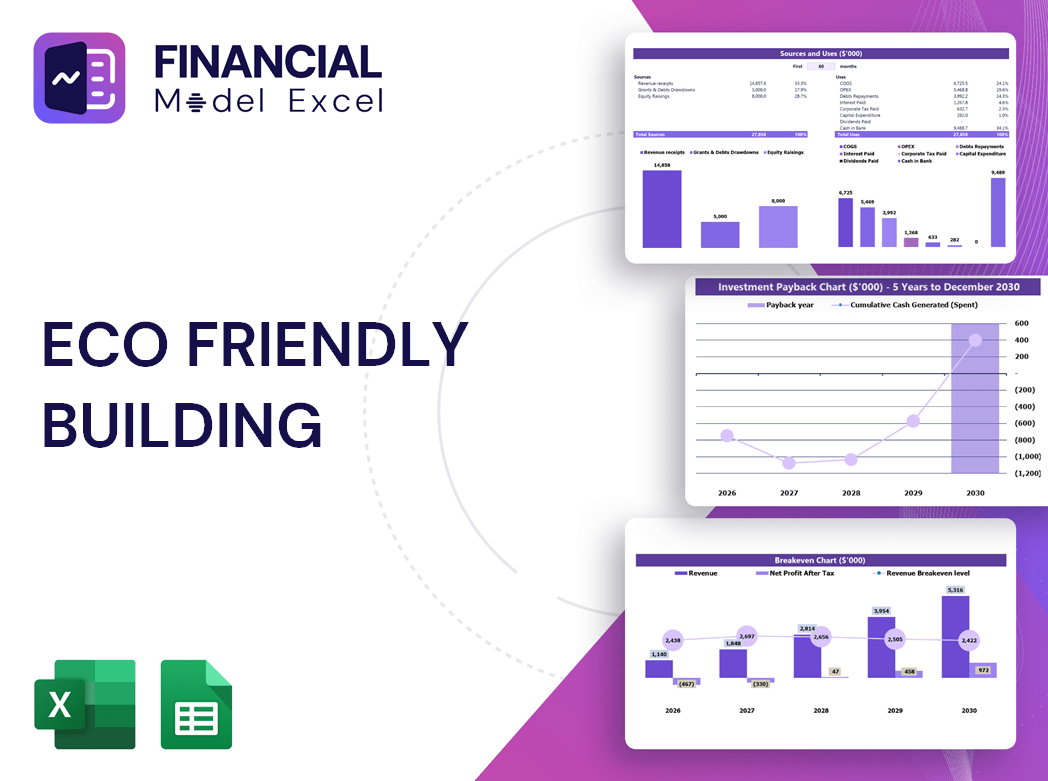

This comprehensive five-year sustainable building financial model template in Excel integrates prebuilt consolidated profit and loss statements, balance sheets, and startup cash flow statements, tailored specifically for green construction financial planning. It features key financial charts, summaries, metrics, and funding forecasts designed to support eco-conscious construction budget models and renewable energy building financial plans. Created with the mindset of eco-friendly infrastructure cost modeling, this unlocked, fully editable financial tool helps estimate essential startup costs and facilitates green building investment analysis, energy-efficient building financial forecasting, and overall environmental sustainability financial frameworks.

This green construction financial model template addresses common challenges faced by buyers by providing a comprehensive, easy-to-use tool for environmentally friendly building cost analysis and sustainable building financial planning. It streamlines the complexity of developing accurate green building investment analysis by integrating energy-efficient building financial forecasting, LEED certified building financial model considerations, and carbon neutral building financial planning into one coherent framework. Users benefit from a clean, visually consistent format that includes detailed 5-year proforma financial statements, enabling precise eco-conscious construction budget modeling and green project financial feasibility evaluation. This ready-made model reduces the pain of manual data crunching and uncertainty, empowering stakeholders to confidently track performance metrics, optimize eco-friendly property financial analysis, and present credible, data-driven results to attract funding or secure loans within an environmental sustainability financial framework.

Description

The green construction financial model offers a comprehensive 5-year forecast template tailored for start-ups, SMEs, and ongoing businesses focused on environmentally friendly building cost analysis. This adaptable pro forma excel tool incorporates sustainable development financial modeling principles to accommodate frequent changes and assumptions, enabling precise energy-efficient building financial forecasting. Equipped with detailed assumption sheets, cash flow projections, and income statement drivers, the model supports profitability planning, green building investment analysis, and company valuation, ensuring effective utilization of funds while promoting low carbon footprint building financial planning and eco-conscious construction budget modeling.

ECO FRIENDLY BUILDING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our sustainable building financial model offers a comprehensive 5-year forecast by integrating projected income statements, balance sheets, and cash flow analyses in Excel. Unlike simplified models focusing solely on profit and loss, this eco-conscious construction budget model enables robust scenario planning, allowing you to assess how changes impact your green construction financial plan holistically. Ideal for startups, it supports informed decision-making with detailed green building investment analysis and energy-efficient building financial forecasting, ensuring your eco-friendly project remains financially viable while advancing environmental sustainability goals.

Dashboard

Our sustainable building financial model features an integrated dashboard that delivers clear, visual insights through dynamic graphs and charts. It provides detailed annual revenue breakdowns, streamlined profit and loss highlights, and comprehensive cash flow projections tailored for eco-conscious construction projects. Designed for precision and ease of use, this green construction financial model simplifies forecasting and investment analysis, ensuring accurate, organized data to support your eco-friendly infrastructure cost modeling and sustainable development financial planning. Empower your project decisions with a professional, environment-focused financial framework built for green architecture success.

Business Financial Statements

This sustainable building financial model effortlessly generates comprehensive annual financial statements tailored to your green construction assumptions. Designed for simplicity and precision, just input your eco-conscious construction budget details into our ready-made templates, and watch the model deliver accurate, energy-efficient building financial forecasts. Whether you're developing a LEED certified building or an eco-friendly infrastructure project, this tool streamlines your environmental impact financial modeling with professional ease. Empower your green architecture investment analysis with a reliable, low carbon footprint building financial plan—all automated within one dynamic Excel model.

Sources And Uses Statement

This sustainable building financial model includes a comprehensive Use of Funds tab, clearly detailing the company’s funding structure alongside the allocation and utilization of capital. Designed for eco-conscious construction budget models and green architecture financial projections, this feature ensures transparent tracking of investments and expenditures. Ideal for green construction cash flow modeling and renewable energy building financial plans, it empowers stakeholders to make informed decisions promoting environmental sustainability financial frameworks while optimizing resource allocation.

Break Even Point In Sales Dollars

This sustainable building financial model integrates a break-even analysis graph to identify the sales volume required to cover all fixed and variable costs. Essential for green construction financial planning, this tool ensures accurate cost analysis and supports energy-efficient building financial forecasting. By incorporating environmental impact financial modeling, it empowers stakeholders to make informed decisions about profitability and investment viability in eco-conscious construction projects, driving sustainable development with confidence.

Top Revenue

In sustainable building financial modeling, top-line growth—an increase in revenue or gross sales—is a critical indicator of success. Investors and analysts closely examine these metrics within green construction financial models to assess project viability and profitability. Tracking trends in revenue and profits, especially in eco-conscious construction budgets or renewable energy building financial plans, enables stakeholders to forecast energy-efficient building financial outcomes accurately. Ultimately, strong top-line performance drives positive impacts across the entire environmental sustainability financial framework, reinforcing the value of low carbon footprint building financial models in advancing green architecture investment analysis.

Business Top Expenses Spreadsheet

The Top Expenses tab in this green construction financial model categorizes costs into four key areas, offering a clear overview of budget allocation. Featuring an integrated annual expense chart, it highlights essential expenditures for client acquisition and employee compensation. Both fixed and variable costs are meticulously detailed, supporting accurate eco-conscious construction budget forecasting. This tool ensures comprehensive financial transparency, optimizing your sustainable building financial plan with precision and strategic insight.

ECO FRIENDLY BUILDING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A sustainable building financial model offers precise expense projections essential for identifying and addressing critical areas within your green construction project. Utilizing an eco-conscious construction budget model enables you to forecast costs accurately and enhance your renewable energy building financial plan. These insights are crucial for creating compelling proforma business plans that not only strengthen your sustainable development financial modeling but also convince investors and lenders of your project’s viability. Leveraging a comprehensive green project financial feasibility model ensures effective financial strategy alignment, optimizing both environmental impact and investment potential in eco-friendly infrastructure development.

CAPEX Spending

To drive sustainable growth, companies must continuously invest in innovation and development through a strategic capital expenditure (CAPEX) budget. This budget focuses on acquiring assets that enhance performance and support expansion. In green construction financial models or sustainable building financial plans, these investments are critical for eco-conscious construction budgets and energy-efficient building financial forecasting. CAPEX appears on pro forma balance sheets as depreciated expenses over several years, reflecting long-term value. Incorporating such financial frameworks ensures businesses align growth with environmental sustainability and green architecture financial projections, securing both profitability and eco-friendly advancement.

Loan Financing Calculator

Start-ups and early-stage companies must diligently manage their loan repayment schedules, detailing each loan's principal, interest, amounts, and maturity terms. This schedule plays a crucial role in cash flow analysis and is reflected on the balance sheet. Principal repayments impact the cash flow statement under financing activities, while interest expenses influence both cash flow and outstanding debt balances. Integrating this with a sustainable building financial model or green construction financial plan ensures precise financial forecasting, helping eco-conscious companies maintain strong environmental impact financial modeling alongside robust financial health.

ECO FRIENDLY BUILDING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The Internal Rate of Return (IRR) is a critical metric within sustainable building financial models, including green construction and eco-conscious construction budget models. It estimates investment profitability by identifying the discount rate that sets the net present value (NPV) of all cash flows to zero in financial forecasting. Presented as a percentage, IRR is essential for investors and analysts assessing renewable energy building financial plans, LEED-certified project feasibility, and low carbon footprint building financial models. Incorporating IRR ensures robust green building investment analysis and supports sustainable development financial modeling decisions.

Cash Flow Forecast Excel

The cash balance in a sustainable building financial model reflects the company’s available funds over a 5-year projection, ensuring liquidity to meet ongoing obligations. Integrating this with an eco-conscious construction budget model helps secure financial stability while advancing green architecture goals. Maintaining an optimal cash reserve is crucial for seamless execution of environmentally friendly building cost analysis and reinforces the energy-efficient building financial forecasting necessary for sustainable development financial modeling. This approach supports a robust green construction cash flow model, enhancing the financial feasibility of renewable energy building projects and low carbon footprint building strategies.

KPI Benchmarks

Our sustainable building financial model offers comprehensive benchmarking tools, empowering clients with industry-specific insights to evaluate performance against leading green construction projects. By leveraging this eco-conscious construction budget model, you can identify key areas for improvement and strategically allocate resources to optimize outcomes. Harness the power of environmental impact financial modeling to guide your decisions and achieve superior results in your renewable energy building financial plan. This green architecture financial projection template is essential for driving success in energy-efficient, low carbon footprint building initiatives.

P&L Statement Excel

The Income Statement, or Proforma Profit and Loss Statement, provides a clear view of revenue and expenses within an eco-friendly building financial model. It tracks financial performance from top-line income to bottom-line profit, offering stakeholders insight into the cost structure and profitability of sustainable development projects. By leveraging this green construction financial model’s projections, users can confidently evaluate future financial viability, balancing income with operational costs and creditor obligations. This dynamic tool is essential for informed decision-making in energy-efficient building financial forecasting and eco-conscious construction budget modeling.

Pro Forma Balance Sheet Template Excel

The pro forma balance sheet template in Excel provides a snapshot of a company’s assets and liabilities at a specific point, essential for sustainable building financial modeling. It reveals net worth and the balance between equity and debt, offering crucial insights into liquidity, solvency, and turnover ratios. Paired with forecast income statements, this tool supports green construction financial models, enabling accurate environmental impact financial modeling and green project financial feasibility analysis to drive informed, eco-conscious investment decisions.

ECO FRIENDLY BUILDING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The green construction financial model integrates key metrics like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) to optimize eco-conscious construction budgets. WACC evaluates the capital structure’s equity and debt proportions, serving as a crucial risk assessment tool for lenders in sustainable building investments. Meanwhile, DCF provides precise projections of future cash flows, essential for green building investment analysis and environmental sustainability financial frameworks. This comprehensive approach ensures robust financial forecasting for renewable energy projects and low carbon footprint building financial plans, driving informed decisions in eco-friendly infrastructure cost modeling.

Cap Table

The cap table, integrated within a comprehensive three-statement model template, serves as an essential financial tool for start-ups and early-stage ventures. It provides a detailed breakdown of the company’s securities, investor ownership, valuation, and dilution over time. This clarity supports informed decision-making and strategic planning, especially when developing sustainable building financial models or green construction cash flow models. Accurate cap table management ensures transparency and confidence for investors engaging in eco-friendly property financial analysis or green project financial feasibility assessments.

ECO FRIENDLY BUILDING EXCEL FINANCIAL MODEL TEMPLATE ADVANTAGES

The sustainable building financial model proactively identifies cash flow gaps and surpluses, ensuring confident, efficient project management.

Secure smart financing confidently with our eco-friendly building financial model Excel pro forma template, maximizing green investment returns.

The sustainable building financial model empowers smarter decisions by identifying strengths and optimizing cost efficiency effectively.

Evaluate your project’s success confidently using our eco-friendly building financial model for precise feasibility analysis.

The sustainable building financial model accurately reveals strengths and weaknesses, optimizing your green project's profitability and efficiency.

ECO FRIENDLY BUILDING 3 WAY FINANCIAL MODEL ADVANTAGES

Unlock precise, dynamic insights with our sustainable building financial model for smarter, eco-conscious investment decisions.

This robust eco-friendly building financial model empowers precise, adaptable projections to optimize sustainable project planning and investment decisions.

The sustainable building financial model ensures accurate budgeting, preventing cash flow shortfalls and optimizing green project profitability.

A sustainable building financial model enables proactive cash flow forecasting, preventing costly shortfalls and ensuring long-term project success.

The sustainable building financial model saves you time by streamlining eco-friendly project cost analysis efficiently.

The sustainable building financial model streamlines budgeting, freeing you to focus on innovation, growth, and environmental impact.

Our sustainable building financial model streamlines budgeting, ensuring eco-friendly projects maximize profitability and reduce environmental impact.

Optimize eco-friendly building investments with a clear, color-coded financial model ensuring transparent, detailed planning and projections.

Optimize your project's success with our green construction financial model, ensuring cost-effective, eco-friendly, and sustainable building investments.

The sustainable building financial model enables precise, adaptable cost analysis, ensuring confident investment decisions and long-term eco savings.