Elevator Maintenance Service Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Elevator Maintenance Service Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Elevator Maintenance Service Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ELEVATOR MAINTENANCE SERVICE FINANCIAL MODEL FOR STARTUP INFO

Highlights

Generate a comprehensive 5-year elevator maintenance financial model that includes detailed elevator service revenue projection, lift maintenance budgeting, and elevator repair expense forecast financial models. This template offers in-depth elevator maintenance cash flow analysis, elevator service profit margin insights, and lift maintenance operational cost financial planning, all aligned with GAAP/IFRS standards. Ideal for conducting elevator maintenance investment analysis and evaluating elevator service cost-benefit scenarios, it also features an elevator maintenance income statement and elevator service expense management tools. Fully unlocked and customizable, this model supports elevator maintenance contract evaluation and elevator service pricing strategy development, providing a robust financial dashboard and core metrics to effectively track lift maintenance expenses and forecast lift servicing financial performance before business sale or scaling.

This elevator maintenance financial model Excel template addresses critical pain points by offering a comprehensive lift maintenance budgeting financial model that simplifies expense tracking and repair expense forecasting, enabling users to manage elevator service expense management effectively. Its preventive elevator maintenance financial model feature reduces unexpected costs by accurately projecting maintenance cash flow and operational costs, while the elevator service revenue projection financial model assists in refining the elevator service pricing strategy financial model to maximize profit margins. By integrating an elevator maintenance contract financial model and elevator maintenance income statement financial model, the template ensures seamless financial planning and contract management, and the embedded elevator service cost-benefit financial model supports informed investment decisions. The ready-made structure allows users with basic Excel skills to update assumptions effortlessly, automatically recalculating all relevant lift maintenance financial metric models and delivering real-time insights into business performance, including depreciation schedules and DCF valuations.

Description

The elevator maintenance cost analysis financial model provides a comprehensive framework for forecasting lift maintenance budgeting and elevator repair expense forecast, enabling businesses to optimize preventive elevator maintenance financial model strategies while maintaining tight control over operational costs. This model integrates elevator service revenue projection financial model components to accurately estimate elevator maintenance cash flow financial model outcomes, supporting informed elevator maintenance contract financial model negotiations and effective elevator service pricing strategy financial model development. Inclusion of an elevator maintenance income statement financial model and elevator service profit margin financial model ensures detailed visibility into financial performance, while lift maintenance expense tracking financial model and elevator service expense management financial model tools facilitate ongoing cost control. Additionally, the elevator service depreciation financial model and elevator maintenance investment analysis financial model contribute to refined elevator maintenance business model financial model planning, promoting sustainable growth through lift maintenance financial planning model practices and lift servicing financial forecasting model insights.

ELEVATOR MAINTENANCE SERVICE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Easily build a comprehensive elevator maintenance financial model to analyze costs, project service revenue, and forecast repair expenses. Our customizable Excel template streamlines lift maintenance budgeting, preventive maintenance planning, and cash flow management. Track expenses, optimize contract pricing strategies, and evaluate profit margins with editable tables designed for quick input. Whether you need lift servicing forecasts, investment analysis, or a detailed income statement, this versatile model adapts to your business needs. Unlock precise financial insights and confidently assess your elevator service’s potential—fast, accurate, and user-friendly.

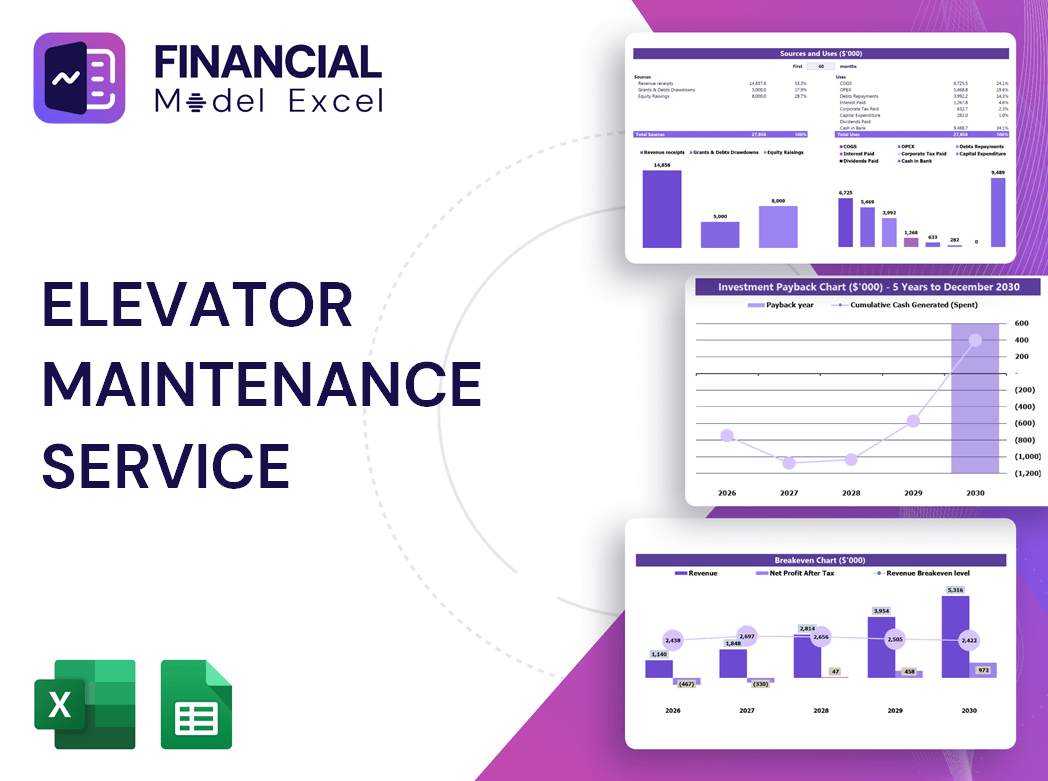

Dashboard

The elevator maintenance financial model is an essential tool for comprehensive lift maintenance budgeting and cost analysis. It enables precise elevator service revenue projection and repair expense forecasting, integrating preventive maintenance and operational cost tracking. With dynamic dashboards displaying data both numerically and graphically, users gain clear insights into cash flow management, profit margins, and contract financial planning. Whether for short-term expense tracking or long-term investment analysis, this model empowers businesses to optimize pricing strategies and enhance elevator service profitability through informed, data-driven decisions.

Business Financial Statements

Our comprehensive elevator maintenance financial model delivers precise cost analyses, revenue projections, and expense forecasts tailored for lift servicing businesses. Equipped with dynamic charts and reports, including cash flow, profit margin, and budgeting insights, it empowers entrepreneurs to effectively communicate financial strategies and progress. The 5-year projection plan simplifies investor presentations by visually summarizing key metrics like maintenance contract valuation, pricing strategy, and operational costs, ensuring clarity and confidence in your business proposal.

Sources And Uses Statement

Utilizing investor capital accelerates profit growth, but precise financial insight is key. An elevator maintenance cash flow financial model enables companies to track sources and uses of funds, revealing strengths and vulnerabilities. Accurate forecasting of revenues, expenses, and profits—through models like lift maintenance budgeting and elevator repair expense forecasts—prevents deficits and supports strategic decisions. This financial clarity empowers elevator service providers to optimize pricing strategies, manage contracts effectively, and maximize profit margins. A robust financial planning model is essential for startups aiming to drive sustainable growth and make informed, confident business decisions.

Break Even Point In Sales Dollars

The break-even point (BEP) calculation provides a clear snapshot of profits across different sales levels, enabling precise financial insights. Coupled with the safety margin, it measures how much sales can decline before losses occur, ensuring proactive risk management. Leveraging an elevator maintenance cost analysis financial model or lift maintenance budgeting financial model enhances your ability to optimize elevator service profit margins and improve lift maintenance financial planning. This strategic approach empowers businesses to confidently navigate fluctuating market conditions while maximizing operational efficiency and profitability.

Top Revenue

When developing an elevator maintenance financial model, accurately projecting service revenue is essential. Revenue drives enterprise value within the lift maintenance budgeting financial model, making precise forecasting critical. Financial analysts must leverage historical data and growth assumptions to craft robust elevator service revenue projection models. Our comprehensive financial plan template integrates key elements—ranging from cash flow and expense tracking to profit margin analysis—empowering users to strategically navigate revenue streams and optimize elevator maintenance profitability with confidence.

Business Top Expenses Spreadsheet

Effective cost management is crucial for optimizing elevator maintenance expenses and maximizing profitability. Our elevator maintenance financial model features a top expense report, highlighting the four largest cost categories—such as lift maintenance operational costs and repair expenses—while grouping others under “other.” This enables businesses to track, analyze year-on-year changes, and identify key expense drivers. Whether through preventive elevator maintenance financial modeling or service expense management, this approach empowers companies to streamline budgeting, improve profit margins, and enhance overall lift maintenance financial planning for sustained success.

ELEVATOR MAINTENANCE SERVICE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive elevator maintenance financial model streamlines salary cost tracking for both FTEs and PTEs, ensuring accurate lift maintenance budgeting and expense forecasting. This dynamic model automatically integrates payroll data across all relevant sections of your elevator service revenue projection and income statement templates. By seamlessly connecting lift maintenance operational cost, repair expense forecasting, and preventive maintenance budgeting, it empowers precise elevator maintenance cash flow management and enhances your elevator service profit margin analysis. Optimize your elevator maintenance contract planning and elevate your lift maintenance financial planning with our expertly designed, data-driven financial model.

CAPEX Spending

The CAPEX expenditure in the elevator maintenance financial model reveals the critical investments driving business growth and competitive advantage. Excluding staff salaries and operating expenses, this analysis highlights where capital allocation yields the greatest return, supporting informed budgeting and strategic planning. Given the variability of capital expenditures across elevator service business models, incorporating this detailed investment analysis is essential for accurate financial forecasting and optimizing lift maintenance budgeting. This approach ensures efficient allocation of resources to maximize profitability and long-term sustainability.

Loan Financing Calculator

Start-ups and growing businesses must meticulously manage loan repayment schedules, detailing amounts, maturity terms, and interest expenses. Integrating this loan payback plan into cash flow analysis is essential, as interest costs directly impact cash flow projections. Principal repayments influence financing activities within the elevator maintenance cash flow financial model, while outstanding debt balances appear on projected balance sheets. Utilizing a comprehensive elevator maintenance financial planning model ensures accurate expense management and supports strategic decision-making for sustainable growth and profitability.

ELEVATOR MAINTENANCE SERVICE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The elevator maintenance service financial model integrates a comprehensive payback period metric, sourced from new customer acquisition costs. This key indicator is essential for evaluating the time required to recover investments by comparing acquisition expenses against the profits generated per customer. By dividing acquisition costs by customer profits, the model delivers a clear payback period, enabling precise elevator service revenue projections and informed lift maintenance budgeting decisions. This insight supports optimizing elevator service pricing strategy and improving overall elevator maintenance contract profitability.

Cash Flow Forecast Excel

Our elevator maintenance cash flow financial model offers precise tracking of your company’s cash position, essential for effective lift maintenance budgeting and expense management. By analyzing payables, receivables, working capital, long-term debt, and net cash, it provides an accurate forecast of cash inflows and outflows. This pro forma template supports elevator maintenance cost analysis and investment planning, ensuring optimal financial health. Use it to enhance your elevator service revenue projection, optimize profit margins, and make informed decisions on preventive maintenance and repair expense forecasts with confidence.

KPI Benchmarks

The startup benchmark tab delivers comprehensive elevator maintenance financial model analysis by comparing key performance metrics—such as lift maintenance budgeting and elevator service revenue projection—against industry averages. Leveraging these elevator maintenance cost analysis insights enables precise elevator repair expense forecasting and elevator service pricing strategy refinement. Employing these financial benchmarks enhances elevator maintenance business modeling and investment analysis, empowering firms to adopt best practices, optimize elevator maintenance cash flow, and improve elevator service profit margins. This professional financial planning tool is essential for informed decision-making and strategic growth in the elevator maintenance sector.

P&L Statement Excel

Our elevator maintenance financial model streamlines comprehensive financial reporting by integrating essential tools for accurate profit and loss projections. Designed for detailed elevator maintenance cost analysis and lift maintenance budgeting, it facilitates precise elevator repair expense forecasts and preventive maintenance cash flow management. This model supports elevator service revenue projection and profit margin analysis, enabling strategic pricing and expense tracking. With built-in elevator maintenance income statement and contract financial models, it empowers your elevator maintenance business with robust financial planning and investment analysis for sustainable growth.

Pro Forma Balance Sheet Template Excel

The projected balance sheet in this elevator maintenance financial model offers a comprehensive snapshot of your startup’s assets, liabilities, and equity accounts. Designed to support elevator service revenue projection and lift maintenance budgeting, it empowers users with clear insights into financial health. Integrating key components like elevator maintenance cash flow and expense tracking, this model facilitates strategic elevator service pricing and contract management. Ideal for proactive financial planning, it ensures informed decision-making to optimize elevator maintenance profit margins and operational costs from day one.

ELEVATOR MAINTENANCE SERVICE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our elevator maintenance financial model integrates key metrics like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) to provide a comprehensive elevator maintenance investment analysis. WACC offers a precise breakdown of capital costs by equity and debt, serving as a critical risk assessment tool for lenders. Meanwhile, DCF evaluates the present value of future cash flows, enabling accurate elevator service revenue projections and informed budgeting decisions. This robust financial framework empowers stakeholders with actionable insights to optimize elevator maintenance cost analysis and maximize service profit margins.

Cap Table

A comprehensive elevator maintenance financial model is essential for optimizing costs and maximizing profitability. Integrating lift maintenance budgeting, repair expense forecasting, and preventive maintenance cash flow analysis, this model supports precise elevator service revenue projections and pricing strategies. By tracking expenses, managing depreciation, and analyzing service profit margins, businesses can make informed decisions on elevator maintenance contracts and investments. This elevator maintenance business model financial tool streamlines expense management and enhances lift servicing financial forecasting, ensuring effective financial planning and sustainable growth in the elevator service industry.

ELEVATOR MAINTENANCE SERVICE BUSINESS PROJECTION TEMPLATE ADVANTAGES

Reduce risk and optimize budgeting with the elevator maintenance service financial planning model’s precise cost analysis.

Optimize elevator maintenance profits with a financial model designed for precise cost and revenue forecasting.

Optimize surplus cash with the elevator maintenance financial model’s precise 5-year cash flow projection in Excel.

The elevator maintenance financial model centralizes assumptions, simplifying analysis and enhancing precision for informed decision-making.

Elevator service expense management financial model enables proactive detection of payment issues, optimizing cash flow efficiency.

ELEVATOR MAINTENANCE SERVICE 3 WAY FINANCIAL MODEL TEMPLATE ADVANTAGES

Optimize costs and boost profits with our elevator maintenance financial model, saving you time and money efficiently.

Streamline elevator maintenance budgeting with our financial model—save costs and focus on strategic growth without expert help.

Optimize profits and reduce risks with our elevator maintenance financial model’s print-ready, data-driven reports.

Elevator maintenance financial models deliver print-ready reports, enhancing accurate budgeting, forecasting, and profitability analysis.

Optimize elevator maintenance budgeting financial model to track expenses and ensure disciplined spending within budget limits.

The elevator maintenance cash flow financial model enables precise future cash planning, enhancing budget control and profitability.

Optimize profits and reduce costs with our elevator maintenance financial model—because we do the math for you.

Maximize elevator service profits effortlessly with our all-in-one financial model—no formulas, coding, or consultants needed!

The elevator maintenance cost analysis financial model simplifies budgeting for precise, efficient, and profitable service management.

Unlock precise, reliable 5-year elevator maintenance financial forecasts with minimal Excel skills and no prior planning experience.