Emerging Technology Investment Firm Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Emerging Technology Investment Firm Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Emerging Technology Investment Firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

EMERGING TECHNOLOGY INVESTMENT FIRM FINANCIAL MODEL FOR STARTUP INFO

Highlights

Financial modeling for tech startups and emerging technology investment firms is essential for creating accurate financial projections, cash flow modeling, and budgeting models that support funding rounds and investment return projections in the tech sector. Utilizing a comprehensive emerging tech company financial metrics model helps investors perform risk assessment in technology investments, profitability analysis, and capital allocation to optimize their portfolio. This financial planning and scenario analysis approach ensures startups and established companies can present robust financial statements and forecasts, enhancing their business plans to secure funding from banks, angels, grants, and venture capital firms through an adaptable, unlocked financial dashboard tailored for tech investment firms.

This ready-made Excel financial model alleviates common pain points faced by emerging tech investors by consolidating comprehensive financial analytics for emerging tech firms and investment firm valuation models into a single dashboard, eliminating the need to navigate multiple sheets; it streamlines cash flow modeling for technology startups, investment return projections tech sector, and risk assessment in technology investments, enabling swift financial scenario analysis investment firms require for confident decision-making. With built-in financial forecast for technology investors, budgeting model for emerging technology firms, and profitability analysis for tech investors, this tool accelerates development of a startup investment financial plan, optimizes capital allocation model for tech investments, and provides clear financial statements for investment firms—all designed to enhance financial planning for emerging tech companies and support efficient investment portfolio financial modeling.

Description

This comprehensive financial model for emerging technology investment firms integrates advanced financial analytics and investment firm valuation models to provide accurate financial projections and budget planning over a 5-year horizon. It features a dynamic financial dashboard tailored for tech venture capital financial modeling, encompassing startup investment financial plans, cash flow modeling, and profitability analysis for tech investors. The model supports risk assessment in technology investments and capital allocation to optimize the investment portfolio, while interactive financial scenario analysis enhances decision-making for funding rounds and long-term financial forecasts. Designed for ease of use, this tool requires no advanced financial expertise, automatically updating financial statements and key emerging tech company financial metrics to ensure precise and actionable insights for both financial planners and technology investors.

EMERGING TECHNOLOGY INVESTMENT FIRM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive financial modeling template is designed specifically for emerging technology investment firms and startups. It integrates pro forma profit and loss statements, balance sheet forecasts, and cash flow projections, offering a robust financial forecast for technology investors. Equipped with budgeting models, performance review reports, and insightful financial analytics, this tool supports risk assessment and capital allocation tailored to tech ventures. Ideal for financial planning, investment return projections, and funding round analysis, it serves as a complete financial dashboard to drive informed decisions and maximize profitability in the dynamic tech sector.

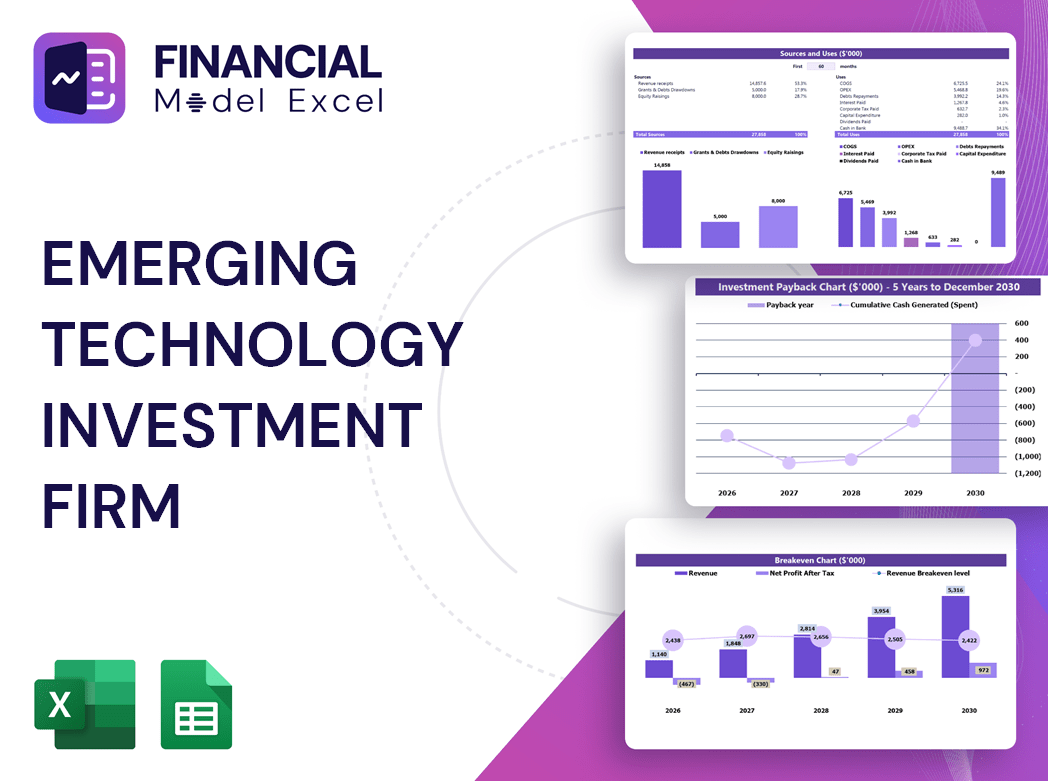

Dashboard

By inputting detailed financial data into our advanced financial modeling tool, you’ll develop a robust 5-year financial projection tailored for emerging tech companies. Leveraging built-in financial analytics and scenario analysis, you can refine your startup investment financial plan to enhance profitability and attract investors. Our intuitive financial dashboard features dynamic charts and graphs, empowering tech venture capital firms to assess risk, optimize capital allocation, and visualize cash flow modeling. Elevate your technology startup’s financial forecast with precision and confidence, ensuring your business plan stands out in the competitive investment landscape.

Business Financial Statements

Our advanced financial modeling template streamlines budgeting and cash flow modeling for technology startups. By simply updating assumptions, this comprehensive model automatically generates all three essential annual financial statements—empowering emerging tech companies with accurate financial forecasts and investment return projections. Designed for tech venture capital financial modeling and investment portfolio analysis, it provides a robust foundation for risk assessment and capital allocation. Optimize your startup investment financial plan effortlessly with this dynamic tool, tailored to fuel data-driven decisions and enhance profitability analysis in the fast-paced tech sector.

Sources And Uses Statement

A comprehensive financial projection model with detailed sources and uses of funds offers crucial insights into a company's income streams and expenditure patterns. For emerging technology firms, integrating this within financial analytics and budgeting models enhances accuracy in cash flow modeling and risk assessment. Tech venture capital firms rely on such investment portfolio financial modeling to optimize capital allocation and forecast returns. By leveraging startup investment financial plans and financial scenario analysis, investors gain a clear profitability outlook and valuation metrics essential for strategic decision-making in technology investments.

Break Even Point In Sales Dollars

The break-even sales calculator is a vital component of this five-year financial projections model, essential for emerging tech startups. It empowers founders and investors to assess whether their business model can achieve profitability, integrating seamlessly with comprehensive financial modeling for tech startups. By consolidating revenue, expenses, and taxes in this dynamic financial dashboard, startups can perform robust profitability analysis and risk assessment. This insight is crucial for tech venture capital financial modeling and capital allocation models, ensuring investment portfolios align with sustainable growth and optimal return projections in the technology sector.

Top Revenue

The Top Revenue tab in this pro forma financial model provides a comprehensive view of each offering’s performance. Designed for emerging tech companies and startups, it delivers detailed annual revenue breakdowns, highlighting revenue depth and bridging gaps across streams. This tool supports precise financial forecasting and profitability analysis, empowering investors and tech venture capital firms with actionable insights. Utilize this robust financial modeling template to enhance your investment portfolio financial modeling and optimize capital allocation for your technology investments.

Business Top Expenses Spreadsheet

The Top Expenses tab in this five-year financial projections model provides a clear breakdown of committed costs across four key categories. Designed specifically for emerging tech companies, it reveals how capital is allocated—whether attracting customers, compensating talent, or supporting operational growth. This financial forecasting tool enhances budgeting accuracy and enables tech venture capital firms to conduct detailed profitability analysis and risk assessment, ensuring strategic investment decisions aligned with startup growth objectives.

EMERGING TECHNOLOGY INVESTMENT FIRM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive costing template integrates salary costs for both FTEs and PTEs, ensuring precise financial planning for emerging tech companies. This seamless data flow enhances your financial modeling for tech startups by automatically updating relevant sections in your financial forecast. Designed for investment firms and venture capitalists, it supports robust financial analytics, risk assessment, and cash flow modeling. Empower your capital allocation model and profitability analysis with accurate, real-time insights, streamlining budgeting and investment return projections in the technology sector.

CAPEX Spending

The development costs section of the emerging technology investment financial projections model details capital expenditures essential for protecting, advancing, and enhancing competitiveness. Excluding staff salaries and operating expenses, this analysis enables investors to identify high-impact investment areas. Given significant variations across business models, incorporating this report into the overall financial planning for emerging tech companies ensures precise capital allocation and supports robust profitability analysis for tech investors.

Loan Financing Calculator

Our financial modeling template features a dynamic loan amortization schedule tailored for emerging tech companies. With integrated formulas, it accurately forecasts each installment’s principal and interest payments, supporting precise cash flow modeling for technology startups. This tool enhances financial planning and risk assessment for technology investments, helping investors and startups optimize capital allocation and improve investment return projections. Ideal for tech venture capital financial modeling, it streamlines budgeting and supports comprehensive financial scenario analysis within your financial dashboard, ensuring a clear roadmap for loan repayment aligned with your startup investment financial plan.

EMERGING TECHNOLOGY INVESTMENT FIRM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

A comprehensive bottom-up financial model delivers critical KPIs, including profitability, cash flow, and liquidity metrics vital for emerging tech companies. By integrating company-specific and industry benchmarks, this model supports robust financial forecasting for technology investors. These insights are essential for startup investment financial plans, enabling precise risk assessment and enhancing funding round financial models. Leveraging such financial analytics ensures effective capital allocation and strengthens investment return projections within the tech sector, empowering investment firms to make strategic, data-driven decisions.

Cash Flow Forecast Excel

Our cash flow modeling for technology startups demonstrates your expertise in managing cash streams and ensuring liquidity to meet obligations. Investment firms prioritize startups with robust financial projections models that confidently forecast adequate cash flow to service debts. A well-crafted startup investment financial plan not only attracts tech venture capital but also strengthens credibility with lenders by showcasing reliable capital allocation models and risk assessment in technology investments. This approach enhances profitability analysis for tech investors, providing a clear pathway to sustainable growth and successful funding rounds.

KPI Benchmarks

The financial benchmarking feature in this financial projection model empowers emerging tech firms to assess key performance indicators against industry peers. By leveraging investment firm valuation models and financial analytics for emerging tech firms, startups gain critical insights to enhance operational efficiency and profitability. This benchmarking process aligns with best practices and supports robust financial planning for emerging tech companies. As a vital tool in tech venture capital financial modeling and startup investment financial plans, it enables informed capital allocation and risk assessment, driving stronger investment return projections and sustainable growth in the competitive technology sector.

P&L Statement Excel

For emerging technology investment firms, utilizing a comprehensive financial projections model is crucial to forecast profitability accurately. Our advanced financial modeling for tech startups enables precise investment return projections and risk assessment in technology investments. This Excel-based budgeting model offers a detailed annual financial forecast, including projected income statements, after-tax balances, and net profit analysis. Designed to support startup investment financial plans, it empowers venture capitalists and tech investors with reliable financial analytics and scenario analysis, ensuring informed capital allocation decisions and maximizing long-term profitability in the dynamic tech sector.

Pro Forma Balance Sheet Template Excel

A pro forma balance sheet template in Excel offers a clear snapshot of an emerging tech firm’s assets, liabilities, and equity at a future date. Essential for financial modeling for tech startups, it supports accurate financial projections and risk assessment in technology investments. Use this tool to strengthen your startup investment financial plan, optimize capital allocation, and enhance financial forecasting for technology investors. Gain insights into your organization’s financial position, ensuring informed decision-making and robust investment return projections in the rapidly evolving tech sector.

EMERGING TECHNOLOGY INVESTMENT FIRM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our comprehensive 3-way financial model for emerging technology investments delivers precise startup valuation and robust financial projections. Featuring weighted average cost of capital (WACC) to demonstrate minimum required returns, free cash flow valuation to highlight cash available to investors, and discounted cash flow analysis to present the present value of future earnings—this model equips tech venture capitalists and investment firms with essential financial analytics. Enhance your investment portfolio financial modeling and risk assessment with clear, actionable insights designed to optimize capital allocation and drive confident decision-making in the dynamic tech sector.

Cap Table

This financial modeling Excel template offers a comprehensive startup investment financial plan, integrating cash flow modeling and profit & loss projections. Featuring a detailed capital allocation model and capitalization table, it supports accurate financial forecast for technology investors. Ideal for emerging tech companies and investment firms, it enables profitability analysis, risk assessment, and funding round financial modeling. With this tool, venture capitalists and tech startups can confidently evaluate sales, EBITDA, and investment returns—empowering data-driven decisions through robust financial analytics and scenario analysis tailored for the dynamic tech sector.

EMERGING TECHNOLOGY INVESTMENT FIRM FINANCIAL PROJECTIONS SPREADSHEET ADVANTAGES

Financial modeling for tech startups accelerates strategic alignment, enhancing investment decisions and driving growth efficiently.

Reduce risk and maximize returns with our emerging technology investment firm’s precise financial forecast model in Excel.

Our financial model empowers emerging tech startups to confidently prove loan repayment and attract savvy investors.

Our 5-year financial projection model ensures accurate cost assumptions, optimizing investment decisions for emerging tech companies.

Create a flexible 5-year financial model to optimize capital allocation and forecast startup growth with precision.

EMERGING TECHNOLOGY INVESTMENT FIRM PRO FORMA INCOME STATEMENT TEMPLATE EXCEL ADVANTAGES

Accurate financial modeling empowers tech investors to forecast impacts of upcoming changes, optimizing investment strategies confidently.

Financial modeling enables precise cash flow forecasts and scenario analysis, optimizing investment decisions for emerging tech firms.

Our dynamic financial model powers precise investment forecasts, maximizing returns and minimizing risks for emerging tech ventures.

Our three-statement financial model empowers precise forecasting and agile adjustments, optimizing investment strategies for tech startups.

Optimize capital allocation and ensure budget discipline with our precise financial modeling for emerging technology investments.

Our cash flow modeling for technology startups delivers precise projections, empowering strategic financial planning and confident investment decisions.

Our financial modeling for tech startups delivers precise projections, attracting investors and accelerating funding success.

The emerging technology financial model empowers startups to attract investors with accurate, compelling financial forecasts and projections.

Our financial modeling for tech startups identifies cash gaps and surpluses proactively, ensuring smarter investment decisions.

Financial modeling for tech startups enables proactive cash flow management, preventing deficits and optimizing growth opportunities effectively.