Employee Engagement Agency Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Employee Engagement Agency Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Employee Engagement Agency Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

EMPLOYEE ENGAGEMENT AGENCY FINANCIAL MODEL FOR STARTUP INFO

Highlights

The employee engagement agency financial model template is an essential tool for startups and established companies aiming to secure funding or optimize their business planning. By incorporating financial model assumptions, key metrics, and revenue streams, it enables comprehensive financial forecasting and budgeting. This includes cash flow projections, cost analysis, break-even analysis, and scenario planning to evaluate profitability and funding requirements effectively. The model’s structure and variables provide a clear financial dashboard, helping agencies assess startup costs, develop investment plans, and strategize for sustainable growth. Fully unlocked and customizable, this financial model enhances any business plan and supports informed decision-making for future expansion.

The employee engagement agency financial model template effectively addresses common pain points by providing a comprehensive financial model structure that integrates key metrics, revenue streams, and cost analysis, enabling buyers to streamline their budgeting, forecasting, and scenario planning processes. Its well-defined assumptions and variables simplify complex financial decisions, while the built-in break-even analysis and cash flow projections deliver clarity on profitability and funding requirements. Furthermore, the interactive financial model dashboard enhances real-time data visualization, making it easier to track financial health and investment plans, ultimately offering a ready-made solution that reduces the time and expertise needed to develop reliable financial forecasts and strategic investment strategies for employee engagement agencies.

Description

The employee engagement agency financial model template offers a comprehensive structure encompassing key metrics, revenue streams, and detailed cost analysis to support accurate financial forecasting and budgeting for start-ups and SMEs. Incorporating essential assumptions and scenario planning variables, this model enables precise cash flow management, break-even analysis, and profitability projections. Its intuitive financial model dashboard facilitates monitoring funding requirements, investment plans, and financial strategies, while the pro forma income statement and financial statements provide clear insights into profit and loss forecasts, empowering businesses to optimize employee engagement initiatives and maximize overall financial benefits.

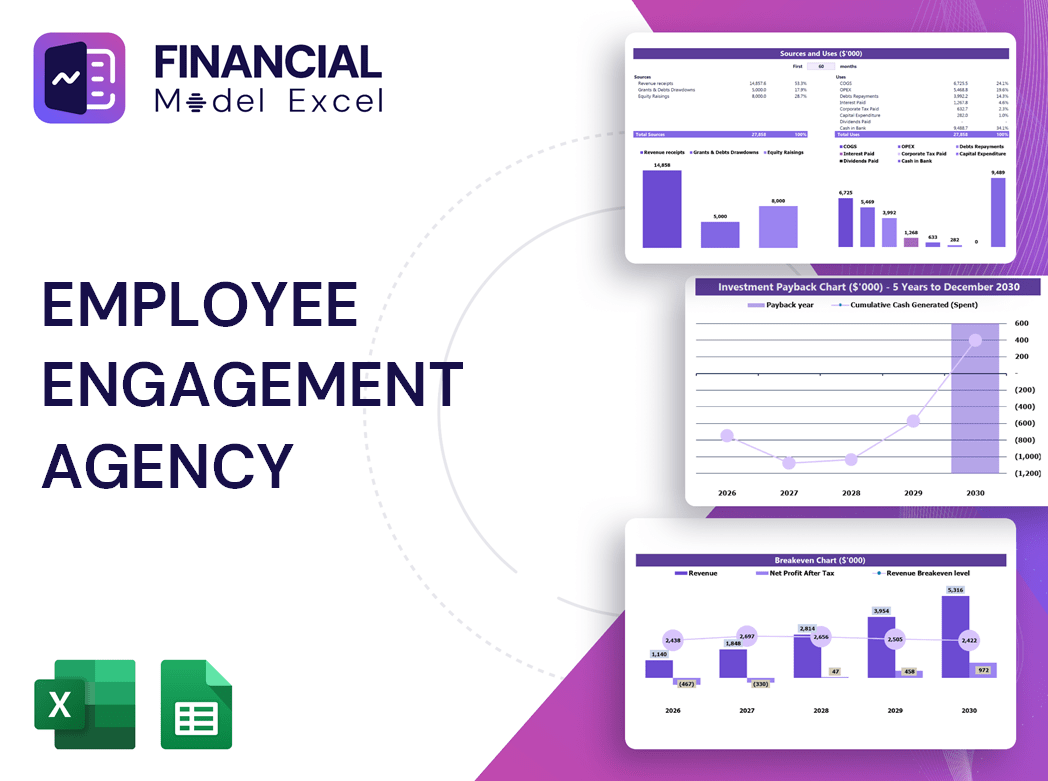

EMPLOYEE ENGAGEMENT AGENCY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive employee engagement agency financial model integrates key components such as income statements, cash flow, and balance sheets to deliver accurate projections. Utilizing a financial model template ensures holistic budgeting, cost analysis, and scenario planning aligned with your agency’s revenue streams and key metrics. Completing a feasibility study and refining financial assumptions annually enhances forecasting and profitability insights. Leveraging a robust financial model dashboard supports strategic decision-making and funding requirements, empowering your agency to optimize investment plans and break-even analysis for sustained growth and employee engagement success.

Dashboard

Our employee engagement agency financial model template features a comprehensive dashboard designed for fast, accurate financial projections and scenario planning. This all-in-one tool streamlines cost analysis, budgeting, and cash flow management, empowering professionals to evaluate key metrics and revenue streams with ease. Built for transparency and efficiency, the model supports strategic decision-making by providing clear assumptions, break-even analysis, and profitability insights. With this powerful financial model structure, you'll confidently navigate funding requirements and investment plans—unlocking actionable insights to drive sustained business growth.

Business Financial Statements

Our employee engagement agency financial model template offers a comprehensive financial summary that consolidates key data from balance sheet forecasts, monthly profit and loss statements, and cash flow projections. Designed with precision, this ready-to-use dashboard streamlines budgeting, cost analysis, and profitability forecasting—ideal for inclusion in your pitch deck. Leverage built-in financial model assumptions and scenario planning features to confidently present your agency’s revenue streams, investment plans, and break-even analysis, ensuring clear visibility into key metrics and funding requirements for strategic growth.

Sources And Uses Statement

The employee engagement agency financial model template offers a clear summary of capital sources and their planned uses, ensuring total amounts align perfectly. This essential financial model structure supports strategic decision-making, including recapitalization, restructuring, or mergers & acquisitions (M&A). With integrated cost analysis, revenue streams, and cash flow projections, it empowers agencies to forecast profitability and funding requirements confidently. Utilizing key metrics, scenario planning, and budgeting strategies, this model enhances financial clarity and drives informed growth for employee engagement agencies.

Break Even Point In Sales Dollars

Our employee engagement agency financial model template features an integrated worksheet that seamlessly links with your company’s financial statements. It automates break-even analysis, providing clear insights into break-even sales, units, and ROI. This tool empowers management with precise projections and profitability timelines, enabling informed decision-making and strategic financial planning.

Top Revenue

In an employee engagement agency financial model, understanding key metrics like the top line (revenue streams) and bottom line (profitability) is crucial. Investors closely monitor sales growth and earnings fluctuations, as these impact financial projections and funding requirements. Utilizing a robust financial model template with scenario planning, forecasting, and cash flow analysis ensures accurate budgeting and cost analysis. This structured approach helps optimize profitability and supports strategic decision-making, driving sustainable growth for the agency.

Business Top Expenses Spreadsheet

Effective financial management is crucial for any employee engagement agency. Our financial model template includes a detailed cost analysis and a top expense report, highlighting the four largest expense categories alongside other costs. This allows users to monitor spending patterns, optimize expenses, and enhance profitability. By leveraging key metrics and cash flow projections, agencies can strategically plan budgets, conduct break-even analysis, and ensure sustainable growth. Prioritizing cost management through scenario planning and budgeting empowers both startups and established firms to maintain financial health and drive long-term success.

EMPLOYEE ENGAGEMENT AGENCY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurate forecasting is vital for expense management in an employee engagement agency. Our financial model template enables detailed projections and budgeting up to five years, tracking cost fluctuations across periods. It integrates key variables like income percentages, payroll, recurring and current expenses, categorizing costs into fixed, variable, COGS, wages, and startup budgets. This structured approach provides robust scenario planning, cash flow analysis, and break-even insights, making the financial model a powerful tool for strategic decision-making and profitability forecasting within employee engagement agency operations.

CAPEX Spending

For any employee engagement agency, a robust financial model is essential to drive steady growth and profitability. Integrating key financial model assumptions with detailed cost analysis and revenue streams ensures strategic investment planning. Utilizing a comprehensive financial model template, including forecasting, budgeting, and cash flow projections, empowers business owners to develop an effective CAPEX strategy. By leveraging scenario planning and key metrics dashboards, agencies can optimize funding requirements and break-even analysis, aligning new technologies with sustainable expansion. This structured approach enhances decision-making and accelerates long-term success.

Loan Financing Calculator

Our employee engagement agency financial model template includes a dynamic loan amortization schedule, equipped with pre-built formulas for precise repayment tracking. It captures installment amounts, principal, and interest payments, providing clear visibility into monthly, quarterly, or annual obligations. This feature supports accurate cash flow forecasting, budgeting, and break-even analysis, helping you manage funding requirements and optimize profitability. Leverage this tool to enhance financial strategies and ensure confident, data-driven decision-making within your agency’s financial model structure.

EMPLOYEE ENGAGEMENT AGENCY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The gross profit margin, a key metric in an employee engagement agency financial model template, measures profitability by comparing revenue after sales costs to total revenue. An increasing gross margin percentage signals improved financial health, driven by either rising sales revenue or reduced cost of goods sold. This indicator is essential in financial model projections, cost analysis, and profitability assessments, enabling agencies to refine strategies, optimize revenue streams, and enhance budgeting accuracy. Understanding gross profit margin within the financial model dashboard supports informed decision-making and sustainable growth for employee engagement agencies.

Cash Flow Forecast Excel

An employee engagement agency financial model is essential for projecting cash flow, revenue streams, and profitability. Utilizing a robust financial model template with clear assumptions, key metrics, and scenario planning enables precise forecasting and budgeting. This strategic tool supports cost analysis, break-even analysis, and funding requirements, making it invaluable for startups seeking loans or capital raises. By leveraging a well-structured financial model dashboard and investment plan, agencies can confidently plan for sustainable growth and maximize employee engagement benefits.

KPI Benchmarks

A benchmarking study within an employee engagement agency financial model template helps startups evaluate key metrics like profit margins, cost analysis, and productivity margins by comparing them to industry peers. This strategic tool supports financial model projections and scenario planning, enabling companies to identify performance gaps and optimize revenue streams. By leveraging benchmarking, agencies enhance budgeting accuracy, improve cash flow forecasting, and strengthen investment plans. Ultimately, benchmarking drives informed decision-making and boosts overall profitability, making it an essential component of any employee engagement agency financial model structure.

P&L Statement Excel

The profit and loss statement within an employee engagement agency financial model incorporates non-cash transactions, such as asset depreciation, reflecting the true cost of operations for the period. Unlike cash flow forecasts that track only actual cash movements, this statement provides a comprehensive view of all expenses incurred, offering vital insights for accurate budgeting, cost analysis, and profitability projections. Utilizing a robust financial model template with structured assumptions and key metrics ensures strategic scenario planning and informed decision-making for sustained agency growth.

Pro Forma Balance Sheet Template Excel

An employee engagement agency financial model template offers a clear projection of your organization’s assets, liabilities, and equity over time. By incorporating key metrics, assumptions, and revenue streams, this model provides actionable insights into your agency’s financial health. Utilize scenario planning, cash flow analysis, and budgeting strategies to forecast profitability and funding requirements effectively. Our comprehensive financial model dashboard enables you to evaluate cost structures, investment plans, and break-even points, empowering informed decisions that drive sustainable growth and enhanced employee engagement outcomes.

EMPLOYEE ENGAGEMENT AGENCY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

An employee engagement agency financial model template streamlines forecasting by incorporating key metrics like Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC provides a clear breakdown of equity and debt proportions, essential for risk assessment and loan approval. Meanwhile, DCF offers insight into the present value of future cash flows, guiding investment decisions. Combining these assumptions and variables, the financial model structure enables effective budgeting, scenario planning, and profitability analysis—empowering agencies to optimize revenue streams and funding requirements confidently.

Cap Table

An equity cap table is a vital tool for any employee engagement agency’s financial model. It offers comprehensive insights into investments, shareholders, and funding limits, serving as the foundation for accurate financial projections and scenario planning. By integrating cap table data into your financial model structure, you enhance budgeting, cash flow analysis, and break-even forecasting, ensuring strategic decision-making and optimized revenue streams. This transparency supports robust financial model assumptions and key metrics, empowering your agency to navigate funding requirements and drive profitability effectively.

EMPLOYEE ENGAGEMENT AGENCY FINANCIAL MODEL STARTUP ADVANTAGES

Our employee engagement agency financial model drives profitability through accurate forecasting, strategic budgeting, and clear revenue streams.

Establish clear milestones using an employee engagement agency financial model to boost forecasting accuracy and profitability.

Set new goals confidently using the employee engagement agency financial model template for precise forecasting and profitability analysis.

Take control of cash flow with a tailored employee engagement agency financial model for accurate forecasting and profitability.

Optimize surplus cash efficiently with our employee engagement agency financial model for accurate projections and strategic growth.

EMPLOYEE ENGAGEMENT AGENCY 3 WAY FINANCIAL MODEL TEMPLATE ADVANTAGES

Our employee engagement agency financial model enhances profitability with accurate cash flow and dynamic scenario planning in USD.

Our employee engagement agency financial model ensures precise forecasting and profitability through customizable assumptions and key metrics.

Optimize cash flow and profitability with an employee engagement agency financial model for strategic accounts receivable management.

Our financial model enables clear cash flow forecasting by analyzing invoice timings, improving payment strategies and profitability insights.

Unlock growth with an employee engagement agency financial model offering precise forecasting and profitability insights for startups.

The employee engagement agency financial model streamlines forecasting, boosting investor confidence with clear profitability and cash flow insights.

Our employee engagement agency financial model ensures accurate projections and profitability to attract confident investor funding.

Our financial model links all variables seamlessly, delivering clear, investor-ready projections that enhance strategic decision-making.

Optimize profitability and avoid cash flow shortfalls with our employee engagement agency financial model forecasting and budgeting strategies.

The employee engagement agency financial model dashboard enables proactive cash flow forecasting to prevent damaging startup shortfalls effectively.