Energy Infrastructure Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Energy Infrastructure Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Energy Infrastructure Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ENERGY INFRASTRUCTURE FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year energy infrastructure investment model offers robust financial modeling for energy projects, tailored specifically for early-stage startups aiming to impress investors and secure capital. It integrates renewable energy financial analysis and energy asset valuation techniques to evaluate startup ideas, forecast energy infrastructure costs, and facilitate financial planning for energy developments. The model also incorporates project finance for energy infrastructure, energy project cash flow modeling, and financial risk assessment in energy projects, making it an essential tool for startups seeking funding from banks, angels, grants, and venture capital. Fully unlocked and editable, it supports detailed financial scenario analysis in the energy sector to optimize infrastructure financing strategies and enhance the financial feasibility of energy projects.

The ready-made energy infrastructure investment model addresses critical pain points by providing a comprehensive financial planning tool tailored to renewable energy projects, integrating financial modeling for energy projects with precise energy infrastructure cost forecasting and capital budgeting for energy infrastructure. Its built-in energy project cash flow modeling and financial risk assessment in energy projects enable users to quickly evaluate the financial feasibility of energy projects while leveraging robust energy asset valuation techniques and energy sector financial projections. This template simplifies project finance for energy infrastructure by including infrastructure financing strategies, energy infrastructure debt modeling, and energy infrastructure loan structuring, ensuring accurate utility infrastructure financial models and energy market financial forecasting. By consolidating complex financial scenario analysis in the energy sector and financial metrics for energy projects, the model significantly reduces time spent on manual calculations and enhances confidence in energy infrastructure funding options, ultimately streamlining financial decision-making for project developers and investors alike.

Description

The comprehensive energy infrastructure investment model integrates advanced financial modeling for energy projects, encompassing renewable energy financial analysis and detailed energy asset valuation techniques to enhance decision-making. This 5-year financial framework includes robust energy project cash flow modeling, energy infrastructure cost forecasting, and capital budgeting for energy infrastructure, facilitating precise energy sector financial projections. By incorporating financial risk assessment in energy projects and infrastructure financing strategies, it enables thorough financial scenario analysis within the energy sector. The model supports financial planning for energy developments with utility infrastructure financial models, energy infrastructure loan structuring, and energy infrastructure debt modeling, ensuring a holistic approach to evaluating the financial feasibility of energy projects. Additionally, it generates key financial metrics for energy projects and optimizes energy infrastructure funding options, streamlining project finance for energy infrastructure while providing reliable energy market financial forecasting to meet the stringent requirements of investors and financial institutions.

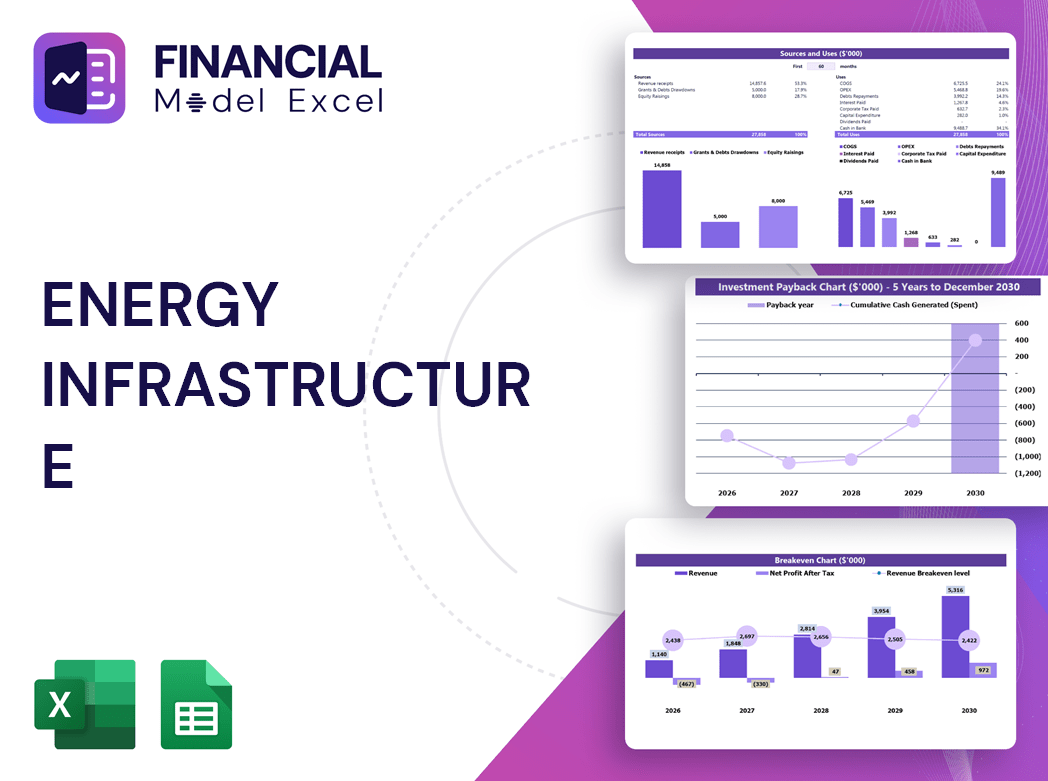

ENERGY INFRASTRUCTURE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Investors demand a robust energy infrastructure investment model, making a detailed financial plan essential. Our comprehensive 5-year energy infrastructure financial model incorporates financial modeling for energy projects, including cash flow modeling, debt structuring, and financial risk assessment. This 3-statement Excel template enables precise capital budgeting and renewable energy financial analysis, clearly outlining funding requirements and projected returns. By leveraging advanced energy asset valuation techniques and scenario analysis, our model ensures confident decision-making and maximizes investment potential in energy infrastructure developments.

Dashboard

Discover a comprehensive energy infrastructure investment model that streamlines financial modeling for energy projects. Our dynamic templates deliver clear charts for energy asset valuation techniques, energy infrastructure cost forecasting, and project finance for energy infrastructure. Transform raw data into compelling energy sector financial projections and financial metrics for energy projects, making your financial planning and capital budgeting for energy infrastructure both insightful and engaging. Easily customize inputs to perform financial risk assessment and energy project cash flow modeling—ready to enhance your decks with professional precision and impactful energy market financial forecasting.

Business Financial Statements

Our comprehensive 5-year financial projection model empowers energy project developers to perform in-depth financial modeling for energy projects, including cash flow modeling, cost forecasting, and financial risk assessment. This tool streamlines capital budgeting for energy infrastructure and enhances financial planning for energy developments. Dynamic charts and graphs translate complex renewable energy financial analysis and asset valuation techniques into clear insights, enabling effective communication with stakeholders and investors. Leverage robust energy infrastructure investment models and infrastructure financing strategies to showcase the financial feasibility of your projects and secure funding with confidence.

Sources And Uses Statement

The sources and uses statement is essential in energy infrastructure investment models, providing clear visibility into cash inflows and outflows. It underpins financial modeling for energy projects by detailing revenue sources and expenditure destinations. This statement supports financial planning for energy developments, enabling accurate energy project cash flow modeling, energy asset valuation techniques, and financial risk assessment in energy projects. Incorporating it enhances capital budgeting for energy infrastructure and infrastructure financing strategies, ensuring robust financial feasibility and energy sector financial projections. Ultimately, it guides strategic decisions in energy infrastructure loan structuring and funding options.

Break Even Point In Sales Dollars

The break-even analysis in energy infrastructure financial modeling pinpoints where total revenue equals fixed costs, resulting in zero profit or loss. Utilizing marginal costing principles, it captures varying cost behaviors across output levels. This technique is essential in renewable energy financial analysis and energy project cash flow modeling, offering critical insights into profit margins at different sales volumes. Incorporating break-even graphs enhances financial planning for energy developments, supports capital budgeting for energy infrastructure, and improves financial risk assessment in energy projects by forecasting cost and revenue thresholds vital for informed investment decisions.

Top Revenue

This financial model offers a comprehensive revenue analysis tab, enabling detailed financial planning for energy developments. Leverage this template to conduct segmented revenue assessment across products or services, enhancing energy project cash flow modeling and financial scenario analysis. Ideal for renewable energy financial analysis and infrastructure financing strategies, it supports robust capital budgeting for energy infrastructure. Elevate your financial risk assessment in energy projects by accurately forecasting energy sector financial projections and optimizing energy infrastructure investment models for informed decision-making.

Business Top Expenses Spreadsheet

The Top Expenses section of the financial projection template is essential for capturing a company’s annual costs, categorized into four key groups. This energy infrastructure investment model provides a comprehensive financial planning framework, incorporating detailed cost analysis—from customer acquisition to fixed expenses. Leveraging energy project cash flow modeling and financial risk assessment in energy projects, it enables precise energy infrastructure cost forecasting. Understanding expense origins empowers strategic financial management, supports capital budgeting for energy infrastructure, and enhances financial feasibility of energy projects. This approach is vital for optimizing infrastructure financing strategies and ensuring sustainable growth in the energy sector.

ENERGY INFRASTRUCTURE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive energy infrastructure investment model is essential for accurate financial planning and cost forecasting in energy projects. Leveraging advanced financial modeling for energy projects automates expense tracking and enhances financial risk assessment, ensuring a clear understanding of project cash flows and capital budgeting needs. This robust model supports funding strategies by improving financial feasibility analysis and energy asset valuation techniques. Organized cost projections not only streamline budget management but also serve as a strategic communication tool with investors and lenders, facilitating effective project finance for energy infrastructure and optimizing infrastructure financing strategies.

CAPEX Spending

Capital expenditures (CapEx) represent the investment in acquiring, maintaining, or upgrading fixed assets like property, equipment, and technology critical to energy infrastructure. Accurately integrating CapEx within financial modeling for energy projects enhances capital budgeting and energy infrastructure cost forecasting. These expenses are vital components in projected balance sheets and play a significant role in energy project cash flow modeling and financial feasibility assessments. Properly accounting for CapEx ensures robust financial planning for energy developments, supporting effective infrastructure financing strategies and reliable energy sector financial projections.

Loan Financing Calculator

Start-ups and early-stage energy companies must meticulously manage loan repayment schedules to ensure robust financial planning for energy developments. These schedules detail loan amounts, maturity terms, and principal repayments, critical for accurate energy project cash flow modeling and infrastructure financing strategies. Incorporating interest expenses within the debt schedule enhances financial modeling for energy projects, directly impacting cash flow statements and energy sector financial projections. Effective loan structuring and debt modeling enable precise financial risk assessment and support capital budgeting for energy infrastructure, ultimately strengthening the financial feasibility and valuation of renewable energy investments.

ENERGY INFRASTRUCTURE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA represents earnings before interest, taxes, depreciation, and amortization, serving as a key indicator of operational performance. In financial modeling for energy projects, particularly within energy infrastructure investment models, EBITDA provides critical insight for capital budgeting, financial risk assessment, and energy asset valuation techniques. Accurate EBITDA projections enhance energy sector financial forecasts and support robust infrastructure financing strategies, ensuring comprehensive financial planning for energy developments and effective energy project cash flow modeling.

Cash Flow Forecast Excel

Effective financial planning for energy developments hinges on robust cash flow modeling and energy infrastructure cost forecasting. Utilizing proforma cash flow statements enables precise financial scenario analysis in energy projects, capturing both inflows and outflows. This financial modeling for energy projects supports capital budgeting for energy infrastructure and enhances financial risk assessment, driving optimized asset valuation techniques. Harnessing these tools empowers business owners to refine infrastructure financing strategies, improve energy sector financial projections, and ultimately boost capital turnover and revenue in renewable energy and utility infrastructures. Embracing such models is essential for sustainable growth in the energy sector.

KPI Benchmarks

This Excel-based financial model features a dedicated tab for comprehensive financial benchmarking research. It enables in-depth financial analysis of a company's performance alongside comparative evaluation using key financial metrics against industry peers. By leveraging energy infrastructure financial modeling and energy asset valuation techniques, users gain critical insights into competitiveness, operational efficiency, and productivity. This approach supports robust financial risk assessment in energy projects and enhances financial planning for energy developments, ensuring strategic alignment with industry standards and optimized capital budgeting for energy infrastructure investments.

P&L Statement Excel

Our comprehensive Excel template for annual projected profit and loss offers an insightful financial planning tool for energy infrastructure projects. It captures all transactions over the year, integrating key financial metrics, cost forecasting, and profitability ratios. Designed to support financial modeling for energy projects, this template enhances energy asset valuation techniques and improves financial risk assessment. Whether for capital budgeting or energy market financial forecasting, it provides a clear, data-driven foundation to optimize infrastructure financing strategies and ensure robust financial feasibility in renewable energy developments.

Pro Forma Balance Sheet Template Excel

A projected balance sheet is essential in financial modeling for energy projects, detailing a company’s assets, liabilities, and net worth at a specific point in time. It divides capital into equity and borrowed funds, providing crucial insights into liquidity, solvency, and turnover ratios. Coupled with profit and loss forecasts, it supports robust energy infrastructure investment models and capital budgeting for energy infrastructure. This financial planning foundation enables accurate energy sector financial projections, effective project finance strategies, and comprehensive financial risk assessment in energy projects, ensuring sound financial feasibility and optimal infrastructure financing decisions.

ENERGY INFRASTRUCTURE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This 5-year projection template features an advanced valuation report module designed for precise discounted cash flow analysis. By inputting key rates in the cost of capital, users can seamlessly conduct energy asset valuation techniques essential for financial modeling of energy projects. This tool supports detailed financial planning for energy developments, enabling robust financial feasibility assessments and capital budgeting for energy infrastructure. Ideal for energy sector financial projections and energy infrastructure investment models, it empowers stakeholders to make informed decisions with confidence.

Cap Table

Our pro forma financial statements template includes a comprehensive cap table—an essential tool for startups and energy projects alike. It details the company’s ownership structure, listing shares, options, investor purchase prices, and each stakeholder’s ownership percentage. Integrating this with financial modeling for energy projects and capital budgeting for energy infrastructure ensures accurate energy asset valuation techniques and robust financial risk assessment in energy projects. This holistic approach supports informed decision-making, optimizing infrastructure financing strategies and energy infrastructure loan structuring for sustainable project finance.

ENERGY INFRASTRUCTURE 5 YEAR CASH FLOW PROJECTION TEMPLATE ADVANTAGES

Optimize energy infrastructure investments with advanced financial modeling for reliable, data-driven project growth and risk management.

Avoid cash flow issues by leveraging our energy infrastructure financial model for precise project finance and risk assessment.

Our energy infrastructure investment model enhances financial accuracy, boosting investor confidence and accelerating project funding.

Optimize capital demand accurately with our comprehensive energy infrastructure financial modeling and business projection template.

Unlock strategic growth with our energy infrastructure financial model, delivering precise 5-year forecasts for confident investment decisions.

ENERGY INFRASTRUCTURE FINANCIAL MODEL ADVANTAGES

Our energy infrastructure investment model enhances project viability with precise financial risk assessment and robust cash flow forecasting.

A robust energy infrastructure financial model empowers precise cash flow forecasting and minimizes financial risks for sustainable growth.

Our energy infrastructure investment model delivers precise financial projections, optimizing capital allocation and maximizing project returns efficiently.

Our financial modeling offers comprehensive, print-ready reports to optimize energy project profitability and streamline cash flow management.

Our energy infrastructure investment model saves time and money through precise financial risk assessment and cost forecasting.

Our energy infrastructure investment model delivers precise financial analysis, saving costs while empowering your strategic growth and innovation.

Our energy infrastructure investment model ensures precise financial risk assessment, optimizing project feasibility and funding strategies effectively.

A clear, well-structured financial model enables efficient hypothesis testing and enhances decision-making in energy infrastructure investments.

Our energy infrastructure investment model enables better decision making through precise financial risk assessment and cost forecasting.

Optimize energy project decisions confidently using advanced energy project cash flow modeling for accurate financial scenario analysis.