Energy Regulation Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Energy Regulation Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Energy Regulation Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ENERGY REGULATION FINANCIAL MODEL FOR STARTUP INFO

Highlights

Develop a comprehensive 5-year energy regulation impact model in an Excel template featuring detailed cash flow projections, financial dashboards, and core GAAP/IFRS metrics to support utility financial planning and energy policy financial assessment. This energy contract financial modeling tool aids in evaluating startup ideas, optimizing energy cost structures, and securing funding from banks, angels, grants, and venture capital by providing robust energy sector budgeting and energy market financial modeling capabilities. Fully editable and customizable, it enables precise energy finance scenario analysis and energy asset valuation to enhance decision-making within the renewable energy financial analysis and power sector financial forecast domains.

This ready-made energy regulation financial model Excel template alleviates common challenges faced by buyers in energy market financial modeling and utility financial planning by providing an intuitive platform for renewable energy financial analysis and energy contract financial modeling without requiring advanced expertise. It automates complex calculations across critical reports such as energy sector cash flow models, energy infrastructure financial models, and energy economics financial planning, enabling seamless updates with simple input edits. With features like energy policy financial assessment, energy risk management model integration, and energy market pricing simulation, users can confidently conduct energy finance scenario analysis, optimize energy tariffs, and accurately forecast power sector profits, thus transforming conceptual plans into compelling investment-ready documents that enhance stakeholder confidence and streamline energy project investment modeling.

Description

This comprehensive energy regulation impact model integrates a robust 3-way financial structure encompassing profit and loss projections, balance sheet forecasts, and cash flow analysis over a 60-month horizon, designed to support utility financial planning and energy sector budgeting. Featuring detailed energy contract financial modeling and energy tariff modeling components, it enables precise energy cost optimization and energy market financial modeling, facilitating accurate energy asset valuation and energy finance scenario analysis. This model is essential for evaluating the implications of regulatory changes on energy project investment models, assisting stakeholders with strategic decision-making through energy policy financial assessment and energy risk management models, thereby enhancing overall energy economics financial planning and energy infrastructure financial model accuracy.

ENERGY REGULATION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our energy regulation impact model offers a comprehensive financial forecast by integrating your company’s core financial statements, including profit and loss, balance sheet, and cash flow projections. Unlike simplified models, this energy project investment model enables detailed energy finance scenario analysis, allowing you to assess how changes in regulatory policies affect your income, expenditures, and overall cash flow. Perfect for renewable energy financial analysis and energy sector budgeting, our model supports strategic utility financial planning and energy asset valuation, empowering informed decision-making and optimized energy cost management.

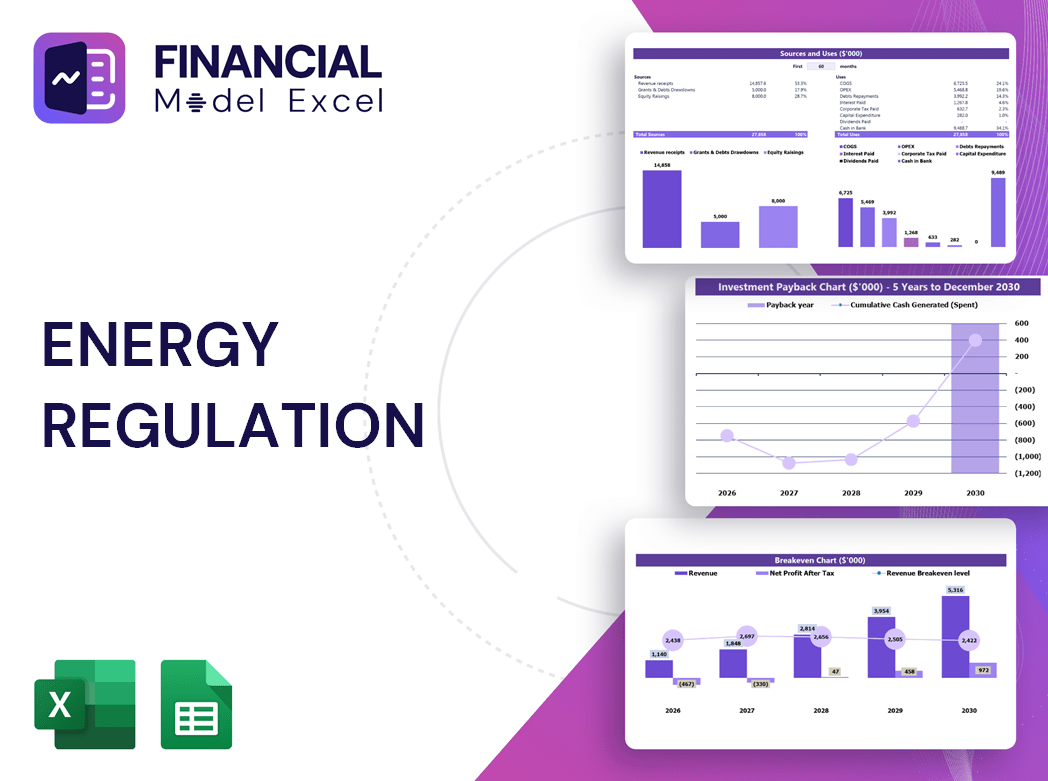

Dashboard

Our energy market financial modeling dashboard streamlines renewable energy financial analysis and energy project investment modeling. With embedded calculations tailored for energy sector budgeting and energy cost optimization models, it allows seamless tracking of revenues, expenses, and cash flow forecasts. This powerful tool enables utility financial planning and energy contract financial modeling, providing clear KPIs to guide strategic decisions. Monitor electricity pricing financial models, energy tariff scenarios, and energy asset valuation effortlessly—empowering your business to optimize performance and achieve sustainable growth in the dynamic power sector.

Business Financial Statements

Our comprehensive energy market financial modeling template empowers professionals to develop detailed renewable energy financial analysis, energy project investment models, and power sector financial forecasts. It facilitates the creation of accurate business financial statements, computations, and scenario-based predictions. With dynamic energy tariff modeling and energy cost optimization charts, users can effectively communicate key insights to stakeholders. These intuitive financial visualizations streamline the presentation of complex data, enhancing engagement with investors and supporting strategic decision-making across energy finance and utility financial planning initiatives.

Sources And Uses Statement

The Sources and Uses statement within this energy finance scenario analysis model meticulously details all funding origins and allocations, providing a clear framework for energy project investment models. This enables stakeholders to optimize capital deployment, enhance energy asset valuation, and support robust utility financial planning. By integrating comprehensive energy sector cash flow modeling, the statement ensures precise tracking of financial inflows and outflows, empowering strategic decisions in renewable energy financial analysis and energy cost optimization models. This transparency is crucial for navigating complex energy market financial modeling and improving overall energy economics financial planning.

Break Even Point In Sales Dollars

A break-even financial model is essential in energy market financial modeling, enabling companies to pinpoint when projects or products achieve profitability. Utilizing a 5-year energy project investment model, this tool forecasts sales volumes needed to cover fixed and variable costs, optimizing energy cost management. Integrating renewable energy financial analysis and utility financial planning, it supports robust energy sector budgeting and risk management. This dynamic approach empowers stakeholders to make informed decisions through accurate energy asset valuation and energy finance scenario analysis, ultimately enhancing energy sector cash flow and profitability.

Top Revenue

In energy finance, precise financial modeling—such as energy market financial modeling and renewable energy financial analysis—is crucial for accurate forecasting and investment decisions. Monitoring top-line growth, or revenue increases, in energy project investment models signals operational success and market potential. Equally, bottom-line profits reveal financial health, guiding stakeholders through energy sector budgeting models and energy cost optimization models. Robust electricity pricing financial models and energy contract financial modeling further enhance strategic planning, ensuring comprehensive energy asset valuation and risk management. Such integrated financial insights are vital for navigating the evolving energy market landscape with confidence.

Business Top Expenses Spreadsheet

Effective energy cost optimization is essential for sustained profitability in startups and established firms. Our energy sector cash flow model features a comprehensive top spending report, highlighting the four largest expense categories and consolidating others for clarity. This empowers users to monitor expense trends, enabling precise financial planning and control. Leveraging renewable energy financial analysis and energy project investment models, businesses can make informed decisions that enhance budgeting, optimize energy tariff modeling, and improve financial forecasts in the dynamic power sector. Meticulous expense management fuels long-term success in the evolving energy market landscape.

ENERGY REGULATION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our comprehensive energy market financial modeling template seamlessly integrates individual and group budgets, allowing precise tracking of FTEs and PTEs salary costs. Designed for renewable energy financial analysis and energy project investment models, this dynamic tool ensures all input data automatically updates across a 3-year financial projection. It supports energy asset valuation, energy tariff modeling, and utility financial planning with unmatched accuracy. Empower your power sector financial forecast and energy cost optimization model with a solution tailored to streamline energy contract financial modeling and energy policy financial assessment for strategic, data-driven decision-making.

CAPEX Spending

Our capital expenditure forecasting tool delivers precise CAPEX planning integrated with automated depreciation calculations, essential for robust energy project investment models. Users can seamlessly apply straight-line or double-declining balance depreciation methods, enhancing accuracy in energy sector cash flow models and utility financial planning. This functionality supports comprehensive energy asset valuation and strengthens energy contract financial modeling by providing reliable inputs for power sector financial forecasts and renewable energy financial analysis. Optimize your energy infrastructure financial model with dynamic CAPEX management tailored for advanced energy market financial modeling and energy cost optimization.

Loan Financing Calculator

Effective loan repayment schedules are crucial for startups and growing companies, directly influencing cash flow and financial planning. These schedules detail principal amounts, terms, maturity, and interest rates, impacting cash flow analysis and the energy sector cash flow model. Accurate loan repayment tracking ensures precise reflection of debt on balance sheets and integration into pro forma cash flow statements. Integrating this with energy project investment models and utility financial planning supports robust energy finance scenario analysis, optimizing financial health and strategic decision-making within the dynamic power sector financial forecast environment.

ENERGY REGULATION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Assets (ROA) is a key metric in energy asset valuation, measuring profitability relative to total assets. Using data from a projected balance sheet and income and expenditure templates, ROA reveals how efficiently an energy project investment model converts assets into earnings. This metric is vital for utility financial planning and energy industry budgeting models, guiding stakeholders in optimizing energy cost, assessing financial performance, and enhancing energy infrastructure financial models. Accurate ROA analysis supports informed decisions within energy finance scenario analysis and risk management frameworks, ensuring optimal returns in dynamic energy markets.

Cash Flow Forecast Excel

In energy sector financial planning, net income from projected statements often aligns with changes in cash flow for simpler operations. However, an energy sector cash flow model goes further by incorporating financing activities such as project loans or capital injections—elements excluded from income statements. This energy finance scenario analysis is vital for accurately forecasting cash needs, burn rates, and runway duration, enabling proactive energy project investment modeling and effective energy cost optimization.

KPI Benchmarks

Our comprehensive 3-statement financial model Excel template integrates industry benchmark analysis, empowering energy sector professionals with precise comparisons of key financial indicators. Designed for energy market financial modeling and renewable energy financial analysis, this tool enables robust energy project investment modeling and utility financial planning. By aligning your company’s performance metrics against industry standards, it enhances energy sector cash flow modeling and energy asset valuation accuracy. Ideal for energy finance scenario analysis and power sector financial forecasting, this template supports strategic decision-making and optimizes financial performance across diverse energy markets.

P&L Statement Excel

The profit and loss statement template in Excel is crucial for comprehensive energy finance scenario analysis, capturing revenues, expenses, and non-cash items like depreciation. Unlike energy sector cash flow models that track actual cash movements, this financial tool provides a deeper insight into long-term profitability and asset valuation. Integrating such detailed income statements enhances utility financial planning and energy project investment models, ensuring accurate power sector financial forecasts and robust energy contract financial modeling for informed decision-making in the evolving energy market.

Pro Forma Balance Sheet Template Excel

A projected balance sheet captures a company’s financial position at a specific point, highlighting assets, liabilities, and equity—crucial for energy asset valuation and utility financial planning. Complemented by profit and loss forecasts, which reflect operational results over time, these models provide vital insights into liquidity, solvency, and turnover ratios. Integrating these templates within energy market financial modeling or renewable energy financial analysis supports robust energy project investment models and enhances energy sector cash flow forecasting, enabling smarter capital allocation and risk management in the evolving power sector.

ENERGY REGULATION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our energy asset valuation model integrates a robust discounted cash flow analysis, enabling precise financial assessment for startups in the power sector. By inputting key rates such as the Cost of Capital, users can effortlessly perform comprehensive valuations. This streamlined approach supports energy project investment modeling and enhances utility financial planning, providing clarity in complex energy finance scenario analysis. Ideal for renewable energy financial analysis and energy market pricing simulation, our model empowers stakeholders with actionable insights for informed decision-making and optimized energy sector cash flow management.

Cap Table

In energy project investment models, accurate cap table management—detailing equity distribution across common stock, preferred shares, options, and warrants—is crucial. Maintaining an organized, up-to-date capitalization schedule empowers stakeholders to make informed decisions on financing rounds, employee incentives, and strategic acquisitions. Integrating this with energy sector financial forecasting and energy asset valuation enhances overall energy finance scenario analysis, optimizing capital allocation and risk management within renewable energy financial analysis and utility financial planning.

ENERGY REGULATION BUSINESS PLAN EXCEL FINANCIAL TEMPLATE ADVANTAGES

Optimize energy investments confidently with our 5-year pro forma model, enhancing financial accuracy and strategic planning.

Streamline funding pitches with our energy regulation financial model, ensuring accurate feasibility and confident investment decisions.

Gain strategic control and optimize profits with an advanced energy regulation impact financial model for startups.

The energy market financial modeling tool optimizes costs and guides strategic investment decisions for maximum profitability.

Our energy project investment model delivers precise 5-year cash flow forecasts, empowering confident financial planning decisions.

ENERGY REGULATION BUSINESS PLAN EXCEL TEMPLATE ADVANTAGES

Optimize investments confidently with our energy project investment model driving precise financial analysis and risk management strategies.

Optimizing decisions with energy regulation impact models ensures accurate cash flow forecasts, minimizing financial risk and promoting sustainable growth.

Get a robust energy market financial model that drives accurate forecasting and maximizes investment returns efficiently.

This robust energy regulation impact model empowers precise financial planning, customization, and advanced scenario analysis for startups.

Our energy project investment model delivers precise financial forecasts, maximizing returns while minimizing investment risks for stakeholders.

Accelerate funding with energy project investment models delivering precise financial insights and driving confident investor negotiations.

Our energy market financial modeling empowers better decision-making through accurate forecasting and optimized investment strategies.

Optimize operational decisions confidently using our energy sector cash flow model for precise financial scenario forecasting.

Optimize profitability and avoid cash flow shortfalls with our precise energy market financial modeling solutions.

Energy sector cash flow models enable accurate forecasting, preventing costly shortfalls and optimizing financial stability efficiently.