Engine Manufacturing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Engine Manufacturing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Engine Manufacturing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ENGINE MANUFACTURING FINANCIAL MODEL FOR STARTUP INFO

Highlights

The engine manufacturing financial forecasting model is a comprehensive 5-year budget planning tool designed specifically for companies in the engine production sector. This engine manufacturing cost analysis model enables startups and established businesses to perform detailed financial projection for engine manufacturing, including revenue forecasts, expense tracking, and capital expenditure planning. Equipped with a robust financial statement model for engine production, it supports evaluating startup ideas, conducting financial risk assessments, and securing funding from banks, angel investors, and venture capitalists. This unlocked engine manufacturing profitability model serves as an essential financial budgeting tool, facilitating effective engine manufacturing break-even analysis and overall financial performance management.

The engine manufacturing financial forecasting model addresses critical pain points by streamlining complex budget planning, cost analysis, and cash flow management into an intuitive Excel template, empowering businesses to accurately project revenue, track production expenses, and evaluate capital expenditures with ease. This ready-made financial model excels in delivering clear financial statements, comprehensive break-even analysis, and profitability modeling, helping manufacturers quickly identify financial risks and opportunities without the need for extensive accounting expertise. By integrating dynamic dashboards and scenario planning capabilities, it enables users to assess the impact of market fluctuations, operational changes, and investment decisions, ensuring robust financial performance and effective cost management within the engine production sector.

Description

Our engine manufacturing financial forecasting model is a comprehensive tool designed to support detailed engine manufacturing budget planning and cost analysis, integrating dynamic assumptions for revenue, expenses, initial investments, and production ramp-up. This manufacturing business financial model engine includes financial projection for engine manufacturing, investment analysis, and a robust engine manufacturing cash flow model to monitor liquidity and capital expenditure. Equipped with financial risk assessment and profitability modeling, it features a cost management model for engine manufacturing alongside break-even analysis and expense tracking to optimize operational efficiency. The model provides a full suite of financial statements essential for engine production financial planning, including financial budgeting tools and financial performance metrics that enable thorough financial statement modeling and revenue forecasting within the manufacturing sector.

ENGINE MANUFACTURING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Discover our comprehensive engine manufacturing financial forecasting model designed for accuracy and scalability. Built to encompass all critical assumptions, this robust financial projection tool supports budget planning, cost analysis, and profitability assessment. Tested against diverse scenarios, it ensures reliable engine production financial planning and risk evaluation. Fully customizable, our engine manufacturing financial model empowers you to tailor expense tracking, revenue forecasting, and capital expenditure insights, providing a dynamic foundation for your manufacturing business’s growth and success. Elevate your strategic planning with a model that adapts seamlessly to your unique engine manufacturing operations.

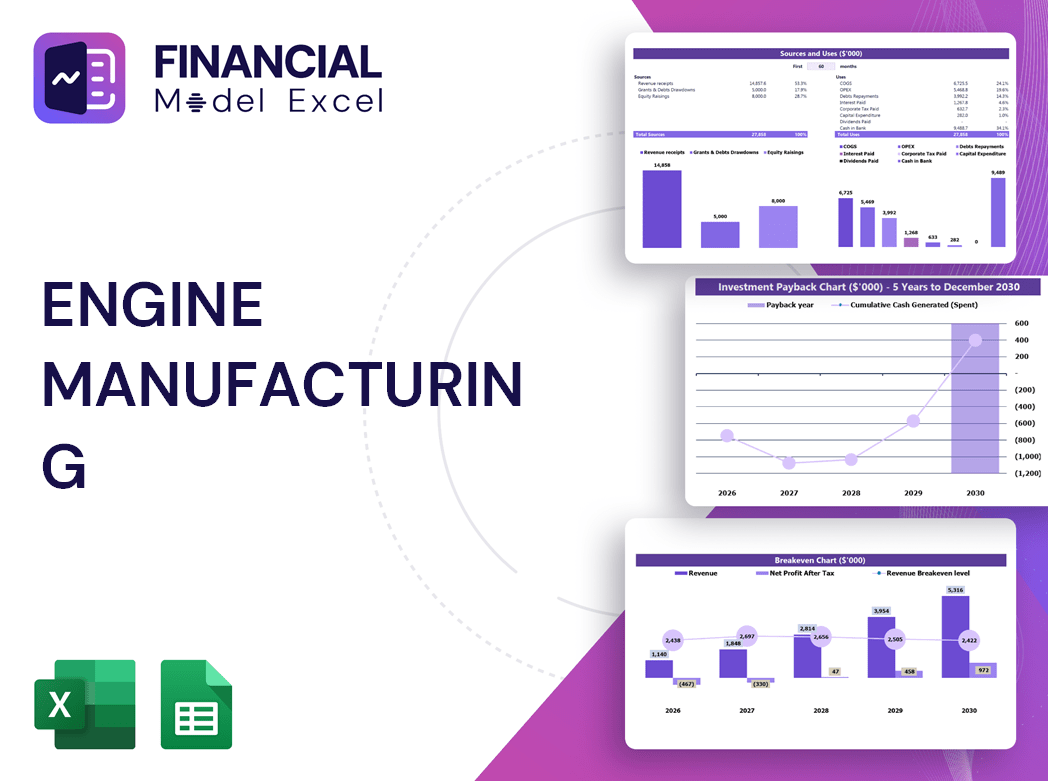

Dashboard

The Dashboard tab within our engine manufacturing financial forecasting model presents a dynamic snapshot of key financial metrics through intuitive graphs, charts, and ratios. Designed for seamless integration, these visuals and summaries can be effortlessly copied into your pitch deck, enhancing presentations with real-time insights. This powerful financial performance model for engine production streamlines your budget planning, cost analysis, and profitability assessment, empowering strategic decision-making in engine manufacturing financial planning.

Business Financial Statements

Our engine manufacturing financial forecasting model features an integrated structure with pre-built business financial statements, including projected balance sheets, profit and loss statements, and cash flow models. Designed for precision, it automates five-year financial projections and supports both GAAP and IFRS formats. This comprehensive financial planning tool empowers users with detailed cost analysis, budgeting, profitability, and investment insights—perfect for optimizing engine production financial planning and risk assessment. Elevate your manufacturing business with a robust financial performance model tailored specifically for the engine manufacturing sector.

Sources And Uses Statement

Our engine manufacturing financial forecasting model offers a powerful tool for tracking cash flow, budgeting, and cost analysis. Designed for both novices and experts, it provides investors with clear insights into fund allocation and capital needs. This financial planning solution enables accurate revenue forecasting, break-even analysis, and risk assessment, empowering manufacturers to optimize performance and profitability. With intuitive features for expense tracking and investment analysis, our business financial model ensures efficient management of resources and strengthens your competitive position in the manufacturing sector.

Break Even Point In Sales Dollars

The engine manufacturing break-even analysis model pinpoints when total costs equal total revenue, marking the shift from loss to profit. Utilizing this financial projection for engine manufacturing, businesses can accurately identify necessary sales volume and revenue targets to cover fixed and variable expenses. This cost management model for engine manufacturing also aids in optimizing sales prices, enhancing the contribution margin—the difference between unit selling price and variable costs. Implementing this model within your financial forecasting and budget planning tools ensures precise financial planning, boosting profitability and informed decision-making in engine production operations.

Top Revenue

Our proforma business plan template features a dedicated engine manufacturing revenue forecast model, enabling precise analysis of your company’s revenue streams. Customize insights at the product or service level for tailored financial projection and revenue tracking. This tool supports strategic engine production financial planning, enhancing your ability to optimize profitability and cash flow. Ideal for developing comprehensive financial budgeting, cost management, and investment analysis models, it empowers informed decision-making with detailed, actionable data on every aspect of your engine manufacturing business.

Business Top Expenses Spreadsheet

The engine manufacturing financial forecasting model categorizes annual expenses into four clear segments for precise budget planning. This comprehensive financial budgeting tool captures key costs, including customer acquisition, fixed and variable expenses, and employee salaries. By integrating cost management and cash flow insights, it empowers engine production financial planning with accurate expense tracking and profitability analysis. This model enables manufacturing businesses to optimize their financial performance and investment decisions effectively.

ENGINE MANUFACTURING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

A comprehensive engine manufacturing financial forecasting model empowers startups to accurately project costs and streamline budget planning. This sophisticated tool enhances engine production financial planning by identifying potential risks and inefficiencies early, enabling proactive cost management. Utilizing a detailed engine manufacturing cost analysis model supports informed decision-making, optimizing resource allocation to achieve strategic goals. Additionally, it strengthens investor confidence and facilitates funding by providing clear financial projections and profitability insights. Embrace this financial budgeting tool for engine manufacturing to drive sustainable growth and maximize operational efficiency in the competitive manufacturing sector.

CAPEX Spending

Startup expenses in the engine manufacturing financial forecasting model represent the total investment in property, plant, equipment, and fixed assets crucial for operational competitiveness. Our report details how these capital expenditures drive efficiency and asset performance within the engine production financial planning framework. Note, this excludes salaries and general administrative costs. Given the variability of capital expenditures across the manufacturing sector, understanding their impact is vital when analyzing engine manufacturing profitability models and investment analysis tools. This insight supports effective budget planning and cost management for long-term success.

Loan Financing Calculator

An engine manufacturing financial forecasting model integrates a detailed loan amortization schedule to inform stakeholders of periodic payments for amortizing loans. This schedule outlines the loan amount, interest rate, maturity term, payment periods, and amortization methods—such as straight-line, declining balance, annuity, bullet, balloon, and negative amortization. Utilizing this comprehensive financial planning tool enhances the accuracy of budget planning, cost analysis, and investment decisions within engine production, driving informed financial performance and risk assessment in the manufacturing sector.

ENGINE MANUFACTURING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The engine manufacturing financial forecasting model highlights EBIT—Earnings Before Interest and Taxes—as a key profitability metric. EBIT reflects operating income by subtracting operating expenses, including cost of sales, loan interest, and taxes, providing a clear view of true profit-generating ability. This critical figure, often called operating profit, serves as a foundation for accurate financial projection, cost analysis, and investment assessment within engine production financial planning. Leveraging EBIT enhances budget planning, cash flow management, and profitability modeling to drive informed decisions across the manufacturing sector.

Cash Flow Forecast Excel

A detailed engine manufacturing cash flow model provides a comprehensive view of cash inflows and outflows over a specified period. This financial planning tool is essential for accurate financial forecasting, budgeting, and cost analysis within engine production. By leveraging this model, businesses can enhance expense tracking, optimize capital expenditure, and improve profitability through informed decision-making. An effective cash flow statement supports robust financial risk assessment and strengthens overall manufacturing business financial performance.

KPI Benchmarks

Our 5-year financial projection template features a comprehensive engine manufacturing financial forecasting model, incorporating industry benchmarks and key financial metrics. By comparing your company’s performance against these standards, the model enables objective assessment and strategic insight into profitability, cost management, and cash flow. This powerful benchmarking tool provides critical visibility into your engine production financial planning, helping identify growth opportunities, manage financial risks, and optimize budget planning. Leverage this financial statement model for engine production to elevate your business decisions and drive sustainable success in the competitive manufacturing sector.

P&L Statement Excel

The engine manufacturing financial forecasting model streamlines financial reporting with precise calculation tools, ensuring accuracy and reliability. This projected pro forma profit and loss statement offers comprehensive insights, evaluating profitability, revenue forecasts, and key financial metrics. It enables in-depth assessment of the engine manufacturing business’s financial performance and growth potential, supporting strategic planning, cost management, and investment analysis. Designed for clarity and efficiency, this model is an essential tool for effective engine production financial planning and profitability optimization.

Pro Forma Balance Sheet Template Excel

The 5-year projected balance sheet in Excel is essential for engine manufacturing financial forecasting models. It offers a comprehensive view of the company’s financial health, highlighting capital requirements to achieve projected profits. This pro forma balance sheet is a vital component of any engine manufacturing profitability model and financial projection, providing clarity on the company’s future position. Integrating it with budget planning, cost analysis, and cash flow models ensures precise engine production financial planning and robust risk assessment. Such financial statement models empower informed decision-making and optimize long-term manufacturing business performance.

ENGINE MANUFACTURING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our engine manufacturing financial forecasting model employs two integrated valuation methodologies to project expected performance accurately. By combining discounted cash flow (DCF) analysis with the weighted average cost of capital (WACC), our financial projection for engine manufacturing delivers a robust assessment of profitability and investment potential. This approach enhances precision in engine manufacturing budget planning and cost analysis, supporting informed decisions for manufacturing business financial models.

Cap Table

The engine manufacturing financial forecasting model offers a robust tool to evaluate stock impacts on your company’s financial health. By systematically inputting and analyzing data, it delivers deep insights into profitability, cash flow, and investment potential. This financial planning model empowers manufacturers to optimize budget planning, conduct precise cost analysis, and assess financial risks with confidence—ensuring informed decisions that drive sustainable growth in the competitive engine production sector.

ENGINE MANUFACTURING FINANCIAL PROJECTION EXCEL ADVANTAGES

The engine manufacturing financial forecasting model empowers strategic decisions, boosting profitability and minimizing financial risks efficiently.

Optimize profits and streamline costs using the engine manufacturing financial forecasting model for precise budgeting and planning.

Boost profitability and streamline decisions with our comprehensive engine manufacturing financial forecasting and budgeting model.

A financial model for engine manufacturing enhances credibility, impressing investors with precise budgeting and profitability insights.

Unlock precise budgeting and profitability insights with the advanced engine manufacturing financial forecasting model.

ENGINE MANUFACTURING THREE WAY FINANCIAL MODEL ADVANTAGES

Run different scenarios with the engine manufacturing financial forecasting model to optimize budgeting and maximize profitability confidently.

The engine manufacturing cash flow model enables dynamic scenario analysis, optimizing financial planning and enhancing profitability insights.

The engine manufacturing financial forecasting model ensures accurate budgeting and maximizes profitability by minimizing financial risks.

The engine manufacturing cash flow model enables proactive financial control, preventing cash gaps and enhancing business growth opportunities.

The engine manufacturing financial forecasting model enhances accuracy and drives strategic decisions for optimal profitability.

A clear, well-structured engine manufacturing financial forecasting model streamlines decision-making and fuels strategic growth.

Optimize cash flow and reduce risks with the engine manufacturing financial forecasting model for precise accounts receivable management.

The engine manufacturing cash flow model identifies late payments, optimizing financial planning and improving cash flow accuracy.

Our integrated financial model enhances engine manufacturing profitability through precise forecasting, cost control, and investor confidence.

The engine manufacturing financial forecasting model ensures accurate, investor-friendly projections that drive confident, strategic business decisions.