Engineering Consulting Firm Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Engineering Consulting Firm Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Engineering Consulting Firm Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ENGINEERING CONSULTING FIRM FINANCIAL MODEL FOR STARTUP INFO

Highlights

This sophisticated 5-year engineering consulting financial forecasting model is designed for firms of any size and development stage, enabling accurate financial planning for engineering consultants with minimal prior experience and basic Excel skills. The comprehensive engineering firm budget planning model supports evaluation of startup ideas, detailed cost estimation, and financial analysis for engineering consulting projects, helping secure funding from banks, angels, grants, and VC funds. Fully unlocked and editable, this engineering consulting revenue and cash flow model provides reliable cash flow projections, expense forecasting, and profit margin insights to streamline financial scenario planning and improve investment decision-making.

This engineering consulting financial projections model serves as a powerful pain reliever by addressing common challenges in financial forecasting for engineering firms, offering a comprehensive engineering firm budget planning model that simplifies expense forecasting and cash flow projections. It enables detailed financial analysis for engineering consulting by integrating an engineering consulting revenue model, cost estimation model for engineering firms, and profit margin model engineering firm, helping users achieve accurate financial planning for engineering consultants. Additionally, its engineering project financial model and financial statement model for engineering consultants ensure clarity in financial reporting, while the engineering consulting firm valuation model and engineering consulting investment model provide critical insights for stakeholders. With robust features like financial risk model engineering consulting and financial scenario planning, this ready-made Excel template minimizes uncertainty, maximizes financial performance model for engineering consultants, and streamlines decision-making through dynamic visual tools such as charts and graphs, ultimately empowering engineering consulting firms to optimize profitability and secure investment confidence.

Description

Our comprehensive engineering consulting financial projections model is meticulously crafted to support detailed financial forecasting for engineering firms, integrating key components such as revenue modeling, cost estimation, and expense forecasting to facilitate precise budget planning. This dynamic engineering project financial model includes a full suite of pro forma financial statements—including cash flow projections, income statements, and balance sheets—over a 60-month horizon, empowering management and investors to evaluate profitability, cash flow stability, and risk through metrics like IRR, NPV, and break-even analysis. Designed with user-friendly features, the model serves both seasoned professionals and entrepreneurs new to financial planning for engineering consultants, enabling robust financial scenario planning, profit margin optimization, and investment appraisals with a clear focus on sustainable growth in the engineering consulting sector.

ENGINEERING CONSULTING FIRM FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

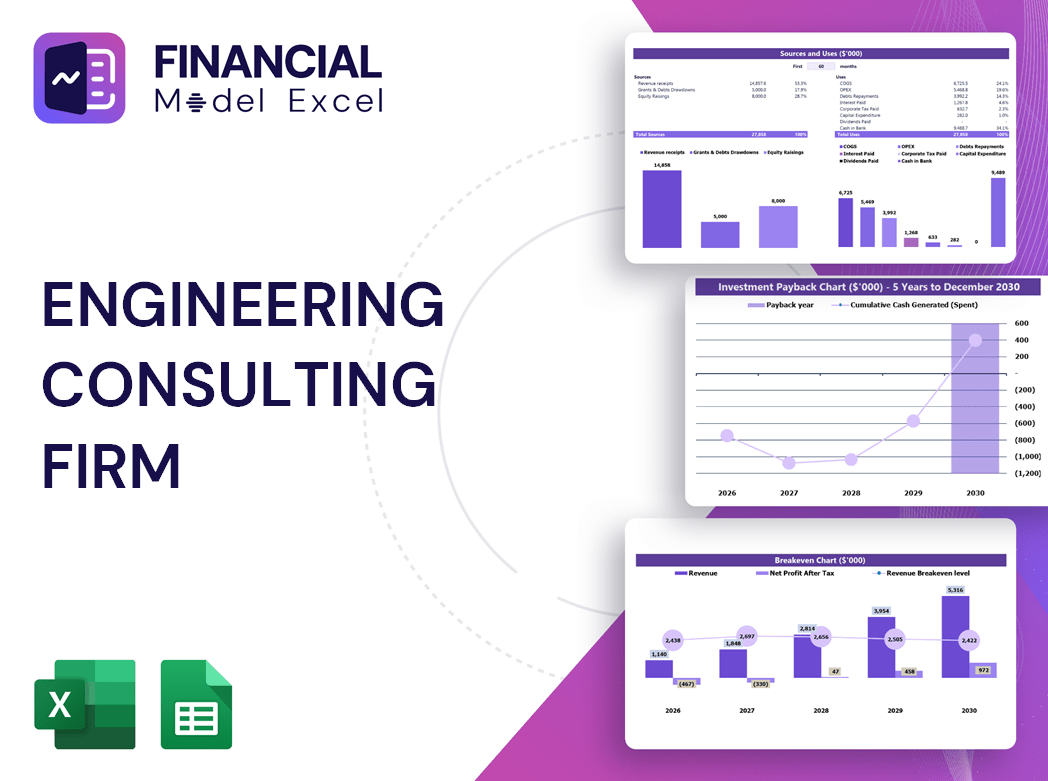

Our engineering consulting financial projections model delivers comprehensive financial forecasting and budgeting tailored for engineering firms. Featuring detailed cash flow models, profit margin analyses, and expense forecasting, it supports both start-ups and established firms. This dynamic template includes monthly and annual pro forma profit and loss statements, balance sheets, and financial performance reports—empowering precise financial planning and scenario analysis for engineering consultants to optimize revenue, manage costs, and enhance firm valuation effectively.

Dashboard

This all-in-one engineering consulting financial projections model features a dynamic dashboard offering a clear snapshot of your firm’s key start-up metrics. Easily visualize core financials, revenue breakdowns over multiple years, cash flow projections, profit margin forecasts, and cumulative cash flow—all presented through intuitive charts and graphs. Ideal for engineering firms, this tool streamlines financial planning, budgeting, and scenario analysis, empowering consultants to make informed decisions and drive sustained growth with confidence.

Business Financial Statements

This engineering consulting financial projections model features a comprehensive financial summary that seamlessly integrates data from all key spreadsheets, including the pro forma balance sheet, projected profit and loss statement, and a detailed 5-year cash flow model. Designed for engineering firms, this ready-to-use summary streamlines your financial forecasting, budget planning, and performance analysis. Professionally formatted, it provides a polished overview essential for your pitch deck, enhancing investor confidence and supporting strategic decision-making within your engineering consulting firm.

Sources And Uses Statement

The sources and uses of funds statement within an engineering consulting financial forecasting model offers a clear overview of capital inflows ('Sources') and planned expenditures ('Uses'). Ensuring these totals balance is essential for accurate financial planning for engineering consultants. This statement is especially vital during recapitalization, restructuring, or M&A processes, providing transparency and supporting informed decision-making in engineering firm budget planning models. Integrating this within your engineering project financial model enhances financial analysis and risk assessment, driving strategic growth and operational efficiency.

Break Even Point In Sales Dollars

Our engineering consulting financial projections model features an integrated break-even graph, pinpointing the sales volume needed to cover all fixed and variable costs. This vital financial forecasting tool empowers engineering firms to assess profitability accurately. By leveraging this engineering firm budget planning model, you can easily adjust assumptions in your engineering consulting revenue model to optimize profit margins. Whether refining your cash flow model for engineering consulting or enhancing your financial planning for engineering consultants, this dynamic scenario planning tool ensures your business model drives sustainable growth and reliable financial performance.

Top Revenue

In engineering consulting financial forecasting, the top line on a profit and loss forecast represents gross revenues, a critical metric investors scrutinize closely. Growth in this figure—known as top-line growth—signals increased sales, positively impacting the engineering firm’s financial performance. Accurate engineering consulting revenue models and financial analysis enable firms to track these changes effectively. By integrating robust financial planning for engineering consultants with detailed cash flow models and expense forecasting, firms can enhance profit margin models and ensure sustainable growth. This holistic approach supports informed decision-making and strengthens the firm's valuation and investment appeal.

Business Top Expenses Spreadsheet

Effective cost management is crucial for engineering consulting firms aiming to maximize profitability. Our engineering firm budget planning model features a top expense report that highlights the four largest expense categories, enabling precise financial forecasting and expense monitoring. This financial analysis tool simplifies tracking year-on-year changes and underlying causes, supporting informed decision-making. Whether for financial planning or cash flow projections, our cost estimation model empowers engineering consultants to optimize expenses and enhance profit margin models, ensuring robust financial performance and strategic growth in competitive markets.

ENGINEERING CONSULTING FIRM FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurately managing start-up costs is crucial for engineering consulting firms to ensure sound financial forecasting and avoid funding shortfalls or overestimations. Our engineering consulting financial projections model offers a comprehensive proforma that integrates cost estimation and funding analysis. This tailored tool enables precise budget planning and expense control, empowering your firm to align spending with available resources confidently. Harness this engineering firm budget planning model to optimize your financial performance and support sustainable growth from the very start.

CAPEX Spending

The capital expense budget is a critical component of the engineering consulting financial projections model. Financial experts develop and monitor startup budgets to ensure accurate engineering firm budget planning. Understanding initial capital expenditures is essential for effective financial forecasting and optimizing cash flow models for engineering consulting. A well-structured startup budget directly impacts the company’s financial performance model and investment strategy. Responsible financial planning for engineering consultants ensures precise cost estimation and supports sustainable growth in engineering project financial models. Prioritizing thorough capital budgeting fosters a healthy profit margin model and long-term business success.

Loan Financing Calculator

Loan amortization in an engineering consulting financial projections model involves systematically spreading loan repayments over multiple reporting periods. This process entails fixed payments—typically monthly, but sometimes quarterly or annually—ensuring predictable cash flow management within your engineering firm budget planning model. Incorporating loan amortization into your engineering consulting cash flow projections enhances financial forecasting accuracy, supporting effective financial planning for engineering consultants. By aligning debt repayment schedules with your engineering project financial model, firms can optimize profit margin models and mitigate financial risks, driving sustainable growth and improved valuation outcomes.

ENGINEERING CONSULTING FIRM FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

The payback period, integrated within the engineering consulting firm’s three-statement financial model, is a critical metric derived from customer acquisition costs. This measure should be evaluated against the revenue generated by those customers to assess profitability effectively. By dividing the acquisition cost by the profits gained, firms can determine the payback period, enabling informed financial forecasting and strategic planning. Incorporating this metric into your engineering consulting financial model enhances accuracy in cash flow projections, investment decisions, and overall financial performance management.

Cash Flow Forecast Excel

The cash flow model for engineering consulting is a cornerstone of any comprehensive financial forecasting for engineering firms. Integrated within the engineering firm budget planning model, it ensures seamless updates across financial statement models and projected balance sheets. Accurate cash flow projections directly impact financial analysis for engineering consulting, enabling precise expense forecasting and reliable profit margin modeling. Without a robust engineering consulting cash flow projection, other financial scenarios—such as revenue models and investment assessments—lack accuracy, compromising strategic decision-making for engineering firm growth and sustainability.

KPI Benchmarks

Our engineering consulting financial projections model includes a powerful benchmarking study tab, enabling firms to perform comparative financial analysis. By evaluating key financial indicators—such as profit margins, cash flow, and expense forecasting—businesses can measure their performance against industry peers. This insight guides strategic decisions, optimizing engineering firm budget planning and enhancing overall financial performance. Effective benchmarking is essential for engineering consultants aiming to elevate their firm’s financial success through data-driven financial forecasting and scenario planning. With our model, you gain clarity to confidently drive growth and achieve sustainable profitability.

P&L Statement Excel

The Profit and Loss Statement—also known as the Income Statement—provides a clear view of your engineering consulting firm’s revenue streams and key expense categories. This essential financial analysis tool enables stakeholders to evaluate profitability, expense structure, and loan repayment capacity within your engineering consulting financial model. Utilizing financial forecasting and budget planning models, you can project future income and expenses to assess the viability of your engineering consulting projects or start-ups, ensuring informed decision-making and strategic growth.

Pro Forma Balance Sheet Template Excel

Our comprehensive engineering consulting financial projections model seamlessly integrates cash flow forecasts, profit and loss templates, and key input metrics with pro forma balance sheets—monthly or yearly. This robust engineering firm budget planning model delivers a clear, detailed view of your assets, liabilities, and equity, empowering precise financial forecasting for engineering firms. Leverage this financial planning tool to optimize cash flow projections, enhance profit margin modeling, and support strategic decision-making for sustainable growth within your engineering consulting practice.

ENGINEERING CONSULTING FIRM FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our engineering consulting financial model seamlessly integrates two advanced valuation methods: Discounted Cash Flow (DCF) and Weighted Average Cost of Capital (WACC). Designed for precision, this model delivers comprehensive financial forecasting for engineering firms, enabling accurate revenue projections, cash flow analysis, and profit margin assessments. Ideal for financial planning, budgeting, and investment evaluation, it empowers engineering consultants to make data-driven decisions with confidence and optimize their firm’s financial performance.

Cap Table

A streamlined cap table is essential for engineering consulting firms to clearly summarize investor data, calculate ownership percentages, and track capital contributions. Integrating this with a comprehensive financial model—such as a financial forecasting or cash flow model for engineering consulting—enhances accuracy in budget planning and investor reporting. This approach supports strategic financial analysis, enabling precise revenue modeling, expense forecasting, and valuation assessments critical to informed decision-making and sustainable growth.

ENGINEERING CONSULTING FIRM FINANCIAL PROJECTION MODEL ADVANTAGES

Engineering consulting financial models accurately predict cash shortages and surpluses, optimizing startup cash flow management.

The three-statement financial model pinpoints break-even and maximizes ROI for engineering consulting firms.

Optimize your engineering consulting firm's growth with a precise financial forecasting and budgeting model.

Drive smarter growth with engineering consulting firm financial models for accurate projections and strategic business planning.

Boost your engineering firm's success with precise financial forecasting and budgeting models designed for strategic growth.

ENGINEERING CONSULTING FIRM BUSINESS PLAN EXCEL TEMPLATE ADVANTAGES

Streamline your engineering firm’s growth with our easy-to-follow financial forecasting and budget planning model.

Streamline engineering consulting finances with a clear, color-coded Excel model ensuring precise planning and transparent projections.

Our engineering consulting financial forecasting model ensures accurate, reliable projections to satisfy external stakeholders like banks confidently.

A robust engineering consulting financial model ensures clear budgeting, satisfying banks and optimizing your firm’s financial performance.

Save time and money with our engineering consulting financial projections model that optimizes budgeting and forecasting accuracy.

Streamline your engineering consulting growth with our 5-year financial projection model—no formulas, coding, or costly consultants needed.

Optimize engineering firm growth with our precise financial forecasting and cash flow model—investors ready, results assured.

Optimize engineering firm profits with our comprehensive financial forecasting model, including P&L, cash flow, and ratios.

Boost profitability with our simple-to-use engineering consulting financial projections model designed for precise budget planning.

Achieve quick, reliable insights with our user-friendly engineering consulting financial model, requiring minimal Excel or planning experience.