Errand Running Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Errand Running Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Errand Running Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

ERRAND RUNNING FINANCIAL MODEL FOR STARTUP INFO

Highlights

Generate a comprehensive 5-year errand running financial plan including detailed errand service revenue forecast, break-even analysis, and expense tracking to optimize your errand business profit margins. Utilize an advanced errand running cash flow model and operational budget integrated into a dynamic financial dashboard presenting core errand business financial metrics in GAAP/IFRS formats. This financial modeling for service startups supports a robust errand running startup financial plan, incorporating investment analysis and strategic financial assumptions to create a compelling errand business funding plan. Perfect for securing funds from banks, angels, grants, and VC funds, this unlocked financial model allows full customization to align with your errand service pricing strategy financials and growth projections.

This ready-made errand running financial plan template effectively alleviates common pain points by providing a comprehensive errand service revenue forecast and detailed errand running cost structure, enabling entrepreneurs to confidently execute errand running break-even analysis and financial analysis for errand business operations. Its integrated errand service cash flow model and errand running income statement streamline errand service expense tracking and operational budgeting, while built-in errand business financial metrics and errand service pricing strategy financials help optimize profit margins. Additionally, the template supports errand business funding plan development and errand service investment analysis, reducing uncertainty in financial assumptions and enhancing errand service growth projections, making financial modeling for service startups accessible and time-efficient.

Description

Our errand running financial model template is an all-encompassing tool designed to facilitate comprehensive financial analysis for errand business startups, enabling users to develop detailed errand running startup financial plans, including expense tracking, cost structure assessment, and business budgeting. By integrating errand service revenue forecasts alongside errand running cash flow models and income statements, this model supports precise 5-year errand service growth projections and break-even analysis to optimize errand business profit margins. Equipped with customizable errand running financial assumptions and pricing strategy financials, it streamlines the creation of operational budgets and financial plans for errand services while delivering vital errand business financial metrics and investment analysis essentials. This flexible financial modeling for service startups empowers users without prior finance expertise to efficiently manage errand running operational budgets and funding plans, making it indispensable for operational management and investor negotiations.

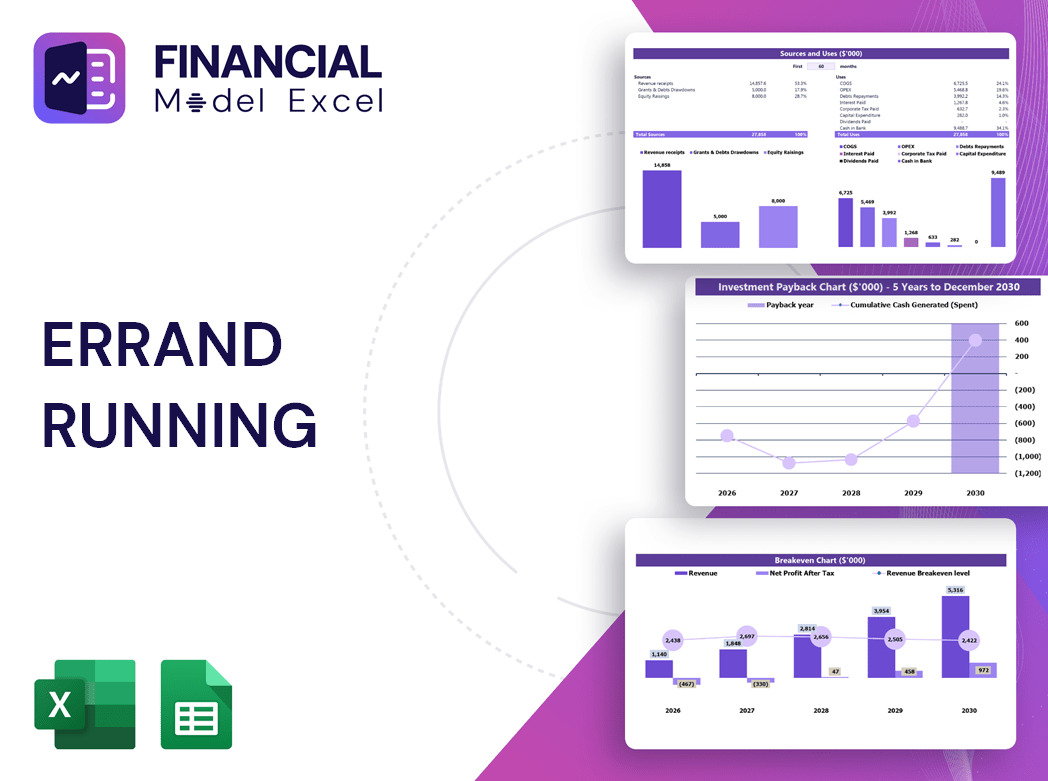

ERRAND RUNNING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

A comprehensive errand running startup financial plan integrates the income statement, cash flow model, and balance sheet to deliver a holistic view of your business’s financial health. This detailed financial analysis for errand business captures all operational changes throughout the year, enabling accurate errand service revenue forecasts and expense tracking. Completing a full errand running financial projections template annually is essential, regardless of business size, to refine budgeting, assess profit margins, and support strategic growth. Such meticulous financial modeling for service startups ensures informed decision-making and positions your errand service for sustainable success.

Dashboard

To conduct a thorough financial analysis for your errand running startup, comprehensive data is essential. Our financial modeling template streamlines this process by integrating key elements such as errand running income statements, cash flow models, and break-even analysis. With dynamic graphs and charts, you can effortlessly track expense patterns, project revenue forecasts, and analyze profit margins. This tool empowers you to develop accurate errand service pricing strategies and growth projections, ensuring informed business budgeting and investment decisions for sustainable success.

Business Financial Statements

Creating a comprehensive errand running startup financial plan requires integrating key components into a clear, intuitive three-statement financial model. This includes errand service revenue forecasts, expense tracking, cost structure analysis, and break-even projections. An easily navigable financial model not only enhances your errand business budgeting accuracy but also strengthens your financial analysis for investor review. Prioritizing transparency and simplicity ensures stakeholders can confidently assess your errand service pricing strategy financials and growth projections, ultimately supporting a robust errand business funding plan.

Sources And Uses Statement

A well-structured sources and uses table is essential for precise errand running business budgeting. It enables clear tracking of all income origins and allocation points, supporting accurate financial analysis for errand business operations. This transparency strengthens errand running financial projections, enhances errand service expense tracking, and informs informed decision-making within the errand running startup financial plan. Integrating this table into your errand running operational budget ensures effective errand service cash flow model management and improves errand business profit margins over time.

Break Even Point In Sales Dollars

The 5-year break-even analysis in your errand running financial plan identifies the sales volume needed to cover all fixed and variable costs, ensuring zero profit or loss. Once revenues surpass this break-even point, your errand service starts generating profit. Our financial model includes a detailed break-even chart, highlighting the minimum sales required to cover your errand running cost structure. This critical metric helps investors assess revenue targets and timelines needed to recover investments, providing clarity on errand service growth projections and the path to profitability.

Top Revenue

When crafting an errand running startup financial plan, revenue forecasts are pivotal in the pro forma income statement and overall financial modeling. Accurate errand service revenue forecasts drive business valuation and inform strategic decisions. Financial analysis for errand business requires carefully developed growth assumptions based on historical data to ensure reliable projections. Utilizing a comprehensive errand service cash flow model and expense tracking tools helps refine budgeting and optimize profit margins. Our five-year errand running financial projections template integrates these elements, offering a robust foundation for errand business funding plans and operational budget management.

Business Top Expenses Spreadsheet

The Top Expenses tab in this errand running startup financial plan provides a comprehensive breakdown of annual costs, categorized into four key groups. This detailed financial analysis for errand business enables precise tracking of expenses—whether fixed costs or customer acquisition expenses. By clearly understanding your errand running cost structure, you gain essential insights to optimize budgeting, improve errand business profit margins, and maintain financial control. This robust financial modeling for service startups empowers smarter decision-making and paves the way for sustainable growth in your errand service cash flow model.

ERRAND RUNNING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurately managing start-up costs is crucial for your errand running startup financial plan. Expenses begin accumulating before operations launch, making early tracking vital. Our comprehensive errand running financial model features a detailed three-statement proforma, enabling precise expense tracking, errand running cost structure management, and effective errand service expense tracking. This tool supports your errand service pricing strategy financials and business budgeting efforts, helping you create realistic operational budgets and funding plans. Stay ahead with clear visibility into your errand service cash flow model, ensuring informed financial decisions from day one.

CAPEX Spending

The capital expense budget is essential for errand running startups, outlining initial costs and supporting accurate financial projections. It enhances the errand business budgeting process by detailing capital expenditures alongside incoming investments. This clarity strengthens pro forma income statements and financial analysis for errand services, enabling precise errand service revenue forecasts and break-even analysis. Incorporating this budget into your errand running financial plan ensures solid financial modeling, informed investment analysis, and effective expense tracking—empowering confident decisions that drive sustainable growth and robust profit margins.

Loan Financing Calculator

Our pro forma template integrates a comprehensive loan amortization schedule, seamlessly distinguishing between principal repayment and interest charges. This dynamic tool instantly calculates your errand running business’s payment amounts, including principal, interest, payment frequency, and total repayment duration. Ideal for errand service financial projections and budgeting, it empowers precise cash flow modeling and expense tracking—ensuring accurate financial analysis for your startup’s funding plan and growth projections. Streamline your errand service’s financial management with clear, actionable insights.

ERRAND RUNNING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Sales growth year-to-date (YTD) is a vital errand service financial metric that tracks revenue trends over comparable periods. For errand running startups, monitoring this metric within a comprehensive financial plan—using tools like a 3-statement financial model—enables precise errand service revenue forecasts and informed decision-making. Seasonal fluctuations make accurate sales tracking and errand running expense tracking critical for analyzing cash flow models and maintaining healthy errand business profit margins. This YTD growth percentage helps management evaluate team performance and adjust errand service pricing strategy financials to drive sustainable business growth.

Cash Flow Forecast Excel

The errand running cash flow model is a vital component of your startup financial plan, enabling detailed tracking of operating, investing, and financing cash flows. This dynamic financial statement integrates seamlessly with your errand service revenue forecast and expense tracking, ensuring accurate break-even analysis and robust financial projections. Without a precise cash flow projection, the projected balance sheet and income statement cannot align, impacting your errand business budgeting and profit margins. Utilize this comprehensive financial modeling tool to enhance your errand service growth projections, optimize your cost structure, and support informed investment analysis and funding plans.

KPI Benchmarks

Leverage our intuitive financial benchmarking tool within the errand running startup financial plan template to effortlessly compare your errand service revenue forecast, cost structure, and profit margins against industry peers. This peer-to-peer financial analysis highlights your errand business’s cash flow model, expense tracking, and break-even analysis, revealing gaps and growth opportunities. Essential for start-ups, benchmarking sharpens your operational budget, pricing strategy financials, and funding plan—empowering you to optimize errand service financial metrics and drive success with data-backed insights. Stay ahead by understanding where your errand business stands and what it takes to close performance gaps.

P&L Statement Excel

The monthly projected income statement delivers precise financial insights essential for comprehensive errand running business analysis. By leveraging accurate calculations and tailored income statement templates, it enables detailed evaluation of profit and loss trends. This foundation supports the creation of annual reports and gross profit assessments, critical for refining errand service revenue forecasts, optimizing cost structures, and enhancing profit margins. Integrating this with your errand running startup financial plan ensures informed decisions and strategic growth through robust financial modeling and budgeting.

Pro Forma Balance Sheet Template Excel

A projected balance sheet forecast offers a clear snapshot of your errand running startup’s assets, liabilities, and equity over a defined period. Incorporating this into your errand service financial plan enables precise financial analysis, supporting informed decisions on cost structure, profit margins, and funding strategies. Utilize our pro forma balance sheet in Excel to assess your business’s financial position, enhance budgeting accuracy, and strengthen your errand service revenue forecast and growth projections. This essential tool empowers your financial modeling for service startups, guiding your path to sustainable profitability and operational success.

ERRAND RUNNING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our errand running startup financial plan template offers a comprehensive financial analysis for errand business ventures. It integrates detailed errand service revenue forecasts, expense tracking, and cost structure insights, ensuring precise errand running cash flow models. With built-in break-even analysis and profit margin evaluation, this tool empowers you to confidently project growth and create robust errand business budgeting strategies. Whether developing your errand service pricing strategy financials or preparing investor-ready funding plans, our model captures all financial assumptions and timing of cash flows, delivering a clear outlook on your investment’s potential value and return.

Cap Table

The Equity Cap Table provides a comprehensive overview of the company’s financial structure, detailing ownership percentages, investor stakes, and capital invested. In an errand running startup financial plan, integrating this with errand service revenue forecasts and cost structures enhances clarity on funding allocation and profit margins. The pro forma cap table further breaks down equity shares, preferred shares, and options, offering critical insights for financial modeling, expense tracking, and investment analysis—key components in optimizing errand business budgeting and growth projections.

ERRAND RUNNING FINANCIAL MODEL ADVANTAGES

The 3-way financial model empowers precise comparison of errand service income and expenses across multiple periods for strategic growth.

A tailored errand running financial model reveals strengths and weaknesses, driving smarter budgeting and profitable growth.

Excel-based errand service financial models enhance team alignment, driving informed decisions and strategic growth.

Optimize your errand running financial model to boost profitability and confidently secure strategic funding.

A precise errand running financial model empowers startups with clear customer insights for smarter, profitable decisions.

ERRAND RUNNING STARTUP COSTS SPREADSHEET ADVANTAGES

Accurate errand running financial models empower precise budgeting and growth projections, ensuring startup success from day one.

A precise errand running financial model ensures confident funding decisions and maximizes investor appeal for your startup.

Our errand running financial model provides accurate cash flow forecasts, optimizing budgeting and maximizing your business profit margins.

A robust errand running financial model empowers confident growth by accurately forecasting cash flow and minimizing operational risks.

Optimize your errand service’s profitability with our USD-based financial modeling for precise revenue forecasts and cost control.

Optimize errand service profitability with customizable Excel financial models featuring precise currency and denomination settings.

Our errand running financial model saves you time by simplifying budgeting, forecasting, and cash flow analysis effortlessly.

Our errand running financial model streamlines budgeting and projections, boosting focus on growth and customer engagement.

Get a robust, fully expandable errand service financial model to optimize budgeting, forecasting, and maximize profit margins.

This robust errand running financial model empowers precise budgeting, forecasting, and tailored strategic planning for business growth.