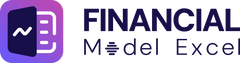

EV Battery Manufacturing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

EV Battery Manufacturing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

EV Battery Manufacturing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

EV BATTERY MANUFACTURING FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year electric vehicle battery production financial forecast template in Excel offers a robust lithium-ion battery manufacturing profit model, featuring prebuilt three-statement integration with consolidated profit and loss, balance sheet, and cash flow analysis. Designed specifically for advanced battery manufacturing investment analysis, it includes key financial charts, summaries, and metrics essential for battery cell production budgeting financial models and ev battery plant financial planning templates. This electric vehicle battery business financial plan empowers users to perform battery pack manufacturing expense forecasting and ev battery supply chain cost modeling, enabling startup founders and established manufacturers to optimize their electric car battery assembly cost model and secure funding from banks, angels, grants, and VC funds with an unlocked, fully editable format.

This ready-made ev battery manufacturing cost analysis financial model alleviates common pain points by providing an all-encompassing electric vehicle battery production financial forecast that simplifies complex budgeting and cash flow management, allowing users to accurately estimate battery cell production budgeting and battery pack manufacturing expense forecasting with ease. The template integrates a comprehensive lithium-ion battery manufacturing profit model alongside an automotive battery manufacturing revenue model, empowering startups with a lithium battery factory startup financial model and established businesses with ev battery production capacity financial analysis. By streamlining electric car battery assembly cost modeling and incorporating ev battery supply chain cost modeling, this tool reduces errors and saves time, while the built-in electric vehicle energy storage financial model and advanced battery manufacturing investment analysis deliver actionable insights for strategic decision-making, enhancing financial planning and ensuring sustainable growth in the competitive renewable energy battery financial projection landscape.

Description

This comprehensive ev battery manufacturing cost analysis financial model offers a detailed lithium-ion battery manufacturing profit model tailored for electric vehicle battery production financial forecasts and battery cell production budgeting financial planning templates. It enables precise electric car battery assembly cost modeling and battery pack manufacturing expense forecasting while integrating ev battery supply chain cost modeling and electric vehicle energy storage financial projections. Designed for advanced battery manufacturing investment analysis, this automotive battery manufacturing revenue model provides a robust electric vehicle battery business financial plan, including lithium battery factory startup financial projections and ev battery production capacity financial analysis. The model supports battery module manufacturing cost estimation, electric vehicle battery cost structure modeling, and battery manufacturing operational cost models, ensuring accurate electric car battery manufacturing cash flow management and enabling assessments of ev battery recycling financial viability. Its user-friendly structure automates updates based on input changes, facilitating strategic financial decision-making and KPI tracking over a five-year horizon.

EV BATTERY MANUFACTURING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This comprehensive EV battery manufacturing financial model is essential for securing investor confidence. Use this detailed business plan and forecast template to accurately estimate startup capital and project investor returns. An in-depth electric vehicle battery business financial plan validates your venture’s profitability, addressing cost structures, production capacity, and revenue models. Investors demand clear, data-driven insights—without a robust business plan Excel template, gaining their trust is challenging. Leverage this tool for precise budgeting, cash flow analysis, and financial viability, ensuring your lithium-ion battery manufacturing or EV battery plant startup stands out in a competitive market.

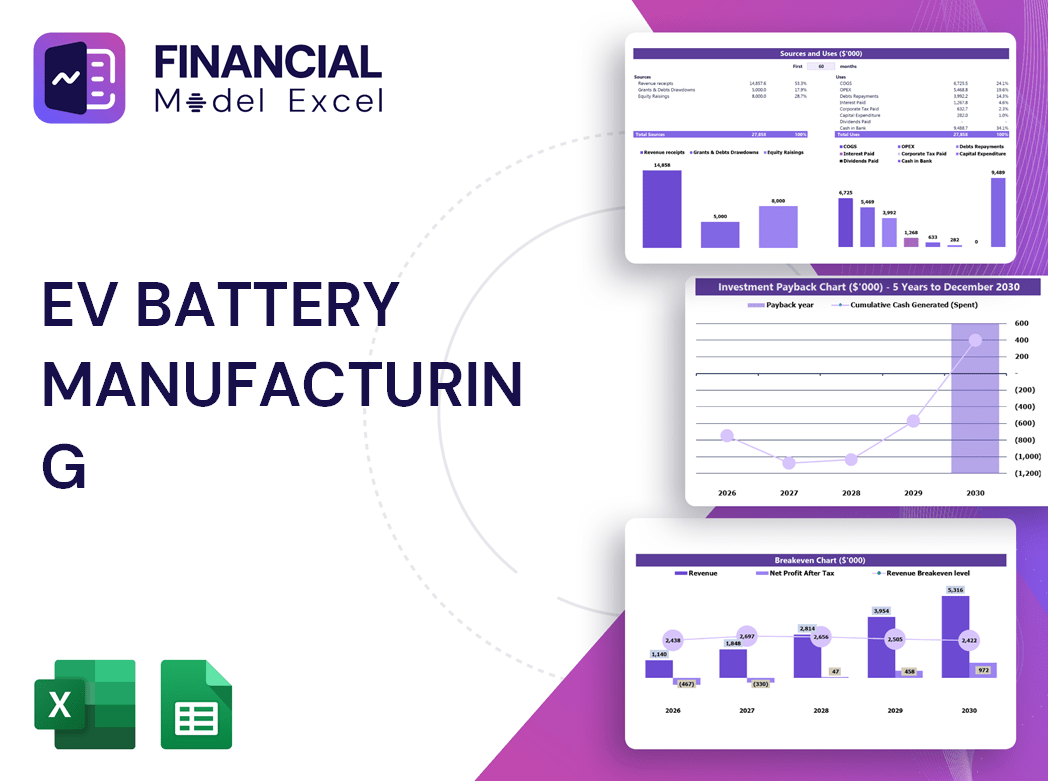

Dashboard

Our comprehensive EV battery manufacturing financial model features an intuitive all-in-one dashboard, empowering professionals with fast, transparent insights into electric vehicle battery production costs, revenue projections, and capacity analysis. Designed for swift decision-making, this tool streamlines financial planning, budgeting, and cost structure modeling—from lithium-ion battery manufacturing profit analysis to battery pack expense forecasting. Easily drill down into detailed financial data, evaluate key KPIs, and generate actionable reports that drive strategic growth in automotive battery manufacturing and renewable energy storage sectors. Simplify complex financial forecasting with this essential EV battery plant financial planning template.

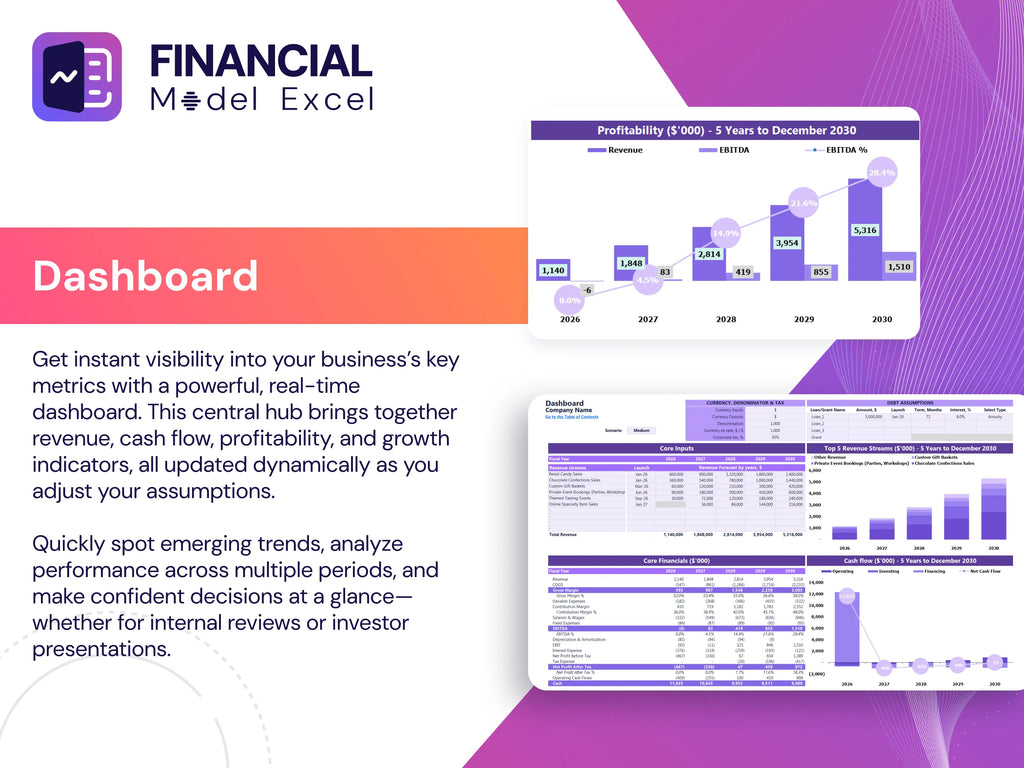

Business Financial Statements

Understanding a company’s performance demands a comprehensive financial approach. An electric vehicle battery business financial plan leverages the profit and loss forecast template Excel to unveil core operational earnings, while advanced battery manufacturing investment analysis utilizes pro forma balance sheets and cash flow forecasting tools to optimize capital management. These models—from lithium-ion battery manufacturing profit models to battery pack manufacturing expense forecasting—offer critical insights into asset allocation, cost structure, and cash flow, empowering strategic decisions across ev battery production capacity financial analysis and supply chain cost modeling. Together, they form the backbone of successful EV battery plant financial planning.

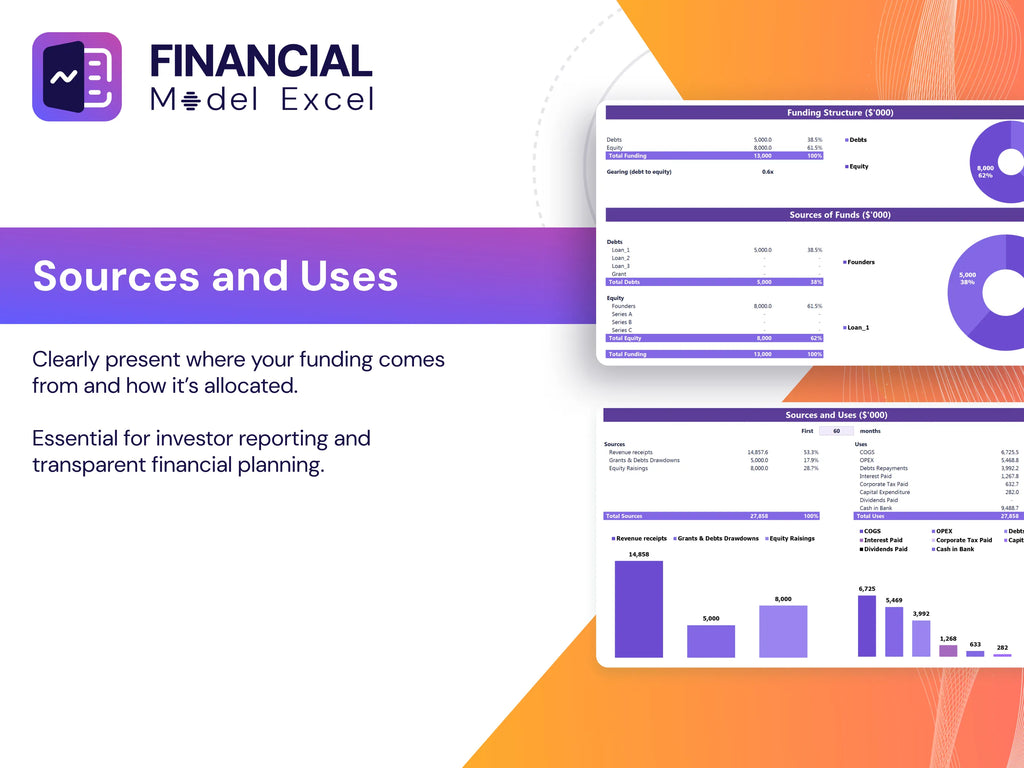

Sources And Uses Statement

This electric vehicle battery business financial plan template offers a flexible 5-year forecast for capital sourcing and allocation, tailored to your company’s unique needs. It clearly maps out funding timelines and strategic uses, enabling precise ev battery manufacturing cost analysis and financial planning. A balanced source and use of funds statement ensures optimal capital management—highlighting excess funding or capital shortfalls. Ideal for lithium-ion battery manufacturing profit modeling or battery cell production budgeting, this user-friendly financial model streamlines cash flow tracking and investment analysis without requiring advanced expertise.

Break Even Point In Sales Dollars

Curious when your electric vehicle battery business will turn profitable? Our comprehensive EV battery manufacturing cost analysis financial model pinpoints the exact sales volume and revenue needed to break even. This advanced three-statement template seamlessly integrates key metrics—from battery cell production budgeting to supply chain cost modeling—enabling precise forecasting of manufacturing expenses and profits. Whether launching a lithium-ion battery factory or optimizing automotive battery production, leverage this tool for clear insights into your EV battery plant’s financial viability and strategic planning. Start mastering your electric vehicle battery business financial plan today with confidence and clarity.

Top Revenue

In financial modeling for EV battery manufacturing, analyzing the top line (gross revenue) and bottom line (net profit) is essential. Whether using a lithium-ion battery manufacturing profit model or an electric vehicle battery business financial plan, stakeholders rely on accurate forecasts to assess growth. Top-line growth signals increased production capacity and strong market demand, positively impacting EBITDA and cash flow. Rigorous cost modeling—from battery cell production budgeting to supply chain expense forecasting—ensures optimized operations and investor confidence. Ultimately, a well-structured financial model drives strategic decisions and fuels sustainable success in the competitive EV battery industry.

Business Top Expenses Spreadsheet

Assess your spending effectively using our Electric Vehicle Battery Business Financial Plan template. Expenses are categorized into four key groups for streamlined analysis, with an adaptable ‘Other’ section allowing you to input customized data tailored to your company's unique requirements. This flexible EV battery manufacturing cost analysis financial model empowers precise budget management and strategic decision-making in lithium-ion battery production and assembly cost forecasting.

EV BATTERY MANUFACTURING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

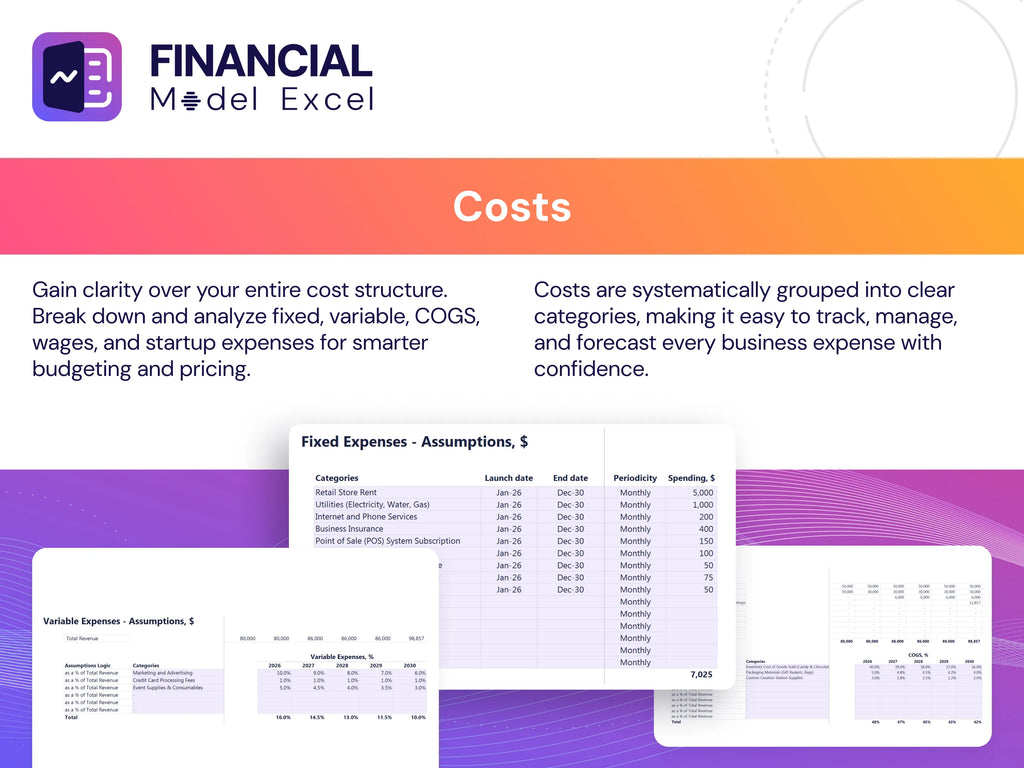

Costs

Launching an electric vehicle battery business involves significant upfront expenses that impact your financial health before operations begin. Precise monitoring of start-up costs is essential to prevent budget overruns and funding shortfalls. Our EV battery manufacturing cost analysis financial model offers a comprehensive pro forma template designed to streamline your budgeting, expense forecasting, and cash flow management. With built-in statements focused on lithium-ion battery production, supply chain cost modeling, and plant financial planning, this tool empowers you to maintain financial control and drive profitability from day one.

CAPEX Spending

Capital expenditures are essential for driving the rapid growth and innovation of companies, especially in sectors like EV battery manufacturing. Investments in cutting-edge technologies and optimized products require thorough financial planning using models such as lithium-ion battery manufacturing profit models and ev battery plant financial planning templates. A well-structured CAPEX strategy—integrated with electric vehicle battery business financial plans and production capacity financial analyses—ensures balanced accounting and effective control over costs. This disciplined approach enables companies to confidently navigate capital-intensive projects and secure long-term profitability in the dynamic electric vehicle energy storage industry.

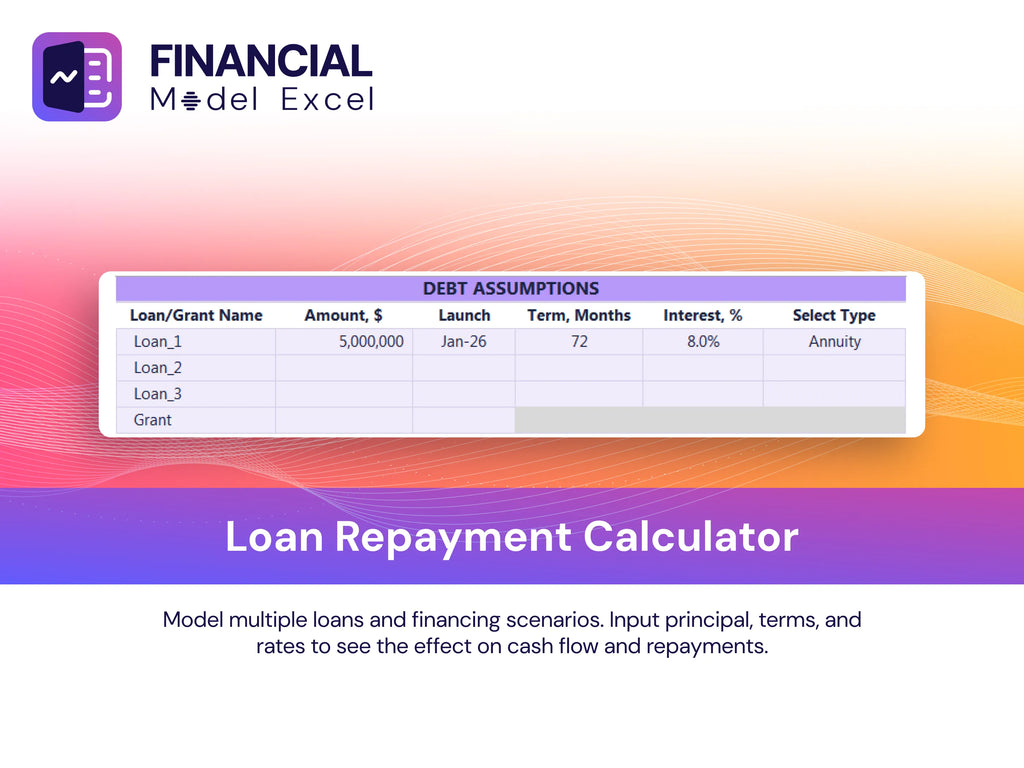

Loan Financing Calculator

A comprehensive lithium battery factory startup financial model features a detailed loan amortization schedule, offering stakeholders clear insights into periodic loan payments. This schedule outlines key data such as loan amount, interest rate, maturity term, payment frequency, and amortization method. Common approaches include straight line, declining balance, annuity, bullet, balloon, and negative amortization. Integrating this into your electric vehicle battery business financial plan ensures precise cost structure modeling and supports informed decision-making for sustainable EV battery manufacturing growth.

EV BATTERY MANUFACTURING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

In an electric vehicle battery business financial plan, key performance indicators (KPIs) are essential for owners and investors alike. These metrics enable precise ev battery manufacturing cost analysis and operational cost modeling, providing clear insights into profitability and efficiency. By leveraging KPIs within your battery cell production budgeting financial model, you can accurately track performance, optimize cost structures, and enhance your lithium-ion battery manufacturing profit model. Staying focused on these indicators ensures your electric car battery assembly cost model and supply chain cost modeling align with your strategic goals, driving sustainable growth and investor confidence.

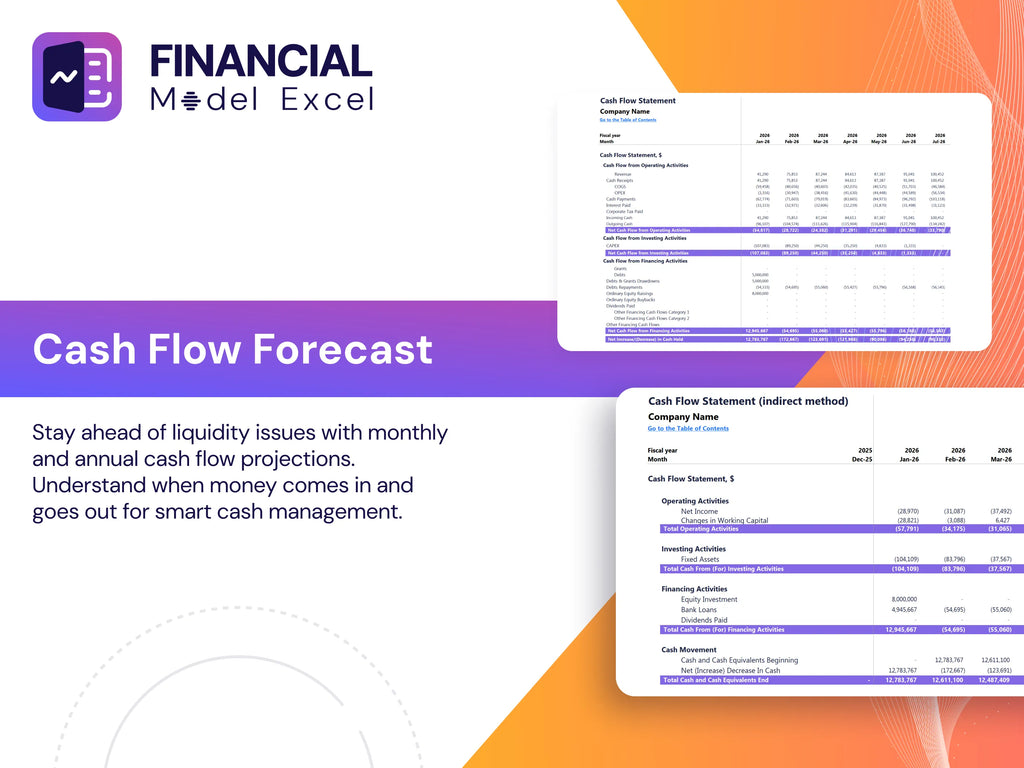

Cash Flow Forecast Excel

A startup cash flow statement is a crucial component of any electric vehicle battery business financial plan. This detailed financial model captures the inflow and outflow of cash, highlighting available liquidity for operational growth and liability management. Utilizing an advanced electric car battery manufacturing cash flow model enables startups to effectively track funding utilization, optimize financial planning, and demonstrate profitability potential to investors. Accurate cash flow projections drive informed decisions within ev battery production capacity financial analysis and battery manufacturing operational cost models, ensuring sustainable and efficient business growth from inception to expansion.

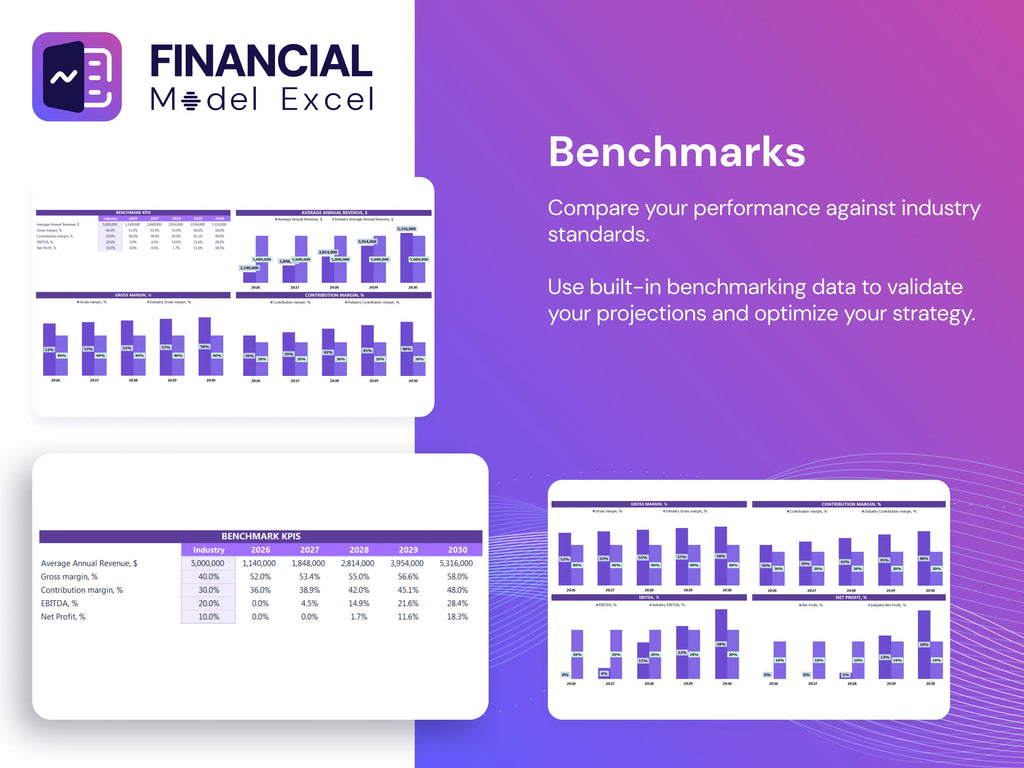

KPI Benchmarks

The financial benchmarking tab in this electric vehicle battery business financial plan enables companies to evaluate key performance indicators against industry peers. Benchmarking involves comparing your EV battery manufacturing cost analysis and revenue models with leading competitors to identify best practices. This insight drives improved operational efficiency and strategic decision-making within lithium-ion battery manufacturing profit models or battery pack manufacturing expense forecasting. Start-ups and established firms alike benefit from leveraging this tool to optimize their electric vehicle battery plant financial planning templates, ensuring stronger financial forecasts and enhanced competitive positioning in the evolving EV battery supply chain landscape.

P&L Statement Excel

Our electric vehicle battery business financial plan includes a comprehensive monthly profit and loss statement template. This advanced battery manufacturing investment analysis tool features a pro forma income statement designed to track revenue, cost of sales, operating expenses, taxes, gross profit, and net profit. It enables precise forecasting of profits and losses over the next 60 months, providing critical insights into your lithium-ion battery manufacturing profit model and EV battery production financial forecast. Ideal for battery cell production budgeting and electric car battery assembly cost modeling, this template supports robust financial planning and strategic decision-making.

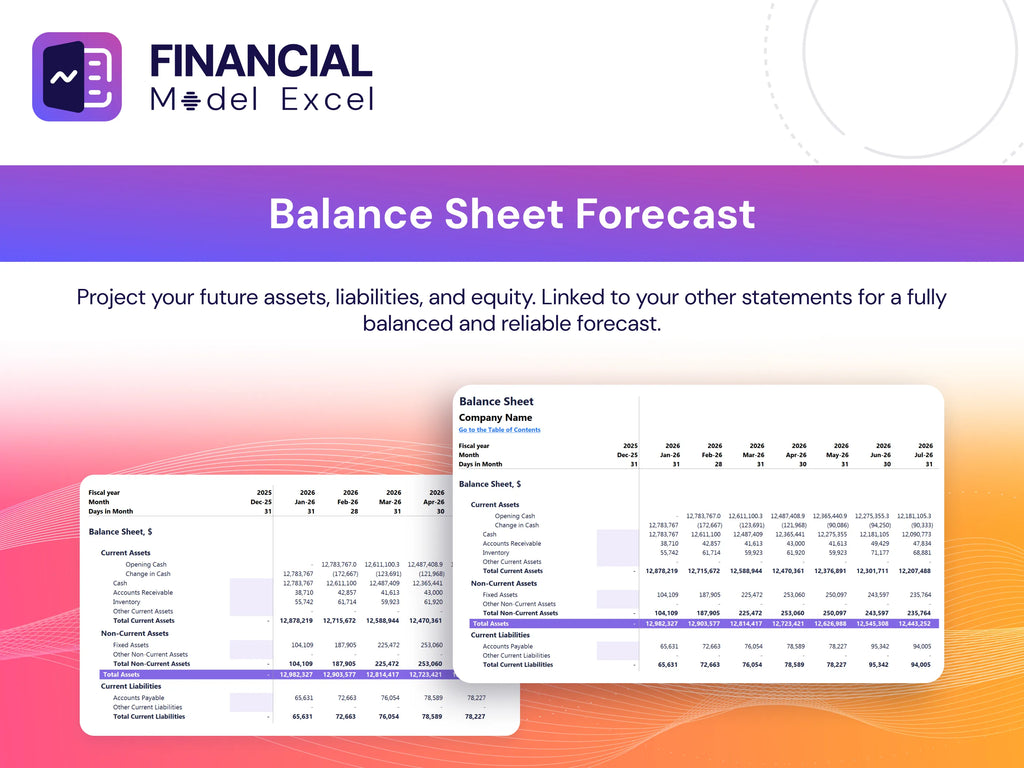

Pro Forma Balance Sheet Template Excel

Our comprehensive financial model incorporates a detailed balance sheet forecast, enabling precise visualization of total assets, liabilities, and shareholders’ equity. Tailored for electric vehicle battery manufacturing, this budgeting and cost estimation tool empowers stakeholders with clear insights into the company’s financial health. Whether analyzing lithium-ion battery production costs or planning battery plant investments, this model supports strategic decision-making with transparent, accurate financial statements.

EV BATTERY MANUFACTURING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

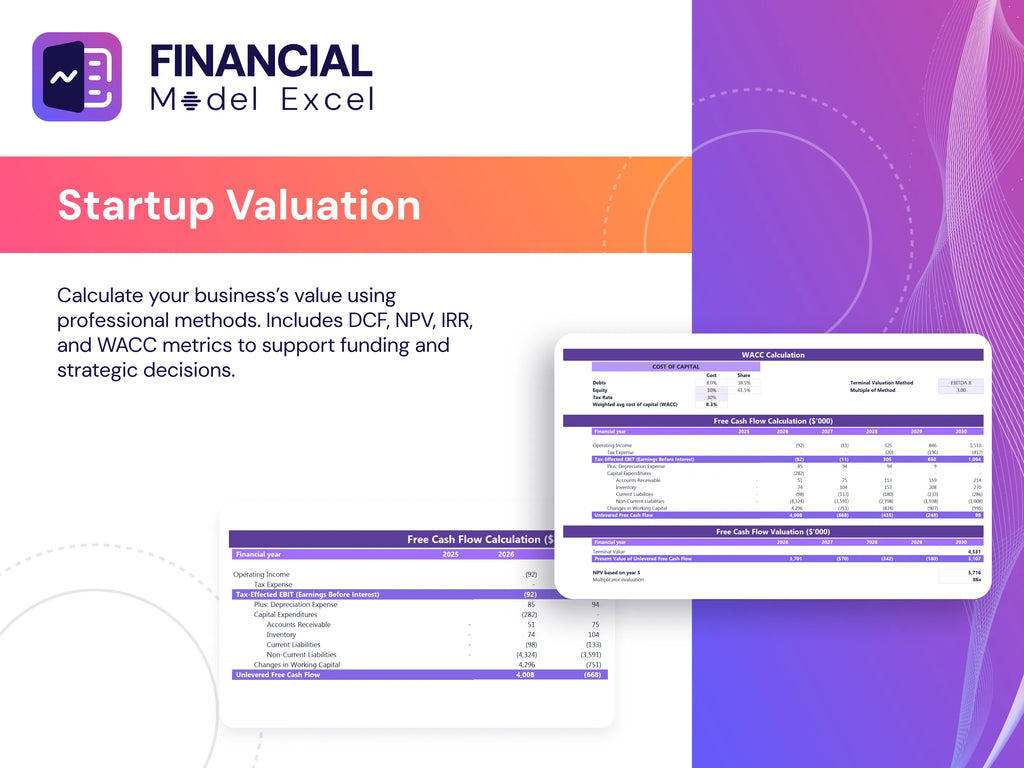

Startup Valuation Model

Discover our comprehensive EV battery manufacturing financial model, designed for precise cost structure modeling and cash flow forecasting. This advanced template enables in-depth valuation analysis, including Discounted Cash Flow (DCF), residual value, replacement cost, and market comparables. Ideal for lithium-ion battery manufacturing profit models, EV battery supply chain cost modeling, and electric vehicle battery business financial plans, it empowers stakeholders with accurate financial projections to support strategic decision-making and investment analysis. Streamline your battery plant financial planning and elevate your automotive battery manufacturing revenue forecasting with this all-in-one financial tool.

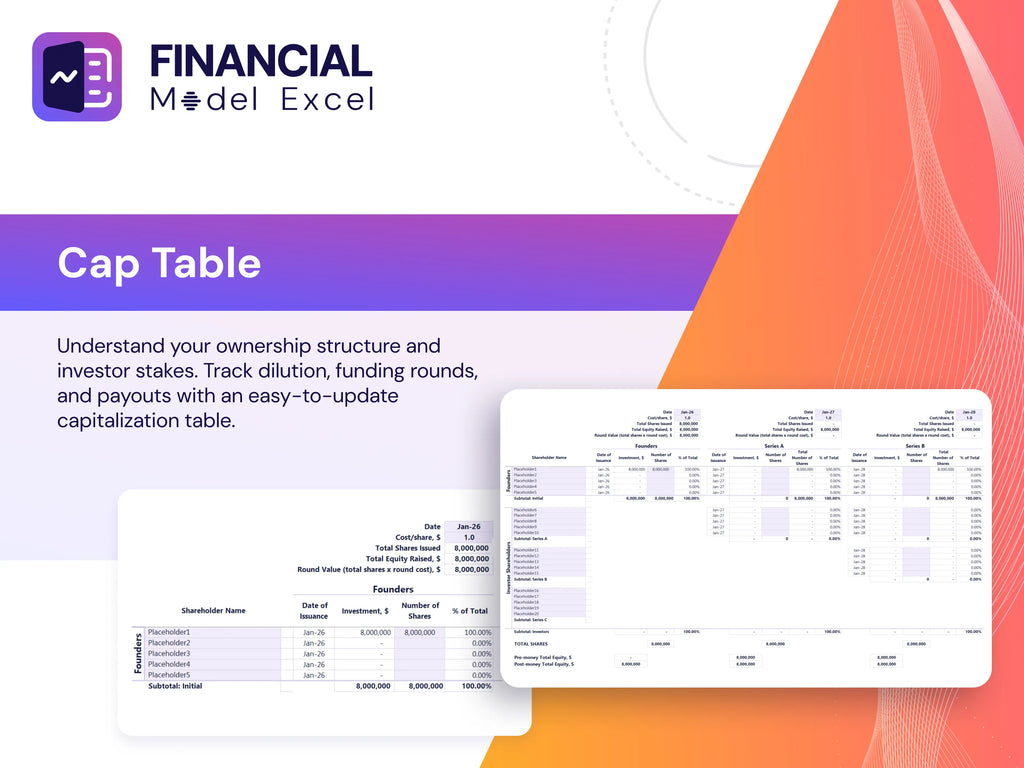

Cap Table

A comprehensive equity cap table is an essential tool for businesses, offering precise calculations of shareholder ownership dilution across multiple funding rounds. Integrating this with an electric vehicle battery production financial forecast or an advanced battery manufacturing investment analysis enhances strategic decision-making. With up to four distinct funding phases, each can be applied individually or collectively, supporting robust financial planning—whether for a lithium-ion battery manufacturing profit model or an EV battery plant financial planning template. This dynamic approach streamlines equity tracking and empowers businesses to optimize their electric vehicle battery business financial plans effectively.

EV BATTERY MANUFACTURING 3 WAY FINANCIAL MODEL ADVANTAGES

Our EV battery financial model enables precise 5-year cost forecasting for confident, strategic manufacturing investment decisions.

The financial model accurately forecasts cash flow, empowering strategic decisions and optimizing electric vehicle battery business growth.

Optimize profitability and forecast growth confidently with our comprehensive EV battery manufacturing cost analysis financial model.

The financial model pinpoints cost drivers, optimizing EV battery manufacturing profitability and strategic planning accuracy.

Optimize profits and reduce risks with the EV battery manufacturing financial model’s accurate 3-statement Excel analysis.

EV BATTERY MANUFACTURING 3 WAY FINANCIAL MODEL TEMPLATE ADVANTAGES

Optimize EV battery production costs and stay within budget using our precise financial modeling tools.

The EV battery financial model empowers accurate cash flow forecasting to optimize budgeting and drive profitable production planning.

Get a robust, fully expandable financial model that optimizes EV battery manufacturing cost analysis and boosts profitability insights.

This robust EV battery manufacturing financial model ensures precise 5-year projections, empowering confident business planning and scalability.

Optimize funding success with our electric vehicle battery business financial plan for precise cost control and profitability forecasting.

Impress investors with a solid EV battery manufacturing financial model delivering accurate cost analysis and reliable profit forecasting.

Our EV battery financial model clearly proves your ability to repay loans through precise cost and revenue forecasting.

Leverage our electric vehicle battery business financial plan to confidently showcase loan repayment and secure funding approval.

Optimize surplus cash flow with our electric vehicle battery production financial forecast for smarter, strategic investment decisions.

Our electric car battery manufacturing cash flow model enables precise planning and strategic management of surplus funds.