Farm Equipment Manufacturing Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Farm Equipment Manufacturing Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Farm Equipment Manufacturing Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FARM EQUIPMENT MANUFACTURING FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive 5-year farm equipment manufacturing financial model offers detailed agricultural machinery financial planning and farm machinery operating budget modeling, including startup cash flow statements and a financial dashboard with core metrics aligned to GAAP/IFRS standards. It enables precise farm equipment production budgeting, agri equipment cost forecasting, and agriculture equipment revenue projection to support effective financial modeling for farm machinery companies. Ideal for investment analysis for farm equipment manufacturers, business valuation, and manufacturing financial performance assessment, this model facilitates evaluating startup ideas, planning pre-launch expenses, and securing funding from banks, angels, grants, and VC funds, all while providing unlocked flexibility for in-depth customization.

This farm equipment manufacturing financial model Excel template effectively addresses common pain points by providing a comprehensive and integrated tool for agricultural machinery financial planning, farm equipment production budgeting, and agri equipment cost forecasting. It simplifies complex processes such as financial modeling for farm machinery companies, manufacturing cost models for farm equipment, and agricultural equipment revenue projection by automating calculations across a 5-year horizon, including profit and loss, balance sheets, and cash flow modeling. The model’s inclusion of investment analysis, NPV, and free cash flow projections helps users perform precise farm machinery investment modeling and business valuation, while features like break-even analysis, expense tracking, and operating budget models reduce errors and save time typically spent on manual financial statement modeling and expense reconciliation. This results in a robust, user-friendly system that supports farm equipment industry financial metrics and capital expenditure planning, ultimately enhancing agribusiness decision-making and profitability forecasting.

Description

This comprehensive farm equipment manufacturing financial model offers an integrated approach to agricultural machinery financial planning by incorporating a three-statement template that facilitates accurate farm equipment production budgeting, revenue projection, and cost forecasting. Designed for both startups and established firms, the model delivers detailed farm equipment cash flow modeling, profit estimation, and investment analysis for farm equipment manufacturers, supporting up to 60 months of financial data on a monthly and annual basis. Key features include manufacturing cost models for farm equipment, agribusiness equipment expense tracking, sales financial forecasts, and farm machinery operating budget models, along with diagnostic tools and feasibility matrices to conduct agricultural equipment break-even analysis and business valuation. This user-friendly financial modeling solution requires no advanced finance expertise and empowers decision-makers to optimize farm equipment industry financial metrics, capital expenditure planning, and fund utilization to drive profitable growth and informed investment decisions.

FARM EQUIPMENT MANUFACTURING FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Unlock the full potential of your agribusiness with our comprehensive, easy-to-use farm equipment manufacturing financial model. Featuring a 5-year forecast, this bottom-up tool supports detailed agricultural machinery financial planning, cost forecasting, and investment analysis. Whether refining your manufacturing cost model or projecting revenue and cash flow, our template adapts to your expertise, empowering precise budgeting, expense tracking, and profit estimation. Elevate your farm equipment business valuation and make informed decisions with confidence using this robust model tailored for the farm machinery industry’s financial metrics and operating budgets.

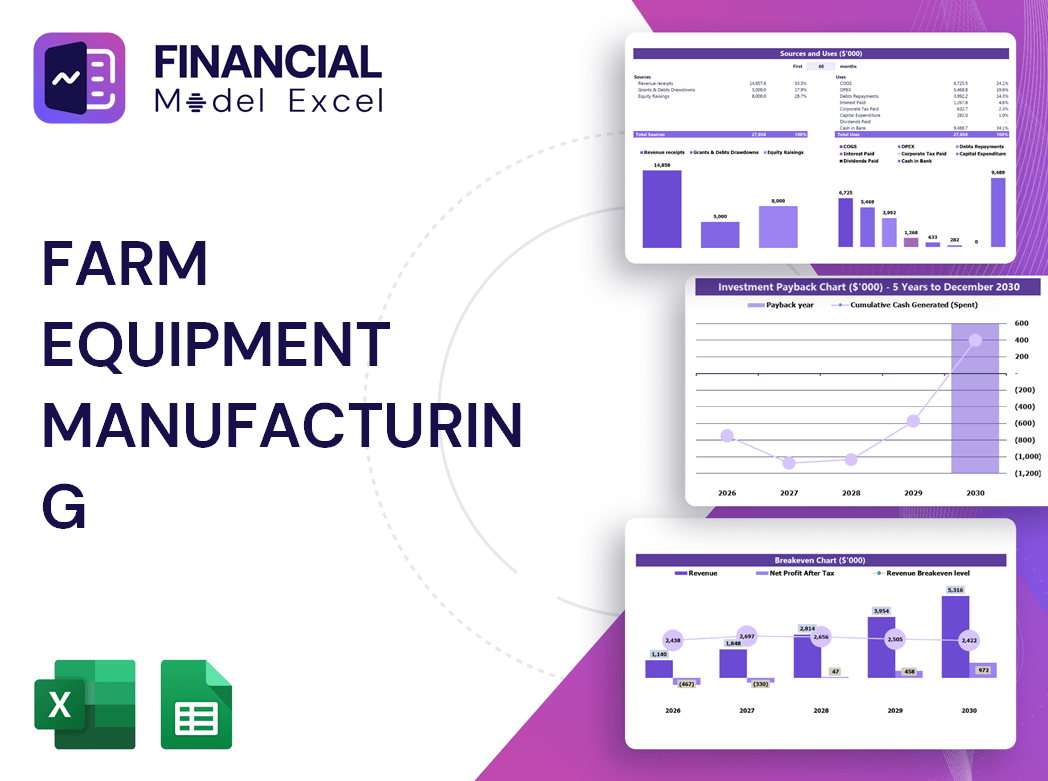

Dashboard

The Dashboard tab in this farm equipment manufacturing financial analysis template provides a dynamic snapshot through intuitive graphs, charts, key ratios, and comprehensive financial summaries. Designed for seamless integration, these insights streamline your agricultural machinery financial planning by enabling quick copy-paste into your pitch deck. Enhance your farm equipment production budgeting and investment modeling with clear visuals that support robust agribusiness equipment expense tracking and revenue projection. This tool empowers precise farm machinery operating budget modeling and accelerates manufacturing financial performance assessments, ensuring confident decision-making in the competitive farm machinery industry.

Business Financial Statements

A comprehensive financial analysis for farm equipment manufacturing requires integrating profit and loss projections with detailed balance sheet and cash flow models. The projected profit and loss statement offers critical insight into core operating activities driving earnings, while the pro forma balance sheet and cash flow forecasts emphasize capital management, asset allocation, and financial structure. Together, these models enable precise agricultural machinery financial planning, investment analysis, and cost forecasting, empowering stakeholders to optimize profitability, manage expenses, and accurately value the farm equipment business for strategic growth.

Sources And Uses Statement

A well-structured sources and uses chart is essential for farm equipment manufacturing financial analysis. It clearly tracks all income streams alongside every allocation of funds, enhancing transparency in agricultural machinery financial planning. This tool supports accurate farm equipment production budgeting, agri equipment cost forecasting, and investment analysis for farm equipment manufacturers. By providing detailed insights into financial inflows and outflows, it strengthens farm machinery operating budget models and manufacturing financial performance assessments, ultimately enabling smarter, data-driven decisions in the agribusiness equipment sector.

Break Even Point In Sales Dollars

A break-even analysis graph in Excel is an essential financial modeling tool for farm equipment manufacturers. It precisely identifies the sales volume and development stage at which agricultural machinery production becomes profitable. By integrating fixed and variable costs, this financial planning model aids in manufacturing cost forecasting, revenue projection, and operating budget management. Leveraging this tool enables agribusinesses to optimize investment analysis, enhance cash flow modeling, and make informed decisions on capital expenditure, ultimately driving sustainable growth within the farm equipment industry.

Top Revenue

In the Top Revenue tab of this farm equipment manufacturing financial analysis, users can forecast demand by product or service to evaluate potential profitability. This agricultural machinery financial planning tool enables detailed revenue projection and revenue bridge analysis, helping businesses simulate various scenarios. By examining demand levels across periods, such as weekdays versus weekends, companies gain valuable insights to optimize resource allocation—including manpower and inventory. This enhances manufacturing cost models and supports effective farm equipment production budgeting, ensuring precise agribusiness equipment expense tracking and robust financial performance in the competitive farm machinery industry.

Business Top Expenses Spreadsheet

The 5-year projection template’s Top Expenses page offers comprehensive farm equipment manufacturing financial analysis by categorizing yearly expenses into four key groups. This agricultural machinery financial planning tool delivers a full cost analysis—covering elements such as customer acquisition and fixed costs. Accurate farm equipment expense tracking empowers manufacturers to efficiently manage cash flow, optimize budgeting, and enhance profitability. Understanding detailed cost drivers through this farm machinery operating budget model enables informed decision-making and strengthens financial control across the agri equipment production process.

FARM EQUIPMENT MANUFACTURING FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Effective farm equipment manufacturing financial analysis starts with accurate startup cost modeling. Early-stage investment analysis for farm equipment manufacturers is crucial to avoid underfunding or overspending. Our five-year agricultural machinery financial planning template includes a comprehensive Pro-forma, detailing essential funding and cost data. Designed for precision, it enables agribusinesses to manage production budgeting, forecast expenses, and optimize cash flow modeling. This financial tool supports informed decision-making through reliable agricultural equipment profit estimation and operating budget models, ensuring sustainable growth and profitability in the competitive farm machinery industry.

CAPEX Spending

Capital expenditures (CAPEX) form the foundation of a startup budget, driving the growth of farm equipment manufacturing businesses. Utilizing a detailed agricultural machinery capital expenditure plan enables precise financial analysis and investment modeling. This approach supports effective management of resources, ensuring accurate farm equipment production budgeting and cost forecasting. Business owners rely on a comprehensive 5-year projection template to enhance financial modeling for farm machinery companies, optimize cash flow, and boost profitability. By leveraging these financial tools, agribusinesses achieve reliable revenue projections and sustainable growth in the competitive farm equipment industry.

Loan Financing Calculator

The loan amortization schedule within this feasibility study template provides a clear timeline of repayments, detailing periodic installments that include both principal and interest components. This schedule ensures precise tracking of farm equipment manufacturing financial obligations throughout the loan term, supporting accurate cash flow modeling and investment analysis for farm machinery companies. By integrating this tool, agricultural equipment financial planning becomes streamlined, enabling effective budgeting and forecasting to optimize business valuation and profitability.

FARM EQUIPMENT MANUFACTURING FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Investment (ROI) is a critical metric in agricultural machinery financial planning, reflecting profitability in farm equipment manufacturing. It quantifies the efficiency of investments by comparing net gains to total costs. In financial modeling for farm machinery companies, calculating ROI—net investment gains divided by total investment costs—provides valuable insights for investment analysis, farm equipment business valuation, and revenue projection. This essential metric supports informed decision-making in budgeting, cost forecasting, and capital expenditure planning within the agribusiness equipment industry.

Cash Flow Forecast Excel

A pro forma cash flow projection is a critical component of farm equipment manufacturing financial analysis. It reveals the company’s ability to generate and manage cash flows, essential for attracting investment and ensuring operational sustainability. By integrating agricultural machinery financial planning and farm equipment cash flow modeling, manufacturers can forecast funding needs accurately and optimize their manufacturing cost model for farm equipment. This insight supports strategic decision-making, helping agri equipment businesses maintain healthy liquidity, guide budget allocation, and enhance overall financial performance.

KPI Benchmarks

Our startup’s financial projections incorporate comprehensive proforma models aligned with industry benchmark analysis. By leveraging key farm equipment industry financial metrics, users can compare essential performance indicators—such as profitability, cash flow, and manufacturing costs—against peers in agricultural machinery manufacturing. This empowers informed decision-making through accurate investment analysis, cost forecasting, and revenue projection, ensuring robust financial planning and strategic growth within the agribusiness equipment sector.

P&L Statement Excel

The forecasted income statement is the key financial document investors analyze to assess farm equipment manufacturing profitability. Accurate agricultural machinery financial planning—including detailed profit and loss forecasts—is essential. However, standalone income statements don’t capture assets, liabilities, or cash flow critical for comprehensive insight. Our farm equipment business valuation and manufacturing cost model provide a full financial picture, integrating investment analysis, expense tracking, and revenue projection. With our complete financial modeling for farm machinery companies, you gain clarity on operational budgeting, capital expenditures, and overall financial performance to confidently navigate the agri equipment market.

Pro Forma Balance Sheet Template Excel

The included pro forma balance sheet template Excel is an essential tool within the five-year farm equipment financial projection. It clearly outlines current and long-term assets, liabilities, and equity, providing crucial insight for agricultural machinery financial planning. This projected balance sheet empowers manufacturers with accurate data for farm equipment business valuation, investment analysis, and key financial metrics. Leveraging this template enhances financial modeling for farm machinery companies, supporting informed decisions in budgeting, cost forecasting, and revenue projection—vital for optimized manufacturing financial performance and sustainable agribusiness growth.

FARM EQUIPMENT MANUFACTURING FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive financial model for farm equipment manufacturing empowers users to conduct precise Discounted Cash Flow valuations with minimal inputs, focusing on the Cost of Capital. Designed for agricultural machinery financial planning, it streamlines farm equipment business valuation, investment analysis, and cash flow modeling. Ideal for professionals seeking robust manufacturing cost models, revenue projections, and expense tracking, it enhances decision-making in farm equipment production budgeting and capital expenditure planning—driving strategic growth and optimized financial performance within the agribusiness equipment sector.

Cap Table

The cap table Excel is crucial for analyzing share capital, supporting informed financial decisions in farm equipment manufacturing. It enables precise valuation, market capitalization insights, and investment analysis for agricultural machinery ventures. Our comprehensive farm equipment financial model includes detailed proformas for cash flow modeling, revenue projection, expense tracking, and manufacturing cost analysis. Designed for robust agricultural equipment financial planning, this tool streamlines budgeting, break-even analysis, and business valuation. Access the full version now to enhance your farm machinery investment modeling and drive sound agribusiness financial performance.

FARM EQUIPMENT MANUFACTURING STARTUP FINANCIAL PLAN TEMPLATE ADVANTAGES

Optimize loan repayments confidently using our farm equipment manufacturing financial model with precise business plan projections.

Empower growth with precise farm equipment financial modeling, enhancing investment decisions and maximizing manufacturing profitability.

Our farm equipment financial model ensures precise cash flow management, securing payments to suppliers and employees reliably.

Accurate financial modeling empowers farm equipment manufacturers to optimize revenues and control expenses for sustained profitability.

Financial modeling for farm equipment ensures early cash flow insights, preventing shortages and optimizing financial performance.

FARM EQUIPMENT MANUFACTURING BUSINESS FINANCIAL MODEL TEMPLATE ADVANTAGES

Financial modeling for farm machinery companies ensures accurate budgeting, maximizing profits while avoiding costly cash flow problems.

Monthly farm equipment cash flow modeling enables proactive decisions, ensuring financial stability and accelerated business growth.

Save time and money with precise financial modeling for farm equipment, optimizing budgeting, forecasting, and investment decisions.

Excel pro forma templates simplify farm equipment financial modeling, saving costs and freeing you to focus on strategic growth.

Financial modeling for farm machinery companies ensures precise budgeting and maximizes profitability—great value for money.

Leverage our proven farm equipment financial model for accurate projections, affordable pricing, and zero hidden or recurring fees.

Unlock investor confidence with precise farm equipment financial modeling driving strategic, profitable business growth and clear ROI projections.

Secure investor meetings effortlessly using the farm equipment manufacturing financial model for precise, compelling financial analysis.

Get a powerful financial model for precise farm equipment cost forecasting and optimized agricultural machinery investment decisions.

This robust farm equipment financial model empowers precise cash flow forecasting and customizable business planning for optimal growth.