Financial Advisor Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Financial Advisor Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Financial Advisor Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FINANCIAL ADVISOR FINANCIAL MODEL FOR STARTUP INFO

Highlights

The financial advisor financial model and business plan template is an essential tool for startups and established companies aiming to raise funds, offering sophisticated cash flow projection models and budgeting and expense tracking features. This proforma template supports comprehensive financial forecasting methods and financial statement analysis to help evaluate startup ideas, optimize investment return strategies, and plan future budgets effectively. By incorporating advanced risk assessment in finance and asset allocation models, it enhances capital budgeting techniques and financial goal setting, making it an invaluable resource for wealth management techniques and tax planning advice.

This ready-made financial model Excel template effectively alleviates common pain points by integrating robust financial forecasting methods and cash flow projection models, enabling users to conduct comprehensive investment portfolio analysis and financial statement analysis with ease. Its intuitive design, featuring financial data visualization through colorful charts and graphs, simplifies budgeting and expense tracking while facilitating strategic financial goal setting. The inclusion of adjustable input assumptions allows for dynamic financial scenario planning, empowering users to optimize investment return optimization and perform risk assessment in finance effortlessly. Additionally, the template supports retirement planning strategies, debt management strategies, and tax planning advice, making it an essential tool for startups and investors aiming to enhance wealth management techniques and execute sound asset allocation models.

Description

This financial advisor model integrates advanced financial planning tools and investment portfolio analysis to provide a comprehensive 5-year projection template designed for startup growth without additional costs. It incorporates financial forecasting methods alongside cash flow projection models and budgeting and expense tracking to accurately capture revenue generation and business expenses, enabling informed decision-making based on precise financial statement analysis. The model includes essential wealth management techniques, risk assessment in finance, and investment risk management to optimize investment returns, supported by capital budgeting techniques and financial scenario planning. Additionally, it offers detailed insights into debt management strategies, business valuation methods, and tax planning advice, featuring key performance indicators such as financial ratios, cash burn analysis, and debt service coverage ratio, all tailored for a robust and efficient financial advisor business model.

FINANCIAL ADVISOR FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

This financial model template transforms your planning with seamless integration of your inputs into highlighted cells, automatically updating complex formulas across 15 interconnected sheets. By consolidating all assumptions in a single, organized sheet, it enhances clarity and efficiency. Utilize advanced financial forecasting methods, cash flow projection models, and investment portfolio analysis—all streamlined to optimize your wealth management techniques and retirement planning strategies. Experience precise asset allocation models, risk assessment in finance, and budgeting and expense tracking designed to elevate your financial goal setting and investment return optimization. Simplify complexity and empower informed decision-making with this dynamic tool.

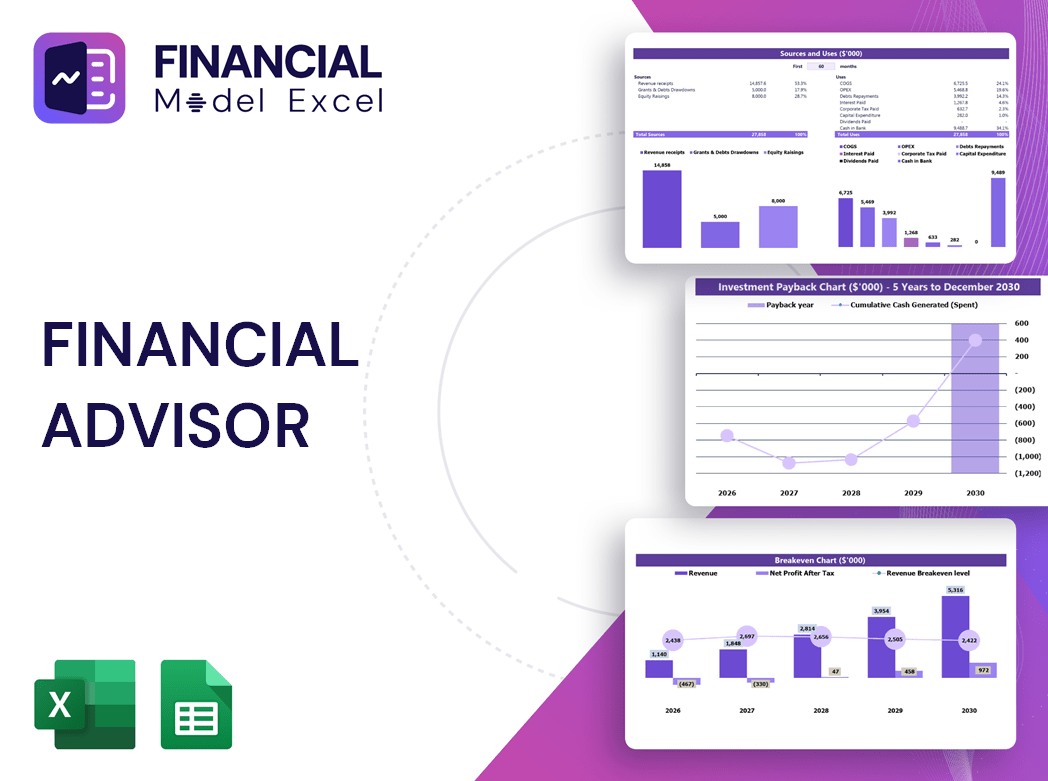

Dashboard

The business financial model template integrates advanced cash flow projection models and financial forecasting methods to support precise startup planning. It offers detailed breakdowns across customizable timeframes—monthly or yearly—empowering users to perform in-depth financial statement analysis and asset allocation modeling. The intuitive dashboard delivers clear financial data visualization, presenting critical insights in both numeric and chart formats. This tool enhances investment portfolio analysis and risk assessment in finance, helping entrepreneurs implement effective budgeting and expense tracking alongside strategic financial goal setting for optimal investment return optimization.

Business Financial Statements

This startup pro forma template is an essential financial planning tool designed to deliver comprehensive financial statement analysis and cash flow projection models. It empowers business owners with accurate financial forecasting methods and investment portfolio analysis, enabling informed decision-making. By integrating budgeting and expense tracking alongside risk assessment in finance, this template supports effective financial goal setting and investment risk management. Perfect for optimizing capital budgeting techniques and retirement planning strategies, it provides a clear roadmap to monitor performance and forecast future growth with confidence.

Sources And Uses Statement

The Sources and Uses template in this financial model expertly outlines your company’s funding origins alongside detailed expenditure allocations. Integrating asset allocation models and cash flow projection methods, it supports comprehensive financial statement analysis and enhances financial forecasting accuracy. This tool is essential for strategic financial goal setting, risk assessment in finance, and investment portfolio analysis, empowering you to optimize investment returns and implement robust debt management strategies. Elevate your business plan with precise budgeting and expense tracking, ensuring effective capital budgeting techniques and tax planning advice for sustained wealth management and retirement planning success.

Break Even Point In Sales Dollars

Utilizing break-even analysis within advanced financial forecasting methods empowers you to assess your business’s viability accurately. This model integrates cash flow projection models and financial statement analysis to pinpoint the minimum sales required to cover expenses. With organized financial data, you can implement effective budgeting and expense tracking, optimize investment return, and refine debt management strategies. Additionally, break-even insight supports realistic financial goal setting and enhances investment risk management by forecasting when your venture becomes profitable—crucial for aligning stakeholder expectations and driving informed wealth management decisions.

Top Revenue

Gain clear insights into your annual revenue streams with our projected income statement Excel template. The Top Revenue tab delivers a detailed financial breakdown by offering, while integrated financial forecasting methods reveal revenue depth and bridge analyses. Empower your financial planning with precise financial data visualization and capital budgeting techniques, enabling smarter decision-making and optimized investment return.

Business Top Expenses Spreadsheet

In the Top Expenses section of our financial projection startup, expenses are categorized into four main groups for streamlined tracking. Our financial modeling Excel template features an additional 'Other' category, allowing you to input customized data tailored to your company’s unique needs. Enhance your financial planning with integrated financial forecasting methods and cash flow projection models. Plus, monitor your progress over time effortlessly by building a comprehensive three-statement model template, valid for up to five years, empowering accurate investment portfolio analysis and strategic decision-making.

FINANCIAL ADVISOR FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Incorporating startup costs into your pro forma income statement is crucial for effective financial goal setting and risk assessment. Proper management of these initial expenses ensures smoother cash flow projections and minimizes unforeseen financial impacts. Our startup financial model template features integrated budgeting and expense tracking alongside financial forecasting methods, enabling precise investment portfolio analysis and optimized capital budgeting techniques. This comprehensive tool supports wealth management strategies and empowers you to make informed decisions that enhance your company’s financial performance from day one.

CAPEX Spending

The automated CAPEX expenses are integrated within cash flow projection models, offering a comprehensive view of capital expenditures. This approach supports robust financial forecasting methods and incorporates alternative income sources, enhancing investment portfolio analysis and capital budgeting techniques. By leveraging these insights, businesses can optimize investment return strategies, improve asset allocation models, and strengthen overall wealth management techniques for sustainable growth.

Loan Financing Calculator

Our business plan financial projections template integrates advanced loan amortization schedules with embedded formulas, enabling clear differentiation between principal and interest payments. This tool offers precise cash flow projection models, detailing repayment amounts, interest accrual, payment frequency, and total loan duration. Enhance your financial planning with accurate debt management strategies and investment risk management insights, empowering smarter decisions for sustainable growth and optimized investment return.

FINANCIAL ADVISOR FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net profit margin is a vital financial metric that reflects your company’s efficiency in converting revenue into actual profit. Utilizing financial forecasting methods and cash flow projection models, this metric offers deep insights into how each dollar earned contributes to overall profitability. Integrating net profit margin analysis with budgeting and expense tracking enhances your ability to optimize investment return, manage risks, and implement effective debt management strategies—key components for driving sustainable long-term growth and strengthening your wealth management approach.

Cash Flow Forecast Excel

A robust cash flow projection model is essential for accurate financial forecasting and effective capital budgeting. Utilizing financial planning tools, startups can visualize cash inflows and outflows, ensuring liquidity management and enhancing investment portfolio analysis. These projections are vital when seeking loans or raising capital, enabling risk assessment in finance and optimizing investment return strategies. By integrating cash flow models into financial scenario planning, businesses can confidently navigate funding challenges and implement sound wealth management techniques from the outset.

KPI Benchmarks

The financial projections template’s benchmark tab integrates key performance indicators with industry average metrics, enabling precise benchmarking analysis. By leveraging financial forecasting methods and market trend analysis, businesses—especially start-ups—can evaluate operational and financial performance against best-in-class standards. This approach enhances financial goal setting, risk assessment in finance, and investment portfolio analysis. Utilizing these insights supports strategic decision-making, optimizing investment return and cash flow projection models. Ultimately, such benchmarks serve as vital wealth management techniques, driving smarter financial planning and robust business valuation methods for sustained growth and competitive advantage.

P&L Statement Excel

Leverage advanced financial forecasting methods and 5-year cash flow projection models to drive confident business decisions. Our expertly designed financial planning tools enable comprehensive financial statement analysis and investment portfolio analysis, allowing you to identify profitability drivers and potential risks. With precise financial scenario planning and asset allocation models, you can optimize investment returns while managing risks effectively. Utilize our business plan Excel template to streamline budgeting, expense tracking, and retirement planning strategies—empowering your wealth management techniques and tax planning advice for sustained growth and success.

Pro Forma Balance Sheet Template Excel

A projected balance sheet offers a snapshot of a company’s assets, liabilities, and equity at a specific moment, essential for financial statement analysis and risk assessment in finance. Complemented by a forecasted income statement, it tracks operational performance over time, aiding in financial forecasting and cash flow projection models. For startups, a pro forma balance sheet reveals net worth divided between equity and debt, providing critical insights into liquidity, solvency, and turnover ratios. Utilizing these tools supports effective financial goal setting, investment risk management, and strategic wealth management techniques.

FINANCIAL ADVISOR FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This pre-revenue valuation spreadsheet offers robust financial forecasting methods, including Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) analysis. WACC serves as a vital risk assessment tool, guiding lenders by evaluating the cost of capital from equity and debt proportions. Meanwhile, DCF empowers investors to optimize investment returns by valuing future cash flows accurately. Together, these financial planning tools support business owners, creditors, and investors in making informed decisions grounded in comprehensive financial scenario planning and investment risk management.

Cap Table

Our cap table serves as a dynamic financial planning tool, effectively guiding asset allocation across various periods. It provides investors with clear insights into expected returns, supporting sound investment portfolio analysis and financial goal setting. By integrating wealth management techniques and cash flow projection models, it becomes an essential resource for optimizing investment return and managing risk. This strategic approach enhances transparency and confidence, empowering stakeholders to make informed decisions grounded in robust financial data visualization and scenario planning.

FINANCIAL ADVISOR FINANCIAL FORECASTING MODEL ADVANTAGES

The Three Statement Financial Model ensures precise cash flow forecasting, confirming your business can reliably meet payment obligations.

Leverage advanced financial modeling to optimize sales strategies and enhance investment portfolio analysis for superior growth outcomes.

Enhance stakeholder trust with accurate financial forecasting methods for confident, data-driven business decisions and growth.

Optimize your startup loan repayments using a financial model that ensures precise planning and strategic feasibility analysis.

Optimize cash flow projection models with our pro forma Excel template for superior accounts receivable management.

FINANCIAL ADVISOR PRO FORMA PROJECTION ADVANTAGES

Leverage advanced financial forecasting methods to optimize investment returns and secure confident funding pitches.

Impress investors with a strategic financial model delivering expert investment portfolio analysis and optimized financial forecasting methods.

Run different financial scenario planning models to optimize investment returns and enhance strategic decision-making confidently.

Cash flow projection models enable dynamic scenario planning, optimizing financial decisions by visualizing variable impacts effectively.

Unlock smarter decisions with our financial forecasting methods for precise, confident planning and optimized investment returns.

Streamline financial planning with a clear, transparent Excel model featuring 15+ color-coded tabs for precise analysis.

Unlock smarter decisions with financial data visualization and investment portfolio analysis in a single, intuitive dashboard.

Streamline financial forecasting with our dashboard, combining investment portfolio analysis and cash flow projection models for instant insights.

Leverage budgeting and expense tracking tools to optimize spending, ensuring disciplined financial management and enhanced savings growth.

Cash flow projection models empower precise budgeting by forecasting future inflows and outflows, enhancing financial decision-making.