Financial Institution Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Financial Institution Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Financial Institution Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FINANCIAL INSTITUTION FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year financial institution financial model offers a robust framework for early-stage startups to impress investors and successfully raise capital. Designed as a versatile financial institution forecasting model, it enables detailed evaluation of startup ideas, planning of startup costs, and development of strategic business plans. Fully unlocked and customizable, this financial institution financial planning model integrates elements of profitability, cash flow, and loan portfolio models to provide a holistic view of financial performance, making it an essential tool for emerging financial institutions seeking to optimize their growth and sustainability.

The ready-made financial institution analysis model addresses critical pain points by offering a comprehensive, print-ready package that includes detailed profit and loss statements, cash flow projections, and industry benchmark KPIs, enabling users to conduct thorough financial institution valuation and performance assessments with ease; its integration of a financial institution loan portfolio model, capital adequacy model, and stress testing capabilities provides robust risk management and regulatory compliance insights, while the financial institution budgeting and forecasting models streamline planning and scenario analysis, ultimately enhancing decision-making efficiency and accuracy for banks and credit unions alike.

Description

The financial institution financial model integrates comprehensive components such as a financial institution valuation model, financial institution cash flow model, and financial institution balance sheet model to project a detailed 5-year monthly and yearly forecast, including income statements and discounted cash flow valuation. This dynamic and adaptable financial institution financial planning model evaluates profitability and liquidity by calculating key performance ratios and KPIs essential for banks, credit unions, and investors, while also incorporating scenario analysis and stress testing models to assess risk and capital adequacy. Designed for startups and existing entities alike, the model supports strategic decisions by providing clear insights into loan portfolio management, budgeting, asset liability dynamics, and regulatory compliance, all underpinned by automated updates upon input modification, making it an indispensable tool for robust financial institution analysis and forecasting.

FINANCIAL INSTITUTION FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Unlock the potential of your financial institution with our customizable, user-friendly financial institution financial planning model in Excel. This robust template serves as a comprehensive guide for sophisticated business modeling, including valuation, risk, forecasting, and profitability analysis. Designed for professionals, it allows seamless tailoring of every sheet to fit your unique needs, whether for banks, credit unions, or other financial entities. Elevate your strategic planning and decision-making with a powerful, flexible financial model built to drive exceptional performance and growth.

Dashboard

Our advanced financial institution financial planning model integrates a dynamic dashboard showcasing key KPIs through precise charts and graphs. Designed for financial specialists, it delivers high-accuracy revenue and earnings forecasts via projected profit and loss statements in Excel. This powerful financial institution cash flow model offers clear insights into liquidity, while the comprehensive financial institution profitability model highlights the company’s growth potential. Together, these tools provide stakeholders with a transparent, data-driven view essential for informed decision-making and strategic success.

Business Financial Statements

When a financial institution forecasting model is accurately populated and key financial and operational assumptions are updated and integrated within the Excel template, projecting essential financial statements becomes seamless. This approach ensures the financial model for banks or credit unions remains intuitive, user-friendly, and professional. Users can confidently rely on the model for precise startup cost analysis, performance evaluation, and collaborative review, streamlining financial planning and decision-making processes with clarity and ease.

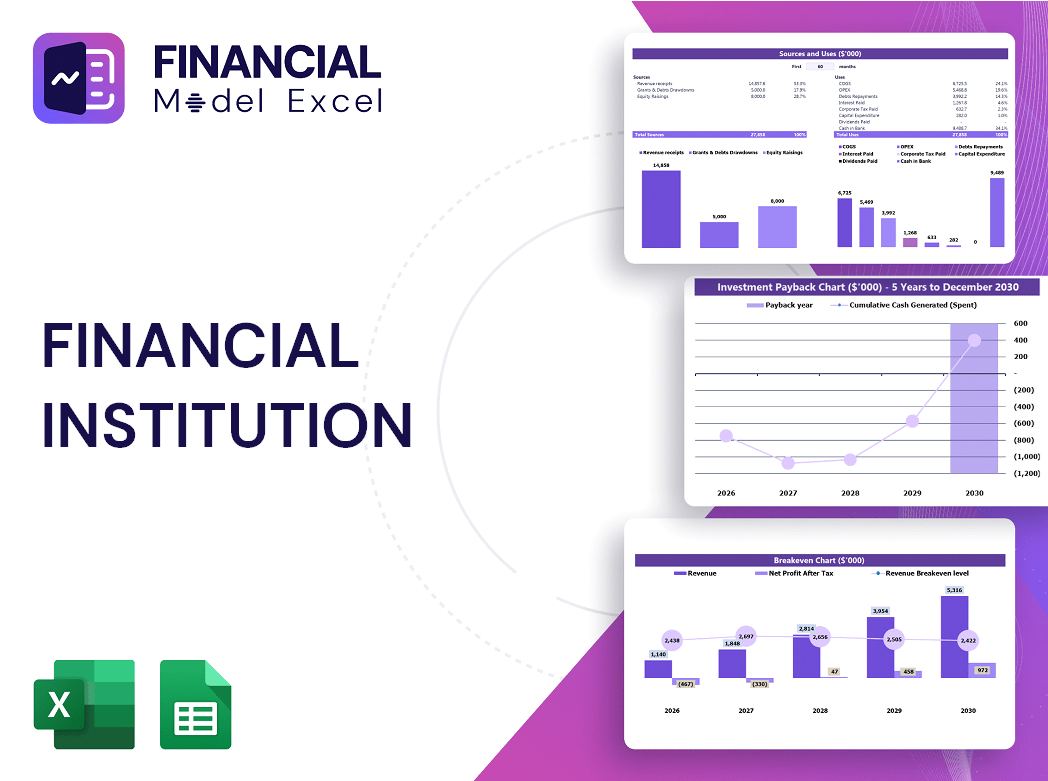

Sources And Uses Statement

Our comprehensive financial institution budgeting model features a pre-built Use of Funds tab, seamlessly outlining primary funding sources alongside corresponding expenditure activities. This tool empowers banks and credit unions to optimize fund management within five-year financial projections. Especially valuable for start-ups, it enhances strategic planning, budgeting, and ongoing monitoring. Incorporating this into your financial institution forecasting model ensures precise allocation and effective utilization of capital—driving sustainable growth and performance.

Break Even Point In Sales Dollars

A financial institution forecasting model is essential for analyzing sales volume needed to cover fixed and variable costs, pinpointing the break-even point. This model enables banks and credit unions to project profitability timelines and investment return periods accurately. By leveraging this financial institution profitability model, management can adjust pricing strategies and operational variables to optimize performance. Additionally, integrating these insights into a financial institution financial planning model empowers decision-makers to refine business assumptions, ensuring sustainable growth and informed resource allocation across loan portfolios, cash flow, and capital adequacy frameworks.

Top Revenue

The Top Revenue tab in our financial institution financial planning model offers a clear, organized view of your product and service revenue streams. It provides an annual summary highlighting revenue depth and the revenue bridge, enabling precise financial institution forecasting and performance analysis. This streamlined approach supports informed decision-making and enhances your institution’s profitability and strategic planning.

Business Top Expenses Spreadsheet

In the Top Expenses section of our business plan financial projections template, key company expenses are clearly categorized into four main areas. The 'Other' category offers flexibility to include any additional costs crucial to your operations. Complement this with our financial institution financial planning model to monitor and forecast your financial health over five years. Leveraging robust financial institution cash flow and profitability models ensures precise tracking and strategic decision-making aligned with your long-term goals.

FINANCIAL INSTITUTION FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Effective management of start-up costs is crucial for financial institutions to avoid cash shortfalls and deficits. Our comprehensive financial institution budgeting model offers advanced Pro-forma templates tailored for precise expense planning and monitoring. Designed to integrate seamlessly with your financial institution forecasting and cash flow models, this tool empowers you to control expenditures from day one, ensuring sustainable growth and financial stability. Leverage our model to transform start-up challenges into opportunities for profitability and long-term success.

CAPEX Spending

A financial expert leverages a robust financial institution budgeting model to accurately forecast startup budgets, capturing investments in fixed assets. This model effectively manages depreciation, additions, and disposals related to property, plant, and equipment (PPE). It also integrates capital expenditure calculations, encompassing asset acquisitions, including those under financial leasing agreements, ensuring a comprehensive and precise capital expense budget. This approach enhances financial planning, supports strategic asset management, and strengthens overall financial institution valuation and performance.

Loan Financing Calculator

The loan amortization schedule within this financial institution loan portfolio model provides a comprehensive breakdown of periodic repayments, detailing principal and interest components. Designed for precise financial forecasting, it outlines each installment throughout the loan term until full repayment is achieved. This template enhances accuracy in financial planning and risk assessment, essential for robust loan management and institutional profitability analysis.

FINANCIAL INSTITUTION FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our financial institution financial planning model features a detailed breakdown of revenue, presented through dynamic charts illustrating monthly income across five key revenue streams. Easily customize the model by adding new products or adjusting the analysis period to fit your institution’s unique needs. This powerful tool integrates seamlessly within our comprehensive financial institution performance and forecasting models, empowering precise financial institution analysis and enhancing decision-making for banks and credit unions.

Cash Flow Forecast Excel

The financial institution cash flow model is an essential tool for precise monthly cash flow projections, empowering businesses to enhance operational efficiency. Incorporating this model within a detailed business plan offers modern, data-driven insights, enabling proactive financial management and strategic decision-making. By leveraging advanced cash flow forecasting and analysis, financial institutions can optimize liquidity, strengthen capital adequacy, and improve overall profitability. This sophisticated approach supports robust financial planning and risk management, driving sustainable growth in today’s dynamic market environment.

KPI Benchmarks

Our financial institution analysis model, featuring an integrated benchmarking template, empowers you to evaluate your company’s operational and financial metrics against industry peers with precision. By leveraging this financial institution performance model, clients gain critical insights into relative strengths and weaknesses, enhancing strategic decision-making. Quickly identify gaps and optimize your financial institution forecasting model to drive superior results. This comprehensive financial model for banks and credit unions streamlines performance assessment, ensuring your institution remains competitive and well-positioned for sustainable growth.

P&L Statement Excel

The profit and loss statement is vital for assessing a financial institution’s profitability, yet it offers limited insight into the asset and liability structure driving those profits. While the profit and loss projection provides reasonable accuracy, it doesn’t fully capture cash flow dynamics or balance sheet strength. Integrating a comprehensive financial institution profitability model with balance sheet, cash flow, and asset liability models ensures a holistic evaluation. This approach empowers stakeholders to analyze risk, forecast performance, and enhance financial planning—delivering a well-rounded view beyond standalone profit projections.

Pro Forma Balance Sheet Template Excel

A financial institution balance sheet model provides a clear snapshot of assets, liabilities, and equity at a specific point in time, essential for effective financial institution analysis models. Complemented by financial institution profitability and cash flow models, it drives insights into liquidity, solvency, and capital adequacy. Utilizing projected balance sheets over a multi-year horizon empowers strategic financial planning and risk assessment within financial institution forecasting and scenario analysis models. These integrated tools are vital for comprehensive performance evaluation and regulatory compliance in banks and credit unions.

FINANCIAL INSTITUTION FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our financial institution valuation model integrates Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) for precise analysis. WACC accurately reflects the cost of equity and debt, serving as a critical risk assessment tool in loan approvals. The DCF component evaluates the present value of future cash flows, empowering banks to make informed investment decisions. This comprehensive financial model for banks enhances forecasting, credit, and profitability analysis, ensuring robust financial planning and capital adequacy assessments.

Cap Table

A robust financial institution capital adequacy model is essential for analyzing and managing a bank’s capital structure, ensuring regulatory compliance, and optimizing investor shares. Similar to a cap table for startups, this model provides a comprehensive view of capital distribution and equity stakes, enabling clear insights into the institution’s financial potential. Leveraging such financial models—including balance sheet, cash flow, and risk models—empowers institutions to make informed decisions, forecast growth, and enhance profitability with precision and confidence.

FINANCIAL INSTITUTION STARTUP FINANCIAL PLAN ADVANTAGES

Boost accuracy and confidence by using a financial institution valuation model for precise business sale projections in Excel.

The financial institution forecasting model empowers precise predictions, enhancing strategic decisions and maximizing profitability.

Enhance strategic insights and mitigate risks with our comprehensive financial institution risk and forecasting model.

Gain precise control and insight with a financial institution financial model tailored for startups’ success and growth.

The financial institution budgeting model optimizes cost planning, ensuring efficient opening and operating activity management.

FINANCIAL INSTITUTION STARTUP FINANCIAL PLAN ADVANTAGES

The financial institution forecasting model empowers confident, data-driven decisions for a secure and profitable future.

Our financial model empowers precise planning, risk prevention, and accurate forecasting for your institution’s future success.

The financial institution forecasting model enables accurate, timely projections essential for satisfying external stakeholders’ regulatory and strategic demands.

A financial institution forecasting model enhances loan approvals by providing accurate, dynamic business forecast templates to banks.

Enhance decision-making with our financial institution forecasting model, delivering precise predictions for strategic growth and stability.

A financial institution cash flow model empowers precise forecasting, minimizing risk and supporting sustainable business growth decisions.

The financial institution stress testing model enhances risk management by predicting and preparing for potential financial challenges.

The financial institution financial model offers clear, transparent, and color-coded tabs for precise, category-specific analysis and reporting.

The financial institution credit model enables better decision making through precise risk assessment and portfolio optimization.

Optimize decisions confidently using the financial institution cash flow model to forecast scenarios and project cash balances accurately.