Fixed Asset Management Software Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Fixed Asset Management Software Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Fixed Asset Management Software Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

FIXED ASSET MANAGEMENT SOFTWARE FINANCIAL MODEL FOR STARTUP INFO

Highlights

The five-year business revenue model template for fixed asset management software provides early-stage startups with a comprehensive financial asset management solution designed to impress investors and facilitate capital raising. This cloud-based fixed asset software integrates advanced asset lifecycle management tools and a fixed asset depreciation calculator to accurately estimate startup costs and streamline budgeting. With features like fixed asset acquisition software, fixed asset cost management tools, and fixed asset reporting tools, the enterprise asset management platform offers robust fixed asset accounting software and an asset inventory management system, ensuring precise tracking, valuation, and maintenance planning. Fully unlocked and editable, this capital asset management system empowers startups to optimize financial modeling for asset management and confidently plan their growth trajectory.

This comprehensive financial model for fixed asset management software effectively addresses common pain points faced by buyers of ready-made Excel templates by integrating asset lifecycle management tools, a fixed asset depreciation calculator, and a fixed asset cost management tool to ensure accurate valuation and budgeting without hidden fees or recurring costs; it also incorporates cloud-based fixed asset software capabilities and fixed asset reporting tools that enhance transparency and streamline financial modeling for asset management, while supporting seamless integration with capital asset management systems and enterprise asset management platforms for robust fixed asset acquisition software, audit, and maintenance planning, ultimately delivering an affordable, all-in-one asset inventory management software solution that eliminates complexity and reduces risk associated with manual asset management processes.

Description

This cloud-based fixed asset software financial model leverages an advanced bottom-up approach to deliver comprehensive asset lifecycle management tools, including fixed asset depreciation calculator and fixed asset valuation software, allowing detailed insight into capital asset management systems. The model generates a robust 5-year financial projection with integrated fixed asset accounting software features, producing monthly and annual profit and loss statements, projected balance sheets, and cash flow projection templates tailored for startups and existing businesses. It also incorporates fixed asset cost management tools alongside fixed asset reporting tools, enabling precise financial modeling for asset management, discounted cash flow valuation, and calculation of key financial performance ratios and KPIs essential for securing investor confidence and optimizing asset inventory management software strategies. With its enterprise asset management platform capabilities, including fixed asset maintenance planner and asset management budgeting software, this model streamlines business operations, minimizes complexity, and enhances decision-making efficiency in fixed asset acquisition software and financial asset management solutions.

FIXED ASSET MANAGEMENT SOFTWARE FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Easily customize every worksheet with our powerful yet intuitive fixed asset management software financial model. Designed for startups, this comprehensive financial modeling tool integrates asset lifecycle management, fixed asset depreciation calculation, and capital asset management system features. It serves as a strategic guide to streamline your asset inventory management, fixed asset reporting, and financial asset management solutions—helping you build a resilient and scalable business model with precision and confidence.

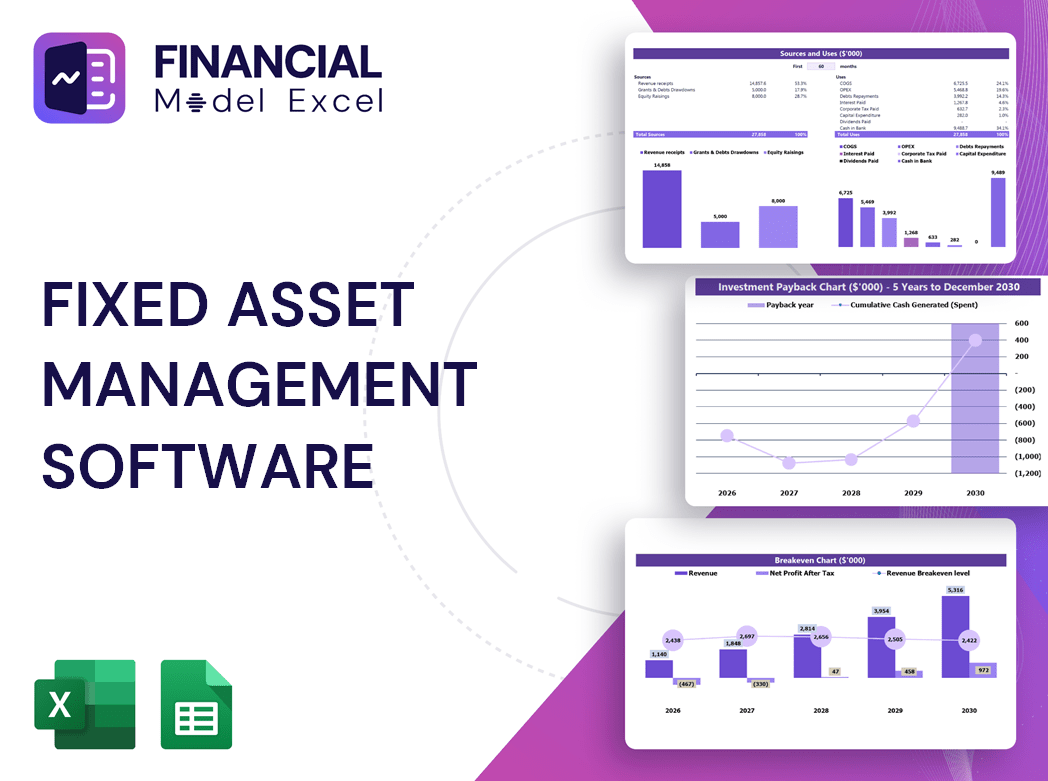

Dashboard

The Dashboard tab in our fixed asset investment modeling platform provides a dynamic financial snapshot through intuitive graphs, charts, ratios, and summaries. Seamlessly integrate these visuals into your pitch deck to showcase clear, data-driven insights. Designed as part of our comprehensive enterprise asset management platform, this feature empowers precise asset lifecycle management and enhances financial modeling for asset management—all within a streamlined, cloud-based fixed asset software environment. Elevate your capital asset management strategy with ready-to-use, insightful fixed asset reporting tools.

Business Financial Statements

Our advanced financial asset management solutions empower businesses to generate detailed financial statements, forecasts, and analyses seamlessly. Integrated fixed asset accounting software and asset lifecycle management tools ensure accurate tracking and valuation, while fixed asset depreciation calculators and reporting tools enhance transparency. Coupled with dynamic charts and graphs, our cloud-based fixed asset software effectively communicates a company’s financial health, enabling stakeholders and investors to grasp critical insights with ease. Elevate financial visibility and decision-making through our comprehensive capital asset management system today.

Sources And Uses Statement

The Sources and Uses Statement tab provides a clear overview of company funding origins alongside planned expenditures within the startup pro forma template. Leveraging advanced fixed asset tracking software and asset lifecycle management tools, this section integrates financial asset management solutions and fixed asset cost management tools to ensure precise capital allocation. Utilizing cloud-based fixed asset software enhances transparency and accuracy, supporting effective asset inventory management and fixed asset depreciation calculations. This approach empowers strategic decision-making and aligns spending with company growth objectives through a comprehensive enterprise asset management platform.

Break Even Point In Sales Dollars

The break-even point in this financial plan template highlights when your business transitions to profitability. Using precise fixed asset reporting tools and financial modeling for asset management, the break-even analysis reveals the exact unit sales needed for revenues to surpass expenses. Integrating a capital asset management system or fixed asset accounting software can further refine these calculations, ensuring accurate financial forecasting and strategic decision-making.

Top Revenue

Leverage our enterprise asset management platform’s fixed asset reporting tools to gain comprehensive financial insights. The Top Revenue tab in the proforma business plan template provides an annual breakdown of revenue streams, allowing you to analyze revenue depth and revenue bridge efficiently. Integrate with cloud-based fixed asset software and fixed asset accounting software for seamless asset lifecycle management and accurate financial asset management solutions. This precise financial modeling for asset management empowers informed decision-making and optimized capital asset management strategies.

Business Top Expenses Spreadsheet

Effective cost management is vital for any company’s profitability. Our cloud-based fixed asset software includes comprehensive fixed asset reporting tools that categorize expenses into key groups, highlighting major costs while consolidating minor ones under ‘other.’ This asset lifecycle management tool empowers businesses to monitor annual expenses with precision, optimize financial performance, and enhance decision-making. Whether a start-up or established enterprise, leveraging a capital asset management system ensures stability and drives your company toward sustained growth and prosperity.

FIXED ASSET MANAGEMENT SOFTWARE FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs accrue before operations begin, making early monitoring essential to prevent overspending or underfunding. Our cloud-based fixed asset management and tracking system features a dedicated proforma for start-up costs within its financial modeling template. This enterprise asset management platform enables seamless integration of funding and expenses in one place, empowering you to track expenditures and optimize budgeting effectively. Utilize our fixed asset cost management tools to ensure accurate financial projections and streamline your capital asset management from day one.

CAPEX Spending

Capital expenditures drive dynamic growth by enabling companies to adopt cutting-edge technologies and innovate products and services. Utilizing advanced fixed asset tracking software and capital asset management systems ensures precise oversight of CAPEX, a major expense category. Integrating asset lifecycle management tools and fixed asset accounting software empowers startups to maintain financial balance, streamline budgeting, and enhance decision-making. With cloud-based fixed asset software and fixed asset depreciation calculators, businesses gain real-time visibility and control, optimizing asset utilization and sustaining long-term growth in an ever-evolving market landscape.

Loan Financing Calculator

Start-ups and early-stage companies benefit from robust asset management and tracking systems to optimize loan repayment schedules. Utilizing cloud-based fixed asset software and fixed asset accounting software enables precise monitoring of loan breakdowns, amounts, and maturity terms. Integrating fixed asset depreciation calculators and financial asset management solutions ensures accurate cash flow analysis and balance sheet reporting. Effectively managing principal repayments and interest expenses through advanced asset lifecycle management tools supports informed forecasting in cash flow statements, strengthening overall financial health and strategic planning.

FIXED ASSET MANAGEMENT SOFTWARE FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Net Present Value (NPV) is a crucial financial metric within fixed asset accounting software and financial asset management solutions. It calculates the current worth of future cash flows by discounting them, helping businesses evaluate investment decisions. Utilizing asset lifecycle management tools or a capital asset management system, NPV answers key questions like, “What is the present value of $1 received in the future?” Integrated fixed asset reporting tools and fixed asset valuation software further enhance precision in financial modeling for asset management, empowering informed asset acquisition and cost management strategies.

Cash Flow Forecast Excel

Our cloud-based fixed asset software integrates advanced financial asset management solutions, empowering startups to accurately forecast cash flow and capital needs. Utilizing fixed asset cost management tools and asset lifecycle management features, users can efficiently plan and track financials to support loan forecasting and investment decisions. This enterprise asset management platform ensures comprehensive asset inventory management and precise fixed asset depreciation calculations, enabling businesses to optimize capital asset management and drive profitable growth with confidence.

KPI Benchmarks

Our enterprise asset management platform includes fixed asset reporting tools that enable comprehensive financial benchmarking. Using advanced financial modeling for asset management, businesses can compare performance metrics, identify losses, and evaluate results against industry peers. This cloud-based fixed asset software provides actionable insights, guiding firms to optimize asset lifecycle management and capital asset strategies. By leveraging these asset management and tracking systems, companies gain the clarity needed to drive consistent financial growth and maximize their fixed asset investment modeling for superior outcomes. Benchmarking with our asset inventory management software is essential for sustained business success.

P&L Statement Excel

Maximize your profitability with our advanced fixed asset tracking software and asset lifecycle management tools. Simplify complex calculations using our integrated fixed asset depreciation calculator and financial asset management solutions. Whether you need a cloud-based fixed asset software or a comprehensive capital asset management system, our enterprise asset management platform streamlines asset acquisition, valuation, and reporting. Empower your business with precise fixed asset accounting software and fixed asset investment modeling to project revenues effortlessly. Experience seamless asset inventory management and budgeting with our cutting-edge fixed asset register software—designed to enhance accuracy and drive informed financial decisions.

Pro Forma Balance Sheet Template Excel

A cloud-based fixed asset software integrates seamlessly with your pro forma balance sheet, providing precise asset lifecycle management tools that capture total assets, liabilities, and equity at a specific point in time. This fixed asset reporting tool offers a clear snapshot of your company’s net worth and capital structure. When combined with profit and loss statements, it delivers comprehensive financial modeling for asset management, enabling smarter decisions. Leverage a capital asset management system and fixed asset depreciation calculator to enhance accuracy and gain a dynamic, holistic view of your enterprise’s financial health over time.

FIXED ASSET MANAGEMENT SOFTWARE FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our cloud-based fixed asset management and tracking system features a pre-built startup valuation model, delivering essential data for investors and lenders. Utilizing financial modeling for asset management, it calculates weighted average cost of capital (WACC) to reveal your minimum return expectations. The fixed asset valuation software integrates free cash flow valuation to highlight cash available beyond operations, while discounted cash flow analysis determines the present value of future business cash flows. Empower your capital asset management strategy with comprehensive financial insights that drive confident investment decisions.

Cap Table

Our cloud-based fixed asset software streamlines accurate allocation of a company’s financial assets across reporting periods. Integrated with advanced fixed asset valuation and depreciation calculators, it offers investors clear insights into expected returns. This enterprise asset management platform not only enhances fixed asset accounting and audit processes but also supports strategic financial modeling for asset management. Optimize your capital asset management system with our asset lifecycle management tools for precise fixed asset cost management and investment modeling, empowering informed decisions and maximizing asset performance.

FIXED ASSET MANAGEMENT SOFTWARE 3 WAY FINANCIAL MODEL TEMPLATE ADVANTAGES

Financial modeling for asset management accurately predicts cash flow, optimizing startup costs and preventing financial shortfalls.

Run diverse scenarios effortlessly using fixed asset financial modeling software to optimize your business planning accuracy.

Optimize your business growth with fixed asset investment modeling for accurate financial projections and strategic decision-making.

Financial modeling for asset management accurately forecasts cash inflows and outflows, optimizing fixed asset investment decisions.

Start a new business confidently with fixed asset management software’s financial model for accurate profit and loss projections.

FIXED ASSET MANAGEMENT SOFTWARE 3 WAY FINANCIAL MODEL ADVANTAGES

Financial modeling for asset management enhances accuracy and insight, driving smarter investment and budgeting decisions.

Financial modeling for asset management ensures precise cash flow projections, minimizing risk and supporting sustainable business growth.

Financial modeling for asset management delivers precise insights, optimizing investment decisions with print-ready reports for ultimate clarity.

Experience precise financial modeling for asset management with comprehensive print-ready reports, enhancing strategic decision-making efficiency.

Boost accuracy and efficiency with financial modeling for asset management—streamline decisions and maximize fixed asset value.

Easily refine your financial modeling for asset management with dynamic input adjustments to maximize fixed asset efficiency.

Our financial modeling for asset management offers a simple-to-use, accurate tool for smarter investment and budgeting decisions.

Our fixed asset financial modeling tool delivers accurate 5-year projections with minimal experience, empowering strategic asset management decisions.

Financial modeling for asset management delivers precise key metrics analysis, optimizing investment decisions and maximizing asset value.

Accelerate informed decisions with our fixed asset investment modeling delivering dynamic 5-year forecasts and GAAP/IFRS compliance instantly.