Gastropub Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Gastropub Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Gastropub Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

GASTROPUB FINANCIAL MODEL FOR STARTUP INFO

Highlights

The gastropub financial model Excel spreadsheet is an essential tool for startups and established companies aiming to secure funding from banks or investors by accurately calculating gastropub funding requirements and performing detailed gastropub cash flow management. It supports comprehensive gastropub budget planning, gastropub revenue projections, and gastropub expense forecasting, enabling precise gastropub profitability analysis and gastropub break-even analysis. Utilizing this unlocked and fully editable model enhances your business plan by integrating gastropub financial statements, gastropub sales forecasting, and gastropub cost control strategies, ultimately improving gastropub profit margin calculation and offering valuable gastropub financial planning tools to ensure effective gastropub business model financials and sound gastropub investment analysis.

The ready-made gastropub financial model Excel template effectively alleviates key pain points by streamlining gastropub budget planning, revenue projections, and expense forecasting, allowing users to quickly generate accurate gastropub income statements and financial reports in compliance with GAAP/IFRS standards. It simplifies gastropub profitability analysis and cash flow management through automated profit margin calculation and break-even analysis, enabling operators to make informed decisions on gastropub pricing strategy analysis and cost control strategies. Additionally, the model addresses challenges related to gastropub startup costs, capital expenditure, and funding requirements by providing comprehensive gastropub investment analysis and sales forecasting tools, ultimately enhancing financial planning and optimizing gastropub business model financials with minimal manual input.

Description

This comprehensive gastropub financial model integrates detailed gastropub revenue projections, expense forecasting, and cash flow management to provide a robust framework for budget planning and profitability analysis. Featuring a gastropub income statement template alongside a 60-month forecasted income statement and a projected balance sheet, it supports accurate gastropub break-even analysis, cost control strategies, and capital expenditure tracking. Designed to facilitate effective gastropub startup cost management and funding requirements assessment, this model accommodates gastropub sales forecasting and profit margin calculation to optimize the gastropub pricing strategy analysis. With user-friendly gastropub financial planning tools and a clear presentation of gastropub business model financials, it empowers users to produce insightful gastropub financial reports and conduct thorough gastropub investment analysis without requiring advanced financial expertise.

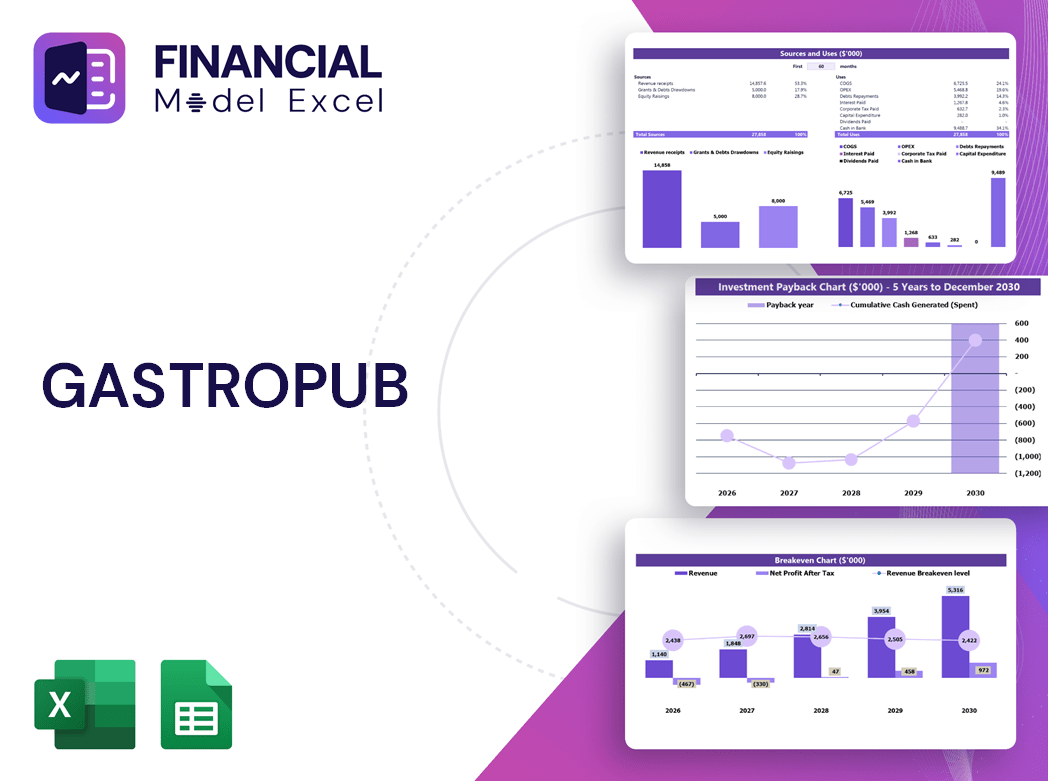

GASTROPUB FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Develop a comprehensive gastropub financial model template to guide your budget planning and revenue projections with confidence. This tool automates all three essential financial statements—profit and loss, five-year projected balance sheet, and pro forma cash flow—enabling precise expense forecasting and cash flow management. Gain real-time insights through a sleek dashboard featuring key KPIs such as break-even analysis, profit margin calculation, and funding requirements. Empower your strategic decisions today with accurate gastropub cost control strategies, pricing analysis, and startup investment evaluation—all designed to optimize profitability and ensure sustainable growth.

Dashboard

Effective gastropub financial planning demands comprehensive data integration. Our financial projection model streamlines gastropub budget planning, revenue projections, and expense forecasting, delivering organized, customizable insights. It simplifies preparing projected income statement templates and startup balance sheets, essential for accurate gastropub profitability analysis and cash flow management. Clients benefit from clear, visualized financial statements and reports, enabling precise gastropub cost control strategies and investment analysis. This tool empowers gastropub owners to optimize pricing strategy analysis and capital expenditure decisions, ensuring confident, data-driven growth with robust financial planning tools.

Business Financial Statements

Our comprehensive gastropub financial plan delivers an integrated financial report, synthesizing data from essential templates like pro forma balance sheets, income statement templates, and cash flow projections. Expertly crafted, this package supports your pitch deck with precise gastropub revenue projections, expense forecasting, and profit margin calculations. Leverage our robust gastropub financial planning tools to streamline budget planning, cost control strategies, and break-even analysis, ensuring confident investor presentations and effective cash flow management from startup costs through capital expenditure.

Sources And Uses Statement

Our gastropub financial planning tools simplify budget planning by clearly outlining sources and uses of funds within cash flow management. This approach helps stakeholders—lenders and investors alike—understand funding requirements and alternative financing options, such as crowdfunding. Incorporating gastropub investment analysis and expense forecasting, the statement balances funding sources with planned capital expenditures, ensuring transparency. Whether addressing startup costs or unexpected events, this proven strategy enhances gastropub profitability analysis and builds confidence in your gastropub business model financials, making financial planning both accessible and strategic.

Break Even Point In Sales Dollars

Gastropub break-even analysis is essential for pinpointing when your business will cover all expenses and start generating profit. Accurately forecasting fixed costs—like rent and administrative salaries—and variable costs tied to sales volume, such as inventory and shipping, forms the foundation of this analysis. Utilizing gastropub financial planning tools and break-even charts in Excel enables precise expense forecasting and informed pricing strategy analysis. This approach supports effective gastropub budget planning and enhances profitability analysis, ensuring your gastropub’s financial health and sustainable growth.

Top Revenue

The Top Revenue tab in this gastropub financial modeling Excel template provides a detailed overview of each offering’s performance. Utilizing this tool, you gain clear annual revenue projections, showcasing depth and bridges across your income streams. This insight enhances gastropub revenue projections and supports precise budget planning, expense forecasting, and profitability analysis, empowering informed decision-making for sustainable growth.

Business Top Expenses Spreadsheet

The Top Expenses tab in our gastropub startup financial plan template categorizes costs into four key groups, offering clear insight into budget planning. This dynamic model includes detailed charts highlighting annual expenses such as customer acquisition, payroll, and operational costs. Designed specifically for gastropub business planners, the projected income statement supports accurate revenue projections, expense forecasting, and profitability analysis—essential tools for effective cash flow management and strategic financial planning.

GASTROPUB FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Instant, organized, and straightforward—this gastropub financial model empowers you to effortlessly manage budget planning, expense forecasting, and cash flow management. Designed for startups, it offers automated 5-year revenue projections and operating expenses tracking with integrated formulas across multiple worksheets. Streamline gastropub profitability analysis, break-even calculations, and capital expenditure planning without manual updates. Optimize your investment analysis and pricing strategy with this comprehensive tool, built to simplify financial statements and boost your gastropub’s financial health from day one.

CAPEX Spending

In gastropub budget planning, capital expenditure (CapEx) is critical for both startups and growing businesses investing in property, plant, equipment, new products, or technologies. These substantial investments play a key role in gastropub financial statements and must be carefully detailed in a 5-year projected balance sheet. While CapEx significantly affects gastropub operating expenses and investment analysis, it typically has a limited impact on cash flow forecasts. Accurate inclusion of CapEx enhances gastropub profitability analysis and supports informed decision-making by financial analysts and investors.

Loan Financing Calculator

Similar to amortizing startup assets in gastropub financial planning, loan amortization involves systematically spreading loan repayments across multiple reporting periods. This process entails fixed payments—often monthly but sometimes quarterly or annually—ensuring predictable cash flow management. Incorporating loan amortization into gastropub budget planning and expense forecasting enhances accuracy in profitability analysis and financial reporting. Utilizing gastropub financial planning tools to track these repayments supports effective cost control strategies and informs smart investment analysis, ultimately strengthening your gastropub’s financial health and long-term success.

GASTROPUB FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our gastropub financial planning tools deliver tailored KPIs essential for effective budget planning, revenue projections, and expense forecasting. By focusing on gastropub-specific metrics like profit margin calculation, break-even analysis, and cash flow management, you gain precise insights into profitability and cost control strategies. Unlike generic models, our approach emphasizes relevant gastropub financial statements and sales forecasting, ensuring your business model financials align with industry demands. This targeted analysis empowers informed decisions on startup costs, capital expenditure, and funding requirements, driving sustainable growth and robust profitability for your gastropub venture.

Cash Flow Forecast Excel

A gastropub cash flow management tool, such as an Excel template, streamlines accurate cash flow projections essential for funding requirements and loan applications. Incorporating gastropub expense forecasting and revenue projections, it empowers startups to anticipate financial activity and avoid liquidity challenges. Combined with gastropub budget planning and profitability analysis, this financial planning tool ensures informed decisions, safeguarding business stability and growth from day one.

KPI Benchmarks

Our gastropub financial planning tools include a comprehensive benchmarking study within our three-statement model template. This enables precise gastropub profitability analysis by comparing your revenue projections, expense forecasting, and profit margin calculations against industry peers. By leveraging gastropub financial reports and income statement templates, startups can identify performance gaps and optimize cost control strategies. Understanding your gastropub business model financials through benchmarking empowers strategic decisions, ensuring effective gastropub budget planning and cash flow management to drive continuous growth and maximize financial success.

P&L Statement Excel

Utilizing a monthly forecast income statement offers a reliable and efficient approach to gastropub revenue projections and expense forecasting. This strategic financial planning tool empowers owners to perform accurate gastropub profitability analysis and cash flow management, ensuring informed decision-making. Trusted by industry leaders, this projection model enhances gastropub budget planning, cost control strategies, and break-even analysis—helping your gastropub thrive with confidence and clarity.

Pro Forma Balance Sheet Template Excel

A projected balance sheet forecast is essential for any gastropub’s financial planning. Detailing current and long-term assets, liabilities, and equity, it offers a clear view of your financial position over the next five years. Using this data in Excel enables accurate gastropub profitability analysis, cost control strategies, and investment analysis. These insights empower you to optimize cash flow management and refine your pricing strategy analysis, ensuring sustainable growth and strong financial performance. Incorporating this into your gastropub business model financials is key to informed decision-making and strategic budget planning.

GASTROPUB FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Our gastropub financial planning tools include sophisticated calculators for Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF). WACC gauges your cost of capital from debt and equity, serving as a critical risk assessment metric frequently reviewed by banks when evaluating funding requirements. Meanwhile, DCF offers precise valuation of future cash flows, empowering informed investment analysis and strategic gastropub budget planning. These features enhance your gastropub profitability analysis and cash flow management, ensuring robust financial statements and confident decision-making for sustainable growth.

Cap Table

A comprehensive gastropub financial plan includes critical tools like a cap table template, detailing share distribution, investor pricing, and ownership percentages. Integrating gastropub budget planning, revenue projections, and expense forecasting ensures accurate profitability analysis and cash flow management. By leveraging gastropub financial planning tools alongside break-even analysis and cost control strategies, operators can optimize funding requirements and capital expenditure decisions. This strategic approach supports informed investment analysis, enhances profit margin calculation, and drives sustainable growth within the competitive gastropub market.

GASTROPUB STARTUP FINANCIAL MODEL ADVANTAGES

Master gastropub cash flow management with our financial model for optimized profitability and strategic growth.

Optimize gastropub profitability with our financial model supporting 161 currencies for precise global budgeting and forecasting.

Optimize surplus cash efficiently with the gastropub three-way financial model for precise budgeting and forecasting.

A 5-year gastropub financial model predicts challenges early, enabling proactive profit and cash flow management.

This gastropub financial model enables precise revenue projections and expense forecasting for optimized profitability and tax planning.

GASTROPUB FINANCIAL FORECAST TEMPLATE ADVANTAGES

Simple-to-use gastropub financial planning tools streamline budget planning, cash flow management, and profitability analysis for business growth.

Optimize gastropub profitability with our easy, comprehensive financial model requiring minimal Excel skills for fast, reliable insights.

Optimize gastropub profitability with dynamic financial planning tools for accurate revenue projections and expense forecasting.

Gastropub financial models enable precise budget planning and dynamic forecasting for improved profitability and cash flow management.

Optimize gastropub profitability with our financial model’s intuitive dashboard for seamless budgeting, forecasting, and cost control.

Streamline gastropub financial planning with an all-in-one dashboard for instant access to key reports and forecasts.

Optimize gastropub profitability with precise revenue projections and cash flow management to attract confident investor backing.

The gastropub financial model boosts investor confidence, securing meetings through precise revenue projections and profitability analysis.

Optimize gastropub profitability with precise financial planning tools that drive growth and control operating expenses effectively.

Gastropub financial models empower strategic cash flow management, revealing optimal growth options and funding impacts for profitability.