Green Building Company Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Green Building Company Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Green Building Company Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

GREEN BUILDING COMPANY FINANCIAL MODEL FOR STARTUP INFO

Highlights

The green building company financial model financial projection template in Excel is an essential tool for startups or established companies focused on sustainable construction financial planning. It enables users to perform detailed green building cost-benefit analysis, develop accurate green building cash flow models, and create comprehensive environmental building project budgeting. By leveraging this eco-friendly building cost analysis and green building investment model, businesses can effectively forecast profitability, track expenses, and enhance their green construction profitability forecast. Additionally, this unlocked, fully editable template supports the development of a robust green building funding model and sustainable development financial modeling, helping companies prepare for investor presentations and refine their green architecture financial evaluation to ensure long-term success in the energy-efficient building financial strategy domain.

This ready-made sustainable construction financial planning Excel template effectively addresses the common challenges faced by green building companies by offering an intuitive green building cash flow model that streamlines complex eco-friendly building cost analysis and expense tracking. With built-in green construction profitability forecast and green building revenue forecasting features, it eliminates manual calculations, ensuring accuracy and saving valuable time. The comprehensive green building investment model and renewable energy building financial model components allow users to perform detailed green building lifecycle cost model evaluations and green architecture financial assessments, facilitating informed decisions on LEED certified building financial plans and environmentally friendly building financial models. Additionally, the template’s automated Sources and Uses projections and monthly profit and loss template enable precise environmental building project budgeting and sustainable construction financial forecasting over a 5-year horizon, optimizing the green building funding model and green infrastructure financial assessment processes for maximum financial strategy efficiency.

Description

Our comprehensive green building company financial projections model offers a robust sustainable construction financial planning tool that integrates eco-friendly building cost analysis with green building investment models to support accurate environmental building project budgeting and green construction profitability forecasts. This financial template includes detailed green building cash flow models, energy-efficient building financial strategies, and green architecture financial evaluations, allowing users to perform sustainable development financial modeling and green building cost-benefit analysis efficiently. Equipped with LEED certified building financial plans and green infrastructure financial assessments, the model supports green building revenue forecasting, expense tracking, and lifecycle cost modeling to assist in environmentally friendly building financial decision-making. Featuring the three core financial statements alongside cash flow, key performance indicators, financial ratios, cash burn analysis, investment, and debt service coverage ratios, the model is designed to facilitate financing options such as business loans and equity funding, automatically generating projections based on input data for precise green construction financial forecasting.

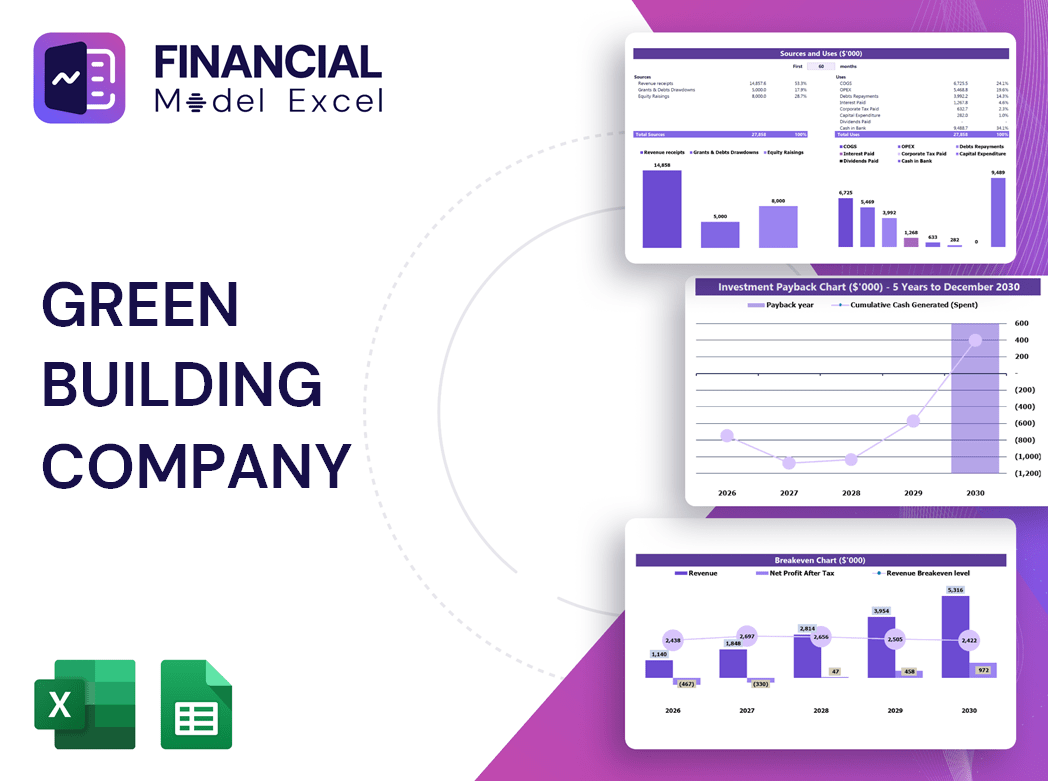

GREEN BUILDING COMPANY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Easily build a comprehensive green building financial model in Excel with our intuitive forecasting tools. Whether you’re assessing sustainable construction financial planning, conducting eco-friendly building cost analysis, or preparing a LEED certified building financial plan, our fully customizable template lets you effortlessly project personnel, sales, expenses, investments, and funding. Simply input your assumptions to generate a detailed green building cash flow model and profitability forecast. Tailor every table to fit your unique green architecture financial evaluation or renewable energy building financial strategy—no advanced skills needed. Unlock the potential of your environmental building project budgeting today!

Dashboard

Our green building financial projections template features a dynamic dashboard that consolidates data from all sustainable construction financial planning sheets. Easily set and track key performance indicators (KPIs) tied to your eco-friendly building cost analysis and green construction profitability forecast. This customizable dashboard updates core financial metrics monthly, providing real-time insights into your renewable energy building financial model and green infrastructure financial assessment. Adapt it anytime to support comprehensive green building expense tracking and optimize your energy-efficient building financial strategy with precision and ease.

Business Financial Statements

Our comprehensive green building financial projections template empowers sustainable construction businesses to craft accurate budgets, cost analyses, and revenue forecasts. Designed for eco-friendly building ventures, it streamlines green construction profitability forecasts and environmental project budgeting. With automated financial statements, cash flow models, and visually compelling charts, it enables clear communication of key metrics to stakeholders and potential investors. Whether assessing LEED-certified building financial plans or renewable energy infrastructure funding models, this tool ensures strategic financial planning, expense tracking, and investment evaluation for successful sustainable development projects.

Sources And Uses Statement

The Sources and Uses chart within this green building financial model outlines all funding origins alongside detailed expenditure allocations. This comprehensive overview supports sustainable construction financial planning by clearly illustrating capital inflows and eco-friendly building cost analysis. It serves as a critical tool for green building investment models and environmental building project budgeting, ensuring transparency and effective resource management throughout the project lifecycle. Utilizing this chart enhances green construction profitability forecasts and streamlines green building expense tracking for optimized financial strategy and sustainable development financial modeling.

Break Even Point In Sales Dollars

The break-even analysis in green building financial planning provides a clear snapshot of profitability across varying sales volumes. It identifies the sales level where total contribution margin precisely covers fixed costs, signaling a zero profit-loss scenario. This essential technique, grounded in marginal costing principles, adapts to different output levels, enabling precise green construction profitability forecasts. Utilizing this approach strengthens sustainable construction financial forecasting and supports data-driven decisions in eco-friendly building cost analysis and green architecture financial evaluation.

Top Revenue

In sustainable construction financial planning, understanding the top line and bottom line is crucial. The top line represents gross revenue, reflecting successful green building investment models and eco-friendly building cost analysis. Bottom line, or net profit, reveals true green construction profitability forecasts and energy-efficient building financial strategies. Stakeholders rigorously evaluate these metrics—often within green building cash flow models and lifecycle cost models—to ensure strong green infrastructure financial health. Consistent top-line growth signals effective sustainable development financial modeling and reinforces confidence in LEED certified building financial plans and environmentally friendly building financial models.

Business Top Expenses Spreadsheet

Our green building financial model features a comprehensive Top Expenses tab that generates detailed cost reports, ideal for sustainable construction financial planning. This internal expense tracking tool categorizes costs, simplifies tax preparation, and supports accurate green building expense tracking. It enables precise green infrastructure financial assessment by comparing actual versus projected expenses, allowing for insightful variance analysis. This functionality enhances your green building investment model, facilitating data-driven decisions for environmentally friendly building financial strategies and profitability forecasting. Use it to optimize budgeting, refine your renewable energy building financial model, and ensure sustainable development financial modeling stays on target for long-term success.

GREEN BUILDING COMPANY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Accurately managing startup costs is crucial for any green building company. Our sustainable construction financial planning model offers a pre-designed template to control expenses, ensuring efficient investment use and minimizing losses. This eco-friendly building cost analysis tool enables precise green building expense tracking and lifecycle cost modeling. Utilizing the integrated pro forma financial statements, you can confidently forecast cash flow, evaluate profitability, and optimize your green infrastructure financial assessment. Empower your renewable energy building financial strategy with our comprehensive green building investment model for a sustainable, profitable future.

CAPEX Spending

The CAPEX budget is a vital element within sustainable construction financial planning. Financial experts develop and track startup budgets to ensure accurate green building cash flow models and investment forecasts. A thorough understanding of initial expenses enhances the accuracy of green building cost-benefit analysis and supports effective environmental building project budgeting. This responsible approach to startup capital expenditures is crucial for optimizing financial strategy, ensuring sustainable development financial modeling aligns with profitability forecasts, and driving long-term success in eco-friendly building projects.

Loan Financing Calculator

Accurate loan payment calculations are crucial for start-ups in sustainable construction. Our green building financial projections include a robust loan amortization schedule and calculator, simplifying complex repayment planning. This eco-friendly building financial strategy empowers companies to efficiently forecast expenses and enhance their green construction profitability forecast, ensuring smoother project budgeting and cash flow management.

GREEN BUILDING COMPANY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our 5-year sustainable construction financial planning template includes EBIT (Earnings Before Interest and Tax), a key metric in green building financial projections. EBIT is calculated by subtracting cost of sales and operating expenses from total revenue, offering a clear view of operational profitability. This essential component supports green building investment models, green construction profitability forecasts, and eco-friendly building cost analyses, enabling precise green building cash flow modeling and energy-efficient building financial strategies for informed decision-making in environmentally friendly building projects.

Cash Flow Forecast Excel

This green building cash flow model offers a comprehensive foundation for sustainable construction financial planning. With detailed breakdowns of operating, investing, and financing cash flows, it enables precise cash flow budgeting and forecasting. Designed for monthly or annual input, this eco-friendly building financial strategy supports green building expense tracking and enhances green construction profitability forecasts. Perfect for LEED certified building financial plans and renewable energy building financial models, it empowers developers to optimize investment models and perform thorough green building cost-benefit analyses with confidence.

KPI Benchmarks

A benchmarking study in green building financial projections evaluates key performance indicators—such as profit margins, cost per unit, and productivity—against industry leaders in sustainable construction financial planning. This approach enables eco-friendly building companies to refine their green building investment models and optimize green construction profitability forecasts. By comparing financial metrics within the renewable energy building financial model and green architecture financial evaluation, firms can adopt best practices to enhance cash flow, expense tracking, and overall project budgeting. Benchmarking is essential for driving sustainable development financial modeling and ensuring competitive advantage in environmentally friendly building financial strategies.

P&L Statement Excel

Utilize a monthly profit and loss template in Excel to simulate costs and revenues in real time for your green building financial projections. Unlike a cash flow pro forma that captures actual cash movements, the P&L statement incorporates non-cash elements such as depreciation—crucial for a comprehensive green building cost-benefit analysis and sustainable construction financial planning. This approach ensures accurate expense tracking and informs strategic decisions within green building investment models and environmental project budgeting, ultimately enhancing profitability forecasts and supporting energy-efficient building financial strategies.

Pro Forma Balance Sheet Template Excel

The projected balance sheet template Excel is vital when combined with sustainable construction financial planning tools, as it clearly outlines the investment needed to support predicted profits and sales. This green building financial model enables accurate green construction profitability forecasts and cash flow management, providing a comprehensive view of where the company’s finances will stand over time. Integrating eco-friendly building cost analysis and green building expense tracking ensures a robust environmental building project budgeting process, empowering green building companies to strategize effectively for sustainable growth and long-term financial success.

GREEN BUILDING COMPANY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This Excel financial model offers a comprehensive green building investment model, featuring a streamlined Discounted Cash Flow valuation tool. Users can effortlessly conduct sustainable construction financial planning by inputting key Cost of Capital rates. Ideal for eco-friendly building cost analysis and green construction profitability forecasts, this template supports precise financial strategies for LEED-certified building projects and renewable energy building financial models. Enhance your green architecture financial evaluation and optimize environmental building project budgeting with this robust, easy-to-use tool designed to drive informed decision-making in sustainable development financial modeling.

Cap Table

Our green building financial projections include a comprehensive cap table model, essential for sustainable construction financial planning. This spreadsheet details the company’s ownership structure, listing shares, options, and investment prices. It provides clear insights into each investor’s percentage of ownership, enabling precise green building funding models and eco-friendly building cost analysis. Integrating this tool supports green construction profitability forecasts and sustainable development financial modeling, ensuring informed decision-making for environmentally friendly building projects. Elevate your renewable energy building financial strategy with accurate ownership tracking and transparent financial evaluation tailored for LEED certified building financial plans.

GREEN BUILDING COMPANY PRO FORMA TEMPLATE ADVANTAGES

Evaluate project feasibility confidently using our green building company financial model for accurate, insightful investment decisions.

Boost sales confidently with our green building company financial model, optimizing sustainable construction profitability and funding strategies.

Raise capital confidently with a green building financial model offering precise 5-year projections and sustainable investment insights.

A green building financial model confidently demonstrates your ability to repay loans while promoting sustainable investment success.

The green building financial model ensures precise tracking of expenses, optimizing sustainable project budgeting and profitability forecasts.

GREEN BUILDING COMPANY STARTUP PRO FORMA TEMPLATE ADVANTAGES

Our green building financial model offers a 5-year forecast horizon, maximizing sustainable construction profitability and investment confidence.

Experience accurate, automated five-year green building financial projections for optimized profitability and sustainable growth.

Our green building financial model saves you time by streamlining sustainable construction cost analysis and revenue forecasting efficiently.

Our green building financial model streamlines budgeting, boosting profitability while prioritizing sustainable construction and eco-friendly investments.

Our green building financial model ensures accurate cost analysis and maximizes sustainable construction profitability with real-time updates.

With a green building financial model, easily adjust inputs to optimize profitability and ensure sustainable project success.

Our green building financial model delivers precise key metrics analysis, optimizing sustainable construction profitability and investment decisions.

Our green building financial model delivers precise 5-year projections, enhancing sustainable construction planning and profitability forecasts.

Our green building financial model drives sustainable growth by optimizing costs and maximizing eco-friendly investment returns.

A green building cash flow model reveals optimal growth strategies and funding impacts to maximize sustainable construction profitability.