Heavy Equipment Rental Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Heavy Equipment Rental Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Heavy Equipment Rental Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

HEAVY EQUIPMENT RENTAL FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year heavy equipment rental financial model template is designed for early-stage startups seeking to impress investors and raise capital. It features detailed financial projections including rental equipment cash flow models, heavy machinery rental income forecasts, and equipment rental profitability models. The template supports thorough financial planning for heavy machinery rental businesses by incorporating capital expenditure for equipment rental, operational expenses, and rental equipment EBITDA calculations. Ideal for equipment rental startup financial models, it also facilitates heavy equipment rental break-even analysis and investment analysis, enabling entrepreneurs to create an effective construction equipment rental financial plan and secure funding from banks or investors with confidence.

The ready-made heavy equipment rental financial model in Excel effectively addresses common pain points by streamlining complex financial planning tasks such as heavy machinery rental income forecast, equipment rental cash flow modeling, and rental business revenue projections. It simplifies heavy equipment rental cost analysis and operational expense tracking while providing a robust equipment rental profitability model, enabling users to conduct accurate break-even analysis and EBITDA calculations with ease. This comprehensive equipment rental business financial plan also integrates capital expenditure for equipment rental and heavy equipment leasing financial analysis, ensuring precise financial forecasting for equipment rental ventures. By automating sales forecasts, investment analysis, and budget templates, the model significantly reduces the time and expertise needed, offering users a professional-grade financial planning tool tailored to the unique demands of heavy machinery leasing and equipment rental industries.

Description

Our comprehensive heavy equipment rental financial model offers detailed construction equipment rental financial projections, integrating a thorough equipment rental business financial plan that covers heavy machinery rental income forecasts and capital expenditure for equipment rental. This robust rental equipment cash flow model facilitates in-depth heavy equipment leasing financial analysis and equipment rental profitability modeling, supporting precise financial forecasting for equipment rental operations. Equipped with a heavy equipment rental budget template and rental business revenue model, it provides clarity on equipment rental operational expenses, heavy equipment rental cost analysis, and financial planning for heavy machinery rental. With features including heavy equipment rental break-even analysis, rental equipment EBITDA calculation, and equipment rental sales forecast, this equipment rental startup financial model enhances decision-making through heavy machinery leasing revenue projections and comprehensive heavy equipment rental investment analysis, ensuring optimal financial control and strategic growth.

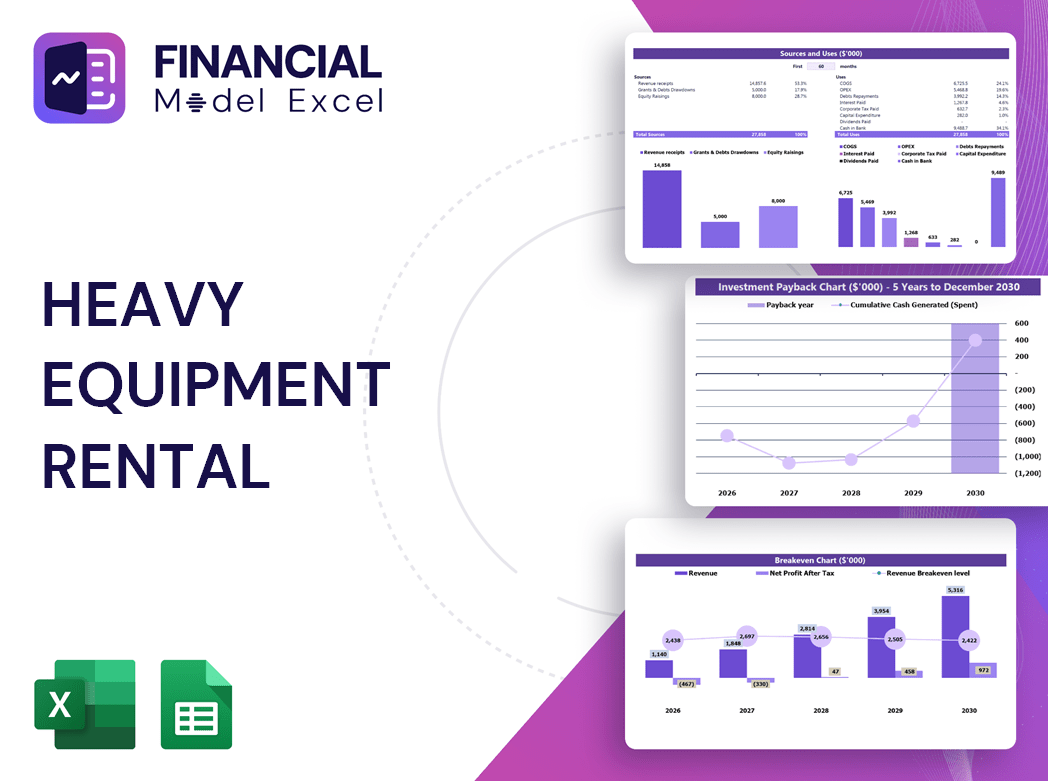

HEAVY EQUIPMENT RENTAL FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Unlock the potential of your equipment rental business with our comprehensive heavy equipment rental financial model. Designed for easy customization, this bottom-up financial planning tool empowers you to forecast rental income, analyze operational expenses, and perform break-even analysis with precision. Whether refining your capital expenditure plans or projecting EBITDA, our model adapts to your expertise level, offering clear insights for profitability and growth. Elevate your financial forecasting and investment analysis with a trusted resource built to support your success in the heavy machinery leasing industry.

Dashboard

Having a comprehensive 3-statement financial model Excel dashboard is essential for heavy equipment rental businesses. It streamlines financial planning by integrating heavy equipment rental financial projections, cash flow models, and profitability analysis. This all-in-one dashboard empowers you to present clear equipment rental business financial plans, revenue models, and break-even analysis to stakeholders, investors, and lenders with confidence. Featuring charts and detailed equipment rental operational expenses, capital expenditure data, and sales forecasts, it’s the ultimate tool for informed decision-making and growth in the construction equipment rental sector.

Business Financial Statements

The pro forma balance sheet in our construction equipment rental financial model offers a clear snapshot of your startup’s financial position at a specific date. It details assets alongside liabilities and equity, reflecting your company’s financial structure. Designed for heavy equipment rental businesses, this template streamlines financial planning by automatically generating accurate startup financial statements. Users can effortlessly input data to produce a comprehensive balance sheet, supporting robust financial forecasting, heavy equipment rental investment analysis, and operational expense management for optimal equipment rental profitability.

Sources And Uses Statement

The sources and uses of capital table within the equipment rental business financial plan illustrates how the company secures funding and allocates resources across operations and capital expenditure for equipment rental. This financial blueprint highlights primary funding channels and planned investments, providing a clear heavy equipment rental budget template. Essential for start-ups, this statement supports financial forecasting for equipment rental, ensures transparency for stakeholders, and guides critical decisions in heavy machinery leasing revenue projections and rental equipment cash flow models, driving sustainable profitability and growth.

Break Even Point In Sales Dollars

A thorough break-even analysis in heavy equipment rental financial planning distinguishes clearly between sales, revenue, and profit. Sales represent the total units sold, while revenue reflects the total income from equipment rental services. Profit is calculated by subtracting all fixed and variable equipment rental operational expenses from revenue. Incorporating this understanding into your equipment rental business financial plan ensures accurate heavy machinery rental income forecasts and supports robust financial forecasting for equipment rental profitability and sustainable growth.

Top Revenue

In heavy equipment rental financial projections, the top line represents total revenue from leasing and rental services, while the bottom line reflects net profit after deducting operational expenses. Investors closely analyze these metrics within an equipment rental business financial plan to assess profitability and growth potential. A strong rental business revenue model shows top-line growth, indicating increased rental income and improved EBITDA margins. Accurate heavy equipment rental cost analysis and cash flow models are essential for reliable financial forecasting, break-even analysis, and capital expenditure planning, ensuring sustainable profitability and long-term success in heavy machinery leasing revenue projections.

Business Top Expenses Spreadsheet

The equipment rental business financial plan outlines the key expenses over the first year, categorized into four main areas. Our heavy equipment rental budget template provides detailed cost analysis tailored to your company’s needs, including customer acquisition, unexpected operational expenses, and employee salaries. This comprehensive equipment rental cost analysis supports accurate financial forecasting for equipment rental, ensuring your rental business revenue model and heavy machinery leasing revenue projections are both realistic and actionable.

HEAVY EQUIPMENT RENTAL FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Elevate your equipment rental business with a comprehensive five-year heavy equipment rental financial projections template. Our construction equipment rental financial model delivers precise cost analysis and a clear heavy machinery rental income forecast, enabling informed financial planning and identifying potential gaps. This robust rental equipment cash flow model supports effective budgeting and enhances communication with lenders and investors. Leverage our equipment rental profitability model and heavy equipment rental break-even analysis to secure growth and ensure long-term success in the competitive rental market.

CAPEX Spending

Capital expenditures (CapEx) represent the investment in acquiring, maintaining, or enhancing fixed assets like property, machinery, and technology critical to equipment rental businesses. In a construction equipment rental financial model, CapEx is a key component of the balance sheet projections, influencing the heavy equipment rental budget template and cash flow forecasts. Proper financial planning for heavy machinery rental includes integrating CapEx into the rental equipment cash flow model and income forecast, ensuring accurate equipment rental profitability models and supporting effective heavy equipment leasing financial analysis for sustainable growth.

Loan Financing Calculator

Start-ups and growing equipment rental businesses must closely track loan repayment schedules, detailing amounts, maturities, and terms. This schedule is vital for accurate heavy equipment rental cash flow models and financial forecasting for equipment rental operations. Interest expenses affect rental equipment EBITDA calculations, while principal repayments impact pro forma cash flows and the balance sheet. Integrating loan data into your construction equipment rental financial model ensures precise heavy machinery rental income forecasts and supports effective equipment rental profitability models and break-even analysis. Sound financial planning and investment analysis hinge on diligent loan management within your equipment rental business financial plan.

HEAVY EQUIPMENT RENTAL FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

A comprehensive rental equipment cash flow model delivers critical KPIs, including profitability metrics, liquidity ratios, and cash flow indicators. These insights encompass both company-specific and industry benchmarks, essential for accurate heavy equipment rental financial projections. Such data plays a pivotal role in supporting heavy machinery leasing revenue projections and securing funding investments. Utilizing a robust equipment rental business financial plan with integrated financial forecasting and break-even analysis ensures informed decision-making and maximizes equipment rental profitability.

Cash Flow Forecast Excel

The heavy equipment rental financial projections rely heavily on a robust rental equipment cash flow model. This cash flow template integrates operating, investing, and financing activities, forming a crucial part of the equipment rental business financial plan. Accurate cash flow forecasting ensures alignment with the projected income statement and balance sheet, enabling precise heavy machinery rental income forecasts. Without this comprehensive financial forecasting for equipment rental, capital expenditure analysis and rental equipment EBITDA calculation, the overall financial model risks imbalance. Leveraging a detailed heavy equipment rental budget template enhances the equipment rental profitability model, supporting strategic decision-making and investment analysis.

KPI Benchmarks

Our business forecast template offers a comprehensive industry benchmark analysis, enabling you to compare key financial indicators against leading equipment rental companies. This robust financial planning tool integrates heavy equipment rental financial projections and operational expenses, providing clear insights into your rental business revenue model and profitability. Leverage this to optimize your heavy machinery rental income forecast, conduct break-even analysis, and refine your capital expenditure for equipment rental. Ideal for financial forecasting, investment analysis, and elevating your equipment rental business financial plan with data-driven decisions.

P&L Statement Excel

For equipment rental businesses, the heavy equipment rental financial projections are crucial in assessing profitability. While the forecast income statement provides a reliable view of earning potential, it doesn’t capture capital expenditure for equipment rental or rental equipment operational expenses. Consequently, relying solely on a rental equipment cash flow model or P&L statement template may overlook key factors like heavy machinery leasing revenue projections and equipment rental cost analysis. Comprehensive financial planning for heavy machinery rental requires integrating profitability models with cash flow forecasts and break-even analysis to ensure accurate equipment rental business financial plans and informed investment decisions.

Pro Forma Balance Sheet Template Excel

The monthly and yearly projected balance sheets for your startup seamlessly integrate with cash flow analysis, forecasted income statements, and key inputs. This comprehensive heavy equipment rental financial model offers a complete overview of assets, liabilities, and equity accounts. Utilizing this equipment rental business financial plan ensures accurate heavy machinery rental income forecasts and supports informed decision-making. Elevate your financial forecasting for equipment rental with a robust cash flow model and detailed investment analysis, empowering your rental business revenue model and capital expenditure planning for sustained profitability.

HEAVY EQUIPMENT RENTAL FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Easily impress investors with our comprehensive heavy equipment rental financial model Excel—designed for seamless financial forecasting and investment analysis. Utilize built-in templates to generate precise WACC, illustrating your rental business’s cost of capital. Showcase free cash flow valuations to highlight distributable cash for shareholders and creditors. Our discounted cash flow feature translates future heavy machinery leasing revenue projections into present value, delivering clear insight into profitability and investment potential. Streamline your equipment rental business financial plan with accurate rental equipment cash flow models and break-even analysis to confidently present robust financial projections.

Cap Table

The cap table model is an essential tool for businesses, providing clear insights into shareholder ownership dilution across multiple funding rounds. With four distinct rounds available, it enables precise financial forecasting, supporting robust equipment rental business financial plans and heavy equipment rental investment analysis. Integrating this model enhances rental equipment cash flow modeling and strengthens capital expenditure strategies, ensuring accurate heavy machinery leasing revenue projections and equipment rental profitability models. Utilize the cap table model to optimize your heavy equipment rental financial projections and make informed decisions for sustainable growth.

HEAVY EQUIPMENT RENTAL THREE STATEMENT MODEL TEMPLATE ADVANTAGES

Our 5-year financial model ensures accurate forecasting, boosting profitability and strategic planning for equipment rental businesses.

Our equipment rental financial model minimizes risk by accurately forecasting profitability and guiding smarter investment decisions.

The construction equipment rental financial model empowers accurate profit forecasting, optimizing business growth and customer insights.

Optimize profits and forecast growth accurately with our comprehensive heavy equipment rental financial model.

The heavy equipment rental financial model ensures accurate planning, preventing misunderstandings and boosting business profitability.

HEAVY EQUIPMENT RENTAL 3 WAY FINANCIAL MODEL ADVANTAGES

Our integrated financial model ensures accurate equipment rental forecasts, maximizing profitability and confidently attracting investor support.

Our financial model streamlines assumptions and outputs into a clear, investor-ready tool, boosting equipment rental profitability.

Save time and money with our equipment rental financial model for accurate forecasting and optimized profitability.

The heavy equipment rental financial model streamlines planning with zero tech hassle, maximizing growth focus and efficiency.

Experience seamless financial forecasting for equipment rental with our convenient all-in-one dashboard, boosting profitability insights.

Comprehensive financial model ensures accurate forecasting, profitability, and strategic planning for heavy equipment rental businesses.

Unlock growth and profitability with our precise construction equipment rental financial model for confident future planning.

The equipment rental financial model empowers precise forecasting, optimizing growth, profitability, and strategic decision-making effortlessly.

Our equipment rental financial model delivers clear, actionable insights for confident, profitable business planning and growth.

Unlock accurate heavy equipment rental financial projections effortlessly with our user-friendly, sophisticated financial model template.