Lock Production Company Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Lock Production Company Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Lock Production Company Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

LOCK PRODUCTION COMPANY FINANCIAL MODEL FOR STARTUP INFO

Highlights

This comprehensive five-year lock production financial planning model in Excel integrates prebuilt consolidated financial statements—including profit and loss forecasts, balance sheets, and cash flow projections—tailored specifically for lock manufacturing companies. Featuring key financial metrics, expense tracking, and lock production cost optimization models, it delivers insightful lock industry financial projections to support budgeting, break-even analysis, and investment strategies. Designed for effective financial scenario planning and revenue modeling, this tool empowers lock factory financial strategy development, enabling manufacturers to optimize production costs and enhance overall financial performance. Consider exploring this startup financial forecasting template before purchasing to unlock the full potential for your lock company's financial analysis and planning needs.

This ready-made Excel financial model serves as an essential pain reliever for lock production companies by providing a comprehensive lock manufacturing financial analysis tool that streamlines financial forecasting for lock companies and enhances lock industry financial projections accuracy. It features an integrated lock production cost model paired with expense tracking to optimize expenditures while offering a lock company budgeting model that simplifies budget management. The model supports dynamic lock business cash flow model and lock company profit and loss forecast generation, ensuring clear visibility into financial performance of lock businesses. Additionally, advanced financial modeling techniques for lock industry users enable precise lock manufacturing investment analysis and scenario planning, reducing uncertainty and improving decision-making. This turnkey solution automates financial statements for lock manufacturers and lock production revenue model calculations, facilitating break-even analysis and lock production financial budgeting with ease, ultimately empowering managers to achieve optimized financial results and sustainable growth.

Description

The lock production financial model offers a comprehensive framework combining lock manufacturing financial analysis with advanced financial forecasting for lock companies, enabling precise lock industry financial projections and detailed lock production cost modeling. This adaptable lock company budgeting model integrates financial statements for lock manufacturers and lock manufacturing expense tracking to optimize the lock factory financial strategy. It supports thorough lock business cash flow modeling, lock company profit and loss forecasting, and lock manufacturing break-even analysis, while employing robust financial modeling techniques for the lock industry to enhance investment decisions and lock production cost optimization. Through dynamic lock company financial scenario planning, it ensures accurate assessment of the financial performance of lock businesses and drives sustainable profitability.

LOCK PRODUCTION COMPANY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our modular lock production financial planning model offers comprehensive tools—including lock manufacturing expense tracking, budgeting, and investment analysis. This flexible 5-year lock industry financial projection template enables tailored forecasting and revenue modeling, adapting to your unique business needs. With fully unlocked formulas, you can easily customize financial statements for lock manufacturers, perform break-even analysis, and optimize production costs. Empower your lock company’s financial strategy with precise profit and loss forecasts, cash flow modeling, and scenario planning, ensuring data-driven decisions for sustainable growth and profitability in the competitive lock production market.

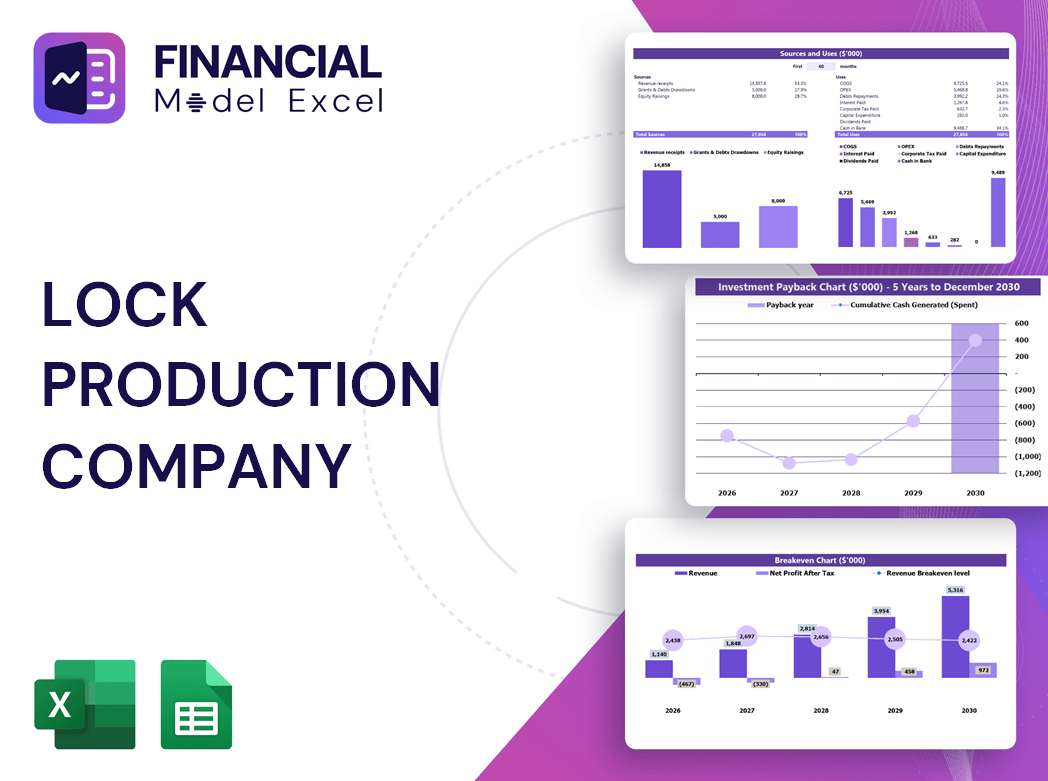

Dashboard

The lock production company financial planning model offers an advanced Excel template to streamline lock manufacturing financial analysis and forecasting. It enables detailed lock production cost modeling, cash flow projections, and lock company profit and loss forecasts with monthly or yearly granularity. Integrated dashboards provide clear, customizable visualizations of key financial metrics for lock production, supporting strategic lock factory financial strategy and budgeting. This solution empowers lock businesses to optimize expenses, perform investment analysis, and conduct break-even analysis for robust financial scenario planning within the lock industry.

Business Financial Statements

When developing a lock production company financial planning model, ensure your startup financial statements include all essential components within an intuitive pro forma template. A clear and well-structured lock manufacturing financial analysis or lock company budgeting model not only aids in accurate financial forecasting for lock companies but also enhances understanding among stakeholders. Utilizing effective financial modeling techniques for the lock industry—such as lock production cost optimization models and lock company profit and loss forecasts—ensures your lock factory financial strategy is robust, transparent, and ready for review by investors or management teams.

Sources And Uses Statement

The business forecast template features a comprehensive sources and uses of funds tab, outlining the lock company’s financial structure with precision. This section supports advanced lock industry financial projections and cash flow models, enabling strategic lock manufacturing expense tracking and investment analysis. By integrating lock production cost models and financial scenario planning, it empowers informed decision-making for budgeting, forecasting, and optimizing profitability. This robust framework ensures clear visibility into the origins and applications of capital, driving effective financial planning and performance management for lock manufacturers.

Break Even Point In Sales Dollars

Break-even analysis is crucial in lock manufacturing financial analysis, pinpointing when revenue equals total costs—neither profit nor loss. Utilizing a lock production cost model and financial forecasting for lock companies, break-even in unit sales reveals the relationship between fixed costs, variable costs, and revenue. This insight drives lock production cost optimization and informs financial scenario planning. Typically, lock companies with lower fixed costs experience a reduced cost-volume-profit (CVP) ratio, enhancing financial performance. Effective financial modeling techniques for the lock industry leverage break-even analysis to optimize budgeting and investment decisions, ensuring sustainable growth and profitability.

Top Revenue

When developing a 5-year lock manufacturing financial projection, revenue stands as the pivotal element driving key financial metrics and overall valuation. Accurate lock production revenue models are essential for insightful financial forecasting for lock companies. Effective lock company budgeting models incorporate growth assumptions grounded in historical financial data. Our comprehensive lock industry financial projections offer best-practice financial modeling techniques for the sector, ensuring precise lock manufacturing expense tracking and robust lock business cash flow models. By prioritizing these elements, lock production cost optimization models and lock manufacturing break-even analysis become more reliable, enhancing the financial performance of lock businesses.

Business Top Expenses Spreadsheet

Achieving financial success in the lock industry requires precise expense tracking and control. Our lock manufacturing financial analysis template in Excel categorizes costs into key groups, including a customizable “Other” section for additional expenses. This lock production cost model enables accurate financial forecasting for lock companies, helping identify trends and optimize expenditures. By monitoring annual expenses, lock manufacturers can evaluate operational efficiency and make informed decisions using advanced financial modeling techniques tailored for the lock industry’s unique challenges. Streamline your lock factory financial strategy and enhance profitability with our comprehensive budgeting and expense tracking tools.

LOCK PRODUCTION COMPANY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our lock manufacturing financial analysis tool integrates seamlessly with your lock company budgeting model, enabling precise tracking of FTE and PTE salary costs. Designed for individual and group budgets, it supports comprehensive lock production cost optimization and expense tracking. Once your company’s unique inputs are entered, data automatically flows through the entire 5-year lock business cash flow model, enhancing your financial forecasting for lock companies. This robust financial planning model empowers you with accurate lock production revenue projections and profit and loss forecasts, driving informed decision-making and strategic growth in the lock industry.

CAPEX Spending

A comprehensive lock production cost model is essential for accurately determining initial startup expenses and informing financial forecasting for lock companies. This model supports detailed lock company profit and loss forecasts by clearly outlining capital expenditures and anticipated investments. By integrating lock manufacturing financial analysis and expense tracking, businesses can optimize cash flow and enhance budgeting strategies. Leveraging advanced financial modeling techniques for the lock industry ensures robust lock factory financial strategies, enabling precise lock industry financial projections and informed investment decisions for sustained growth.

Loan Financing Calculator

Our lock production financial forecasting model integrates a comprehensive loan amortization schedule, detailing principal repayment and interest calculations. This advanced lock company financial scenario planning tool accurately projects payment amounts by factoring in loan principal, interest rates, term length, and payment frequency. By incorporating this robust feature into your lock manufacturing financial analysis, you can optimize cash flow management and enhance the financial performance of your lock business with precise budgeting and investment planning.

LOCK PRODUCTION COMPANY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

EBITDA, or Earnings Before Interest, Taxes, Depreciation, and Amortization, is a key financial metric in lock manufacturing financial analysis. Within a lock company profit and loss forecast, EBITDA measures operating performance by excluding non-operational expenses. Calculated as EBITDA = Revenue minus Expenses (excluding interest, taxes, depreciation, and amortization), it provides clear insight into core business profitability. Integrating EBITDA into lock production financial budgeting enhances financial forecasting for lock companies, supporting effective lock factory financial strategy and informed decision-making in lock industry financial projections.

Cash Flow Forecast Excel

A robust lock business cash flow model is essential to demonstrate your company’s capacity to cover liabilities and operational costs. This financial forecasting for lock companies not only ensures smooth day-to-day operations but also satisfies lenders’ requirements by proving your lock manufacturing financial strategy can reliably service bank loans. Incorporating precise lock production cost models and financial statements for lock manufacturers strengthens your lock company profit and loss forecast, enabling confident financial scenario planning and optimized investment decisions within the lock industry.

KPI Benchmarks

Leverage our lock manufacturing financial analysis with built-in benchmarking tools in the lock production financial budgeting model. Effortlessly compare your lock company's financial performance, cash flow, and expense tracking against industry peers. This peer-to-peer financial forecasting for lock companies highlights gaps in profitability, capital efficiency, and operational metrics. Ideal for startups and established firms alike, our lock manufacturing break-even analysis and financial scenario planning enable data-driven decisions to optimize production costs and boost revenue. Stay ahead in the lock industry with precise financial modeling techniques and investment analysis designed to elevate your lock factory financial strategy.

P&L Statement Excel

Maximizing profitability is crucial in the lock industry, reflected through accurate lock company profit and loss forecasts. Developing a reliable lock production financial budgeting model can be complex, involving detailed lock manufacturing expense tracking and financial forecasting for lock companies. To simplify this, we offer an advanced profit and loss forecast template designed specifically for lock manufacturers. This tool streamlines calculations, optimizes the lock production cost model, and delivers precise lock production revenue projections, enabling informed financial planning and strategic decision-making for your lock business’s financial success.

Pro Forma Balance Sheet Template Excel

The lock production company financial planning model delivers a comprehensive financial overview by integrating the projected profit and loss forecast, cash flow model, and pro forma balance sheet. This dynamic approach ensures all financial statements for lock manufacturers are interconnected and balanced, providing accurate lock industry financial projections. Utilizing advanced financial modeling techniques for the lock industry, the model supports effective lock business cash flow management, budget optimization, and performance analysis—empowering stakeholders to make informed decisions based on reliable lock manufacturing expense tracking and financial scenario planning.

LOCK PRODUCTION COMPANY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

Leverage our comprehensive lock production company financial planning model, designed to deliver detailed financial projections and key metrics for lock manufacturers. Our template includes weighted average cost of capital (WACC) to demonstrate the minimum required return on invested capital, alongside free cash flow valuation highlighting cash available to investors. Utilize discounted cash flow analysis to accurately assess the present value of future earnings. This robust lock manufacturing financial analysis empowers your stakeholders with transparent insights into profit and loss forecasts, investment analysis, and cash flow modeling—essential tools for strategic decision-making and optimizing financial performance in the lock industry.

Cap Table

A comprehensive lock production financial planning model integrates key financial statements with a cap table tailored for lock manufacturing startups. This model offers detailed insights into ownership structure, equity distribution—including preferred shares and options—and their valuation. Utilizing advanced financial forecasting for lock companies, it supports precise lock manufacturing financial analysis, expense tracking, and revenue modeling. These financial modeling techniques empower lock businesses to optimize production costs, perform investment analysis, and conduct scenario planning, ensuring robust financial performance and strategic growth within the lock industry.

LOCK PRODUCTION COMPANY FINANCIAL MODELING FOR STARTUPS ADVANTAGES

Run different scenarios confidently with the lock production company financial model for strategic, data-driven decision-making.

Unlock precise capital demand forecasting with our expert-designed lock production company financial model template in Excel.

Build a 3-way lock production financial model to optimize costs, forecast profits, and secure confident funding pitches.

Avoid cash flow problems with the lock production company financial model, ensuring accurate forecasting and optimized budgeting.

The lock production financial model enables precise expense tracking and revenue forecasting to optimize profitability and growth.

LOCK PRODUCTION COMPANY FINANCIAL PLANNING MODEL ADVANTAGES

Unlock great value with our lock production financial model, optimizing costs and boosting profitability efficiently.

Boost lock production profitability with our proven, affordable financial forecasting model—no hidden or recurring fees included.

Our lock production financial model ensures precise budgeting and forecasting, maximizing profits while avoiding cash flow problems.

Lock production cash flow models enable proactive financial planning, preventing gaps and supporting sustainable business growth.

Unlock growth with our lock production financial model, optimizing costs and boosting accurate revenue forecasting.

Unlock precise financial forecasting and cost optimization with tailored lock production budgeting and scenario planning models.

The lock production financial model saves time and money by optimizing costs and improving budgeting accuracy.

Our lock production financial model delivers effortless, accurate projections—saving money and empowering strategic, creative decision-making.

Our lock production financial model optimizes costs and boosts profitability through precise forecasting and strategic budgeting.

Unlock precise financial forecasting for lock companies—no formulas, programming, or costly consultants needed, just pure strategy focus.