Historical Inn Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Historical Inn Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Historical Inn Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

HISTORICAL INN FINANCIAL MODEL FOR STARTUP INFO

Highlights

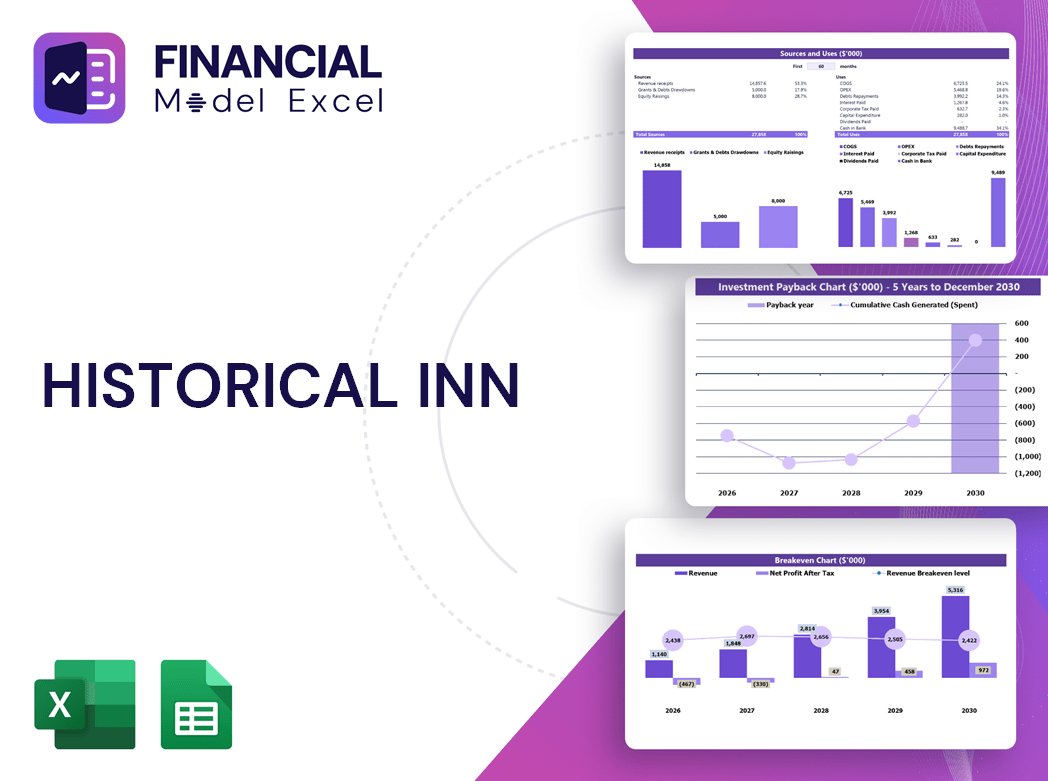

This comprehensive five-year historical inn financial model template in Excel includes prebuilt consolidated pro forma income statement, balance sheet, and cash flow forecasts, designed specifically for accurate historical inn revenue projections financial model and expense forecasting. Featuring a robust historical inn profitability financial model alongside break-even analysis and room rate optimization tools, it facilitates detailed scenario planning and sensitivity analysis. The model incorporates key financial charts and dashboards for monitoring operational costs, capital expenditure, and marketing budgets, while supporting investor presentations and payback period calculations to enhance investment analysis and valuation. Fully unlocked and editable, this template is an essential tool for historical inn financial statements forecasting and strategic budgeting before committing to any business decisions.

The historical inn financial model template expertly addresses common pain points faced by inn operators and investors by providing detailed revenue projections and expense forecasting tailored specifically to the hospitality sector, ensuring accurate cash flow analysis and profitability insights. It simplifies complex evaluations such as break-even analysis, investment analysis, and payback period calculations, empowering users with scenario planning and sensitivity analysis features to test various operational and market conditions. The template also integrates occupancy rate trends and room rate optimization strategies alongside budgeting tools for marketing and capital expenditures, streamlining the projection of operational costs and debt service commitments. Its comprehensive financial statements forecasting combined with an intuitive financial performance dashboard allows for transparent valuation modeling and compelling investor presentations, ultimately saving time and reducing errors while enhancing financial decision-making confidence.

Description

The historical inn financial model Excel template incorporates comprehensive historical inn revenue projections financial model, historical inn expense forecasting financial model, and historical inn cash flow analysis financial model to deliver detailed 5-year monthly and yearly profit loss statements, pro forma balance sheets, and cash flow projections. This dynamic and adaptable financial framework includes crucial components such as historical inn break-even analysis financial model, historical inn profitability financial model, and historical inn capital expenditure financial model, allowing users to efficiently perform scenario planning financial model and sensitivity analysis financial model for robust decision-making. Additionally, the model integrates historical inn room rate optimization financial model alongside occupancy rate and marketing budget financial models, consolidated with a discounted cash flow valuation to produce an accurate historical inn valuation model, comprehensive financial statements forecasting, and key financial performance ratios, empowering startups and existing operations to optimize operational costs, manage debt service, and present a solid historical inn investor presentation financial model.

HISTORICAL INN FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Gain a comprehensive understanding of your historical inn’s financial health with this all-encompassing financial model. It integrates revenue projections, expense forecasting, cash flow analysis, and profitability insights, ensuring precise budgeting and break-even analysis. Easily evaluate occupancy rates, optimize room pricing, and plan capital expenditures, while conducting scenario planning and sensitivity analysis. This robust model supports investment analysis and debt service management, empowering your decision-making with reliable financial statements forecasting and an investor-ready presentation. Elevate your inn’s financial performance through a clear, detailed, and professional approach to every critical metric.

Dashboard

Our historical inn financial performance dashboard is a powerful tool for detailed financial planning and analysis. Featuring intuitive charts and graphs, it enhances the accuracy of revenue projections, expense forecasting, cash flow analysis, and profitability modeling. Designed to provide comprehensive insights into operational costs, occupancy rates, and room rate optimization, this dashboard empowers stakeholders with precise data essential for scenario planning, investment analysis, and budgeting. Unlock deeper understanding and confident decision-making with a financial model tailored to optimize your inn’s future growth and valuation.

Business Financial Statements

Each financial statement offers unique insights crucial for comprehensive historical inn financial analysis. The historical inn revenue projections financial model and expense forecasting financial model reveal profitability drivers and operational costs. The historical inn cash flow analysis financial model details cash inflows and outflows from core activities, investments, and financing. Combined, these models provide a clear snapshot of the inn’s financial health, guiding strategic decisions on budgeting, break-even analysis, and room rate optimization to maximize profitability and valuation.

Sources And Uses Statement

The historical inn financial model provides a clear statement of sources and uses of funds, detailing capital inflows and planned expenditures. This essential component ensures that total sources match total uses, offering accurate insights for investment analysis, budgeting, and capital expenditure planning. Crucial for recapitalization, restructuring, or M&A decisions, this model supports scenario planning and sensitivity analysis, empowering stakeholders with reliable financial projections and a comprehensive view of the inn’s revenue, expenses, and profitability.

Break Even Point In Sales Dollars

The historical inn break-even analysis financial model is an essential tool to identify the precise revenue point at which profitability is achieved. Utilizing integrated financial statements forecasting, this model calculates the sales volume required to cover both fixed and variable operational costs. Designed to support strategic decision-making, it aids innkeepers in optimizing occupancy rates and room rates, ensuring sustainable growth. By providing clear insights into financial performance and cash flow dynamics, this model empowers investors and management to confidently navigate development stages and maximize historical inn profitability.

Top Revenue

When developing a historical inn financial model, accurate revenue projections are paramount. Utilizing past data, our model integrates detailed historical inn revenue projections, expense forecasting, and cash flow analysis to optimize profitability and occupancy rates. By incorporating growth rate assumptions and scenario planning, it delivers precise forecasts critical for budgeting, break-even analysis, and investment decisions. This comprehensive financial model enhances strategic planning with tools like marketing budget optimization, capital expenditure tracking, and sensitivity analysis—empowering inn managers to maximize valuation and ensure sustainable financial performance.

Business Top Expenses Spreadsheet

Our historical inn financial model offers detailed expense forecasting, categorizing your top operational costs into four key segments with an additional customizable ‘other’ category. Easily tailor the model to reflect your recorded financial data or develop comprehensive five-year projections. This flexible budgeting and expense forecasting tool empowers precise cash flow analysis, profitability assessment, and scenario planning, ensuring robust investment analysis and optimized financial performance for your inn.

HISTORICAL INN FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Start-up costs are a critical element in any historical inn financial model. Accurately forecasting these expenses ensures effective budgeting and prevents cash flow shortfalls early in the inn’s lifecycle. Our historical inn expense forecasting financial model integrates comprehensive start-up cost tracking, enabling precise management of initial investments. The built-in proforma consolidates expense data and financing, supporting a robust operational cost plan. This strategic approach enhances your historical inn’s financial performance dashboard, driving informed decision-making and safeguarding long-term profitability.

CAPEX Spending

Our historical inn capital expenditure financial model delivers detailed budgeting analysis with automated depreciation calculations, vital for comprehensive financial planning. Users can seamlessly apply straight-line or double-declining balance depreciation methods to enhance accuracy in investment analysis and cash flow forecasting. This robust tool empowers innkeepers to optimize operational costs, improve profitability, and support informed decision-making in business plans and investor presentations.

Loan Financing Calculator

Our historical inn financial model includes a comprehensive loan amortization schedule, meticulously designed to detail repayment timelines. Featuring pre-built formulas, it accurately outlines each installment’s principal and interest components, adaptable for monthly, quarterly, or annual periods. This robust schedule integrates seamlessly with broader historical inn debt service financial models, enhancing cash flow analysis and investment planning. By providing clear visibility into loan obligations, it supports precise budgeting, scenario planning, and profitability forecasting, empowering stakeholders to optimize financial performance and drive strategic growth.

HISTORICAL INN FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Our historical inn financial model automatically calculates the Internal Rate of Return (IRR), a key metric reflecting the discount rate that balances net present value to zero across cash flows from investments and expenses. This powerful indicator enables investors and analysts to gauge the inn’s profitability and long-term return potential with precision. By integrating IRR within our comprehensive financial model—covering revenue projections, expense forecasting, and cash flow analysis—stakeholders gain critical insights for informed decision-making and strategic planning.

Cash Flow Forecast Excel

The historical inn cash flow analysis financial model provides a comprehensive summary of cash movements across operating, investing, and financing activities. Like a zero-based budget, it forecasts cash flow over a defined period, offering clear visibility into cash inflows and outflows. This model is essential for accurate expense forecasting, break-even analysis, and investment decision-making—empowering inn owners to optimize financial performance, improve budgeting accuracy, and confidently present data in investor presentations.

KPI Benchmarks

Our historical inn financial model features comprehensive benchmarking tools, enabling precise comparison of revenue projections, expense forecasting, and profitability against industry peers. This model’s built-in templates allow seamless analysis of occupancy rates, operational costs, and cash flow, empowering you to identify strengths and address weaknesses effectively. Utilize scenario planning and sensitivity analysis to optimize room rates, marketing budgets, and capital expenditures. With this insightful financial plan, inn operators can confidently drive performance, enhance investment decisions, and achieve sustainable growth through data-driven strategies tailored to the hospitality sector.

P&L Statement Excel

The historical inn profitability financial model enables detailed forecasting of revenues and expenses as they occur, unlike traditional cash flow analysis which tracks actual cash movements. This projection includes non-cash items such as depreciation, allocating costs over multiple years to present an accurate income statement. Utilizing this advanced financial model supports precise budgeting, break-even analysis, and scenario planning, empowering inn operators to optimize room rates, manage operational costs, and enhance overall financial performance with confidence.

Pro Forma Balance Sheet Template Excel

A comprehensive historical inn financial model includes a balance sheet forecast, essential for accurate profit and loss projections. This report details current and long-term assets, liabilities, and shareholders’ equity, providing critical insight into the inn’s financial health. Leveraging this pro forma balance sheet enhances historical inn valuation models and supports precise calculation of key financial ratios. It forms the backbone of effective historical inn investment analysis, budgeting, and scenario planning, empowering stakeholders to make informed decisions and drive sustainable profitability.

HISTORICAL INN FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

The historical inn valuation model integrates Weighted Average Cost of Capital (WACC), Discounted Cash Flows (DCF), and Free Cash Flows (FCF) calculations. WACC accurately reflects the inn’s capital cost by proportionally weighting equity and debt, serving as a critical risk assessment metric for lenders. The DCF analysis projects the value of future cash flows, vital for informed investment analysis and decision-making. This comprehensive financial model enhances historical inn investment analysis, supporting precise revenue projections, expense forecasting, and overall profitability evaluation.

Cap Table

This historical inn financial model template features integrated proformas for revenue projections, expense forecasting, discounted cash flow analysis, and profitability assessments. Business owners can confidently evaluate exit valuations and forecast investor returns, supported by robust scenario planning and sensitivity analysis. The model’s flexible cap table component is optional and won’t affect core three-way financial statements forecasting—ensuring seamless budgeting, break-even analysis, and operational cost management. Ideal for optimizing room rates, marketing budgets, and capital expenditures, this comprehensive tool empowers strategic decision-making and enhances overall financial performance insights.

HISTORICAL INN PROFIT LOSS PROJECTION ADVANTAGES

Optimize decision-making with a flexible 5-year historical inn financial model for accurate revenue and expense projections.

Optimize surplus cash flow confidently with the historical inn financial model for precise startup pro forma planning.

The historical inn budgeting financial model empowers precise expense forecasting, boosting profitability and strategic decision-making.

The historical inn financial model empowers precise revenue projections, optimizing profitability and strategic decision-making confidently.

Historical inn financial models empower precise forecasting, optimizing profits and guiding strategic investment decisions confidently.

HISTORICAL INN FINANCIAL MODELING FOR STARTUPS ADVANTAGES

Get a robust, fully expandable historical inn financial model to optimize revenue, expenses, and profitability with precision.

This robust historical inn financial model empowers precise forecasting, optimizing profitability and strategic decision-making with customizable flexibility.

The simple-to-use historical inn profitability financial model enhances strategic decisions with precise, data-driven insights.

Unlock precise historical inn profitability insights swiftly with our user-friendly, comprehensive three-statement financial model.

The simple-to-use historical inn profitability financial model enhances strategic decisions with precise, data-driven insights.

Unlock rapid, accurate insights with a sophisticated historical inn financial model requiring minimal Excel skills or prior planning experience.

The historical inn financial model enables precise revenue projections and optimized profitability for strategic, data-driven decision-making.

A clear, well-structured historical inn financial model enables quick, accurate scenario testing and informed strategic decisions.

The historical inn financial model ensures precise expense forecasting, maximizing profitability while avoiding cash flow problems.

The historical inn cash flow analysis financial model empowers proactive decision-making by forecasting future cash gaps accurately.