Home Loan Company Financial Model

5-Year Financial Projections

100% Editable

Investor-Approved Valuation Models

MAC/PC Compatible, Fully Unlocked

No Accounting Knowledge Needed

Home Loan Company Financial Model

Bundle Includes:

-

Financial Model

-

Business Plan

-

Pitch Deck

-

Financial Dashboard

ALL IN ONE MEGA PACK - CONSIST OF:

Home Loan Company Financial Model/Business Plan Excel Template

Pitch Deck Template For PowerPoint, Keynote & Google Slides

Business Plan Guide and Business Plan Template in MS Word Format

Financial Dashboard in Excel To Track Your Business Performance

HOME LOAN COMPANY FINANCIAL MODEL FOR STARTUP INFO

Highlights

The home loan company financial model template offers a comprehensive 5-year financial planning solution tailored for businesses in the mortgage lending sector. Ideal for both startups and established home loan companies, this financial model for mortgage lending integrates key elements such as mortgage company financial forecasts, home loan revenue models, and loan servicing financial models to accurately estimate startup costs and project cash flows. With unlocked, fully editable features, users can perform detailed home loan portfolio financial analysis, assess credit risks through a home loan credit risk financial model, and generate financial statements for home loan companies, ensuring precise budgeting, expense forecasting, and strategic financial planning for sustainable mortgage lender profitability.

This ready-made home loan company financial model template expertly addresses key challenges faced by mortgage lending businesses by providing comprehensive financial planning tools such as home loan cash flow projections, mortgage origination financial models, and loan servicing financial models. It alleviates common pain points including complex home loan interest rate modeling, accurate loan disbursement tracking, and managing credit risk through integrated home loan credit risk financial models, enabling precise mortgage company financial forecasts and expense forecasting. The template’s home loan revenue model and mortgage lender profitability model facilitate clear visibility into profitability drivers, while the home loan portfolio financial analysis and amortization schedule models support detailed risk assessment and payment structuring. This all-in-one solution empowers users to confidently prepare financial statements for home loan companies, conduct robust financial planning for home loan companies, and optimize company budgeting with minimal manual input, dramatically reducing time-consuming data management and improving investor communication through dynamic charts and valuation modeling.

Description

Our comprehensive financial model for mortgage lending offers a detailed five-year home loan company financial projection plan designed to support strategic decision-making through precise financial planning for home loan companies. Incorporating key elements such as a home loan revenue model, mortgage company financial forecast, and loan servicing financial model, this tool provides an all-encompassing approach including home loan portfolio financial analysis, credit risk assessment, and expense forecasting. Complete with critical financial statements for home loan companies, amortization schedule modeling, and cash flow projections, the model enables accurate mortgage origination financial modeling alongside profitability assessments and investment metrics like debt service coverage ratio. By integrating input and revenue data, the home loan business valuation model dynamically calculates profit and loss projections, KPIs, and diagnostic tools, empowering startups and established lenders to demonstrate financial viability to investors and streamline financial management with advanced underwriting and risk assessment capabilities.

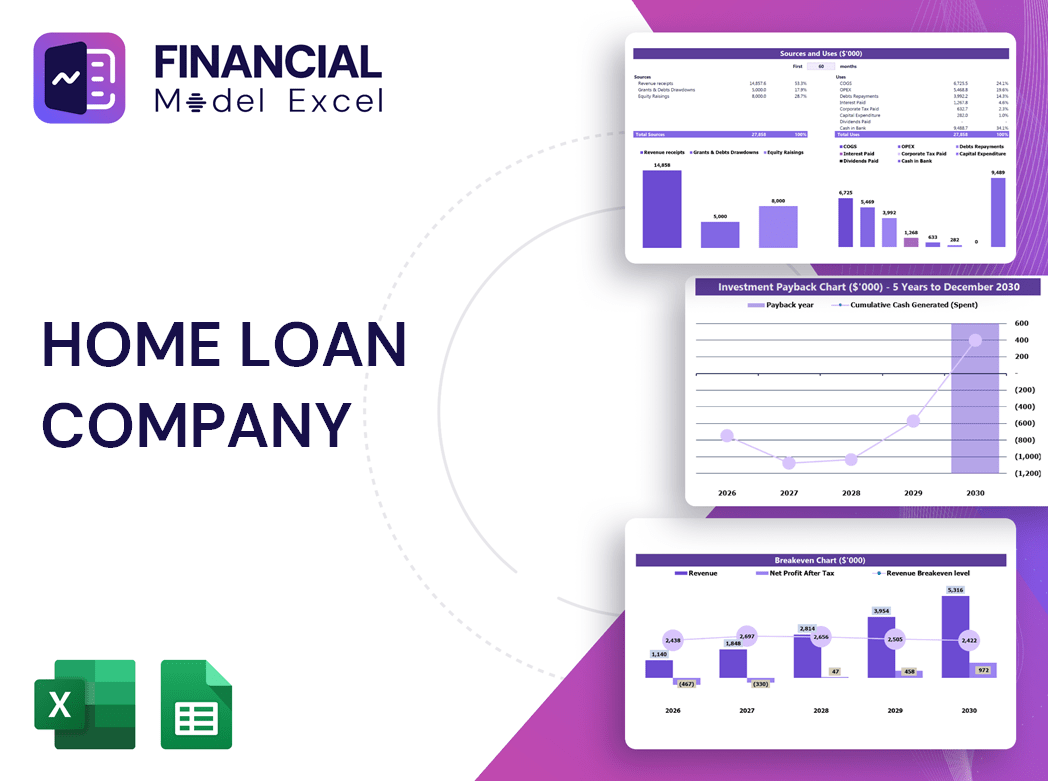

HOME LOAN COMPANY FINANCIAL MODEL FINANCIAL MODEL REPORTS

All in One Place

Our comprehensive financial model for mortgage lending delivers essential financial projections and reports tailored for home loan companies. This robust template features detailed proformas including forecasted income statements, cash flow projections, and balance sheets. It supports month-on-month and year-on-year summaries, enabling insightful performance reviews. Ideal for startups and established lenders, it streamlines financial planning, enhances home loan portfolio financial analysis, and supports mortgage company expense forecasting—empowering your business with precise, actionable insights for sustainable growth.

Dashboard

Access an intuitive dashboard offering comprehensive financial projections tailored for home loan companies. Gain clear insights into your mortgage lender profitability model, loan servicing financial model, and home loan portfolio financial analysis. Effortlessly share key data—such as mortgage company financial forecasts and home loan revenue models—with stakeholders to enhance financial planning and drive informed decisions. Empower your team with a dynamic tool designed to streamline budgeting, risk assessment, and expense forecasting, ensuring your mortgage origination financial model stays precise and actionable from startup to growth.

Business Financial Statements

A comprehensive home loan company financial forecast relies on accurate financial statements—both historical and projected. Incorporating key elements into dynamic charts enhances the clarity of home loan portfolio financial analysis and improves investor presentations. Our Excel-based mortgage company financial model streamlines this process, automatically generating detailed charts tied to your home loan revenue model, loan servicing financial model, and mortgage origination financial model. This professional tool supports robust financial planning for home loan companies, empowering precise cash flow projections, expense forecasting, and profitability modeling to drive confident, data-driven decisions.

Sources And Uses Statement

Our home loan company financial projections include a clear Sources and Uses table within the financial model for mortgage lending, simplifying financial planning. This statement transparently outlines how much funding is needed and potential alternative sources, boosting lender and investor confidence. It highlights flexibility in funding strategies—such as crowdfunding—to attract diverse capital. The uses of funds section details planned allocations, ensuring balance with sourced amounts. This approach strengthens mortgage company financial forecasts and loan servicing financial models, providing a reliable framework for home loan portfolio financial analysis and mortgage lender profitability models.

Break Even Point In Sales Dollars

The break-even point is a critical metric in financial planning for home loan companies, marking when revenue fully covers all costs—fixed and variable. In mortgage lending financial models, understanding this threshold helps optimize profitability by balancing operating expenses and loan servicing costs. Companies with lower fixed costs achieve break-even at fewer unit sales, enhancing cash flow projections and risk assessment models. Integrating break-even analysis into home loan business valuation models and mortgage company expense forecasting drives informed decision-making and sustainable growth in a competitive market.

Top Revenue

This comprehensive pro forma Excel template features a dedicated tab for in-depth home loan revenue model analysis. It meticulously breaks down revenue streams by product and service, enabling precise financial planning for home loan companies. Ideal for mortgage company financial forecasting, this tool supports robust financial projections, enhances mortgage origination financial models, and streamlines home loan portfolio financial analysis for accurate business valuation and profitability assessment.

Business Top Expenses Spreadsheet

This financial model for mortgage lending features a dedicated tab for in-depth home loan revenue model analysis. It meticulously breaks down revenue streams by product and service, enabling precise mortgage company financial forecast and comprehensive home loan portfolio financial analysis. Designed to enhance financial planning for home loan companies, this tool supports accurate mortgage lender profitability modeling and strategic decision-making.

HOME LOAN COMPANY FINANCIAL MODEL FINANCIAL PROJECTION EXPENSES

Costs

Our home loan company budgeting model offers comprehensive financial planning for home loan companies by forecasting expenses and revenue over a 5-year horizon. It enables detailed home loan portfolio financial analysis and mortgage company expense forecasting, categorizing costs into fixed and variable, including wages, COGS, and development expenses. This financial model for mortgage lending supports accurate home loan cash flow projections, enhancing your mortgage lender profitability model. By leveraging this tool, businesses can create reliable financial statements for home loan companies and optimize loan servicing financial models, ensuring informed decision-making and sustainable growth in the competitive mortgage industry.

CAPEX Spending

Development costs in a home loan company reflect strategic investments in enhancing business performance—such as acquiring advanced equipment or adopting innovative financial models for mortgage underwriting and loan servicing. These expenditures support expansion of products and services, driving growth in mortgage origination and loan disbursement. Captured within the home loan company budgeting model, capital expenditures are recorded on the pro forma balance sheet as depreciated assets over time, ensuring accurate financial planning for home loan companies and supporting robust mortgage company financial forecasts.

Loan Financing Calculator

Our Excel financial model for mortgage lending features a comprehensive home loan amortization schedule model designed to manage all loan types. It meticulously tracks key loan details, including principal amount, interest rate and type, loan duration, and repayment schedules. Ideal for financial planning for home loan companies, this template supports accurate home loan portfolio financial analysis and enhances mortgage company financial forecasts, ensuring precise loan servicing financial models and reliable home loan cash flow projections. Elevate your home loan business valuation model with a tool built for rigorous financial statements and mortgage origination financial modeling.

HOME LOAN COMPANY FINANCIAL MODEL EXCEL FINANCIAL MODEL METRICS

Financial KPIs

Return on Investment (ROI) is a vital financial metric in home loan company financial projections and mortgage lender profitability models. It measures the efficiency of investments by comparing net gains to total costs, expressed as a percentage. Within a comprehensive financial model for mortgage lending, ROI helps assess profitability and guides strategic decision-making. Accurate ROI calculations, integrated into home loan revenue models and financial statements for home loan companies, are essential for optimizing financial planning, risk assessment, and expense forecasting—ensuring sustained growth and investor confidence in the mortgage business.

Cash Flow Forecast Excel

This comprehensive home loan cash flow projections model offers a clear, detailed view of your mortgage company’s cash inflows and outflows—surpassing traditional P&L forecasts. Designed for financial planning for home loan companies, this fully integrated Excel template supports 12-month monthly forecasts or annual projections up to 5 years. Ideal for mortgage lender profitability modeling, loan servicing financial analysis, and home loan portfolio financial analysis, it empowers informed decision-making by accurately capturing cash movements critical to your home loan business valuation model and mortgage origination financial model.

KPI Benchmarks

The benchmark tab in a home loan company financial model provides key performance indicators based on industry-wide averages. This mortgage company financial forecast tool enables startups to compare their home loan revenue model and loan servicing financial model against top performers. Using these benchmarks in financial planning for home loan companies ensures accurate home loan portfolio financial analysis and supports strategic decision-making. Ultimately, benchmarking is essential for optimizing mortgage lender profitability models and enhancing loan origination financial models, driving smarter financial statements for home loan companies and fostering sustainable growth.

P&L Statement Excel

Our home loan company financial projections template is expertly crafted for precision and versatility, supporting forecasts from monthly up to 5 years. Designed for mortgage lenders, it enables robust financial planning, mortgage company expense forecasting, and accurate home loan portfolio financial analysis. This comprehensive financial model for mortgage lending empowers you to make informed management decisions by projecting income statements, cash flow, and profitability. Track sales performance, loan servicing, and risk assessment effortlessly with a modern tool tailored to enhance your home loan business valuation model and mortgage origination financial model, ensuring confident strategic growth and operational success.

Pro Forma Balance Sheet Template Excel

A comprehensive financial model for mortgage lending includes a pro forma balance sheet and income statement to evaluate a home loan company’s financial health. The five-year projected balance sheet offers a snapshot of assets, liabilities, and net worth, distinguishing equity from debt. Integrating home loan cash flow projections and mortgage company expense forecasting ensures accurate financial planning for home loan companies. Key metrics like liquidity, solvency, and turnover ratios—central to home loan portfolio financial analysis—are derived from these statements, empowering mortgage lenders to optimize profitability and risk assessment with confidence.

HOME LOAN COMPANY FINANCIAL MODEL FINANCIAL PROJECTION TEMPLATE VALUATION

Startup Valuation Model

This comprehensive financial model for mortgage lending includes a robust home loan business valuation model, featuring discounted cash flow (DCF) analysis. It empowers users to accurately assess financial metrics like residual value, replacement costs, market comparables, and recent transaction comparables. Ideal for home loan companies seeking precise financial planning, mortgage company financial forecasts, and detailed portfolio financial analysis, this template streamlines valuation and enhances strategic decision-making with clear, actionable insights.

Cap Table

Utilizing a comprehensive financial model for mortgage lending empowers home loan companies to enhance their financial planning and forecasting accuracy. By integrating home loan portfolio financial analysis with detailed cash flow projections and risk assessment models, businesses gain clear visibility into loan servicing and mortgage origination performance. This strategic approach to financial statements and expense forecasting enables precise valuation and profitability modeling, ensuring informed decisions on interest rate strategies and amortization schedules. Ultimately, robust financial models drive transparency in capital allocation, positioning home loan companies for sustained growth and success in a competitive market.

HOME LOAN COMPANY BUSINESS PLAN EXCEL TEMPLATE ADVANTAGES

Financial models for home loan companies enhance accuracy and unite teams through clear financial projections and risk assessments.

Our financial model empowers precise home loan cash flow projections, enhancing forecasting accuracy and strategic planning.

Make confident hiring decisions using the home loan company financial model for accurate forecasts and strategic planning.

Accurately estimate home loan company expenses with our financial model for strategic budgeting and optimized future planning.

Reassess assumptions accurately with our home loan company financial model, enhancing forecasting and strategic decision-making confidently.

HOME LOAN COMPANY 5 YEAR FORECAST TEMPLATE ADVANTAGES

Optimize profitability and reduce risk with our accurate, comprehensive financial model for mortgage lending—get it right the first time.

Optimize funding success with a precise home loan company financial model, showcasing clear forecasts to impress investors confidently.

Our financial model for mortgage lending enhances accuracy and drives profitability through detailed home loan portfolio financial analysis.

A robust home loan financial model empowers precise forecasting, minimizing risk and driving sustainable business growth confidently.

Our financial model for mortgage lending optimizes forecasting accuracy, empowering smarter decisions and maximizing home loan profitability.

Our financial model for mortgage lending simplifies planning by eliminating complex formulas, programming, and costly consultants.

Optimize surplus cash efficiently with a comprehensive financial model for home loan company budgeting and forecasting.

Financial models for home loan companies enable precise cash flow forecasts, optimizing surplus cash reinvestment and debt management.

Optimize home loan profitability and gain stakeholder trust with our precise financial model for mortgage lending.

A detailed home loan cash flow projection model builds stakeholder trust and simplifies securing future investment opportunities.